Can the seller pay closing costs instead of the buyer?

Sometimes, the seller can be asked to pay for some closing costs instead of the buyer, but it’s important to keep in mind that they’re already paying around 6 percent of the total sale in agent fees and commissions. Buyers may not have much luck asking the seller to absorb additional fees, but occasionally it’s a tactic that does pay off.

How do I avoid paying closing costs on my house?

How sellers can avoid paying closing costs The single biggest cost to home sellers is the real estate commission fee, which averages between 5-6% of the home’s final sale price. Many sellers try to negate this fee by going with a flat fee MLS service where they end up paying a flat fee ranging from $100 to $3000.

What happens if the other party refuses to pay closing costs?

If one party violates the terms of the purchase agreement — which could be the case if they refuse to pay closing costs — the other party can take legal action against them. This could result in the at-fault party either paying damages, or being ordered to perform a specific action — such as paying for closing costs.

How do I convince seller to pay closing costs?

Ways to Get a Seller to Cover Your Closing CostsPay the Full Asking Price. If you want to propose seller concessions, avoid making a lowball offer. ... Be Prepared to Close. ... Don't Make Excessive Demands. ... Be Willing to Negotiate. ... Pay Attention to the Market.

Does seller pay closing costs in Virginia?

Who Pays Closing Costs in Virginia? Both the buyer and seller pay closing costs in VA, but each party pays for different services and fees. Home sellers pay for the agent commission fees and transfer taxes, while the buyer pays for most other closing costs.

Who pays closing costs in Wyoming?

In Wyoming, you'll pay about 0.5% of your home's final sale price in closing costs, not including realtor fees. Keep in mind that this is only an estimate. While closing costs will always have to be paid, your real estate agent can often negotiate who pays them — you or the buyer.

Does the seller pay closing costs in Wisconsin?

In Wisconsin, sellers typically pay for title and closing fees, transfer taxes, owner's title insurance, and recording fees at closing.

How much is the average closing cost in Virginia?

Average Closing Costs By StateStateAverage Closing Costs (Including Taxes)Average Closing Costs (Excluding Taxes)Vermont$5,946.84$3,038.06Virginia$6,185.83$3,357.78Washington$11,513.23$4,205.82Washington, DC$29,329.89$6,250.2047 more rows

What is the average closing cost in Virginia?

According to data from ClosingCorp, the average closing cost in Virginia is $6,185.83 after taxes, or approximately 1.55% to 2.06% of the final home sale price.

Is it a good time to buy a house in Wyoming?

In truth, the best time to buy a house really depends on your priorities and situation....The Best Time to Buy a House in Wyoming.Best Month ForListing priceNovember9.5% lower than averageHousing inventoryJune11.5% more homes to choose fromMortgage ratesDecember2.95% interest for 30-year mortgageRealtor.com data (10/1/2020) Bankrate data (12/1/2020)Jun 16, 2022

How much are closing costs on a 500k house in California?

Closing costs on a $100,000 mortgage might be $5,000 (5%), but on a $500,000 mortgage they'd likely be closer to $10,000 (2%). In addition, closing costs are often a smaller percentage on a refinance loan because some fees— like transfer taxes and owners title insurance — aren't included.

What are closing costs in the USA?

Mortgage closing costs are fees and expenses you pay when you secure a loan for your home, beyond the down payment. These costs are generally 3 to 5 percent of the loan amount and may include title insurance, attorney fees, appraisals, taxes and more.

How do you get closing costs waived?

7 strategies to reduce closing costsBreak down your loan estimate form. ... Don't overlook lender fees. ... Understand what the seller pays for. ... Think about a no-closing-cost option. ... Look for grants and other help. ... Try to close at the end of the month. ... Ask about discounts and rebates.

What are the closing costs for seller?

Typically, sellers pay real estate commissions to both the buyer's and the seller's agents. That generally amounts to average closing costs of 6% of total purchase price or 3% to each agent. Additionally, sellers often pay for the buyer's title insurance policy, which is a low-cost add-on to the lender's policy.

Who pays for title search in Wisconsin?

In Wisconsin, the seller traditionally pays for the Owner's Policy. It may seem odd that the seller pays for the policy if it protects the buyer. However, the seller "warrants" or promises good title and it is the seller's responsibility to insure that promise by giving a title insurance policy at closing.

Who pays for title insurance in Virginia?

the home buyerIn Virginia, the home buyer typically pays for both title insurance policies. It may be possible to include a credit from the seller in your contract. Your realtor or mortgage lender will probably refer you to the title insurance company they usually work with.

What is included in closing costs?

