What happens if you forgot to record depreciation?

Forgetting to make proper depreciation adjustments in your company's financial records can cause delays in equipment replacement. This can lead to equipment failure due to worn out components, which can hurt your company's finances if your business doesn't have the needed cash to replace the assets.

How long can you claim depreciation?

Capital works deductions This depreciation is spread over 40 years — the length of time the ATO says a building lasts before it needs replacing.

Can you catch up on missed depreciation?

Catch-up depreciation is an adjustment to correct improper depreciation. This occurs when: You didn't claim depreciation in prior years on a depreciable asset. You claimed more or less than the allowable depreciation on a depreciable asset.

How do I claim unclaimed depreciation?

There are two ways do this: File an amended return: This only works if you didn't deduct depreciation on your rental assets for one year. Go back and amend the return to reflect the missed depreciation. Note: You can only go back three years to claim a possible refund for missed depreciation.

Can you backdate depreciation?

If you have held an investment property for a prolonged period but have not claimed depreciation yet, you are entitled to backdate this and amend previous years of lodgement for up to a two-year period.

Is it worth getting a depreciation report?

If you own a rental property that is eligible for depreciation, you should get a tax depreciation schedule, or at least a depreciation estimate, to help with your decision. This will allow you to claim depreciation deductions each financial year when lodging your tax return, so you pay less tax.

Does IRS track depreciation?

After the sale of an asset, IRS Form 4797 is used to report depreciation recapture and the total gain or profit from the real estate sale. The total depreciation expense taken to reduce taxable net income is “recaptured” by the IRS and taxed at the investor's ordinary income tax rate, up to a maximum tax rate of 25%.

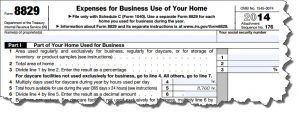

Can I claim past depreciation on my rental property?

You can recover some or all of your improvements by using Form 4562 to report depreciation beginning in the year your rental property is first placed in service, and beginning in any year you make an improvement or add furnishings. Only a percentage of these expenses are deductible in the year they are incurred.

How does catch-up depreciation work?

The catch-up depreciation is the difference between previously taken depreciation and the depreciation if on day-one cost segregation was applied. To get this catch-up depreciation, you must change your depreciation method to match the results of the cost segregation study.

What happens unused depreciation?

You can apply unused depreciation to a particular property you've sold, producing a capital gain. Though you'll owe capital gains tax, the property's unused depreciation will now break the IRS shackles and rush to the aid of that year's ordinary income.

What happens if you claim too much depreciation?

If you took too much depreciation, you must decrease your basis by the amount you should have deducted, plus the part of the excess you deducted that actually lowered your tax liability for any year.

Do you have to take depreciation every year?

Instead, you generally must depreciate such property. Depreciation is the recovery of the cost of the property over a number of years. You deduct a part of the cost every year until you fully recover its cost.

Is equipment 5 or 7 year depreciation?

Five-year property (including computers, office equipment, cars, light trucks, and assets used in construction) Seven-year property (including office furniture, appliances, and property that hasn't been placed in another category)

What is the special depreciation allowance for 2022?

With the Bonus Depreciation limit of 100 percent through 2022, businesses have greater incentive to make near-term purchases. Before the TCJA, was passed, the bonus depreciation limit varied from year to year.

Will Section 179 go away in 2022?

Section 179 tax deduction limit. This was enacted through the Tax Cuts and Jobs Act. In addition, the bill allows businesses to depreciate 100 percent of the cost of eligible equipment bought or financed from September 27, 2017, through 2022.

Can you fully depreciate an asset in one year?

You generally can't deduct in one year the entire cost of property you acquired, produced, or improved and placed in service for use either in your trade or business or income-producing activity if the property is a capital expenditure.

How long do you have to amend a depreciation?

It is important to amend for these three years , because when you sell the property, you'll have to recapture all allowable depreciation, even if you did not actually deduct them.

How long is a rental property depreciated?

This is not correct. Revisit your entry of the house as an asset. Residential rental property is depreciated over 27.5 years.

Where to enter catch up depreciation?

You will make an entry on the Sch E in the other expenses area ... call it form 3115 and enter the amount of catch up depreciation.

Can you claim catch up depreciation on 2018 taxes?

You cannot claim catch-up depreciation on your 2018 tax return.

Can you start depreciation in 2019?

No, you can't just start with 2019, you need to either amend each the property has been a rental or file a Form 3115 to claim the depreciation that you didn't take.

When is unclaimed depreciation taken into account?

The unclaimed depreciation from years prior to the year of change is taken into account as a net negative (taxpayer favorable) adjustment in the year of change, generally effective for tax years ending on or after December 31, 2001 and are deducted in full on the return for the year of change. Changes that are considered to be a change in ...

How to correct depreciation errors?

Depreciation errors are corrected by either filing an amended return or filing a change in accounting method form. Depreciation errors that are NOT subject to the accounting method change filing requirements require amended returns and include:

How long is depreciation on leasehold improvements?

Correcting depreciation on leasehold improvements from using the incorrect life of the lease term to the correct life of the asset (generally 39 years). (Use Code 199 on Form 3115)

What is a change in computing depreciation?

A change in computing depreciation because of a change in the use by the same taxpayer, Changes in placed-in-service dates. Making a late depreciation election or revoking a timely valid depreciation election (including the election not to deduct bonus depreciation).

Can you claim bonus depreciation under 168k?

Election not to claim bonus depreciation under 168k (within its own time period requirements of return due date plus extension). Amending returns will only correct depreciation errors that have occurred in the last three years.

Does depreciation correction qualify for automatic change?

Other depreciation corrections still qualify for the automatic change provisions of Rev. Proc. 2015-13.

What is catch up depreciation?

Claiming catch-up depreciation is a change in the accounting method. You’re changing from a depreciation method that’s not allowed to one that’s allowed.

Can you depreciate rental property?

Yes, you should claim depreciation on rental property. You should claim catch-up depreciation on this year’s return. Catch-up depreciation is an adjustment to correct improper depreciation. This occurs when:

Can you catch up missed depreciation?

You can catch up missed depreciation thru a negative 481a adjustment. With that said, you may want to check to see whether the missed depreciation was indeed an improper method, as opposed to not even having an established method in the first place.

Can you file 481A adjustment for missed depreciation?

Today I mailed a 3115 claiming a ~$2.1 million 481a adjustment for missed depreciation between 2006 and 2016. Yes you can do it all at once on a timely filed return.