Can You claim finance charges on taxes?

You cannot claim for repayments of loans, overdrafts or finance arrangements. You can claim for any insurance policy for your business, for example public liability insurance. If you’re using traditional accounting, you can claim for amounts of money you include in your turnover but will not ever receive (‘bad debts’).

Are investment fees tax deductible?

Fees are not tax deductible, so they are not deductible. A registered account fee or a financial planning fee cannot be deducted as an administration fee. No matter what type of investment account you have, transaction fees for purchasing and selling investments are not tax deductible.

Are investment account fees deductible?

Investment management costs are deductible on Schedule A for taxable accounts. “Job Expenses and Certain Miscellaneous Deductions” is one of the sections. The IRS enables you to deduct “investment-related expenses,” which include things like account fees and investment management fees.

Which credit card fees are tax deductible?

- Tax payments over $100,000 may come with special requirements and these payments must be processed over the phone instead of online.

- Different types of tax payments have a maximum number of times per year that you can pay with a credit card.

- Employer’s federal tax deposits cannot be paid with a credit card.

Are finance charges tax-deductible?

Businesses can deduct all credit card fees as well as finance charges. Businesses are eligible to deduct credit or debit card processing fees associated with paying taxes, but individuals are not.

What type of financing is tax-deductible?

Types of interest that are tax deductible include mortgage interest for both first and second (home equity) mortgages, mortgage interest for investment properties, student loan interest, and the interest on some business loans, including business credit cards.

Are business loan fees deductible?

Yes! The IRS “business loan interest” deduction lets you write off the interest you paid on a business loan. If you take a loan out for your small business, keep track of how much you pay in interest over the year for your taxes.

Are loan processing and underwriting fees deductible?

No, These costs (appraisals, underwriter, attorney, or bank fees, title fees, etc.) are not deductible. However, on a new loan, mortgage interest paid (including origination fee or "points"), real estate taxes are deductible.

Is a car loan tax deductible?

Typically, deducting car loan interest is not allowed. But there is one exception to this rule. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense.

Why are interest payments tax deductible?

The mortgage interest deduction is a tax incentive for homeowners. This itemized deduction allows homeowners to count interest they pay on a loan related to building, purchasing or improving their primary home against their taxable income, lowering the amount of taxes they owe.

Are loan fees considered interest expense?

Upfront fees are generally considered interest expense. An upfront fee is paid by a borrower to the lenders of a credit facility on the closing date of the loan.

What can I write off as a business expense?

What Can Be Written off as Business Expenses?Car expenses and mileage.Office expenses, including rent, utilities, etc.Office supplies, including computers, software, etc.Health insurance premiums.Business phone bills.Continuing education courses.Parking for business-related trips.More items...•

Are mortgage broker fees tax-deductible?

Mortgage Points Many mortgage brokers charge origination and discount points on their mortgages. The Internal Revenue Service defines these points as prepaid interest. Because of this, they are tax deductible.

Are appraisal fees tax-deductible?

Generally, appraisal fees will be deductible on your Schedule C or Schedule E if the appraisal is conducted for business reasons. If you are buying or selling a personal property appraisal fees are not deductible.

How are mutual fund fees charged?

Mutual fund fees are charged in the form of an expense ratio. 4 This cost is deducted out of the return of the fund before your share is allocated to you. 5

What is the 2% deduction for IRA?

The fees debited from an IRA are paid with pre-tax dollars. Fees qualify for the miscellaneous itemized deduction, subject to the 2% limit, prior to tax year 2018, and possibly again beginning in 2026. 1 .

Can I deduct investment management fees?

Investment management fees and financial planning fees could be taken as a miscellaneous itemized deduction on your tax return, like tax preparation fees, but only to the extent that they exceeded 2% of your adjusted gross income (AGI). For example, you'd get no deduction for the first $2,000 of fees you paid but you would be able to deduct ...

Can you pay fees on Roth IRA?

It doesn’t make sense to pay fees from a Roth IRA because these IRA withdrawals aren't taxed. Contributions to Roth accounts are made with after-tax dollars. You’ll want to let the money grow tax-free in a Roth IRA as long as possible. 3

Is a withdrawal from an IRA considered an investment?

It’s not considered to be a withdrawal from an IRA account when fees are paid this way . It's an investment expense, so you’re paying the fees with pre-tax dollars. It would cost you $760 for every $1,000 of fees paid this way on an after-tax basis if you’re at the 24% marginal tax rate.

How much is Schedule A itemized deduction for 2020?

