Can the IRR rule be adjusted to handle mutually exclusive projects?

In principle, it is also possible to adjust the IRR rule so that it can handle investment decisions that involve mutually exclusive projects with different scale. Here is how it works:

Should you use IRR for investment decisions?

Using IRR exclusively can lead you to make poor investment decisions, especially if comparing two projects with different durations. Let’s say a company’s hurdle rate is 12%, and one-year project A has an IRR of 25%, whereas five-year project B has an IRR of 15%.

What is NPV and IRR in project management?

(When projects are mutually exclusive, only one project can be chosen and the others must be abandoned.) Net Present Value (NPV) and Internal Rate of Return (IRR) are the most common methods for ranking projects in terms of the present value of future cash flows.

Is IRR beyond the cost of capital?

And the IRR of its incremental cash flows is 18% and therefore well beyond the cost of capital: As this example shows, the standard IRR rule can therefore be misleading when assessing projects with different investment horizons.

Is IRR or NPV better for mutually exclusive projects?

Using IRR to make investment decisions: For mutually exclusive projects, the NPV and IRR criteria may give conflicting results. Since the NPV criterion is more economically sound than IRR, in case of conflicts decisions should be based on NPV.

What circumstances can the IRR rule not be used to compare mutually exclusive projects?

Hence the IRR rule cannot be used to compare projects of different scales because larger scale projects may be more valuable. ∎ Investment opportunities with the same NPV can have different IRRs because the IRR depends on the timing of the cash flows even when a change in timing does not affect the NPV.

Can you use NPV for mutually exclusive projects?

Mutually exclusive projects: If the NPV of one project is greater than the NPV of the other project, accept the project with the higher NPV. If both projects have a negative NPV, reject both projects.

Can IRR be used to compare projects?

IRR is uniform for investments of varying types and, as such, can be used to rank multiple prospective investments or projects on a relatively even basis. In general, when comparing investment options with other similar characteristics, the investment with the highest IRR probably would be considered the best.

Which of the following is not applicable to IRR?

Q.Which of the following is not applicable to IRR?B.based on time value of moneyC.common for all projectsD.stated in % returnAnswer» c. common for all projects1 more row

When should IRR be accepted?

If the IRR is greater than the cutoff or hurdle rate (r), the proposal is accepted; if not, the proposal is rejected [33]. As we can see, the IRR is in effect the discounted cash flow (DFC) return that makes the NPV zero.

Do NPV and IRR always agree?

Whenever an NPV and IRR conflict arises, always accept the project with higher NPV. It is because IRR inherently assumes that any cash flows can be reinvested at the internal rate of return.

Is IRR and NPV the same?

What Are NPV and IRR? Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.

Why do the NPV method and the IRR method sometimes produce different rankings of mutually exclusive investment projects?

Why do the NPV method and the IRR method sometimes produce different rankings of mutually exclusive investment projects? a. The NPV method does not assume reinvestment of cash flows while the IRR method assumes the cash flows will be reinvested at the IRR.

What are the limitations of IRR?

Limitations Of IRR It ignores the actual dollar value of comparable investments. It does not compare the holding periods of like investments. It does not account for eliminating negative cash flows. It provides no consideration for the reinvestment of positive cash flows.

What are two disadvantages in using IRR versus NPV?

Disadvantages. It might not give you accurate decision when the two or more projects are of unequal life. It will not give clarity on how long a project or investment will generate positive NPV due to simple calculation.

Why is IRR unreliable?

The IRR rule may be unreliable when a project's stream of expected cash flows includes negative cash flows. Negative cash flows can occur when an investment requires the construction of several facilities that are built at different times in the future.

What is the IRR of a project?

It is nothing but the discount rate that would make all of the present values of cash flows equal to the initial outlay. IRR is the discount rate at which the NPV of the project equals zero. Companies often have a hurdle rate or a required rate of return#N#Required Rate Of Return Required Rate of Return (RRR), also known as Hurdle Rate, is the minimum capital amount or return that an investor expects to receive from an investment. It is determined by, Required Rate of Return = (Expected Dividend Payment/Existing Stock Price) + Dividend Growth Rate read more#N#that serves as the benchmark.

What is mutually exclusive project?

What are Mutually Exclusive Projects? Mutually Exclusive Projects is the term which is used generally in the capital budgeting process where the companies choose a single project on the basis of certain parameters out of the set of the projects where acceptance of one project will lead to rejection of the other projects.

Why does IRR tend to skew?

Hence IRR will tend to skew towards a higher range when there are higher cash flows initially. Usually, the discount rates change over the life of the company. An unrealistic assumption that IRR makes is that all cash flows in the future are invested at the IRR rate.

Why do companies choose a larger project with a low IRR?

A company may choose a larger project with a low IRR because it generates greater cash flows than a small project with a high IRR. Investors and firms use the IRR rule to evaluate projects in capital budgeting, but it may not always be rigidly enforced. Generally, the higher the IRR, the better.

What is the IRR rule?

Essentially, IRR rule is a guideline for deciding whether to proceed with a project or investment. The higher the projected IRR on a project, and the greater the amount by which it exceeds the cost of capital, the higher the net cash flows to the company.

What is the best course of action if the IRR is lower than the cost of capital?

On the other hand, if the IRR is lower than the cost of capital, the rule declares that the best course of action is to forego the project or investment.

Is IRR always higher?

The IRR rule may not always be rigidly enforced. Generally, the higher the IRR, the better. However, a company may prefer a project with a lower IRR, as long as it still exceeds the cost of capital, because it has other intangible benefits, such as contributing to a bigger strategic plan or impeding competition.

