Can you change from a capital to an operating lease?

Feb 08, 2022 · Can operating lease be capitalized? The new rule, FASB ASU (Accounting Standards Update) 2016.02, will require that all leases with a term over one year must be capitalized effective for years beginning after 12/15/2021. … Operating leases will need to be recorded as equal and offsetting amounts of assets and liabilities.

How are operating leases different from capital leases?

A capital lease (or finance lease) is treated like an asset on a company’s balance sheet, while an operating lease is an expense that remains off the balance sheet. Think of a capital lease as more like owning a piece of property, and think of an operating lease as more like renting a property. There are significant differences between a capital lease vs operating lease, and this guide will …

What does it mean to capitalize a lease?

Sep 20, 2019 · Under ASC 840 and the old lease accounting rules, capitalization was only required on capital leases. However, the new lease standards require that operating leases are also capitalized, which is why capital leases will now be referred to as finance leases under both ASC 842 and IFRS 16. 2. All leases are capital leases under ASC 842

What is the difference between an operating and finance lease?

Sep 05, 2021 · To be classified as an operating lease, the lease must meet certain requirements under generally accepted accounting principles (GAAP) that exempt it …

What leases should be capitalized?

In capitalizing the lease obligations and leased assets, the company creates either:A Financing Lease Liability for the purchase of an asset that is consumed over the lease term (equipment), or.An Operating Lease Liability for assets that are not consumed over the lease term (land, buildings).

How are operating leases accounted for?

An operating lease is treated like renting—lease payments are considered as operating expenses. Assets being leased are not recorded on the company's balance sheet; they are expensed on the income statement. So, they affect both operating and net income.

Is an operating lease an asset?

Operating leases are shown as an asset on the balance sheet, valued as the present value of the lease payments (not the market value of the asset) The lease liability is shown on the balance sheet (similarly, the present value of the lease payments)Dec 7, 2020

How do you record an operating lease in accounting?

How to Calculate the Journal Entries for an Operating Lease under ASC 842Step 1 Recognize the lease liability and right of use asset. ... Step 2 Recognize the unwinding of the lease liability and amortization of the right of use asset. ... Step 3 Continue to record journal entries until the expiry of the lease.More items...•Apr 13, 2021

What is capital lease and operating lease?

A capital lease (or finance lease) is treated like an asset on a company's balance sheet, while an operating lease is an expense that remains off the balance sheet. Think of a capital lease as more like owning a piece of property, and think of an operating lease as more like renting a property.

Why are operating leases on the balance sheet?

Balance Sheet Example: Operating Leases Because the company isn't paying these expenses for nothing, they get benefit from them and record them as assets on the balance sheet (operating lease right-of-use assets). The liabilities that they owe over the life of the lease is also recorded (operating lease liabilities).Jul 31, 2020

Is operating lease a fixed asset?

The lessor records the asset under an operating lease as a fixed asset on its books, and depreciates the asset over its useful life.Feb 27, 2022

What is an operating lease?

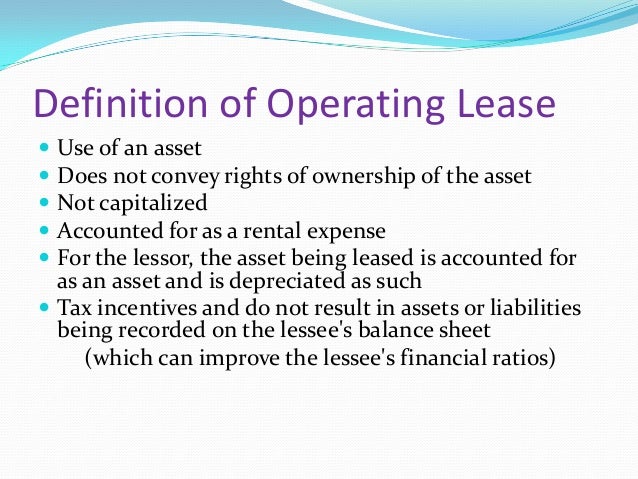

An operating lease is an agreement to use and operate an asset without the transfer of ownership. Common assets. Tangible Assets Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment.