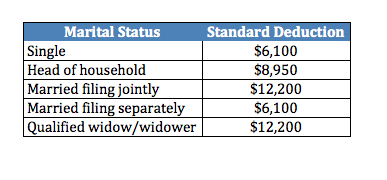

Due to the TCJA standard deductions for U.S. taxpayers increased substantially. For the tax year 2020, those deduction amounts are: 1 . $12,400: single taxpayer (increasing to $12,550 for 2021)

What are the deductions for 2020?

For the tax year 2020, those deduction amounts are: 1 1 $12,400: single taxpayer (increasing to $12,550 for 2021) 2 $12,400: married taxpayer filing separately ($12,550 for 2021) 3 $18,650: head of household ($18,800 for 2021) 4 $24,800: married taxpayer filing jointly ($25,100 for 2021) 5 $24,800: qualifying widow (er) ($25,100 for 2021)

Does credit card fees depend on business?

The short answer is, it depends. It largely depends on whether any credit card fees are incurred for business purposes or if the card was for personal use. Below are details for each type of situation.

Is a credit card tax deductible?

In general, pretty much anything pertaining to a credit card is not tax-de ductible as a personal itemized de duction but is tax-deductible for a business .

Can a credit card be deducted from a business tax return?

Tax deductions for businesses are another story. Nearly any business credit card fee or credit card company charge incurred by a business through the use of a credit card has been and still is eligible to be deducted as a business expense.

Do card processors charge a fee?

Card network processors may charge merchants a flat fee for the privilege of acceptance. Merchants also pay a card processing transaction fee on each card transaction to the card issuer. These fees and any other incurred by a merchant are reported as business expenses and allowed as tax deductions.

Can a business deduct credit card processing expenses?

For example, this alleviates an annual fee on a personal credit card but could include finance charges on purchases made with the card. Businesses can also deduct any credit or debit card processing expenses involved with paying their taxes.

What expenses are deducted from a 1987 tax return?

The following expenses incurred after 1987 in respect of issuances, sales and borrowings occurring after 1987 may be deducted on a current basis to the extent that they may reasonably be considered to relate solely to the taxation year: a stand-by charge, a guarantee fee, a registrar fee, a transfer agent fee, a filing fee, a service fee or any similar fee. These amounts must be incurred: (1) for the purpose of borrowing money to be used by the taxpayer for the purpose of earning income from a business or property, except money used for the purpose of acquiring property the income from which would be exempt; (2) in the course of incurring indebtedness that is an amount payable to acquire property for the purpose of gaining or producing income from the property or from a business, except property that is an interest in a life insurance policy or property the income from which would be exempt; or (3) for the purpose of restructuring, rescheduling or assuming a debt obligation, provided the debt obligation is in respect of a borrowing of money described in (1) or in respect of an amount payable for property described in (2). Where the expenses are incurred in the course of a rescheduling or a restructuring, the rescheduling or a restructuring must provide for the modification of the terms or conditions of the debt obligation, its conversion to a share or other debt obligation, or its substitution with a share or another debt obligation.

Can you deduct a refinance loan over 5 years?

While qualifying financing expenses must normally be amortized over a five year period, the deduction of an expense incurred in the course of a borrowing of money need not be deferred once all of the debt obligations in respect of the borrowing or indebtedness are repaid or otherwise settled or extinguished, except on a refinancing. Deductibility in full in the year of qualifying repayment or other settlement results from the requirement that paragraph 20(1)(e) be read without reference to the 20% restriction and without reference to the phrase “the lesser of”. Partial settlement of the debt obligation in respect of a borrowing or indebtedness will not enable the taxpayer to obtain current deductibility.

Can you deduct expenses for a year other than the year in which they are payable?

The CRA has adopted a position that expenses that relate to a year or years other than the year in which they are payable are deductible in accordance with the provisions of paragraph 20(1)(e) rather than paragraph 20(1)(e.1). There was a concern that if paragraph 20(1)(e.1) was given precedence, the portion of the fees relating to subsequent years would not be deductible since it would not be payable in those years. An amount paid in a year, whether or not it relates to the year in which it is paid, or other years, would appear to be governed by both paragraphs 20(1)(e) and (e.1) on their wording. Paragraph 20(1)(e.1) may have otherwise applied to allow a deduction for an amount paid on the portion that related “solely” to the particular year in which it was paid.

Can a loan be deductible for five years?

As noted earlier, a guarantee fee, to the extent that it is reasonable and that the borrowing satisfies the purpose test, will be deductible either over five years under paragraph 20(1)(e) or, if it can reasonably be considered to relate solely to the year in which it is paid, in the year of payment pursuant to paragraph 20(1)(e.1). An annual guarantee fee would, accordingly, be deductible in full each year.