Thus, closing costs include all expenses and fees charged by lenders and third parties, such as the broker and government, when the buyer gains ownership of a property. Closing costs may be one-time payments like brokerage or payments that recur on account of ownership such as home insurance.

How many months of property taxes are collected at closing in Virginia?

In addition, taxes equal approximately to two months in excess of the number of months that have elapsed in the year are paid at closing. (If six months have passed, eight months of taxes will be collected.)

Can closing costs be included in loan?

Including closing costs in your loan — or “rolling them in” — means you are adding the closing costs to your new mortgage balance. This is also known as financing your closing costs. Lenders may refer to it as a “no-cost refinance.” Financing your closing costs does not mean you avoid paying them.

The Seller Can Pay Up to 9% of Your Costs

The U.S. housing market is expanding. Fueled by low mortgage rates and the rising cost of rent, home sales are at decade-best levels and values hav...

What Are Mortgage Closing Costs?

When you purchase a home using a mortgage, your lender is required to disclose all fees which you’ll incur as part of the transaction. These fees a...

Using Seller Concessions to Reduce Loan Closing Costs

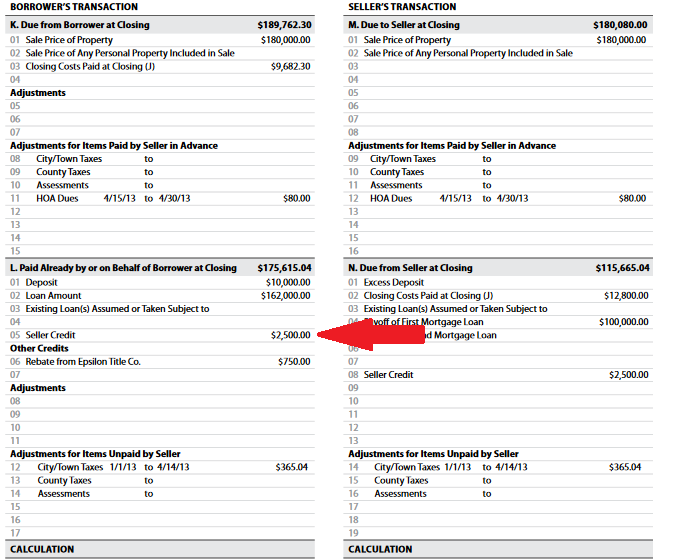

Seller concessions is a formal arrangement by which a home seller agrees to pay some, or all, of a buyer’s closing costs at the time of settlement....

How Seller Concessions / IPCS Work

Here’s how seller concessions work.First, a home buyer and home seller reach agreement on a sales price for a home. It could be any price, so long...

The Limitations of The “Seller Assist”

That said, limitations exist for seller concessions.One, as discussed, is that seller concessions may not exceed the sum of a buyer’s closing costs...

What Are Today’S Mortgage Rates?

If you’re buying a home but don’t want to pay costs, Seller Concessions are a good way to reduce the amount you’ll need at your settlement. Once yo...

What to do if closing costs are lower than what the seller agreed to pay?

The best option is asking your lender to add discount points. Discount points are an extra closing cost that lowers your rate.

Who pays closing costs?

The good news is that, as a home buyer, your contract can stipulate that the seller pays any and all closing costs. You may even be able to bring your closing cost obligation down to zero.

What do seller concessions cover?

Seller concessions can only be used for the buyer’s closing costs. The specific items that can be paid by the seller vary by loan type. But generally, seller concessions are allowed to cover:

What does it mean to get a seller concession?

Importantly, getting a seller concession does not mean the seller will hand over cash to pay for your upfront costs. Rather, it’s an agreement that allows the seller to cover the buyer’s costs using part of the proceeds from the home sale.

What happens if a seller doesn't want to lose money on a sale?

If the seller doesn’t want to lose money on their sale, they might agree to a slightly higher purchase price, and then use those extra funds toward the buyer’s closing costs. This effectively means the buyer is rolling their closing costs into their mortgage instead of paying them at the closing table.

What happens if the appraisal is too low?

If the appraisal is too low, the seller concession may be rejected. For VA loans, the seller concession may be allowed to exceed the 4% limit, since certain closing costs are not covered by that rule.

Why do sellers give concessions?

Typically, seller concessions happen when the seller is having trouble moving their house. As an incentive for buyers, they’ll agree to kick back part of the purchase price to help the buyer cover closing costs.

What fees do sellers pay at closing?

Here are the most common closing costs that sellers face at closing, along with how much each typically costs.

How much does a seller owe in closing costs?