What is a lease in accounting?

Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for money or other assets. The two most common types of leases in accounting are operating and financing (capital leases). Advantages, disadvantages, and examples. Prepaid Lease.

How to adjust financials with approximation method?

Adjusting financials with the approximation method is slightly different from the full adjustment method. Begin by adjusting operating income. Take the reported operating income (EBIT) for the year and add the calculated imputed interest on an operating lease to obtain the adjusted operating income.

What is leased asset?

The leased assets are specialized to the point that only the lessee can utilize these assets without major changes being made to them. Under a capital lease, the lessee is considered an owner and can claim depreciation and interest expense for tax purposes. The leased asset and lease obligation are shown on the balance sheet.

What is lease classification?

Lease Classifications Lease classifications include operating leases and capital leases. A lease is a type of transaction undertaken by a company to have the right to use an asset. In a lease, the company will pay the other party an agreed upon sum of money, not unlike rent, in exchange for the ability to use the asset.

What is the lease term?

The lease term is greater than or equal to 75% of the asset’s estimated useful life. The present value of the lease payments is greater than or equal to 90% of the fair value of the asset. Ownership of the asset may be transferred to the lessee at the end of the lease.

What are tangible assets?

Tangible assets are. that are leased include real estate, automobiles, aircraft, or heavy equipment. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses.

What is capitalized lease method?

What Is a Capitalized Lease Method? The capitalized lease method is an accounting approach that posts a company's lease obligation as an asset on the balance sheet.

What is the present value of a lease?

The present value of the lease payments is at least 90% of the asset's fair market value when the lease is created. A capital lease means that both an asset and a liability are posted to the accounting records.

Do you capitalize lease assets?

A lessee must capitalize leased assets if the lease contract entered into satisfies at least one of the four criteria published by the Financial Accounting Standards Board (FASB). An operating lease expenses the lease payments immediately, but a capitalized lease delays recognition of the expense.

Is a capital lease considered an asset?

In essence, a capital lease is considered a purchase of an asset, while an operating lease is handled as a true lease under generally accepted accounting principles (GAAP). When a lease is capitalized, the lessee creates an asset account for the leased item, and the asset value on the balance sheet is the lesser of the fair market value or ...

Who is Will Wills?

He developed Investopedia's Anxiety Index and its performance marketing initiative. He is an expert on the economy and investing laws and regulations. Will holds a Bachelor of Arts in literature and political science from Ohio University. He received his Master of Arts in economics at The New School for Social Research.

Who is Peggy James?

Peggy James is a CPA with 8 years of experience in corporate accounting and finance who currently works at a private university.

What is an operating lease?

Operating leases are used for short-term leasing of assets and are similar to renting, as they do not involve any transfer of ownership. Periodic lease payments are treated as operating expenses and are expensed on the income statement.

What is capital lease?

To be classified as a capital lease under U.S. GAAP, any one of four conditions must be met: A transfer of ownership of the asset at the end of the term. An option to purchase the asset at a discounted price at the end of the term. The term of the lease is greater than or equal to 75% of the useful life of the asset. The present value.

What are the advantages of operating leases?

There are many advantages to an operating lease as well: 1 Operating leases provide greater flexibility to companies as they can replace/update their equipment more often 2 No risk of obsolescence, as there is no transfer of ownership 3 Accounting for an operating lease is simpler 4 Lease payments are tax-deductible

Why are operating leases important?

Operating leases provide greater flexibility to companies as they can replace/update their equipment more often. No risk of obsolescence, as there is no transfer of ownership. Accounting for an operating lease is simpler. Lease payments are tax-deductible.

What is income statement?

Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or. , impacting both the operating and net income. In contrast, capital leases are used to lease longer-term assets and give the lessee ownership rights.

What is a lease in accounting?

Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for money or other assets. The two most common types of leases in accounting are operating and financing (capital leases). Advantages, disadvantages, and examples. Prepaid Lease.

