The 12b-1 fee is considered to be an operational expense and, as such, is included in a fund's expense ratio. It is generally between 0.25% and 0.75% (the maximum allowed) of a fund's net assets. The fee gets its name from a section of the Investment Company Act of 1940.

Full Answer

What is a 12b-1 fee?

A 12b-1 fee is an annual marketing or distribution fee on a mutual fund. The 12b-1 fee is considered to be an operational expense and, as such, is included in a fund's expense ratio. It is generally between 0.25% and 0.75% (the maximum allowed) of a fund's net assets.

Can the 12b-1 fee offset the cost of bond funds?

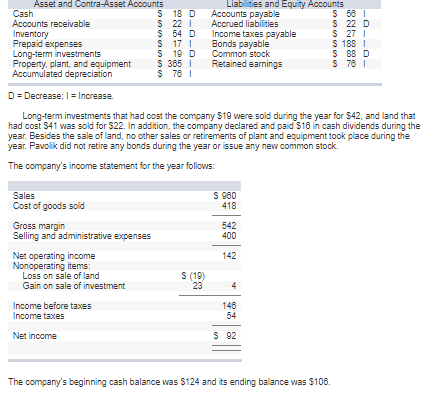

If the largest 12b-1 funds have expense ratios that are lower than the smallest non-12b-1 funds, then one could conclude that it is possible for a fund to achieve sufficient scale economies to offset the 12b-1 fee. This does not appear to be the case for bond funds.

Do 12b-1 funds have higher Expense ratios than non-12b- 1 funds?

higher expense ratios than non-12b-1 funds.23Remarkably, the average expense ratio for 12b-1 funds exceeds that of non-12b-1 funds by more than the average 12b-1 fee.

What is Rule 12b-1 and how does it apply to funds?

Under the directives of Rule 12b-1, the fund’s board is obligated to regularly reevaluate the benefits of the plan to the fund shareholders. Should the board deem that a 12b-1 plan is no longer appropriate for its shareholders, the class system of the fund portfolio, if applicable, would need to be reorganized.

How to avoid 12B-1 fees?

One way to avoid 12b-1 fees and many other costs that come with investing in many mutual funds is to invest in funds that track broad based indexes such as the S&P 500.

What is 12b-1 fee?

A 12b-1 fee is an annual fee that a mutual fund company charges to cover the costs associated with distribution of funds and shareholder services. It derives its name from a Securities and Exchange Commission (SEC) rule authorizing fund companies to charge this fee.

Why is the 12B-1 fee hidden?

12b-1 fees are usually considered a “hidden charge” because they are paid out of the net assets of the fund. 1. The SEC allows a mutual fund firm to take the 12b-1 fee out of a fund’s net assets only if it has adopted a 12b-1 plan. A fund company that adopts a 12b-1 plan files it with the SEC, mapping out the distribution fee for different ...

What is the average expense ratio for mutual funds and ETFs in 2019?

The average expense ratio for mutual funds and ETFs in 2019 was 0.45%. 5

What is the difference between 12B-1 and load?

One of the biggest differences between 12b-1 fees and loads is the fact that loads are a one-time charge, paid either upfront (front end) or when you’re exiting the fund (back end). By contrast, 12b-1 fees are paid out of the fund’s assets each year that you remain invested in the fund.

Can a mutual fund take the 12B-1 fee out of a fund's net assets?

The SEC allows a mutual fund firm to take the 12b-1 fee out of a fund’s net assets only if it has adopted a 12b-1 plan. A fund company that adopts a 12b-1 plan files it with the SEC, mapping out the distribution fee for different intermediaries based on the different share classes of the fund.

Can you review a mutual fund prospectus?

You can review a mutual fund’s prospectus to view its entire fee schedule.

What is 12b-1 fee?

A 12b-1 fee is an annual marketing or distribution fee on a mutual fund charged to investors. 1. The 12b-1 fee is considered to be an operational expense and, as such, is included in a fund's expense ratio. It is generally between 0.25% and 0.75% (the maximum allowed) of a fund's net assets and must be disclosed on the fund's prospectus. 2.

When did 12B-1 fees start?

It also details that 12b-1 fees first emerged in the 1970s during a period when mutual funds were seeing significant redemptions and wanted an avenue to help attract new assets. The funds needed sufficient assets to protect existing investors from the fund managers' having to make forced sales at depressed asset prices or when stocks ...

What is the largest fee for a fund?

The largest fee is usually the management fee , which is what the portfolio managers charge to run the fund. The distribution fee, or 12b-1 fee, will also be listed. Other fees and expenses may include sales charges such as front-end and back-end sales loads that investors incur when they buy or sell a fund.

How many basis points does the 12b-1 fee have?

SEC proposals at the time looked to cap the 12b-1 fee at 25 basis points and to make the fee more transparent to investors who might not even know that they are being charged for marketing, promotion and related sales activities. 5

Is 12B-1 an operational expense?

