The Federal Reserve study points out that the average net worth for people between 45 and 54 is $727,500, and the median figure is $124,200. When you are in your 50s, you are close to retirement, and at this stage, it is advisable to have a net worth that is four times your salary.

How much is really enough to retire?

Using a withdrawal rate of 4%, you should have a minimum of $1 million in retirement savings before you retire. This rule of thumb works whether you plan to retire early at 35 or go the conventional route and retire at 65 years or later.

How much should my net worth grow each year?

My definition of a comfortable net worth is when you become UNCOMFORTABLE losing any more than 15% of your net worth in one year. A 10% annual growth rate is close to the historical S&P 500 average annual return. 10% is also roughly 3X the risk free rate. This net worth growth target rate ensures that you are staying ahead of inflation.

What is the average 60 year olds net worth?

The most recent report released in September 2020 (using data collected in 2019) shows the median U.S. household net worth is $121,700 — but it’s more than double that for people ages 65 to 74. According to the Fed data, the median net worth for Americans in their late 60s and early 70s is $266,400.

How to have a high net worth?

What’s a Good Net Worth at 30?

- Invest Your Money to Build Wealth. Now that we’ve established your budget and your student loan debt has a low-interest rate, you need something to do with that extra money.

- Reaching Your Goals. We like Personal Capital because it’s easy to use and free. ...

- Use the 50/30/20 Budget Rule. ...

How to calculate net worth?

