What does seller pay for closing costs?

Closing costs for sellers of real estate vary according to where you live, but as the seller you can expect to pay anywhere from 6% to 10% of the home’s sales price in closing costs at settlement.

What constitutes closing costs?

What is Included in Closing Costs?

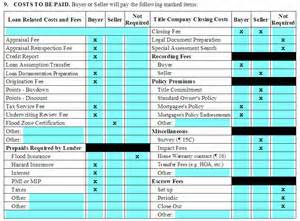

- Appraisal Fee. ...

- Inspection Fee. ...

- Loan Origination Points. ...

- Mortgage Discount Points. ...

- Mortgage Insurance Premium. ...

- Prorated Real Estate Taxes. ...

- Real Estate Commissions. ...

- Recording Fee. ...

- Stamp tax. ...

- Survey Fee. ...

How much is closing costs?

The specific closing costs you’ll need to pay depend on the type of loan you take and where you live. How Much Are Closing Costs? Closing costs can make up about 3 – 6% of the price of the home. This means that if you take out a mortgage worth $200,000, you can expect closing costs to be about $6,000 – $12,000.

Do Sellers still pay closing costs?

Yes, the buyer can pay the seller’s closing costs, if both parties agree to this while negotiating a purchase agreement. However, this is very uncommon, for practical reasons. While home sellers almost always pay their closing costs out of the sale proceeds, buyers typically pay their closing costs out of pocket.

Is a cash offer on a house better?

A cash offer is an all-cash bid, meaning a homebuyer wants to purchase the property without a mortgage loan or other financing. These offers are often more attractive to sellers, as they mean no buyer financing fall-through risk and, usually, a faster closing time.

Why do home sellers prefer cash?

One reason sellers prefer cash buyers is because deals can often close faster when you don't need to get a lender involved. But the primary reason sellers prefer cash buyers is because there is a lower probability of the deal being delayed or falling apart when buyers use all cash.

How much are closing costs for a cash buyer in Florida?

Typically, the buyer closing costs in Florida will add up to around 1-3% of the purchase price. Florida buyer closing costs include appraisal fees, loan origination fees, inspection fees, and recording fees. Cash buyers will pay the lowest closing costs. In Florida, cash buyers will pay less than 1% in closing costs.

Who pays closing costs in Washington?

Closing costs must be paid upfront in a real estate transaction. If you're a buyer, you could be paying anywhere from 2% to 5% of the purchase price of the home. Sellers usually pay more, as much as 8% or more because they pay the real estate commissions, which can be as high as 6%.

How long does a cash buyer house sale take?

As long as the seller doesn't need the buyer's funds to purchase their next property, the cash purchase should proceed quickly, potentially within a few weeks. 'Cash sales do typically go through quicker – within around 30 days in most cases, provided there is no onward chain on the property,' says Dale.

How do I show proof of cash to buy a house?

Proof of Funds usually comes in the form of a bank, security or custody statement, and can be procured from your bank or financial institution that holds your money. Bank statements are the most common document to use as POF and can typically be found online or at a bank branch.

Do you need an appraisal for a cash offer?

With a cash offer, there's no lender so no one to require the appraisal. But cash buyers might consider getting an appraisal done anyway. Just like a lender, you don't want to end up with an asset that's worth less than you paid for it.

How long does it take to close on a house in Florida when paying cash?

Because a lender isn't involved, the closing time for cash purchases can be shorter. Once you're under contract, a cash sale can close in as few as two weeks — just enough time for the title and escrow companies to clear any liens, provide insurance, and get paperwork ready (more on that later).

Who usually pays closing costs?

buyerClosing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

What are typical closing costs for a buyer Washington State?

Closing Costs for Washington Homes: What to Expect But generally, buyers should expect to pay between 2% to 5% in closing costs. While closing costs can be expensive, one of the largest mortgage expenses is the interest rate.

How much are closing costs on a house in Washington?

