Can YOU Cash a handwritten check?

You can cash handwritten checks at banks like Chase and PNC, check cashing stores like Speedy Cash, and some retail stores like H-E-B and Publix. Definitely. The N.I. Act does not lay down that the cheques should be written in pen. In fact, cheques can be written in pencil also.

Are postdated checks considered cash?

Items like postdated checks, certificates of deposit, IOUs, stamps, and travel advances are not classified as cash. These would customarily be classified in accounts such as receivables, short-term investments, supplies, or prepaid expenses. How do I record a post-dated check in Quickbooks? From the File menu, select Print Forms>Cheques.

Can I legally write a post dated check?

You’ll need to check the specific laws for your respective state, but postdated checks are generally legal to write in the United States. Postdating a check may be considered illegal if the check writer’s account does not have the necessary funds to deposit the check, and if the writer’s intent was to defraud at the time of issuing the check.

Do I have to accept a post dated check?

Therefore, a bank will be able to accept a check if it is dated and signed. Ask your bank or credit union for their specific policy for postdated checks in their account disclosures. There are other ways to provide yourself with more time to have the necessary funds to deposit checks in your account besides postdating checks.

What happens if a bank cashes a post-dated check?

After that, the bank or credit union can cash the check before the date you wrote on it. If your bank or credit union cashed a check before the date you put on it while your notice was still valid, then it may be liable to you for any damages.

Do banks accept post-dated checks for deposit?

Can You Cash a Postdated Check Before Date Shown? A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed.

Why banks do not accept post-dated checks?

The main reason the law lets banks cash post-dated checks is that it's too hard to look at checks for their date. Processing 45,000,000 checks a day is tough enough, without looking at dates.

Does the date on a check matter?

Unfortunately, the fact is that there's generally no actual obligation to honor the date on a check.

Can you cash a check a day before its date?

Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice. Contact your bank or credit union to learn what its policies are.

Can I deposit a check the day before the date?

Yes. Banks are permitted to pay checks even though payment occurs prior to the date of the check. A check is payable upon demand unless you submit a formal post-dating notice with your bank, possibly for a fee.

What happens if you deposit a check before the date?

“We'll treat it like any other check to see if it raises any flags. If it is post-dated, we'll still accept it,” she said. “But, we'll tell them that it may bounce if the person writing the check doesn't have sufficient funds in their account.”

Does Chase cash post-dated checks?

Chase Bank: The bank specifies that customers should not issue anything postdated. Wells Fargo: It makes it clear it will not wait until a certain date to cash a check that is postdated unless a stop-payment order is requested.

What is a check that a bank refuses to pay?

Dishonored check. A check that a bank refuses to pay.

What happens if you cash a check a day early?

Function. Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

Are post-dated checks illegal?

Although it is legal to post-date a check, the bank to which the check is presented for payment may charge the payor's account even before the date of the check and even if doing so creates an overdraft.

Can a bank refuse to cash a check drawn on it?

Funds Availability Policies Any bank can refuse to cash a check—even if that bank's customer wrote the check and has sufficient funds. The bank may decide not to cash checks if something is suspicious, or if it chooses not to serve non-customers.

What if I write the wrong date on a check?

If you've made a mistake when writing a check, it's usually safest just to void the check and start a new one. If this isn't an option or your mistake is fixable, draw a neat line through your mistake and write the correction right above it. Initial your correction to help authenticate it.

Can you use a check with an old date?

The Uniform Commercial Code (UCC) is a collection of laws and regulations meant to harmonize the laws of sales and regulations across the U.S. The UCC tells banks that they are under no obligation to accept personal or business checks that are older than 180 days (6 months).

Can you cash a 2 year old check?

Yes, you can cash a 2-year-old check in theory, but the bank won't be legally obligated to process it for you. If you have a 2-year-old check lying around, your best bet is to take up the matter with your bank, the payer, or perhaps even get the state involved.

What date should I put on a check?

All checks contain a place to write the date in the top right corner, and it should be today's date (the date at the time of signing the check). Sometimes people will post-date by writing a future date. However, this has no impact, as the check becomes legal tender as soon as it is signed.

When is a check payable?

A check is payable upon demand unless you submit a formal post-dating notice with your bank, possibly for a fee. Contact your bank about how to provide such notice. Last Reviewed: April 2021.

Can a bank pay a check?

Yes. Banks are permitted to pay checks even though payment occurs prior to the date of the check. A check is payable upon demand unless you submit a formal post-dating notice with your bank, possibly for a fee. Contact your bank about how to provide such notice.

Why do banks cash postdated checks?