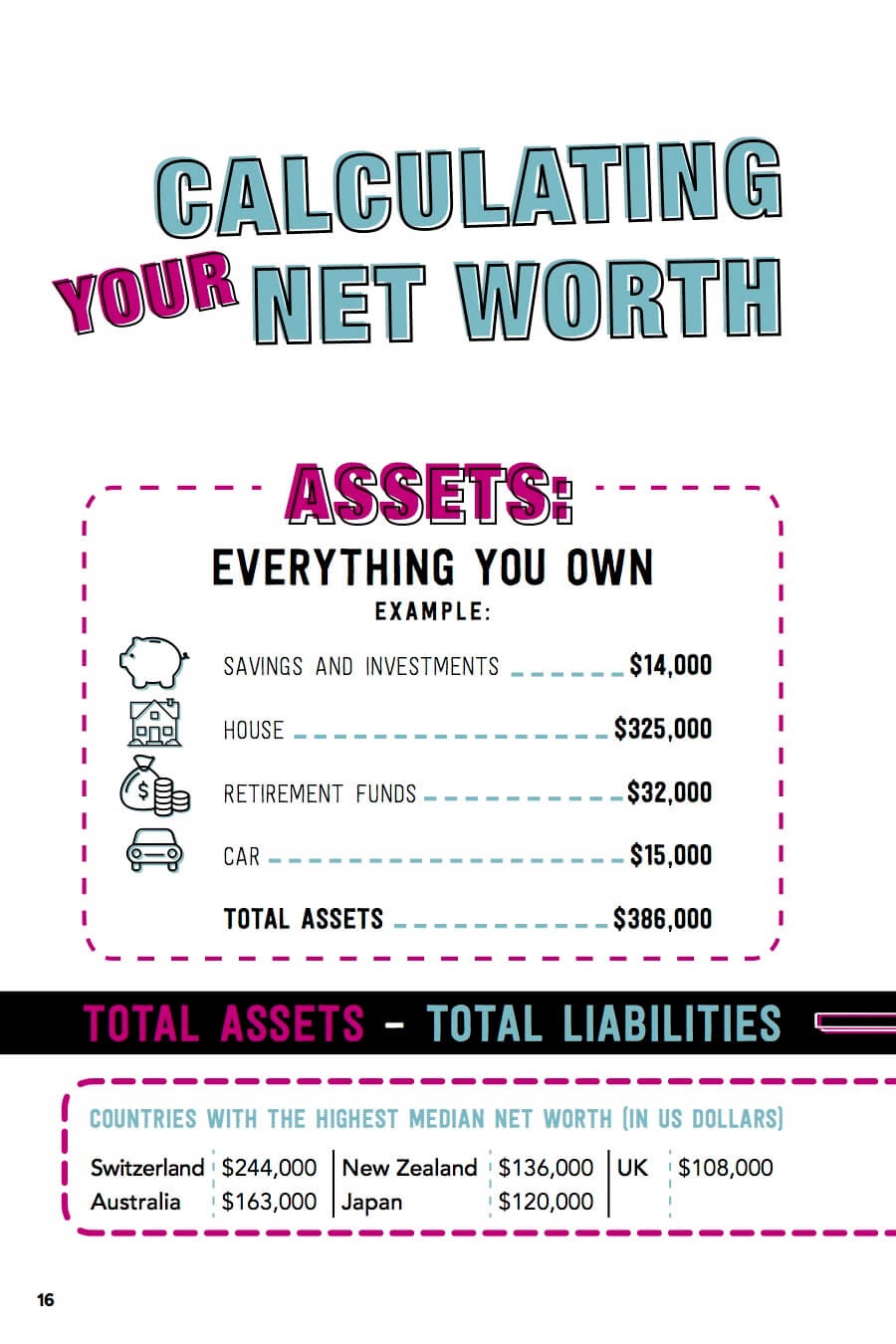

Your net worth looks at the overall value of your possessions by accounting for what you own and subtracting your obligations. "Just like a business, you'll add up the value of all your assets, subtract your liabilities and hopefully the net result will be positive," Krueger says. Start by summing up the value of all your assets, such as cash accounts, stocks, bonds, retirement accounts and the value of your home. "Do not include smaller items that would be difficult to convert to cash such as clothing," Krueger says. Then turn to debts and find the total amount you owe on your mortgage, auto loans, credit cards, student loan balances and any other loans. Subtract the total debt from the total assets to find your net worth.

Is it wise to retire with a high net worth?

Once you achieve the net worth you need to retire , it's still wise to stay budget-savvy. "While a high net worth in any asset may mean a person feels more comfortable retiring, those assets may not last the entirety of their retired life if their lifestyle and withdrawals are too high," says Andrew Bernstein, a wealth management advisor with All Points Wealth Management, a Northwestern Mutual company, in Raleigh, North Carolina.

Why do retirees need less net worth?

It stands to reason that when you own assets that have a high probability to increase in value, logically, you need less net worth to retire.

What is the starting point of knowing what net worth you need to retire?

The starting point in knowing what net worth you need to retire is knowing your expenses.

How do smart retirees get money?

Fortunately, nowadays, many smart retirees are also generating income from their homes by renting a portion of it through AirBnB.

When do people get super focused on increasing their net worth?

Just past midlife, many people get super focused on increasing net worth before retirement.

Does net worth include investment accounts?

Remember that net worth includes all your assets, not just your investment accounts.

Is Social Security available to older people?

In the U.S., social security is available now to those 62 and older, but there can be so many more income streams.

Should I reduce spending after retirement?

While most financial experts and retirement planners recommend decreasing spending after retirement, I don’t .

How to Calculate Your (Tangible) Net Worth

It’s important to note that an individual’s net worth will differ slightly from that of a company’s net worth. In either case, though. all assets minus all liabilities equals net worth. But, for purposes of calculating net worth for individuals, assets are valued at their current market value rather than their original purchase price.

Determining How Much You Need to Retire

You should choose a net worth goal that accommodates your lifestyle and limits in retirement. The thing is, there is no one-size-fits-all approach. As such, figuring out how much you’ll need in your post-work life will vary.

Spend Without Worry in Retirement

Even after doing all of the above, almost half of Americans fear that they’ll run out or outlive their money. While some proclaim that this fear is overblown, there is some validity here. After all, there’s inflation, rising medical costs, and the fact that people are living longer.

What is Net Worth?

Knowing your net worth is one of the most important aspects of personal finance. It’s one of the best indicators we have to see if we are on target to meet our goals.

What is the average net worth of a family of 35 and 44?

For example, the average net worth of American families (head of the household) between the ages of 35 and 44 was $288,300 in 2019. The median figure was reported at $59,800. This is according to the Federal Reserve Board’s triennial Survey of Consumer Finances, based on data collated for 2019 (see table below).

What happens if your assets are more than your liabilities?

If your assets are more than your liabilities, your net worth is positive. Congratulations, you are taking the first step towards retirement success. If your assets are less than your liabilities, your net worth is negative.

What is the average net worth of Singapore?

According to Credit Suisse Global Wealth Report for 2019, Singapore is ranked 6 th in the world in terms of average household wealth per adult with an average net worth of USD297,873. Within Asia, it is second only to Hong Kong.