The average closing costs in 2021 were $3,860 without transfer taxes, according to ClosingCorp data....Average closing costs by state.StateAverage closing costs with taxesAverage closing costs without taxesVirginia$6,346$3,461Washington$13,927$4,86249 more rows•May 12, 2022

How much are closing costs for buyer in Washington?

Buying a House in DC: Typical Closing Costs Typical homebuyers in Washington, DC pay 3-5% of the home's sale price in closing costs.

Why do sellers like cash buyers?

An all-cash offer can occur when the buyer has the ability to purchase a home without taking out a mortgage. All-cash offers are very appealing to sellers because they tend to close faster and there are fewer risks than with mortgage-contingent offers, which are vulnerable to delays and denials.

Why would a cash offer on a house fall through?

If an inspection reveals any problems, you will have to carry out the repairs and/or renegotiate the purchase price. For this reason, a cash transaction may not proceed any faster than a mortgage-financed purchase, and there is still a chance the deal will fall through.

Why do people ask for cash buyers?

Cash buyers can be a huge advantage to selling homeowners as you can sell at a faster pace, and they also carry less risk as they aren't relying on a mortgage approval or their own sale. This reassurance is very important to homeowners, as selling on the open market is full of risks.

How do you beat all-cash offer?

7 Tips to compete with an all-cash offerGet approved for your mortgage. Getting mortgage pre-approval before you try to make an offer on a house is a must. ... Waive contingencies. ... Increase your earnest money deposit. ... Offer above asking price. ... Include an appraisal gap guarantee. ... Get personal. ... Consider a cash offer alternative.

What is closing in buying a house?

A closing is the last step in buying a home. At the closing, you and all of the other parties involved in the transaction sign all of the necessary documents. This may include some combination of:

How Long is the Closing Process in New Jersey?

The closing process usually takes between 30 and 45 days to complete from the first steps to the final walk-through. This is a general breakdown of what steps you will take during this time period. Not every step will apply in every home sale, but in general these are the steps of the closing process. With cash offers, this process can usually be completed much quicker as there are less parties involved to tie things up.

Where are closing costs listed?

Here are all the closing costs when paying cash for a home. The costs are listed under the Debit column.

How much does selling costs eat up?

Selling costs can easily eat up about 6% of the returns from your home due to the 5% real estate selling commission plus transfer taxes and other settlement fees that can amount to 1%.

What happens when you get a title examination?

