If your credit score is a 674 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit.

Full Answer

Can I get a mortgage with a 674 credit score?

With a 674 score, you may potentially be eligible for several different types of mortgage programs. The minimum credit score requirement to get a conventional loan is 674. In order to qualify for a conventional loan, you will need to meet all other loan requirements.

Can I buy a house with a credit score of 600?

Your existing debt can't be too high. To qualify for a mortgage, your total debts – including the home loan – typically need to be under 45% of your pre–tax income If you meet these other criteria, a credit score in the 600 range shouldn’t stop you from buying a house.

Is down payment assistance available to someone with a 674 credit score?

Is down payment assistance available to someone with a 674 credit score? Yes, in fact many down payment assistance programs are available to borrowers with a 674 credit score. The types of programs that exist include both local (city, county, or state level), and nationwide programs.

How does a 600 credit score affect your mortgage rate?

However, the effect a 600 credit score will have on your mortgage rate varies by loan type. Here’s what you should know. FHA mortgage rates are not directly tied to your credit score. So borrowers with 600 credit can often get a low rate using an FHA loan. However, FHA loans also include mortgage insurance premium (MIP).

What is the minimum credit score for a mortgage?

What does a good credit score mean?

Do credit cards require a higher credit score?

Is 674 a good credit score?

Can I get a home loan with 674 credit score?

674 credit score mortgage loan options A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 674, you have a high probability of being approved for a mortgage loan.

What mortgage rate can I get with a 674 credit score?

A 674 credit score means you have good credit and is great if you're looking for a mortgage. Lenders view you as a less risky investment, so you can expect interest rates between 3.75% and 4.38%.

Is 674 a good credit score?

A FICO® Score of 674 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good range.

Is 670 a good credit score to buy a house?

670–740: Good credit – Borrowers are typically approved and offered good interest rates. 620–670: Acceptable credit – Borrowers are typically approved at higher interest rates.

What is the lowest credit score to buy a house?

Generally speaking, you'll need a credit score of at least 620 in order to secure a loan to buy a house. That's the minimum credit score requirement most lenders have for a conventional loan. With that said, it's still possible to get a loan with a lower credit score, including a score in the 500s.

How much of a loan can I get with a 670 credit score?

You can borrow $50,000 - $100,000+ with a 670 credit score. The exact amount of money you will get depends on other factors besides your credit score, such as your income, your employment status, the type of loan you get, and even the lender.

Can I buy a house with a 672 credit score?

If your credit score is a 672 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. There are many mortgage lenders that offer loan programs to borrowers with credit scores in the 500s.

Can I get a new car with a 674 credit score?

There is no set credit score you need to get an auto loan. If you have a credit score above 660, you will likely qualify for an auto loan at a rate below 10% APR. If you have bad credit or no credit, you could still qualify for a car loan, but you should expect to pay more.

What can a 700 credit score do?

What a 700 credit score can get you. Your credit score is used by lenders to see if you qualify for financial products and to set the interest rate you'll pay. With a 700 credit score, you've crossed over into the "good" credit range, where you can get cheaper rates on financial products like loans and credit cards.

What credit score do you need to buy a house in 2022?

a 620 credit scoreYou need at least a 620 credit score to buy a house with a conventional loan in 2022. But, you'll find that there are several other loan types that have much lower requirements. Many first-time home buyers worry that their credit scores are too low to buy a home.

How much can I borrow with a 680 credit score?

If you have a credit score of 680, the maximum amount you can borrow for a personal loan is $100,000. $100,000 is the maximum loan amount for personal loans no matter what your credit score is.

How much house can I afford 40k salary?

3. The 36% RuleGross Income28% of Monthly Gross Income36% of Monthly Gross Income$40,000$933$1,200$50,000$1,167$1,500$60,000$1,400$1,800$80,000$1,867$2,4004 more rows•Oct 7, 2022

How much can I borrow with a 680 credit score?

If you have a credit score of 680, the maximum amount you can borrow for a personal loan is $100,000. $100,000 is the maximum loan amount for personal loans no matter what your credit score is.

What is the average mortgage rate for a 600 credit score?

640 to 659: APR of 6.175% with a monthly payment of $1,222. The total interest paid on the mortgage would be $239,810. 620 to 639: APR of 6.721% with a monthly payment of $1,293.

What credit score gets you the best mortgage rate?

