- You’re not age 55 yet. A penalty tax normally applies to any withdrawals taken before age 59 ½. ...

- You’re age 55 to 59 ½. ...

- You’re age 59 ½ to age 70. ...

- While you are still employed, if you want access to 401 (k) funds from a plan sponsored by your current employer, you may not be able to get your hands ...

- You are age 70 ½ or older. ...

What age should you start withdrawing money from your 401k?

Dec 19, 2021 · If you are between ages 55 and 59 1/2 and get laid off or fired or quit your job, the IRS rule of 55 lets you pull money out of your 401 or 403 plan without penalty. It applies to workers who leave their jobs anytime during or after the …

When can I draw from my 401k without penalty?

Mar 05, 2022 · The IRS dictates you can withdraw funds from your 401 account without penalty only after you reach age 59½, become permanently disabled, or are otherwise unable to work. Depending on the terms of your employer’s plan, you may elect to take a series of regular distributions, such as monthly or annual payments, or receive a lump-sum amount upfront.

What is the minimum age for 401k withdrawal?

Jan 24, 2020 · Can I Withdraw From My 401(k) at 55 Without a Penalty? If you leave your job at age 55 or older and want to access your 401(k) funds, the Rule of 55 allows you to do so without penalty. Whether you've been laid off, fired or simply quit doesn't matter—only the timing does.

How to retire early on a 401k with no penalty?

At what age can you withdraw 401k without penalty? If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. Click to see full answer.

Do I pay taxes on 401k withdrawal after age 60?

If your 401 k contributions were traditional personal deferrals the answer is yes you will pay income tax on your withdrawals. If you take withdrawals before reaching the age of 59 ½, the IRS may also impose a ten per cent penalty.

How much can I take out of my 401k at 55?

What Is the Rule of 55? Under the terms of this rule, you can withdraw funds from your current job's 401(k) or 403(b) plan with no 10% tax penalty if you leave that job in or after the year you turn 55. (Qualified public safety workers can start even earlier, at 50.)Feb 10, 2022

How much can you take out of 401k at age 59 1 2?

There is no limit on how many withdrawals you can make. After age 59 1/2, you can take money out without getting hit with the dreaded early withdrawal penalty.

How can I withdraw money from my 401k without penalty?

Here are the ways to take penalty-free withdrawals from your IRA or 401(k)Unreimbursed medical bills. ... Disability. ... Health insurance premiums. ... Death. ... If you owe the IRS. ... First-time homebuyers. ... Higher education expenses. ... For income purposes.Mar 25, 2022

What is the 55 rule?

The rule of 55 is an IRS provision that allows workers who leave their job for any reason to start taking penalty-free distributions from their current employer's retirement plan once they've reached age 55.Feb 18, 2022

What happens to my Social Security if I retire at 55?

The SSA doesn't penalize working retirees forever. You'll receive all of the benefits the government withheld after you reach your full retirement age. At that time, the SSA recalculates your benefit amount.Sep 23, 2021

Do I have to pay taxes on my 401k after age 65?

Tax on a 401k Withdrawal after 65 Varies Whatever you take out of your 401k account is taxable income, just as a regular paycheck would be; when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on withdrawals.Oct 31, 2018

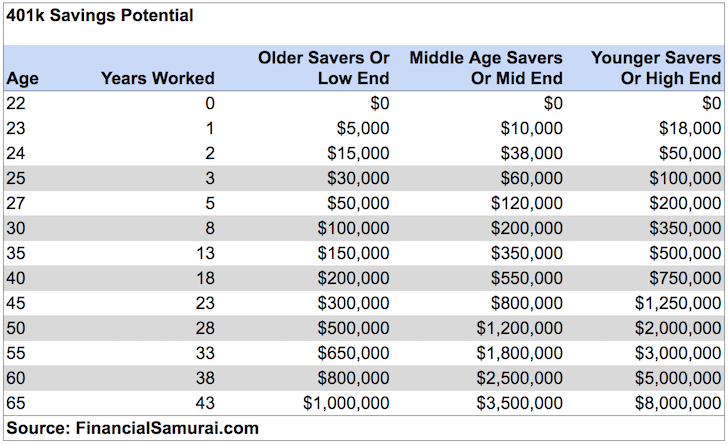

What is the average 401k balance for a 65 year old?

Average 401k Balance at Age 65+ – $469,702; Median – $137,468. The most common age to retire in the U.S. is 62, so it's not surprising to see the average and median 401k balance figures start to decline after age 65.Feb 25, 2022

What is a Covid 19 401k withdrawal?

401(k) and IRA Withdrawals for COVID Reasons Section 2022 of the CARES Act allows people to take up to $100,000 out of a retirement plan without incurring the 10% penalty. This includes both workplace plans, like a 401(k) or 403(b), and individual plans, like an IRA.Jan 12, 2022

How do I withdraw from my 401k after age 60?

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401(k). If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401(k) you had with that current company.Nov 8, 2021

What reasons can you withdraw from 401k without penalty COVID?

The CARES Act waives the 10% penalty for early withdrawals from account holders of 401(k) and IRAs if they qualify as coronavirus distributions. If you qualify under the stimulus package (see above) and your company permits hardship withdrawals, you'll be able to access your 401(k) funds without penalty.Oct 13, 2021

How can I avoid 10 penalty on 401k withdrawal?

Delay IRA withdrawals until age 59 1/2. You can avoid the early withdrawal penalty by waiting until at least age 59 1/2 to start taking distributions from your IRA. Once you turn age 59 1/2, you can withdraw any amount from your IRA without having to pay the 10% penalty.