The main reason the law lets banks cash post-dated checks is that it’s too hard to look at checks for their date. Processing 45,000,000 checks a day is tough enough, without looking at dates.

Do you have to warn your bank about a postdated check?

That’s if you warn your bank ahead of time about your post-dated a check, so it knows to be careful. The law says you have to describe the check “with reasonable certainty,” and give the bank enough time to have "a reasonable opportunity to act.”.

Can you sue over a bounced check?

But that might be hard to prove, and the amount involved—the bounced check fees—probably aren’t enough to sue over. Post-dated checks are perfectly legal. If they weren’t, “pay day” lenders, and other crude forms of credit, couldn’t exist. Only “properly payable” checks are supposed to be cashed by banks. But just about anything with the right ...

How Does a Postdated Check Work?

People usually postdate checks when they want the recipient (the person or business receiving the payment, also known as the payee) to wait before depositing the check. Two potential reasons for this include:

What is a postdated check?

Updated June 28, 2021. A postdated check is a check with a future date written on it. A check is typically postdated to encourage the recipient to wait before cashing the check. Whether you receive a postdated check or are thinking of writing one, it’s important to know that it may not work the way you expect.

Why do people postdate checks?

People usually postdate checks when they want the recipient (the person or business receiving the payment, also known as the payee) to wait before depositing the check. Two potential reasons for this include: 1 The check writer does not have sufficient funds available when writing the check, but those funds will be available on a future date. 2 The check writer is paying for something ahead of time, either before the payment is due or before the service has been completed.

Why is my check postdated?

It’s wise to communicate first with whoever wrote the check—there’s probably a reason it’s postdated. If the account does not have sufficient funds, the check might bounce, and you might have to pay insufficient funds or overdraft fees to your bank. You can try to get those fees reimbursed by the check writer, but collecting from somebody who’s already low on funds can be time-consuming, and if legal action is required, it could be expensive.

What happens if you don't pay your bank?

If you’re unwilling or unable to pay your bank to monitor your account, you’re at the mercy of whoever you give the check to. Even if your payee is honest, they may make the honest mistake of forgetting (potentially leaving you with bad check fees).

Is it easier to cash a postdated check than depositing it?

Cashing a postdated check might be more difficult than depositing it. Depositing allows your bank to place a hold on the funds while the check clears, but cashing a check requires an immediate transaction. If you really want to cash a postdated check for the full amount, take it to the bank that issued the check (where the check writer has a checking account).

Can you cash a check before the date?

Debt collectors may be prohibited from processing a check before the date on the check, but most individuals are free to take postdated checks to the bank immediately. That said, if you agreed to wait, cashing the check prematurely might be considered in violation of an oral agreement, and that could be illegal in some jurisdictions.

Why Write a Postdated Check?

There are multiple reasons why you may need to write a postdated check and the reasons can vary greatly depending on your personal situation. Below are some common reasons why individuals choose to write postdated checks.

What is postdating a check?

Most frequently, postdating a check is an effort to avoid fees. The check writer is waiting for money to be deposited or for another check to clear before the payee will be able to cash the check without overdrawing the writer’s account.

What happens if a check is rejected?

If the payment is rejected, your bank is generally responsible for covering any overdraft charges that occur.

What happens if you overdraft a check?

If an account overdraft happens, there are usually a few fees that are levied, such as insufficient funds or an overdraft fee (and sometimes both). On the payee’s end, there may be a bounced check fee. Banks will often try to collect this from the writer, if possible.

What to do if you are lacking funds?

If you are lacking funds and you need additional time to come up with the money, talk with your check recipient about an alternative payment date.

Is it a courtesy to cash a postdated check?

Postdated Check Cashing. If you are the payee, cashing a postdated check is the same as cashing any other type of check. Since it’s postdated, it’s a courtesy to cash it at the writer’s bank. Note that it is just that, though — a courtesy. It’s not a requirement.

Can a business reject a postdated check?

Businesses may reject a postdated check as a form of payment — and this is well within their legal right. They can also try to cash the check whenever they please. You should clear it with your bank and your payee before writing a postdated check.

What happens if a check doesn't go through?

If it doesn't go through, the recipient might charge you late fees and a bounced-check fee. But usually it doesn’t get much worse. If you are concerned about overdrafting — and you'd rather not deal with a returned check and your landlord's ire — consider switching to a bank with a solid overdraft policies.

What happens if you write a check and don't have enough money?

If you write a check and don't have enough money in your account when it's cashed — whether or not it's postdated — your bank can cover the payment or let the check bounce based on its overdraft policy. If the check goes through, you'll pay an overdraft fee. If it doesn't go through, the recipient might charge you late fees and a bounced-check fee.