The 12b-1 fee is considered to be an operational expense and, as such, is included in a fund's expense ratio.

What is 12B-1 fee?

So-called “12b-1 fees” are fees paid out of mutual fund or ETF assets to cover the costs of distribution – marketing and selling mutual fund shares – and sometimes to cover the costs of providing shareholder services.

How do 12B-1 fees get their name?

12b-1 fees get their name from the SEC rule that authorizes a fund to charge them. The rule permits a fund to pay these fees out of fund assets only if the fund has adopted a plan (“12b-1 plan”) authorizing their payment.

What is 12B-1 fee?

12b-1 fees are annual distribution fees related to mutual funds. They are an operational expense, and they’re usually a part of a fund’s expense ratio. In this guide, you’ll find not only an in-depth explanation of 12b-1 fees, but also ways that you may be able to keep your fees low.

Why do mutual fund investors pay 12B-1 fees?

Mutual fundinvestors pay 12b-1 fees to cover the marketing, promotion and service expenses of their investments. The idea is that this money is used both to attract new investors to a particular fund and to compensate the professionals doing the sales work.

What is Smartasset financial advisor matching tool?

The SmartAsset financial advisor matching tool aims to make it easy to help you find an advisor that can help with your personal needs. Answer the personal finance questions within the tool, and we’ll pair you with as many as three nearby advisors.

What is marketing and distribution fee?

The marketing and distribution fee is a commission investors pay to financial advisors and brokers, while the service fee clients pay to investment managers who provide advice and customer service.

Why do mutual funds charge investors?

Mutual funds justify charging current investors to attract new investors by stipulating that running a these investments has inherent underlying fixed costs. Supporters, in turn, believe that the more investors there are, the more account custodians can spread those fees out.

How to find out if a mutual fund charges 12b-1 fees?

To determine whether the fund charges 12b-1 fees, you’ll have to dig into the mutual fund’s prospectus. Under the shareholder fees section, it will say how much the fund charges for marketing and distribution or account services. This ever-important paperwork is available for review even if you’ve yet to invest in the fund.

When did 12B-1 marketing fees start?

Thus, 12b-1 marketing fees were born via the creation of a new SEC law in 1980.

What is 12b-1 plan?

Rule 12b-1, promulgated pursuant to the Investment Company Act of 1940, allows mutual fund advisers to make payments from fund assets for the costs of marketing and distribution of fund shares under the auspices of 12b-1 plans. The original justification for the plans, as put forth by the mutual fund industry in the 1970s, was that such fees help attract new shareholders into funds through advertising and by providing incentives for brokers to market the fund. Arguably, asset growth from any means benefits shareholders through economies of scale in management expenses and lower flow volatility, which decreases liquidity costs for the fund. If, through 12b-1 plans, funds are able to increase the rate at which their assets grow, then shareholders may be able to attain these cost reductions sooner than by investing in a fund with no 12b-1 plan. However, the costs must decrease sufficiently to cover the cost of the plan, and the benefits of the cost reductions must be passed onto shareholders, or shareholders will not be better off.

How does a 12b-1 plan benefit investors?

If 12b-1 plans constitute a net benefit to investors, the amount of the annual fee should be recovered through higher net returns. Higher net returns could derive from either lower expense ratios due to economies of scale or higher gross returns due to the enhanced capacity of funds to either invest in assets with higher yields or reduce transactions costs. Overall, the results are inconsistent with this hypothesis. 12b-1 plans do seem to be successful in growing fund assets, but with no apparent benefits accruing to the shareholders of the fund. Although it is hypothetically possible for most types of funds to generate sufficient scale economies to offset the 12b-1 fee, it is not an efficient use of shareholder assets. No shareholder will be better off investing in a small 12b-1 fund in hopes of helping the fund grow to attain these scale economies.

How does 12B-1 affect cash flows?

An alternative hypothesis for effect of 12b-1 plans on flows is that, by providing steady inflows of cash, 12b-1 plans reduce the number of times that funds have net redemptions. Unexpected net redemptions can be costly if the fund manager has to sell securities to cover the cash outflow. This leads the fund to incur transactions costs. Also, it potentially takes the asset allocation suboptimally away from the fund manager’s investment strategy. Both of these outcomes reduce gross returns.

When did the SEC ban the use of funds?

The investors that remained in the funds were paying increasingly higher expenses, as the fixed costs of the funds were spread over ever fewer shareholders. The industry asked the SEC to allow advisers to use fund assets to pay for distribution costs. This would allow funds to compete on a more level playing field with other investment products that did not charge upfront loads, leading to a net cash flow into funds and scale economies for shareholders.12 The SEC adopted Rule 12b-1 in October 1980.13

Does 12B1 have lower gross returns?

There is some evidence that these funds have higher flow volatility but no differences in cash balances. If flow volatility leads to higher transactions costs , then 12b-1 funds should earn lower gross returns.