What happens if IRR is greater than or equal to cost of capital?

If the IRR is greater than or equal to the cost of capital, the company would accept the project as a good investment. (That is, of course, assuming this is the sole basis for the decision. In reality, there are many other quantitative and qualitative factors that are considered in an investment decision.)

Does internal rate of return give you return on investment?

Unlike net present value, the internal rate of return doesn’t give you the return on the initial investment in terms of real dollars. For example, knowing an IRR of 30% alone doesn’t tell you if it’s 30% of $10,000 or 30% of $1,000,000.

Why is IRR easier to calculate?

IRR is also easier to calculate because it does not need estimation of cost of capital or hurdle rate. It just requires the initial investment and cash flows. However, this same convenience can become a disadvantage if we accept projects without comparison to cost of capital.

Why is NPV conflicting with IRR?

It is because IRR inherently assumes that any cash flows can be reinvested at the internal rate of return. This assumption is problematic because there is no guarantee that equally profitable opportunities will be available as soon as cash flows occur. The risk of receiving cash flows and not having good enough opportunities for reinvestment is called reinvestment risk. NPV, on the other hand, does not suffer from such a problematic assumption because it assumes that reinvestment occurs at the cost of capital, which is conservative and realistic.

What is the cause of NPV and IRR conflict?

The underlying cause of the NPV and IRR conflict is the nature of cash flows ( normal vs non-normal ), nature of project (independent vs mutually-exclusive) and size of the project.

What is the risk of receiving cash flows and not having good enough opportunities for reinvestment?

The risk of receiving cash flows and not having good enough opportunities for reinvestment is called reinvestment risk. NPV, on the other hand, does not suffer from such a problematic assumption because it assumes that re investment occurs at the cost of capital, which is conservative and realistic.

Can a company accept all projects with positive NPV?

The company can accept all projects with positive NPV. However, in case of mutually-exclusive projects, an NPV and IRR conflict may arise in which one project has a higher NPV but the other has higher IRR. Mutually exclusive projects are projects in which acceptance of one project excludes the others from consideration.

Methods Used by Companies to Evaluate Mutually Exclusive Projects

Examples

Does One Method Have An Advantage Over The other?

Does Npv seem Like A Better Option Then IRR?

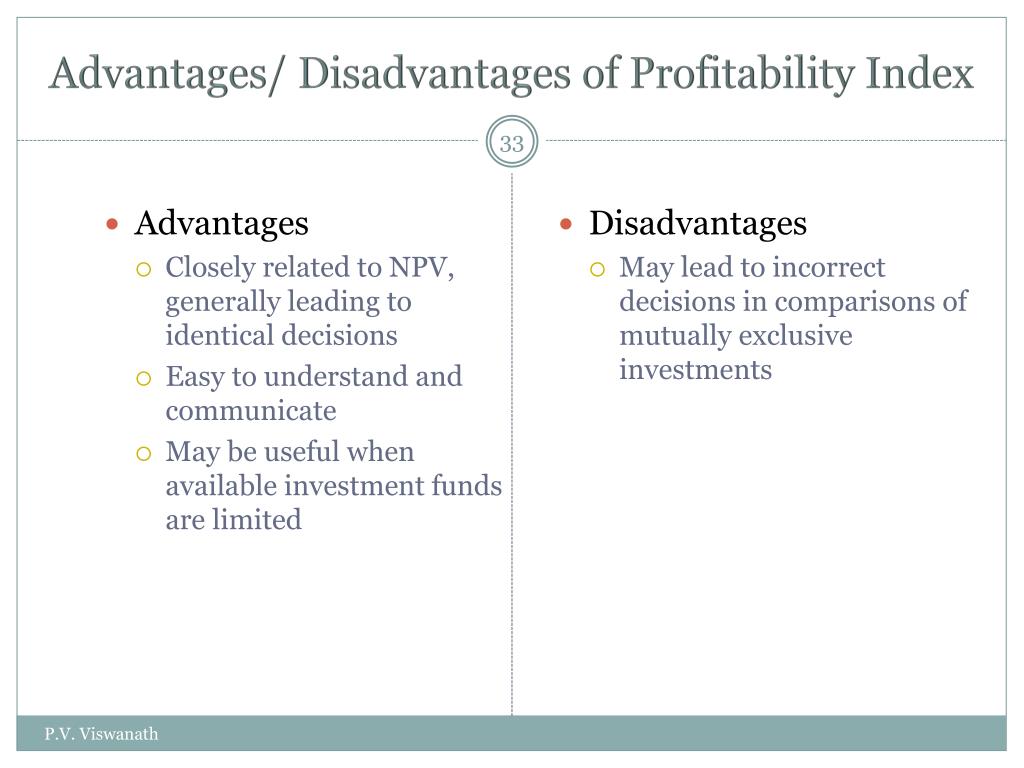

Advantages and Disadvantages

Are There Any Changes Off Late in Mutually Exclusive Projects?

- Well, yes, there is something called incremental analysisIncremental AnalysisIncremental analysis is the financial analysis undertaken by the company to evaluate the available options and improve p...

- It refers to an analysis of differential cash flows of the two projects (Smaller cash flows are deducted from the cash flows of the larger project).

- Well, yes, there is something called incremental analysisIncremental AnalysisIncremental analysis is the financial analysis undertaken by the company to evaluate the available options and improve p...

- It refers to an analysis of differential cash flows of the two projects (Smaller cash flows are deducted from the cash flows of the larger project).

- However, fret not like this analysis is not predominantly used, and companies do majorly rely on NPV and IRR analysis.

Conclusion

Recommended Articles