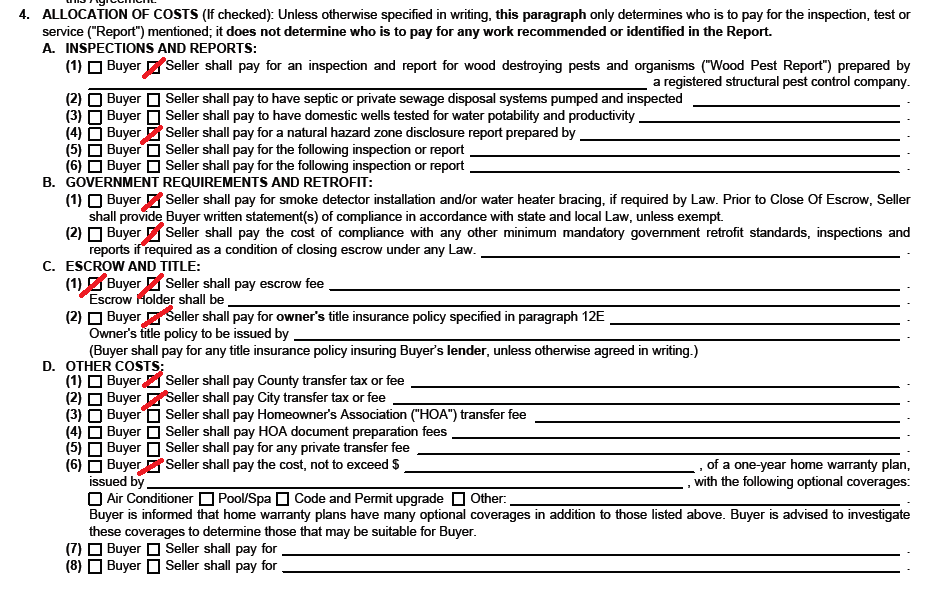

The title examination will reveal that there are several outstanding mortgage liens on the property and the property will not be able to be conveyed to a buyer until this title defect is cleared. Owner’s title insurance will not only protect the seller from this kind of loss but the title insurance company will also defend the seller and pay for the cost in clearing the title.

Why do sellers pick escrow companies?

The escrow company is usually picked by the seller because the seller initially pays a fee to analyze the title of the property before selling. For the buyer to insist on a different escrow company would be a waste of money since analyzing the initial title costs money (~$500). Title Notary: $15.

What happens to a loan when you refinance?

When this happens, a Discharge of the paid off loan is to be recorded at the Registry of Deeds either by the new lender, the closing attorney or the borrower.

How much does a title notary cost?

Title Notary: $15. The notary takes your signatures and thumbprints and makes sure all the documents are official.

What is a costlier title issue to clear?

A costlier title issue to clear would be one involving a discrepancy with land ownership.

How much are closing costs?

Typically, home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees. So, if your home cost $150,000, you might pay between $3,000 and $7,500 in closing costs. On average, buyers pay roughly $3,700 in closing fees, according to a recent survey.

What is closing cost?

Closing costs are fees associated with your home purchase that are paid at the closing of a real estate transaction. Closing is the point in time when the title of the property is transferred from the seller to the buyer. Closing costs are incurred by either the buyer or seller.

How can home buyers avoid closing costs?

You can also avoid upfront fees on your loan by getting a no-closing cost mortgage, in which you don’t pay any of the closing costs when you close on the mortgage.

How long do you have to put down escrow for property taxes?

Escrow Deposit for Property Taxes & Mortgage Insurance: Often you are asked to put down two months of property tax and mortgage insurance payments at closing.

How long before closing should you give closing disclosure?

Remember that you can shop around and you may be able to find other lenders who are willing to offer you a loan with lower fees at closing. At least three business days before your closing, the lender should give you Closing Disclosure statement, which outlines closing fees.

Do you pay title insurance at closing?

Your first year’s insurance is often paid at closing. Lender’s Policy Title Insurance: This is insurance to assure the lender that you own the home and the lender’s mortgage is a valid lien, and it protects the lender if there is a problem with the title. Similar to the title search, but always a separate line item.

Do all lenders charge an application fee?

Not all lenders charge an application fee, and it can often be negotiated. Appraisal: This is paid to the appraisal company to confirm the fair market value of the home. Attorney Fee: This pays for an attorney to review the closing documents on behalf of the buyer or the lender. This is not required in all states.

How much do you pay for closing costs on a home?

However, this number can vary greatly based on a home’s market value and geographic location. As a homebuyer, you can expect to pay 3%-6% of the home's purchase price on closing costs, but that number can be as low as sub-1% or as high as 4+%, depending on the state.

What is the average closing cost for a house?

According to data gathered by The Motley Fool, in 2020, the average closing costs for a house were $5,749. However, this number can vary greatly based on a home’s market value and geographic location.

How do you buy a house with cash without all the cash?

All-cash offers provide a smoother , quicker real estate transaction – and they’re highly attractive for sellers, so cash offers are more likely to win a bidding war .

Why do you want to buy a house with a cash offer?

Increasingly, homebuyers in competitive markets are learning that "cash is king" -- that is to say, buying a house with a cash offer increases your chances of winning when there are multiple offers on a home. Sellers prefer an all-cash deal as it eliminates the uncertainty and slow process of transacting with a traditional mortgage lender. Seriously, high-fives all around!

