Can I file MN renters rebate online? e-File your 2021 (and your 2020)Minnesota Homestead Credit and Renter’s Property Tax Refund return (Form M1PR) using eFile Express! Most calculations are automatically performed for you. Eliminate errors before submitting your return. Receive confirmation that your return was accepted.

Full Answer

How to file m1pr online?

To e-file your Minnesota Property Tax return:

- Click Filing on the left to expand, then click E-File Return.

- Click the option to file Minnesota property tax return along with your other returns.

- Continue through the filing steps until you reach the screen titled Submit Return. Your return will not be submitted until you click Submit.

Can you file MN renters credit online?

You must meet the following eligibility requirements to file a Renter Credit Claim: You may file a Renter Credit Claim even if you are not required to file an income tax return. The Renter Credit Claim can be filed electronically through your tax software or directly in myVTax.

Can you file Minnesota property tax online?

Yes, you can file your M1PR when you prepare your Minnesota taxes in TurboTax. We'll make sure you qualify, calculate your Minnesota property tax refund, and fill out an M1PR form, which can be e-filed. As you're preparing your Minnesota taxes, look for the Other Forms You May Need screen (towards the end of the interview, past the estimated taxes and extension topics). Check the first box and follow the onscreen instructions.

Can I file my m1pr form online?

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. Tip: You can also file your M1PR free of charge at the MN Dept. of Revenue Property Tax Refund site, and if you're a homeowner, you can e-file it through the MN DOR's Property Tax Refund Online Filing System.

Can I file my MN renters rebate online?

e-File your 2021 Minnesota Homestead Credit and Renter's Property Tax Refund return (Form M1PR) using eFile Express! Most calculations are automatically performed for you. Eliminate errors before submitting your return. Receive confirmation that your return was accepted.

Is it too late to file renters rebate MN?

ST. PAUL, Minn. - The Minnesota Department of Revenue reminds homeowners and renters to file for their 2019 property tax refund before the August 15, 2021 deadline. Additionally, claims for 2020 refunds can be filed from now until August 15, 2022.

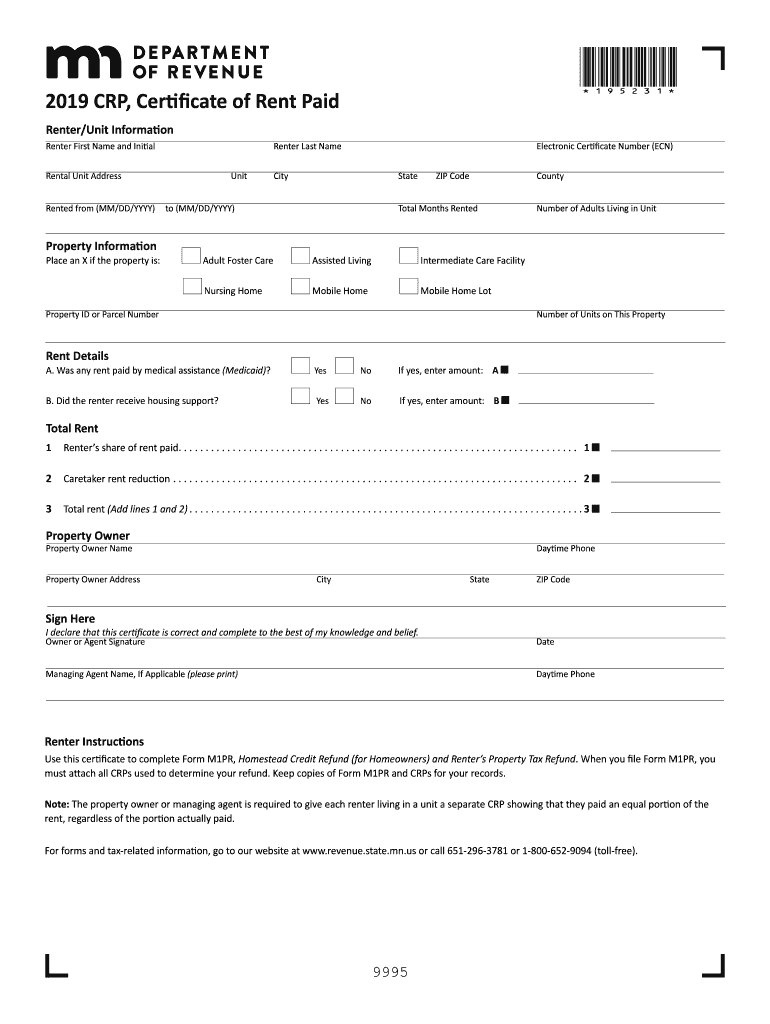

Can I file my CRP on TurboTax?

Certificate of Rent Paid (CRP) is at the very end of the state return, after the questions about penalties, extensions, etc. Look for a page titled "Other Forms You May Need". Check the first box, Property Tax Refund (Form M1PR).

How much do you get back for renters rebate MN?

For refund claims filed in 2021, based on rent paid in 2020 and 2020 household income, the maximum refund is $2,210. Renters whose income exceeds $62,960 are not eligible for refunds. How are claims filed? Refund claims are filed using Minnesota Department of Revenue (DOR) Schedule M1PR.

