The Weekly Payment Option Weekly mortgage payments mean you will pay a quarter of the monthly amount due each week. If your mortgage is $1,600 per month, you will pay $400 a week. Over a year, you will pay considerably more toward your mortgage than if you pay monthly. If you make 52 $400 payments, you will pay $20,800 per year.

Full Answer

Does paying your mortgage twice a month save you money?

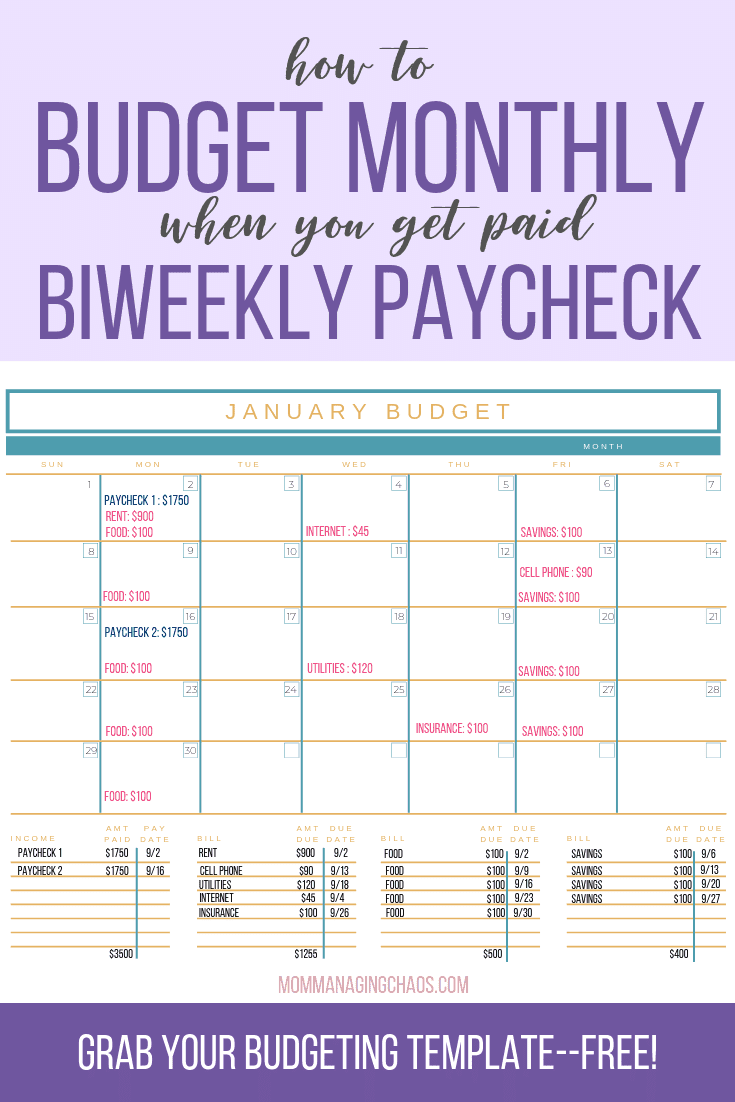

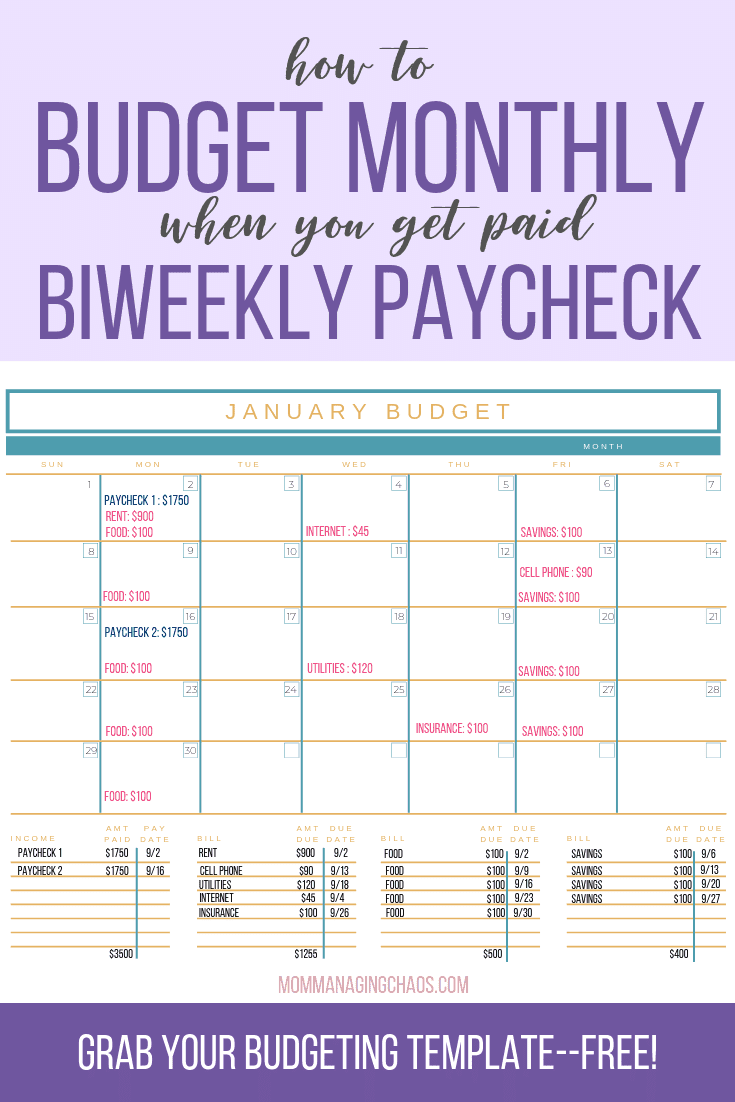

When you make biweekly payments, you could save more money on interest and pay your mortgage down faster than you would by making payments once a month. When you decide to make biweekly payments instead of monthly payments, you’re using the yearly calendar to your benefit.

Should I pay mortgage biweekly?

“One of the best ways to pay off your mortgage early is by paying biweekly,” said Chris Allard, Ottawa mortgage broker. “Biweekly payments, which require paying half of your monthly payment every two weeks, result in a total of 26 half-payments in a given year.

How do you calculate the monthly payment on a loan?

Monthly Interest Rate Calculation Example

- Convert the annual rate from a percent to a decimal by dividing by 100: 10/100 = 0.10

- Now divide that number by 12 to get the monthly interest rate in decimal form: 0.10/12 = 0.0083

- To calculate the monthly interest on $2,000, multiply that number by the total amount: 0.0083 x $2,000 = $16.60 per month

Is making biweekly mortgage payments a good idea?

If you are paid biweekly, then having a biweekly mortgage payment can make it easier to budget. By always having the same amount going toward your mortgage from each paycheck you won’t have to worry about balancing between your two paychecks. Pro 4: You May Save on Interest. Your lender may allow you to put your extra yearly mortgage payment directly toward your loan’s principal.

How Do Weekly Mortgage Payments Help You Save Money?

How many times a year do you make a mortgage payment?

What is the Marimark mortgage newsletter?

How many payments per year for biweekly?

Can you pay your mortgage more quickly?

Can you refinance a mortgage if you have a biweekly payment?

Is it a good idea to switch to a higher frequency mortgage payment plan?

See 2 more

Can a mortgage be paid weekly?

The lender makes no contribution beyond providing the mortgage that credits the extra payment. With weekly payments, the lender multiplies the monthly payment by 12 and divides by 52 in order to calculate the payment. Total payments are unchanged.

Is it better to pay mortgage weekly or biweekly?

When you make biweekly payments, you could save more money on interest and pay your mortgage down faster than you would by making payments once a month. When you decide to make biweekly payments instead of monthly payments, you're using the yearly calendar to your benefit.

Is it better to pay a loan weekly or monthly?