What is an accept.inc all cash offer?

An Accept.inc all-cash offer is similar to a traditional mortgage when it comes to private mortgage insurance -- Since you are still receiving a mortgage at the end of the process, if your down payment is less than 20% of the home's purchase price, you'll still pay PMI. The cost, which ranges from 0.5% to 1% of the loan amount, is calculated annually and added to your monthly mortgage payments. Closing costs on cash offers typically include the buyer’s first month’s payment.

What is an escrow account?

An escrow account, which operates similarly to a savings account, is used to collect and safeguard funds during closing, as well as throughout the lifespan of the loan. In addition to protecting your earnest money deposit, your lender may utilize an escrow account to fund your homeowner’s insurance and annual property taxes.

How much money do you need to make an all cash offer?

It’s a common assumption that in order to make an all-cash offer, you have to have hundreds of thousands of dollars already stashed away in your bank account, or a wealthy relative who does and is willing to front you the cash.

How much does closing cost for cash?

Even if you’re buying a home with cash, the one-time closing costs, or fees you’ll have to pay during the closing process, can be as much as 3% of the purchase price, according to Lee Dworshak, a Realtor with Keller Williams LA Harbor Realty.

Why do people buy houses with cash?

Maybe you came into a large inheritance, or you’re just really good at saving. Either way, paying the price of the home in full means you won’t have to worry about making mortgage payments. Plus, sellers love a cash offer because it means they won’t have to wait for mortgage lenders ...

How much does a HOA cost?

These fees will be based on the size of your home and the amenities in your community, but for a typical single-family home, HOA fees can cost around $200 to $300 a month.

How much does a home warranty cost?

Shur recommends considering a home warranty, which costs about $450 a year and provides coverage on a wide variety of elements such as plumbing, electrical, heating/air conditioning, and appliances.

What utilities do you need to pay for a house?

Don’t forget to factor in utilities such as electric, gas, water, sewer, and trash. To get a clear picture of what you’ll be required to pay, ask your real estate agent to ask the sellers what a year’s worth of bills costs. Utilities can fluctuate from season to season, so this is especially important if you’re moving across the country to a new climate.

Do you have to pay closing costs when paying cash?

You will, however, still be responsible for closing costs when paying cash. Don’t forget about these expenses you’ll have to cover, even if you plan on financing the house with cold, hard cash. Here’s what to know about closing costs for cash buyers.

Do you have to pay property taxes if you pay off your house?

And it’s true! Even if your entire house is paid off, you’ll still have to pay property taxes each month.

Where are closing costs listed?

The closing costs are listed under the Debit column.

Why pay all cash for a house?

Paying all cash for a home is one of the best ways to get a great deal on a property. With all cash, a buyer can make a no-financing contingency offer that is much more attractive to the seller. A financing contin gency and an inspection contingency are the two main reasons why deals fall apart. This post will highlight all ...

Why do sellers pick escrow companies?

The escrow company is usually picked by the seller because the seller initially pays a fee to analyze the title of the property before selling. For the buyer to insist on a different escrow company would be a waste of money since analyzing the initial title costs money (~$500). Title Notary: $15.

What happens to a loan when you refinance?

When this happens, a Discharge of the paid off loan is to be recorded at the Registry of Deeds either by the new lender, the closing attorney or the borrower.

How much does a title notary cost?

Title Notary: $15. The notary takes your signatures and thumbprints and makes sure all the documents are official.

Is closing cost negotiable?

Closing costs are somewhat negotiable if it is a buyer’s market. In other words, you may be able to get your seller to pitch in to cover some of the costs. But this negotiation might also backfire and cause you to lose the property.

Do you have to bake closing costs into an offer contract?

A savvy homebuyer or real estate investor will bake into their offer contract the closing costs. Do not be blindsided by closing costs when it finally comes time to sign the papers.