Where do I send my renters rebate form mn?

Send it to: Minnesota Property Tax Refund St. Paul, MN 55145-0020. You should get your refund within 90 days after August 15, 2019. following things: - File by April 30th if you own your home.

When should I get my renters rebate MN?

You should get your refund within 90 days after August 15.

How do I file a renters rebate on TurboTax?

Do turbo tax file renter rebates forms?Log in to your account.Go to State Taxes.look for the Other Forms You May Need screen (towards the end of the interview, past the estimated taxes and extension topics).Check the first box and follow the onscreen instructions.

How do I file M1PR on TurboTax?

To file a Form M1PR in the TurboTax online program, go to:Across the top, select State Taxes.On screen, Status of your state returns, under Minnesota, click on Start or Continue or Edit.Follow the step-by-step interview questions.On screen, Minnesota Credits, select Continue to proceed,More items...•

Where do you put CRP in taxes?

Individuals must report all CRP payments on Schedule F, Profit or Loss From Farming, line 4a, Agricultural Program Payments.

How does renters rebate work in MN?

You may qualify for a Renter's Property Tax Refund depending on your income and rent paid. To qualify, all of these must be true: You have a valid Social Security Number or Individual Tax Identification Number. You are a Minnesota resident or spent at least 183 days in the state.

How do I claim rent paid on my taxes?

For them, Section 80 (GG) of the Income-tax Act offers help. An individual paying rent for a furnished/unfurnished accommodation can claim the deduction for the rent paid under Section 80(GG) of the I-T Act, provided he is not paid HRA as a part of his salary by furnishing Form 10B.

How do I check my MN renters rebate?

If you are waiting for a refund and want to know its status: Use our Where's My Refund? system. Call our automated phone system (available 24/7) at 651-296-4444 or 1-800-657-3676.

How does renters rebate work in MN?

You may qualify for a Renter's Property Tax Refund depending on your income and rent paid. To qualify, all of these must be true: You have a valid Social Security Number or Individual Tax Identification Number. You are a Minnesota resident or spent at least 183 days in the state.

How do I file M1PR on TurboTax?

To file a Form M1PR in the TurboTax online program, go to:Across the top, select State Taxes.On screen, Status of your state returns, under Minnesota, click on Start or Continue or Edit.Follow the step-by-step interview questions.On screen, Minnesota Credits, select Continue to proceed,More items...•

How do I claim rent paid on my taxes?

For them, Section 80 (GG) of the Income-tax Act offers help. An individual paying rent for a furnished/unfurnished accommodation can claim the deduction for the rent paid under Section 80(GG) of the I-T Act, provided he is not paid HRA as a part of his salary by furnishing Form 10B.

How do I file a renters rebate on TurboTax?

Do turbo tax file renter rebates forms?Log in to your account.Go to State Taxes.look for the Other Forms You May Need screen (towards the end of the interview, past the estimated taxes and extension topics).Check the first box and follow the onscreen instructions.

When are homeowners refunds issued?

Timely-filed current-year Homeowner refunds are typically issued by the end of September.

When is the last day to file M1PR?

Filing Deadlines for the M1PR. The last day you can file your 2020 M1PR return is August 15, 2022. The last day you can file your 2019 M1PR return is August 15, 2021. Tracking Your Return (When Can You Expect Your Refund) Timely-filed current-year Renter refunds are typically issued in August.

Where to get Minnesota tax forms?

You can get it from a library, call (651) 296-3781, or write to: MN Tax Forms, Mail Station 1421, St. Paul, MN 55146-1421. You can also get all forms and information to file online at www.revenue.state.mn.us. If you want to file by regular mail, fill out the form, attach the CRP if you rent, and send it.

What is the Renter’s Refund (Property Tax Refund)?

The amount of your refund depends on: how much rent or property tax you paid, your income, and how many dependents you have.

How do I get my refund?

If you rent, your landlord must give you a Certificate of Rent Paid (CRP) by January 31, 2021. If you own, use your Property Tax Statement.

How to get a CRP if you don't pay rent in 2020?

State the amount of rent you paid in 2020. Keep a copy of your letter. If your landlord still won’t give you the CRP, call the Department of Revenue at (651) 296-3781. Ask them to contact the landlord and charge a fine if the landlord still does not send it to you.

How much does a person have to own a home in Minnesota in 2020?

You own your home and your total household income in 2020 was less than $116,180 (the income eligibility goes up with each dependent) and. You aren’t a dependent on someone else’s 2020 federal tax return, and. You were a full or part year resident of Minnesota in 2020 and.

When are Minnesota property taxes due in 2021?

It is due August 15, 2021. Send it to: Minnesota Property Tax Refund. St. Paul, MN 55145-0020. You should get your refund within 90 days after August 15, 2021. You can get your refund up to 30 days earlier if you file electronically and do the following things: File by April 30th if you own your home. File by July 31st if you rent ...

Where can I get help with tax forms?

If you have a low income, a disability, or are a senior citizen, you can get free help. To find a help site near you, call the Department of Revenue at (651) 297-3724 or United Way, statewide, at 2-1-1.