Is lease expense expensed?

Accounting for an operating lease is relatively straightforward. Lease payments are considered operating expenses and are expensed on the income statement. The firm does not own the asset and, therefore, it does not show up on the balance sheet, and the firm does not assess any depreciation.

What is an operating lease?

If a lease does not meet any of the five criteria, it is an operating lease. Unlike the old standards, both leases must be accounted for on your balance sheet. 3. There will be an exemption for low-value assets. Under the FASB rules, there is not a standard exemption for low value assets.

What are the two types of leases?

The new lease accounting standard still designates two types of leases. Under the old standard, the two types of leases were capital and operating leases. Now, the two types of leases are operating and finance. Though the consideration for operating leases is the same, the consideration for finance leases has slightly changed.

What is incremental borrowing rate?

The incremental borrowing rate is what a lessee would pay to borrow, on a collateralized basis, over a similar term, an amount equal to the lease payments in a similar economic environment. The risk-free rate is the rate of return of an investment with zero risk. It cannot be elected for companies reporting in IFRS.

How long is a lease term?

Any assets that are leased would be subject to capitalization under the new lease rules, except, as stated above, if the lease term is less than or equal to 12 months. There is, however, a method by which lessees can elect to exclude certain low-value assets.

What are the criteria for financing a lease?

Now, there are five criteria to consider for finance leases: Transference of title/ownership to the lessee. A purchase option that the lessee is reasonably certain to exercise.

What is practical expedient?

This practical expedient is a part of what’s known as “the package of practical expedients.”. If you elect it, any leases that were classified as a capital lease under 840 will remain capital leases and the same applies for operating leases.

When will leases be accounted for?

Any leases outstanding as of December 31, 2019 (2021 for non-public entities) will need to be accounted for under the new lease accounting rules. As a result, it is imperative that companies evaluate the impact of the new lease accounting rules for leases that are currently being signed.

What is an operating lease?

Key Takeaways. An operating lease is a contract that permits the use of an asset but does not convey ownership rights of the asset. GAAP rules govern accounting for operating leases.

Who is Carla Tardi?

Carla Tardi is a technical editor and digital content producer with 25+ years of experience at top-tier investment banks and money-management firms. Peggy James is a CPA with 8 years of experience in corporate accounting and finance who currently works at a private university.

Is a capital lease considered operating expense?

GAAP accounting treatments for operating and capital leases are different and can have a significant impact on businesses' taxes. An operating lease is treated like renting—lease payments are considered as operating expenses.

Is a lease a bargain purchase option?

The lease contains a bargain purchase option; The lease life exceeds 75% of the asset's economic life; or, The present value (PV) of the lease payments exceed 90% of the asset's fair market value. If none of these conditions are met, then the lease must be classified as an operating lease.

Is lease an expense?

An operating lease is treated like renting—lease payments are considered as operating expenses. Assets being leased are not recorded on the company's balance sheet; they are expensed on the income statement. So, they affect both operating and net income.

Can a capital lease be reclassified?

The Internal Revenue Service (IRS) may reclassify an operating lease as a capital lease to reject the lease payments as a deduction, thus increasing the company's taxable income and tax liability.

Do leases have to be capitalized?

Effective Dec. 15, 2018, FASB revised its rules governing lease accounting. Most significantly, the standard now requires that all leases— except short-term leases of less than a year—must be capitalized. Other changes include the following:

What is an operating lease?

An operating lease can be defined as a contract that permits the usage of a particular asset. However, it does not transfer ownership rights to the user of the asset. In other words, the ownership rights remain with the owner of the asset. Operating Leases are mostly for a shorter time duration, lesser than a year.

What is capital lease?

What is a Capital Lease? A capital Lease, on the other hand, is a contract that is signed between both parties for an asset, which is supposed to be treated like a fixed asset on the balance sheet of the lessee. This particular lease is mostly on a long-term basis, and cannot be canceled by the lessee, or the lessor.

