Are You subject to capital gains taxes in a Roth IRA?

Apr 14, 2022 · Roth IRA dividends are not taxed at all, since the money you use to fund your account is an after tax contribution. Are capital gains taxed in Roth IRA? Roth IRAs Don’t Tax Any Gains You fund a Roth IRA with money you’ve already paid income taxes on. As long as you wait until you’re 59 ½ and you’ve held the account for at least five ...

Do I have to pay taxes on Roth IRA gains?

Mar 04, 2020 · Tax-Free Growth Earnings in a Roth IRA, including capital gains and dividends on Roth stock investments, are not subject to federal or state income taxes during your working years, so long as you keep the funds in the Roth account until retirement.

What is the tax penalty for a Roth IRA?

Mar 24, 2022 · While dividend income held in a Roth IRA isn’t taxable, if you are investing in dividend stocks outside of a Roth IRA ,say in a typical brokerage account, it is taxed differently. Qualified dividends are taxed as long-term capital gains and nonqualified dividends are taxed at your ordinary tax rate.

Do you pay income taxes on a Roth IRA?

Mar 22, 2022 · A Roth IRA is never subject to short-term or long-term capital gains taxes. Because a Roth IRA is funded with after-tax dollars, you can withdraw your contributions tax- and penalty-free at any time. If you withdraw your earnings before age 59 ½, or it’s been less than five years since you opened the account, you could owe income taxes plus a 10% penalty.

Do capital gains get taxed in a Roth IRA?

Roth IRAs Don't Tax Any Gains You fund a Roth IRA with money you've already paid income taxes on. As long as you wait until you're 59 ½ and you've held the account for at least five years, your gains are tax-free. You can withdraw your Roth IRA contributions without paying taxes or a penalty at any time.Mar 22, 2022

Do dividends get taxed in Roth IRA?

If you buy dividend stocks in your Roth IRA, you can earn a regular stream of tax-free income. Your investments will grow tax-free, and your withdrawals will not be taxed after you've satisfied the requirements.5 days ago

What do you do with dividends and capital gains on a Roth IRA?

If you earn a dividend or a capital gain in your Roth IRA, you can reinvest the gains and not owe any taxes. As long as you keep the money in your Roth IRA, you won't owe anything to the IRS.

Should you have dividend stocks in Roth IRA?

Buying dividend stocks in a Roth IRA can be a great way to bypass annual taxes on your extra income. But if you need your dividend income now, you may run into a little trouble. You can't take advantage of the tax-free dividend income perks until you reach 59 1/2 and have met other requirements.5 days ago

How can I avoid paying tax on dividends?

Use tax-shielded accounts. If you're saving money for retirement, and don't want to pay taxes on dividends, consider opening a Roth IRA. You contribute already-taxed money to a Roth IRA. Once the money is in there, you don't have to pay taxes as long as you take it out in accordance with the rules.

Can you sell and reinvest in Roth IRA?

In a Roth IRA, however, you're free to switch equities – selling current equities at a profit and then reinvesting in a different equity – as often as you like, tax-free. Period. There are no other qualifications. You can reinvest or not.Mar 6, 2019

What is the 5 year rule for Roth IRA?

The five-year rule for Roth IRA distributions stipulates that 5 years must have passed since the tax year of your first Roth IRA contribution before you can withdraw the earnings in the account tax-free.Dec 1, 2021

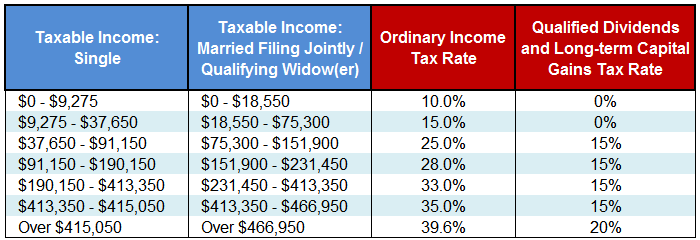

What is the tax rate on capital gains?

This means these earnings could be taxed at a lower rate (from 0% to 20%, depending on your income level).

How long do you have to pay taxes on Roth IRA withdrawals?

As long as you withdraw money invested in a Roth IRA after the age of 59½—and you owned that account for more than five years —you will pay zero taxes on the withdrawals, even if the withdrawals include dividends. If you do need to withdraw money prior to 59½, you are required to pay taxes on any gains you withdraw at your current tax rate.

What are special exceptions?

Special exceptions can include disability, first-time home purchase, and some other qualified exceptions. Even if you meet the special exception rules, you will need to pay taxes on dividends and capital gains at your current tax rate. 3 .