What Is The Covid

You’ll generally have to pay a 10% early withdrawal penalty if you take the cash out before you reach 59 1/2 years old.

What Is The Rule Of 55

Your 401 account is likely one of the most valuable assets you have, so it’s essential to know when and how you can access it. These accounts are intended to fund your retirement, and as such you can access them penalty-free when you reach age 59½.

When Faced With A Sudden Cash Crunch It Can Be Tempting To Tap Your 401 More Than A Few Individuals Have Raided Their Retirement Account For Everything From Medical Emergencies To A Week

But if you’re under 59-1/2, keep in mind that an early withdrawal from your 401 will cost you dearly. You’re robbing your future piggy bank to solve problems in the present.

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

How The Rule Of 55 Works

The rule of 55 affects how and when you can access your retirement savings. If you are between ages 55 and 59 1/2 and get laid off or fired or quit your job, the IRS rule of 55 lets you pull money out of your 401 or 403 plan without penalty. It applies to workers who leave their jobs anytime during or after the year of their 55th birthday.

How Much Money Can You Take Out Of Your 401k Without Penalty

Individuals affected by COVID-19 can withdraw up to $100,000 from employee-sponsored retirement accounts like 401s and 403s, as well as personal retirement accounts, such as traditional individual retirement accounts, or a combination of these. The 10% penalty will be waived for distributions made in 2020.

Tips For Retirement Planning

Meet with your financial advisor to discuss the pros and cons of retiring early. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you.

How early can you take a 401(k) distribution?

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Visit the IRS’ website for more details.

When should I stop tapping into my retirement account?

Your best bet is usually to consciously avoid tapping any retirement money until you’ve at least reached the age of 59 ½. Sometimes, there are circumstances when it’s difficult to avoid tapping into retirement accounts — 10% penalty or no.

How much can I borrow from my 401(k)?

If your plan does allow loans, your employer will set the terms. The maximum loan amount permitted by the IRS is $50,000 or half of your 401k’s vested account balance, whichever is less. During the loan, you pay principle and interest to yourself at a couple points above the prime rate, which comes out of your paycheck on an after-tax basis. Generally, the maximum term is five years. However, if you use the loan as a down-payment on a principal residence, it can be as long as 15 years. Sometimes, employers will require a minimum loan amount of $1,000.

When will 401(k) be available in 2021?

May 18, 2021. 401ks, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Sometimes, however, unplanned circumstances force people to withdraw funds from their IRA or 401k early. In 2020, nearly 33% of Americans took coronavirus-related ...

How long can you roll over an IRA?

You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash.

Is the Cares Act penalty back in 2021?

The early withdrawal penalty of 10% is back in 2021. Income on withdrawals will count as income for the 2021 tax year.

Can you withdraw money from a 401(k) early?

If you find yourself in a situation where you do need to withdraw funds from your 401k or traditional IRA early, there are a few circumstances in which the 10% penalty might be waived. This doesn’t include items that deal with death or complete disablement.

Understanding Early Withdrawal From A 401 (k)

A 401 (k) is a retirement plan that allows you to make tax-deferred contributions into the plan and lets the investments grow tax-free until retirement age. Since this money is supposed to be for retirement, then it needs to remain in the account until you retire. Withdrawing money from your account should only be done in emergency situations.

1. CARES Act Withdrawal

Due to the financial crisis created by the Coronavirus pandemic, the CARES Act was signed into law by President Donald Trump in March 2020. Among the provisions of this act were some situations which allow for penalty-free withdrawals from your 401 (k) in 2020 due to COVID-19. There are a few ways to qualify for a withdrawal under this act.

2. Avoid The 401 (k) Early Withdrawal Penalty

While the age for avoiding the penalty is normally 59 1/2, there is an exception to the age rule. If you leave a job or are terminated at age 55 or later, then you can make withdrawals from your account with that employer without paying the penalty.

3. Hardship Withdrawal

There are times when a severe financial need will be enough to allow you to take a hardship withdrawal without the 10% penalty. The things that specifically qualify as a hardship will be spelled out in your plan documentation, and those will vary between employers.

4. Borrow From Your 401 (k)

This can be a great option for those who need to use money from their 401 (k) but do not want to pay the penalty. It is worth noting that not all plans allow for borrowing, and even if your plan does allow a 401 (k) loan, you should only use it as a last resort.

5. Disability

If you become disabled and unable to work, then you might be able to take money out of your 401 (k) or individual retirement account (IRA) early without paying the penalty. However, not just any disability will qualify you for this exemption.

6. Substantially Equal Period Payments (SEPP)

Substantially Equal Period Payments (SEPP) might be a good option if you need to withdraw money for a long term need. These payments must last a minimum of 5 years or until you reach the normal 401k withdrawal age of 59 1/2, whichever is shorter.

Can you take money out of your 401k without being penalized?

The CARES Act allows individuals to withdraw up to $ 100,000 from a 401k or IRA account without penalty. Early withdrawals are added to the participant’s taxable income and taxed at ordinary income tax rates.

What are exceptions to 401k early withdrawal penalty?

There are a few exceptions to the minimum age of 59½. “The IRS offers retribution without penalty in special circumstances related to death, disability, medical expenses, child support, spousal support, and active military activity,” said Bryan Stiger, CFP, a counsel. Betterment’s 401 (k) financial statement.

Do I pay taxes on 401k withdrawal after age 60?

The IRS defines early retirement as taking money from your retirement plan before the age of 59 years. In most cases, you will have to pay an additional 10 percent tax on early retirements, unless you qualify for an exception. It is above your normal tax rate.