How does a capital lease work?

And How Does It Work? In the capital lease, the lessor tends to transfer the ownership right of the given asset to the lessee at the end of the lease period. However, during the lease period, the possession stays with the lessee, but the legal ownership right stays with the lessor. In a capital lease, there is a certain criterion ...

How often does a lease amount have to be paid to the lessor?

It involves the lessee paying the lease amount to the lessor every month the asset is in possession with the lessee. After the lease period ends, the lessee and lessor can either end the collaboration, or they can renew their lease in the case where the lessee wants to use the asset furthermore.

What is a bargain purchase?

An option that is extended to purchase the asset at a discounted price, at the end of the lease term (also referred to as bargain purchase) The term of the lease is greater than or equal to almost 75% of the useful life of the asset.

How long should a capital lease be?

For example, if the asset has a useful life of 10 years, then the capital lease should cover a period of at least 7.5 years. The present value of the lease payments is greater than or equal to 90% of the fair market value of the underlying asset.

Why do companies use operating leases?

A lot of companies prefer to work with an operating lease because they are relatively easier to obtain, and do not require a large commitment from either the company or the investor. Operating Lease is basically utilized by the company when they want to use an asset, but they do not want to purchase it. They might choose against purchasing the ...

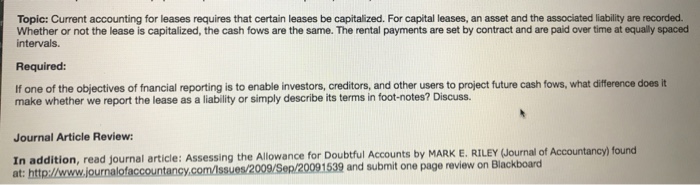

When will lease accounting change?

The rules for accounting for leases in a set of financial statements in accordance with GAAP (Generally Accepted Accounting Principles) will change significantly starting in 2022. The logic for making the change is that balance sheets are currently very different for businesses that own a building compared to businesses that rent a building.

How should lease expense be recorded?

Lease expense should be recorded on a straight line basis over the life of the lease. If the lease has a period of free rent at inception that period should be averaged with the payments over the life of the lease to give an equal expense amount each month.

How long until lease obligation is determined for 2022?

There is just one year until this rule is applicable to calendar 2022 financial statements. If a cooperative has any significant operating leases we recommend that you analyze what the implementation of these new rules will mean for your balance sheet. We expect that the determination of the lease obligation will take a significant amount of time. Looking at this now will help you to more easily implement these rules later and to start discussions now with lenders, boards and other users of your financial statements.

What is the term of a lease for the present value calculation?

The term of the lease for the present value calculation is the non-cancelable period of the lease. This is the period where the cooperative has the exclusive right to use the asset. This will include any periods of free rent which are sometimes at the inception of the lease.

How do cooperatives know the rate of return?

A cooperative might know this rate if it knows what the owner paid for the asset. For instance if a cooperative owned a building, sold to an investor who then immediately leased it back, the cooperative would know the rate of return being used to set the lease payments.

What are non-lease components?

Any non-lease components, such as maintenance, common area maintenance, or real estate taxes should be removed if possible. If these elements are included in the lease payments with no separate identification, they are considered part of the future obligations of the lease for this calculation.

Why is the rate chosen important?

The rate chosen is important since the higher the rate , the lower the present value of the future payments which results in a smaller amount to be capitalized. Once the rate is set it will not be changed later in the lease period even if market rates change significantly. The rate is assumed to be fixed for the term of the lease.

Why is it advantageous to be a party to an operating lease?

For the lessee, it is advantageous to be party to an operating lease because then nothing has to appear on their business balance sheet. Since it is not considered an asset, there are no taxes to pay on it.

What are the different types of commercial leases?

There are essentially two types of commercial leases: an operating lease and a capital lease. The differences between the two have important ramifications for your business expenses and tax situation, so it pays to understand them both.

What is the best way to equip your business with the cars and/or trucks it needs to operate?