Paying weekly or fortnightly instead will save money in the long run because you end up paying an additional month per year. This means that paying weekly or fortnightly can substantially reduce the number of years it takes to pay off your home loan.

Is it OK to pay mortgage a week early?

Simple interest mortgages are often promoted with bi-weekly mortgage payment plans to reduce the interest paid. Making a regular monthly payment one week early on a simple interest mortgage will save on interest and pay the mortgage down faster.

Can you pay off a 30 year mortgage in 15 years?

If you can refinance with a lower interest rate, for a shorter term, it's a win-win. For example, you could refinance a 30-year mortgage into a 15-year loan. The monthly payments will almost certainly be higher, and you'll pay closing costs, but your overall interest expense will be dramatically lower.

What happens if I pay 2 extra mortgage payments a year?

Making additional principal payments will shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down faster, you'll have fewer total payments to make, in-turn leading to more savings.

Do you pay less interest if you pay your mortgage weekly?

An accelerated payment option lets you make weekly or biweekly payments. With this option, you're putting more money toward your mortgage than with a monthly payment. Accelerated payments can save you money on interest charges.

What is the best payment frequency for a mortgage?

MonthlyMonthly is the most common payment frequency. Lenders use this standard payment to calculate the amount you would pay on other schedules. In the example above, you'll pay $2,908 once per month for your 5-year term. If your interest stays the same, it will take the full 25 years to pay off your mortgage.

What happens if I pay an extra $200 a month on my mortgage?

If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000. Another way to pay down your loan in less time is to make half-monthly payments every 2 weeks, instead of 1 full monthly payment.

What happens if I pay my mortgage early every month?

This is a fee your lender charges if you pay off your mortgage prematurely. Prepayment penalties are usually equal to a certain percentage you would have paid in interest. This means that if you pay off your principal very early, you might end up paying the interest you would have paid anyway.

What happens if I make a lump sum payment on my mortgage?

When you make a lump-sum payment on your mortgage, your lender usually applies it to your principal. In other words, your mortgage balance will go down, but your payment amount and due dates won't change.

Should I pay my mortgage on the 1st or 15th?

Well, mortgage payments are generally due on the first of the month, every month, until the loan reaches maturity, or until you sell the property. So it doesn't actually matter when your mortgage funds – if you close on the 5th of the month or the 15th, the pesky mortgage is still due on the first.