How to invest consistently?

The ideal way to consistently invest is to automate the “pay-yourself-first” process as much as possible.

Is it realistic to benchmark your net worth?

No. While it is always easy to benchmark one’s net worth by age according to the national average or median number or use a multiple of one’s current income etc, a more realistic figure should be based on one’s expected retirement expenses to gauge if he/she is indeed on track to retire well.

Is net worth taboo?

The topic of net worth is a pretty sensitive and often taboo subject that most will avoid unless you are a “multi-millionaire with an equally ultra-big ego to boost”. Despite its sensitivity, calculating one’s net-worth should be an exercise taken by all.

Why is real estate the best investment?

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income. With inflation on the horizon, I believe real estate is the top investment we can make to build wealth over the next decade.

How much money can I make with 10 million dollars?

Now that we know 10 million dollars can generate between $150,000 – $400,000 a year without the help from Social Security, let’s go through a budget. I’ve decided to compromise and say 10 million dollars can generate $250,000 a year in relatively low-risk retirement income.

How to get 10 million dollars to last longer?

Another way to get your 10 million dollars to last longer is to not touch it for longer. Instead of retiring before you’re 60, wait until your 60s or later. This way, you allow your 10 million dollars to compound for longer and potentially grow even bigger. The earliest you can receive Social Security is age 62.

How to make 10 million dollars go farther?

If you don’t want to take on more risk, the next best way to make your ten million dollars go farther is to lower your cost of living. Since you’re no longer tied down to a job, you could relocate to the heartland of America to save on living costs.

What to do if you don't want to make supplemental income online?

If you don’t want to make supplemental income online, you can always do some freelance consulting, gig economy work, tutoring, or coaching. The opportunities are endless to make extra income.

Is 10 million enough to retire?

By now, we should all agree that 10 million dollars is enough to retire well. However, I still suggest generating additional side income in retirement to ensure your capital will last for another generation. Earning side income also brings about a sense of purpose.

Does interest rate decline hurt retirement income?

Although a decline in interest rates has helped support the U.S. economy by making borrowing costs cheaper, it has hurt the average retiree’s ability to generate retirement income. Therefore, even with 10 million dollars in investable assets, you’ve still got to pay careful attention to how your capital is allocated.

How much should your retirement withdrawal rate be?

All you need to do is have your investments match inflation each year. With inflation running at roughly 2% a year, 2% should be your annual retirement withdrawal rate if you want to keep most of your principal.

Why is rental income going up?

The reason why is because it now takes a lot more capital to generate the same amount of risk-adjusted income. Yet, real estate prices have not reflected this reality yet, hence the opportunity.

What is 3.5% tax free?

A 3.5% tax-free rate is equivalent to around a 4.6% gross rate at a 25% effective tax rate. Hence, we’re now talking about generating roughly $100,000 a year in gross retirement income.

Is real estate a tangible asset?

Real estate is a core asset class that has proven to build long-term wealth for Americans. Real estate is a tangible asset that provides utility and a steady stream of income if you own rental properties. Given interest rates have come way down, the value of rental income has gone way up.

Is it possible to retire on 2 million dollars?

However, retiring on only two million dollars is completely doable. Especially if you are able to start withdrawing from your 401k penalty free at 59.5, have a pension, and/or can also start receiving Social Security as early as 62. If you can relocate to a lower-cost area of the country, then retiring on two million dollars will go farther ...

How much of Joseph and Debra's stock portfolio should be invested in?

Based on the risk tolerance and their income needs, we determined that Joseph and Debra needed roughly 60% of their investments in stocks and 40% in bonds for the first 10 years of retirement. After some of their goals of buying a timeshare and buying their kids' graduation gifts, then we felt we could tone down the allocation to 40% stocks and 60% bonds (that's what these two graphs represent).

Can financial advisors forget assumptions?

It can be easy for clients – not to mention financial advisors – to forget this and make assumptions without considering all the possible consequences of a particular action. That's why when I sit down with clients I remind them that even though there may be a high degree of certainty of this or that outcome, there is still a possibility that a different outcome may come to pass.

Does a portfolio worth $2 million grow overnight?

A portfolio worth $2 million does not grow overnight. And while it may seem impossible for some to attain, it’s very doable with discipline, a plan of attack and making sure that you're not in denial about your money situation.