March 11, 2020. Commercial vehicle leasing is perhaps the best way to equip your business with the cars and/or trucks it needs to operate. There are many benefits to leasing in volume. Aside from the mobility it gives your employees, the small business help is a big asset.

Is an operating lease an expense?

An operating lease is considered an expense to the lessee - the party doing the leasing. The lessee assumes no ownership stake in the vehicle (s), paying instead for the right to use them. The vehicles are the property of the leasing agent or lessor who in turn accrues the tax benefits involved. This is favorable to the business because ...

Can a capital lease claim depreciation?

Of course, the titles are still held by whoever owns them outright, but because there is joint ownership, the lessee can claim the depreciation of the vehicle (s) and the interest expense from the payments on their annual tax form.

Operating Lease vs. Capital Lease

- An operating lease is different from a capital lease and must be treated differently for accounting purposes. Under an operating lease, the lessee enjoys no risk of ownership, but cannot deduct depreciation for tax purposes. For a lease to qualify as a capital leaseCapital Lease vs Operating LeaseThe difference between a capital lease vs operating lease - A capital lease (or finance lea…

Capitalizing An Operating Lease

- If a lease does not meet any of the above criteria, it is considered an operating lease. Assets acquired under operating leases do not need to be reported on the balance sheet. Likewise, operating leases do not need to be reported as a liability on the balance sheet, as they are not treated as debt. The firm does not record any depreciation for assets acquired under operating l…

Full Adjustment Method

- Step 1: Collect input data

Find the operating lease expenses, operating income, reported debt, cost of debt, and reported interest expenses. Cost of debt can be found using the firm’s bond rating. If there is no existing bond rating, a “synthetic” bond rating can be calculated using the firm’s interest coverage ratio. … - Step 2: Calculate the Present Value of Operating Lease Commitments

By capitalizing an operating lease, a financial analyst is essentially treating the lease as debt. Both the lease and the asset acquired under the lease will appear on the balance sheet. The firm must adjust depreciation expenses to account for the asset and interest expenses to account for the …

Approximation Method

- Step 1: Collect input data

Like the full adjustment method, we will need to collect the same input data. - Step 2: Calculate the Present Value of Operating Lease Commitments

The second step for the approximation method is identical to the second step in the full adjustment method as well. We need to calculate the present value of operating lease commitments to arrive at the debt value of the lease.

Impact on valuation

- There are two effects on free cash flow to the firm (FCFF) when we treat operating lease expenses as financing expenses by capitalizing them: 1. FCFF will increase because the imputed interest expense on the capitalized operating leases is added back to the operating income (EBIT). 2. FCFF will decrease if the present value of leases increases (and vice versa) due to the …

Other Resources

- We hope you’ve enjoyed reading this CFI guide to leases. To learn more, see the following free CFI resources. 1. Lease ClassificationsLease ClassificationsLease classifications include operating leases and capital leases. A lease is a type of transaction undertaken by a company to have the right to use an asset. In a lease, the company will pay the other party an agreed upon sum of mo…

What Is A Capitalized Lease Method?

How The Capitalized Lease Method Works

- While an operating lease expenses the lease payments immediately, a capitalized lease delays recognition of the expense. In essence, a capital lease is considered a purchase of an asset, while an operating leaseis handled as a true lease under generally accepted accounting principles (GAAP). When a lease is capitalized, the lessee creates an asset account for the leased item, an…

Special Considerations

- This accounting treatment changes some important financial ratios used by analysts. For example, analysts use the ratio of current liabilitiesdivided by total debt to assess the percentage of total company debt that must be paid within 12 months. Since a capitalized lease increases liabilities, the lease obligation changes this ratio, which may also change analysts' opinions on t…

Example of How A Capitalized Lease Works

- Assume, for example, that a company has a lease obligation of $540,000 for five years with an interest rate of 10%. The company must make five payments of $90,000, and these payments are comprised of both the interest payments and the principal payments. The interest payments are 10% of the lease balance, and the remainder of each payment pays down the principal balance. …