Meanwhile, sellers owe closing costs equivalent to 8-10% of the final sale price. Given the U.S. median home value of $247,084, this comes out to an average of $19,000-$24,000, which is a huge weight on sellers. The biggest chunk of a seller’s closing costs goes to real estate agent fees. Because the seller usually pays for both their own agent and the buyer’s agent fees, commissions average 5-6% of the home sale. An additional 2-4% of the seller’s closing costs come from taxes and fees.

What is seller concession?

Buyers can ask sellers to cover some of their closing costs. These requests are known as seller concessions. They can cover specific closing costs or be a percentage of total costs. Common seller concessions include:

Why should a buyer include closing costs into a loan?

Why should a buyer include closing costs into a loan? If you need money upfront for repairs or building an emergency fund after spending lots of savings, including your closing costs into the loan is a wise financial decision.

How much can a seller contribute to a VA loan?

In the sale of an investment property, the seller can contribute up to 2%. With a VA loan, the seller can contribute up to 4%. With FHA & USDA loans, the seller can contribute up to 6%. Now, let’s talk about what sellers can do to reduce their closing costs.

What is escrow fee?

Escrow fee: These fees are paid to a title company or to an escrow company for their services (e.g. paperwork) in setting up escrow. Typically, earnest money is included in escrow. In a real estate transaction, this closing fee is split between buyer and seller.

How much does a buyer pay at closing?

A majority of these costs go to the mortgage loan lender. According to CostCorp, the average cost to buyers at closing is $5,749 including taxes. These fees typically consist of the lender’s title, owner’s title, appraisals, settlement fees, recording fees, ...

What is closing cost?

Closing costs are all of the fees and expenses that must be paid on closing day. The general rule of thumb is that total closing costs on residential properties will amount to 3% – 6% of the home’s total purchase price, although this can vary depending on local property taxes, insurance costs and other factors.

When do you receive a closing disclosure?

If a fee is associated with the mortgage process, it’s the buyer’s responsibility. Three days before closing, buyers receive a Closing Disclosure that will give a final breakdown of all the costs associated with the mortgage loan.

What are seller concessions?

Seller concessions are closing costs that the seller agrees to pay and can substantially reduce the amount of cash you need to bring on closing day. Sellers can agree to help pay for things like property taxes, attorney fees, appraisal inspections and mortgage discount points to lower your interest rate.

Why are some houses on the market too long?

Even in a seller’s market, some houses simply have been on the market too long, either because the asking price was too high to begin with or the property is in poor condition. In those cases, too, sellers might have to offer some financial incentive to buyers who are willing to consider these slow-moving homes.

Can you split closing costs?

Although buyers and sellers generally split closing costs, some localities have developed their own customs and practices about how to split closing costs. Be sure to discuss what closing costs look like with your real estate agent early in the home buying process, which may help you negotiate seller concessions.

Do sellers pay closing costs?

Here’s how it works: Sellers don’t agree to pay for closing costs out of the goodness of their hearts. Generally, sellers agree to pay in return for a higher sales price. Buyers might prefer this because it frees them from a demand for cash at a time when there are many financial demands.

Do you pay for appraisals on a home?

Buyers pay for the appraisal – which is required by the lender – and home inspection. Property taxes and homeowner’s association fees are prorated, and buyers pay only for the portion of the year that they will own the home.

What Are Closing Costs?

Buyer and seller closing costs are the monies due at closing, usually ranging from 3 percent to 5 percent of the total purchase price, comprised of fees and taxes. Although buyer vs. seller closing costs vary, they’re usually predictable. Sometimes, the seller can be asked to pay for some closing costs instead of the buyer, but it’s important to keep in mind that they’re already paying around 6 percent of the total sale in agent fees and commissions. Buyers may not have much luck asking the seller to absorb additional fees, but occasionally it’s a tactic that does pay off.

What expenses do you have to pay at closing?

Here’s a look at some of the common expenses a seller will have to pay at closing: Agent commission. Transfer tax. Title insurance.

How to decrease the amount of money you need to bring to the closing table?

One way that home buyers can decrease the amount they need to bring to the closing table is to request that the seller credit the buyer a certain amount of money at closing — above the purchase price. This money is then earmarked for the buyer to apply towards the payment of closing costs. With the seller effectively paying ...

What to learn when selling a home?

There’s a lot to learn for first time home sellers. For example: who pays title fees, buyer or seller? And, do buyer and seller ever split closing costs evenly? If the seller is opting to pay for repairs through escrowed money, they’re going to have to come up with that cash either from the profits of the sale, or out of their own pocket. Here’s a look at some of the common expenses a seller will have to pay at closing: 1 Agent commission 2 Transfer tax 3 Title insurance 4 Prorated property taxes 5 HOA fees 6 Credits toward closing costs 7 Seller attorney fees 8 Any escrowed money promised to the buyer

What is escrow fee?