What to do if you are concerned about overdrafting?

If you are concerned about overdrafting — and you'd rather not deal with a returned check and your landlord's ire — consider switching to a bank with a solid overdraft policies. All of these charge lower than average overdraft fees and offer free ways to avoid that fee while still paying your bills.

What is the basis for check fraud?

Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

What is cash management account?

Cash management accounts are typically offered by non-bank financial institutions.

Can a bank honor a postdated check?

Banks and credit unions generally state rules about postdated checks in their account disclosures. Some of the biggest banks, for example, note specifically that they can honor checks that are made out for future dates.

Can banks honor checks made out for future dates?

Some of the biggest banks, for example, note specifically that they can honor checks that are made out for future dates. The Uniform Commercial Code, a collection of business laws adopted or adapted by many states, gives financial institutions the right to process a correctly written check with a future date.

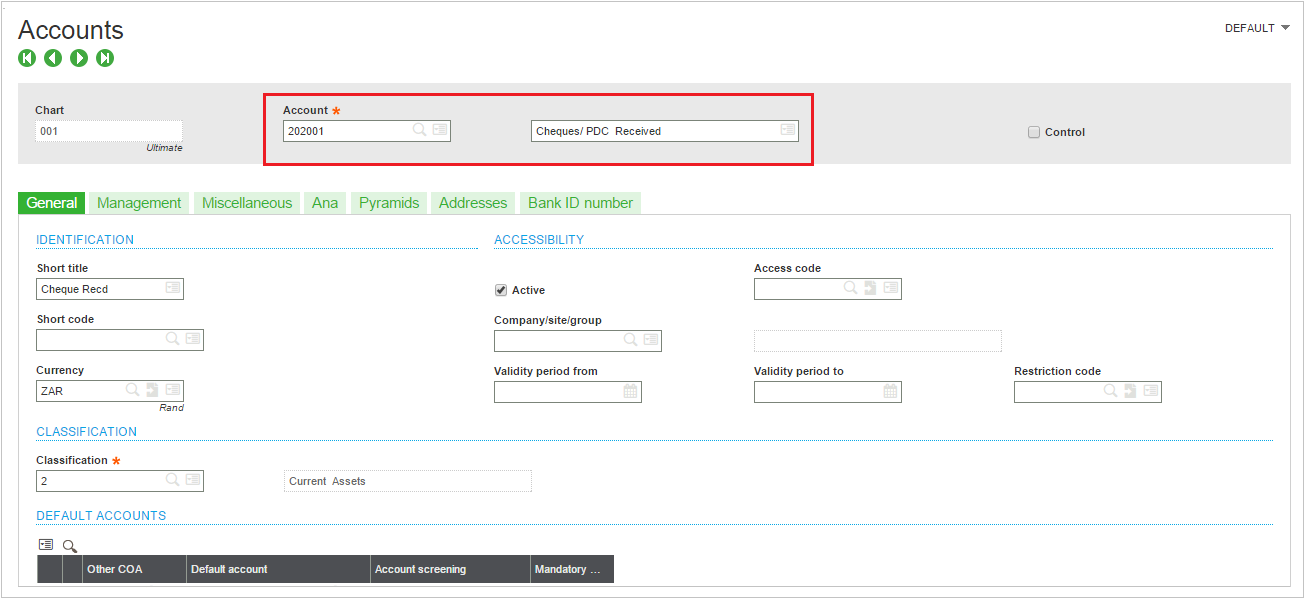

What is a postdated check?

This article provides information about support for postdated checks. Postdated checks are checks that are issued to make and receive payments on a future date. Therefore, the check can't be cashed until the specified date.

When is a postdated check settled?

Settle a postdated check that is posted to a bridging account for a customer or a vendor when the check finally matures. When the check is settled, the bank is finally debit or credit against the clearing account that was used earlier.

When a payment is posted, is the vendor liability recognized?

When the payment is posted, the vendor liability is recognized, but the bank account isn’ t yet credit. Instead, a clearing account is used for this purpose. Register and post a postdated check for a customer. Register the details of a postdated check that you receive from a customer.

Can you post a replacement check?

You can also post the replacement check. When you receive a postdated check from a customer, you can transfer that check to a vendor as a payment. Settle a postdated check that is posted to a bridging account for a customer or a vendor when the check finally matures.

Can you stop payment on a postdated check?

You can stop payment on a postdated check that was issued to a vendor, for reasons such as not sufficient funds, changes in the terms of the agreement with the vendor, supply of defective goods by the vendor, or return of goods to the vendor. You can stop payment only on checks that haven’t cleared.