How much is IRA withdrawal taxed?

Most money withdrawn from a traditional IRA is taxed at your current tax rate, which could be as high as 39.6%. Any capital gains on the earnings in your IRA account do not benefit from lower capital gains tax treatment; they are taxed at the same rate as regular income. 2 . The only exception to that rule is when you contribute ...

Is an IRA a good investment?

An IRA is a great option to save for retirement. The key is to know the rules for withdrawals before you invest, so you do not face any tax surprises at retirement.

Is a Roth IRA better than a traditional IRA?

Additionally, "for many Americans... [especially] millennials, a Roth IRA is the best choice since tax rates will only increase in the future. Although a retiree might benefit from a traditional IRA in the short term, a Roth will win for the majority.

Who is Lita Epstein?

Lita Epstein has 18+ years of experience as an author and financial writer. She has also written over 40 books. Marguerita is Chief Executive Officer at Blue Ocean Global Wealth and specializes in helping people meet their life goals through proper management of their financial resources.

What is Roth IRA?

A Roth individual retirement arrangement allows you to build up a retirement account that will produce tax-free income in your retirement years. With a Roth account, you contribute after-tax income, and your earnings on that money grow tax-free. Many Roth IRA owners invest in the stock market but are uncertain about the tax status ...

How long can you keep Roth IRA?

Once you reach the IRA retirement age of 59.5 years, you can withdraw your stock gains and dividends from your Roth account tax-free and penalty-free, so long as your Roth account has been open more than five years. Roth stock gains and dividends will be taxable if they are withdrawn from a Roth account that is less than five years old, even if you are older than 59.5.

Who is Herb Kirchhoff?

Herb Kirchhoff has more than three decades of hands-on experience as an avid garden hobbyist and home handyman. Since retiring from the news business in 2008, Kirchhoff takes care of a 12-acre rural Michigan lakefront property and applies his experience to his vegetable and flower gardens and home repair and renovation projects.

How long does it take to rollover a Roth IRA?

The rollover must be completed within 60 days, or the earnings become subject to tax. If you funded your Roth IRA with rollovers from another retirement account, the five-year mandatory interval between deposit ...

Is a stock withdrawal from a Roth IRA taxable?

Your stock dividends and capital gains could become taxable if you withdrew them from your Roth IRA before you turned 59.5. The Internal Revenue Service charges Roth IRA withdrawals first against your contributions. Because your contributions were after-tax funds, you owe no tax or penalty on them. But any withdrawal that exceeds your contributions is charged to earnings. Earnings withdrawn early from a Roth are taxed as ordinary income even if they came into the Roth from capital gains, which normally would be taxed at a lower rate.

Roth IRA Dividend Taxes for International Stocks (ADRs)

The general problem with buying stocks which are headquartered outside the U.S. is that you can be subject to double taxation.

Roth IRA Dividend Taxes for Real Estate Investment Trusts (REITs)

REITs are another interesting beast because they have their own tax implications which are a little different than a regular U.S. stock.

Roth IRA Dividend Taxes for Master Limited Partnerships (MLPs)

If you look into certain highly capital intensive industries such as midstream natural gas pipelines, you’ll see that most of them are structured as MLPs.

Who is David Rodeck?

David Rodeck has been writing professionally since 2011. He specializes in insurance, investment management and retirement planning for various websites. He graduated with a Bachelor of Science in economics from McGill University.

Can you use a Roth IRA to pay for college?

You can also use your Roth IRA earnings to pay for your college tuition or the college tuition of a family member. Or you can take out up to $10,000 of earnings from your Roth IRA to buy your first home. These withdrawals avoid the 10 percent penalty, but they are subject to income tax. 00:00.

Can you take out your Roth IRA before retirement?

However, if you take out your investment gains before you turn 59 1/2, it gets expensive. The IRS charges income tax plus a 10 percent early withdrawal penalty on any investment gains taken out of your Roth IRA before retirement.

Can you take money out of a Roth IRA?

There are a few times when you can take your investment earnings out of your Roth IRA and avoid the 10 percent penalty. You can take money out if you become permanently disabled and can no longer work. You can also use your Roth IRA earnings to pay for your college tuition or the college tuition of a family member.

Do you pay taxes on Roth IRA contributions?

Tax Savings. When you invest in a Roth IRA, you don't get a tax deduction for your contribution like you do with the the traditional IRA. Instead, the Roth IRA saves your tax benefit for retirement. When you take money out of your Roth IRA after you turn 59 1/2, the entire withdrawal is tax-free. You never pay taxes on your investment gains.