Escrow fees cover the cost of transferring or wiring the money to and from an account, notary charges and the costs related to copying and administration of account documents. And there you have it! You have a better picture of what closing costs are and how to navigate the home purchasing process.

Why is it important to understand hidden costs when buying a home?

Because it’s so important to understand those hidden costs when buying a home, be sure to get financial updates from your lender frequently. While you're reviewing how you want to manage the purchase expenses for your new home, remember to make time to find the best homeowners insurance coverage before closing day.

What is escrow account?

Escrow is another name for a protected savings account. In the real estate world, escrow accounts are overseen by a third party that holds the buyer’s and seller’s money until the property changes ownership at closing, where it’s then paid out to the appropriate party or held for later use.

How much does a seller pay for closing costs?

Closing costs for sellers of real estate vary according to where you live, but as the seller you can expect to pay anywhere from 6% to 10% of the home’s sales price in closing costs at settlement. This won’t be cash out of the seller’s pocket; rather it will be deducted from the profit on your home—unless you are selling with very low equity on your mortgage. In this case, sellers may need to bring a little cash to the table to satisfy your lender—and some closing costs may be held in escrow.

What are closing costs for sellers?

Additional closing costs for sellers of real estate include liens or judgments against the property; unpaid homeowners association dues; prorated property taxes; escrow fees; and homeowners association dues included up to the settlement date.

What are the taxes that are included in closing costs?

Transfer taxes, recording fees, and property taxes are key parts of a seller’s closing costs. Transfer taxes are the taxes imposed by your state or local government to transfer the title from the seller to the buyer. Transfer taxes are part of the closing costs for sellers.

How much commission does a real estate agent get for a $350,000 purchase?

For a $350,000 purchase price, the real estate agent’s commission would come to $21,000. Buyers have the advantage of relying on sellers to pay real estate agent commissions. 2. Loan payoff costs. Most home sellers often seek out a sales price for their home that will pay off their mortgage and satisfy their lenders.

Do you factor closing costs into the sale price?

If you’re monitoring the value of your home so you can sell it and reap a worthwhile profit, don’t forget to factor in the closing costs for sellers into the sale price.

Do you have to include closing costs when selling a house?

Also, don’t forget to estimate some of the closing costs associated with preparing to sell, such as cosmetic repairs or improvements to make your home more attractive to buyers. Those closing costs may be returned with a higher sales price, but you should still include them in your calculations.

Do you have to pay attorney fees for a real estate sale?

If you have your own attorney represent you at the settlement of your real estate sale, the seller may have to pay attorney fees as part of closing costs. Market traditions vary, so while in some areas both the buyers and sellers have their own attorneys, in others it’s more common to have one settlement attorney for the real estate transaction.

What are VA closing costs?

We've talked about VA loan closing costs in detail before. They're a part of every mortgage deal and home purchase, regardless of the loan type. Some are costs associated with originating the loan, and others cover things like prepaid taxes and homeowners insurance, inspection fees and more. Sellers can pay all of the costs involved with originating the loan and up to 4 percent of the loan amount in concessions, which basically represent anything of value outside of those origination costs. According to the VA Seller Concession Rule, concessions can include things like the prepaid expenses mentioned above and paying off a borrower's collections or liens.

What happens if you buy a house for $224,000?

So, if you agree to buy a home for $224,000, but it turns out the home is only worth $220,000, the lender isn't going to give you a dime more than $220,000. At that point, you're facing another round of negotiation with the seller or possibly walking away from the deal entirely.

What is the fear of losing out on a property?

The fear is that you'll spook the seller and wind up losing out on a property you love. The good news is you may be able to construct your offer in a way that ensures the seller doesn't "lose" money despite paying those costs.

Does Texas offer cash out refinancing?

Due to state restrictions, we do not offer cash-out or debt consolidation refinances in the state of Texas.

Do you have to pay closing costs when making an offer?

When the time comes to make an offer on your dream home , asking the seller to pay your closing costs can almost seem like you're tempting fate. Not only are you hoping to get a great deal on the purchase price, but you're also expecting the person to cover some or all of the up-front expenses that come with getting a mortgage.

Do sellers pay closing costs?

Having sellers pay closing costs is what allows countless VA borrowers to move forward with their purchases. There's no guarantee a seller will agree or that the home will appraise, but it's important to know and understand your options. If you have questions about closing costs, VA appraisals or prequalification you can talk with ...