How much faster can I pay off my mortgage with biweekly payments?

Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. By the end of each year, you will have paid the equivalent of 13 monthly payments instead of 12. This simple technique can shave years off your mortgage and save you thousands of dollars in interest.

What happens if I pay an extra $200 a month on my mortgage?

If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000. Another way to pay down your loan in less time is to make half-monthly payments every 2 weeks, instead of 1 full monthly payment.

Do you pay less interest if you pay weekly?

Pay less interest with weekly or fortnightly repayments If you pay your mortgage repayments weekly or fortnightly, the extra money in redraw or offset reduces the interest you pay every day, and over the life of the loan. Lenders have two ways of calculating weekly or fortnightly repayment amounts.

What are the pros and cons of biweekly mortgage payments?

Pros and Cons of Making Biweekly Mortgage PaymentsPro 1: Pay Off Your Mortgage Faster. ... Pro 2: Build Equity. ... Pro 3: It's Easier to Budget. ... Pro 4: You May Save on Interest. ... Con 1: There May Be a Set-up Fee. ... Con 2: Requires You to Pay More Over the Course of the Year. ... Con 3: It's a Permanent Agreement.More items...•

Weekly Mortgage Payment Calculator with Dynamic Comparison Charts

This calculator will calculate the weekly payment and associated interest costs for a new mortgage. Or, if you are already making monthly house payments, this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per year on a bi-weekly or weekly basis.

Biweekly vs. Monthly Mortgage Payments: What to Know | Chase

Buying home is an important milestone and likely the biggest purchase you'll ever make. Because it's such a big part of your and your family's life, it's important to know all the options available when it comes to paying back your mortgage.

How does a weekly payment work?

With weekly payments, the lender multiplies the monthly payment by 12 and divides by 52 in order to calculate the payment. Total payments are unchanged. Further, every weekly payment program I have seen amortizes monthly, which means that the lender gets to hold the payments as they come in until the first of the month when they are applied. There is no benefit to the borrower, just the convenience or inconvenience of writing 4 or 5 checks every month instead of one.

How early can you pay off a mortgage with 4%?

But if the borrower rounds off the payment to $500, payoff occurs after 659 payments, or 30.5 months early. Biweekly Payments. A biweekly mortgage is one on which ...

What is bimonthly mortgage?

With bimonthly payments, the borrower pays half the monthly payment twice a month, so total payments remain unchanged. Note to readers: please don’t write me that this mortgage should be called a semi-monthly payment mortgage, I know that but decided it would be less confusing to follow industry practice.

What are the savings from increasing the frequency of mortgage payments?

There are only three possible sources of savings to the borrower from increasing the frequency of mortgage payments. One possibility is that the lender offers a rate or fee reduction on the high payment frequency mortgage. I have yet to see an example of this, and will discuss it no further.

How many biweekly payments are there in a year?

A biweekly mortgage is one on which the borrower makes a payment equal to half the fully amortizing monthly payment every two weeks. Since there are 26 biweekly periods in a year, the biweekly produces the equivalent of one extra monthly payment every year.

Can you amortize a mortgage with a shorter payment period?

This will reduce the amount of interest due for the month, leaving more of the payment for further balance reduction. Amortizing the loan using a shorter period generates a real saving for the borrower, but it doesn’t amount to much.

Do shorter mortgage payments save money?

Lenders who offer mortgages with shorter payment periods than the standard monthly payment mortgage usually do claim that they will save the borrower money. But they seldom explain how. There are only three possible sources of savings to the borrower from increasing the frequency of mortgage payments. One possibility is that the lender offers ...

How Do Weekly Mortgage Payments Help You Save Money?

If you are currently paying your mortgage monthly, switching to a weekly payment schedule will help you save money in a very simple way.

How many times a year do you make a mortgage payment?

With a weekly payment schedule, you make one-fourth of your monthly payment 52 times a year, which means you make the equivalent of 13 monthly payments each year, shaving years off your mortgage and saving thousand of dollars in interest.

What is the Marimark mortgage newsletter?

The Marimark Mortgage Newsletter will keep you informed with important events in the mortgage industry that could impact your finances.

How many payments per year for biweekly?

The 26 payments per year you make with a bi-weekly schedule still add up to the equivalent of 13 monthly payments, so you won’t pay off your principal significantly faster.

Can you pay your mortgage more quickly?

And other mortgages may penalize you for paying your mortgage more quickly. So, before closing on a mortgage, make sure you understand the conditions that apply to making more frequent payments. And if you already have a mortgage, check with your lender before making weekly or bi-weekly payments, if you have any questions.

Can you refinance a mortgage if you have a biweekly payment?

If you discover that the terms of your mortgage do not allow for weekly or bi-weekly payments, you may be able to save money by refinancing, and move into a mortgage that allows for extra payments. But until you can refinance into a new mortgage, you can still save money by depositing your weekly mortgage payment into a bank account.

Is it a good idea to switch to a higher frequency mortgage payment plan?

While a weekly mortgage payment schedule can save you a great deal of money over the long term, there are some situations where it isn’t a great idea to switch to a higher frequency payment plan.