Is warrant issuance expense deductible?

The CRA considers that expenses incurred by a corporation in the course of an issuance or sale of warrants are not deductible under subparagraph 20(1)(e)(i) because a warrant is not one of the eligible securities mentioned in that paragraph. However, if the shares supported by the warrants are issued upon the exercise of the warrants, these costs may be deductible under paragraph 20(1)(e) as they would have been incurred “in the course of” an issuance of shares.

Is participation payment deductible?

A participation payment, for purposes of this discussion, will be limited to additional compensation established as a percentage of sales, profits, revenues, or cash flow of the borrower, or dependent on external factors such as stock performance or commodity value, which is provided to a lender over and above a fixed rate of interest. In order to be deductible, such a payment must fall within a specific provision of the Act allowing a deduction. Formerly, participation payments could be characterized as either interest or as a financing expense to be deductible under either paragraphs 20(1)(c) or (e), where appropriate. However, paragraph 20(1)(e) now denies a deduction for an “excluded amount”, which includes a typical participation payment. An excluded amount is defined in subparagraph 20(1)(e)(iv.1) to include amounts that are contingent or dependent on the use of or production from property, and amounts that are computed by reference to revenue, profit, cash flow, commodity price or any other similar criteria or by reference to dividends paid or payable to shareholders of any class of shares of the capital stock of a corporation.

Is a penalty or bonus paid by a taxpayer on the repayment of a debt before maturity deductible?

Until the introduction of new subsection 18(9.1), the Act contained no provision allowing a deduction for a penalty or bonus paid by a taxpayer on the repayment of a debt before maturity, or for a payment made to obtain a reduction in the interest rate on a debt obligation. Subsection 18(9.1) was introduced to deem such a payment to be interest, if paid after 1984, thereby rendering them deductible for the borrower, provided that certain conditions are satisfied. For the recipient, these payments are interest income if paid after July 12, 1990 (other than for a financial institution, as under subsection 142.4(10) they are considered proceeds of disposition).

When does interest on a business line of credit accumulate?

Interest on a business line of credit accumulates only when you withdraw from the fund. The amount of interest deduction hence depends on your usage of the funds. Refer to your business line of credit statements before filing your tax returns.

What is business line of credit?

A business line of credit lets you draw from a pre-approved amount of available funds. You will then repay the amount you withdraw within minimum repayment guidelines. You only attract payable interest on the amount you utilize, unlike what happens with a term loan.

Can you deduct mileage on a car?

You can also use the standard mileage rate to make the deduction. If the car is for business purposes only, the law allows you to deduct all the interest. If the car is sometimes used for personal purposes, you can only deduct a certain business percentage. 2.

Is interest deducted as an investment expense?

The approach of deduction can be a business expense or investment expense. Interest deducted as an investment expense is more limited. Money borrowed to buy a C-corporation is regarded as investment interest. This applies to small corporations and those whose stocks are not yet publicly traded.

Can interest be deducted from a business loan?

An interest that must be added to the principal balance of a business loan can’t be deducted. The expenses accrued from the interest should be depreciated alongside other costs of the business asset.

Is borrowing money from friends and family tax deductible?

The money you borrow from friends or relatives and use for business purposes is tax deductible. The interest gets deducted as a business expense. Loans between friends and family are treated with some suspicions.

Can you use personal loans to pay taxes?

Loans you use on personal needs don’t qualify for tax deductions. You can avoid paying this interest whenever possible. One approach is to use your business to borrow money to pay business expenses. From the money your company earns, you can pay off personal debt.

When did the FAS change the accounting of debt issuance costs?

Effective December 15 2015, FAS changed the accounting of debt issuance costs so that instead of capitalizing fees as an asset (deferred financing fee), the fees now directly reduce the carrying value of the loan at borrowing. Over the term of loan, the fees continue to get amortized and classified within interest expense just like before.

What are the three ways that transaction fees need to be modeled?

Going forward, transaction professionals should take note that there are now three ways that fees will need to be modeled: Financing fees (term loans and bonds): Directly lower the carrying value of the debt. Financing fees (for revolvers): Capitalized and amortized. Transaction fees: Expensed as incurred.

What is debt issuance cost?

When a company borrows money, either through a term loan or a bond, it usually incurs third party financing fees (called debt issuance costs). These are fees paid by the borrower to the bankers, lawyers and anyone else involved in arranging the financing.