What credit score do you need for the best mortgage rate? A credit score of 700-plus will usually land a borrower a lower interest rate, and while mortgage industry experts say you can still qualify for certain loans with a score under 680, the 700s are where you can expect to pay the lowest rates.

Is your mortgage interest rate based on credit score?

Mortgage rates are based on credit score tiers While each lender is free to set its own rules, many will follow conforming loan credit tiers set by Fannie Mae. Fannie and Freddie Mac generally don't lend to borrowers with scores below 620.

What is the minimum credit score for a mortgage?

The minimum credit score is around 620 for most conventional lenders, so you should be able to qualify.

What does a good credit score mean?

Credit scores in the Good range often reflect a history of paying your bills on time. However, you still may have some late payments or charges offs reporting.

Do credit cards require a higher credit score?

Credit card applicants with a credit score in this range will be approved for most credit cards. However, some credit cards require a higher score. If you are able to get approved for a credit card, remember to always make your payments on time and keep your balance below 30% of your credit limit.

Is 674 a good credit score?

FICO scores range from 300 to 850. As you can see below, a 674 credit score is considered Good.

What are the types of loans that can be financed with a 674 credit score?

The types of programs that are available to borrowers with a 674 credit score are: conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, and non-prime loans. With a 674 score, you may potentially be eligible for several different types of mortgage programs.

What credit score do I need to get a jumbo loan?

Most jumbo lenders require a borrower to have a credit score of at least 720. However, there are several non-prime lenders that offers jumbo loans to borrowers with credit scores as low as 600.

What is the down payment requirement for FHA loans?

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

What credit card can I get with a 674 credit score?

As someone with fair credit, you may have access to a number of unsecured credit cards. Unlike secured cards, an unsecured card doesn’t require you to put down a security deposit.

Why is credit score important?

A credit score is a three-digit number that gives potential lenders a sense of your credit health. In other words, it helps lenders understand how likely you are to pay back money if they decide to lend to you. Credit scores aren’t the be-all, end-all of lending decisions, but they can be an important aspect.

Can you get a loan with fair credit?

Fair credit does open the door to some possibilities. With fair credit scores, you might qualify for loans with better terms than you would if you were building credit from scratch. You may also be approved for an unsecured credit card with decent interest rates and fees — and maybe even some modest rewards and cash back.

Is 674 a good credit score?

A 674 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit without high fees and interest rates with a score in this range. “Fair” score range identified based on 2021 Credit Karma data.

Can you have different credit scores?

You can have many different credit scores based on different credit-scoring models created by companies like FICO and VantageScore. These models might weigh certain aspects of your credit history differently, so one of your credit scores may end up different from another. And even if the scores are calculated using exactly the same factors and weighting, the information in them may be different, since credit-scoring models may rely on data from different credit bureaus.

Can a hard inquiry hurt your credit?

While the impact of any one hard inquiry is generally pretty minor, stacking up a ton of hard inquiries in a short period of time can spell trouble for your credit. Potential lenders may interpret all those hard inquiries as a flag that you’re a risky borrower.

Is a fair credit score good?

In a Nutshell. A fair credit score is generally middle of the road — not poor, but not good or excellent, either. With fair credit scores, you may find it difficult to get approved for certain credit cards or loans with favorable terms and rates. Knowing how to read and understand your free credit scores and free credit reports from Credit Karma ...

What is the average age for a credit karma mortgage?

The average age of Credit Karma members who recently opened a mortgage ranges from 35 in Boston, Massachusetts, to 43 in Scottsdale, Arizona . As a generation, millennials have the highest average mortgage balance at $216,382.

What is the average credit score for a TransUnion mortgage?

In general, people in the Northeast or on the West Coast who got mortgages had VantageScore 3.0 credit scores averaging 720 or above — on the higher end of the spectrum.

What is the average credit score for a mortgage opener?

The average VantageScore 3.0 credit score for mortgage openers varies even more widely from city to city — from 657 to 782. Below are the 10 cities where recent homebuyers have the highest average credit scores and the 10 cities where they have the lowest average credit scores.

What is the average credit score in Mississippi?

Our findings: Average credit scores ranged from 683 (Mississippi) to 739 (New Hampshire and Washington state). The range of scores was even wider when broken down by city. (Learn more about our methodology .)

Which generation has the highest mortgage balance?

According to our analysis, millennials are the generation with the highest average open mortgage balance.

Is buying a home a big expense?

No matter where you live in the U.S., there’s no denying it — buying a home is a big expense. Based on our analysis of Credit Karma members, the average open mortgage balance for mortgages that are two years old or less is $196,035. This indicates that there may be certain places where homebuying is significantly more expensive than others.