Is the commitment fee capitalized?

That means that commitment fees continue to be capitalized and amortized as they have been in the past.

What did the taxpayer in the FAA have to do with the loan?

The taxpayer in the FAA had incurred costs when it entered into a credit agreement to borrow term loans from a group of lenders. Subsequently, the taxpayer sought to refinance the term loans by amending the terms of the credit agreement.

How much of the new term loans were issued in exchange for old term loans?

In addition, the amendment allowed the taxpayer to issue new loans for cash to both existing lenders and new lenders. Approximately 49% of the new term loans were issued in exchange for old term loans, while the remaining 51% of new term loans were issued for cash.

Is a loan cost deductible?

Specifically, the loan costs allocable to loans repurchased for money were deductible when the loans were repurchased, and the loan costs allocable to loans exchanged for new term loans were deductible upon the exchange.

Is debt issuance deductible on refinancing?

1. 446 - 5 required debt - issuance costs to be treated like OID, many taxpayers took the position that on a refinancing, unamortized debt - issuance costs were deductible when unamortized OID was deductible. The IRS appears to sanction this position in the FAA.

Can you deduct unamortized debt?

The IRS concluded in a recent field attorney advice memorandum, FAA 20172901F, that a taxpayer could deduct the unamortized debt - issuance costs related to its existing debt upon its exchange for new debt. Though the FAA redacts some facts, the circumstances may be familiar to companies that have refinanced debt obligations.

Is an unamortized loan deductible?

Thus, the IRS concluded that the unamortized loan costs were deductible, including the loan costs allocable to the existing loans that the taxpayer exchanged for the new term loans in a debt - for - debt exchange.

What are legal fees?

You can only deduct a handful of personal legal fees under current tax law. They include: 1 Legal fees in employment discrimination cases (where the you as the taxpayer are the plaintiff): The deduction is limited to the total amount of the your gross income. 2 Claims against the federal government for damage to property: If you are a deployed soldier and your home is damaged while you are gone, you can sue Uncle Sam for damages. 3 Whistleblower rewards: Say you report a person or business for tax fraud or evasion. If that person or business is caught, then you will be paid a percentage of the amount that was evaded. This deduction is limited to the amount that you are paid.

What is tax advice?

Defending any patent, trademark or copyright claims. Tax advice for your business is usually tax-deductible, unlike fees for personal tax guidance.

What was eliminated in the new tax law?

It eliminated not only personal legal fees, but also unreimbursed employee expenses that exceeded 2% of the taxpayer’s adjusted gross income (AGI). 1 Several other miscellaneous fees were also eliminated.

Can you deduct personal legal fees?

Personal Legal Fees You Can Deduct. You can only deduct a handful of personal legal fees under current tax law. They include: Legal fees in employment discrimination cases (where the you as the taxpayer are the plaintiff): The deduction is limited to the total amount of the your gross income.

Is legal fees deductible on Schedule C?

The other side of the coin for taxpayers who are running or starting a business is that many business-related legal fees are deductible on the Schedule C. If you are a businessperson, the legal fees you can deduct include those pertaining to:

What are the fees that can be deducted from a business loan?

These fees include: application, appraisal, processing, and insurance fees. loan guarantee fees. loan brokerage and finder's fees. legal fees related to financing.

How long can you deduct 20% of a loan?

The 20% limit is reduced proportionally for fiscal periods of less than 12 months. If you repay the loan before the end of the five-year period, you can deduct the remaining financing fees then. The number of years for which you can deduct these fees is not related to the term of your loan.

Why do you capitalize interest?

You can choose to capitalize interest on money you borrow for one of the following reasons: When you choose to capitalize interest, add the interest to the cost of the property or exploration and development costs instead of deducting the interest as an expense.

Can you deduct interest expense on a property?

You may be able to deduct interest expenses for a property you used for business purposes, even if you have stopped using the property for such purposes because you are no longer in business. For more information, go to Income Tax Folio S3-F6-C1, Interest Deductibility.

Can you deduct interest on a vehicle?

The interest you can deduct on money you borrow to buy a passenger vehicle or a zero-emission passenger vehicle. For more information, go to Motor vehicle – Interest. The amount of interest you can deduct for vacant land.

Can you deduct a loan fee?

You can deduct the fee you pay to reduce the interest rate on your loan. You can also deduct any penalty or bonus a financial institution charges you to pay off your loan before it is due. Treat the fee, penalty, or bonus as prepaid interest and deduct it over the remaining original term of your loan. For example, if the term of your loan is five ...