Does credit karma look at FICO?

While it’s common for mortgage lenders to look at FICO scores in their application review process, we turned to Credit Karma’s vast collection of VantageScore 3.0 data to get a broad picture of the credit health of people getting mortgages. (Find out more about the similarities and differences between credit-scoring models .)

How to find out if you can buy a house with 600 credit?

So the best way to find out whether you can buy a house with 600 credit is to check in with a few lenders.

What mortgages allow a 600 credit score?

Mortgage loans that allow a 600 credit score. Programs for borrowers buying a house with a 600 credit score include: FHA home loan — These are government loans insured by the Federal Housing Administration (FHA). FHA loans are intended for people with lower credit; they allow a minimum credit score between 500 and 580.

What is the 3.25% mortgage rate?

A 3.25% fee would likely raise rates by about 0.5% to 0.75%. So instead of the 3.0% base rate, your mortgage rate could be as high as 3.75%. These fees are the reason many borrowers with lower credit — even those who might qualify for a conventional loan — opt for FHA loans instead.

What is a 720 credit score?

A credit score of 720 or higher will typically put you in the “prime borrower” category – which gets you access to the ultra–low mortgage rates you see advertised.

How much does rapid rescoring increase credit score?

Sometimes, rapid rescoring increases a credit score by 100 points or more . But the amount it will help you depends on the severity of errors on your credit report.

How long do you have to be employed to get a mortgage?

Lenders must verify your income and confirm your ability to afford a mortgage payment. Typically, you must be employed for at least two consecutive years to qualify for a home loan. (Although there are some exceptions to the two-year job history rule) Your credit history must be good, too.

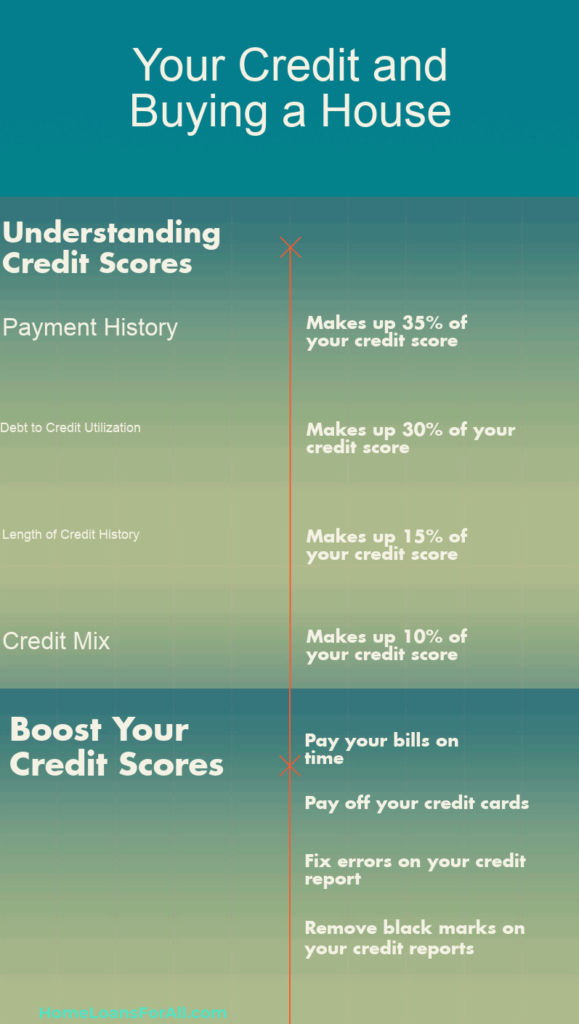

How much does debt make up your credit score?

Debt payment history makes up 35 percent of your credit score, and each timely payment results in positive activity reported to the credit bureaus.

What is the minimum credit score for a mortgage?

The minimum credit score is around 620 for most conventional lenders, so you should be able to qualify.

What does a good credit score mean?

Credit scores in the Good range often reflect a history of paying your bills on time. However, you still may have some late payments or charges offs reporting.

Do credit cards require a higher credit score?

Credit card applicants with a credit score in this range will be approved for most credit cards. However, some credit cards require a higher score. If you are able to get approved for a credit card, remember to always make your payments on time and keep your balance below 30% of your credit limit.

Is 674 a good credit score?

FICO scores range from 300 to 850. As you can see below, a 674 credit score is considered Good.