Can we claim depreciation on sale of assets? Depreciation is permitted under the income tax laws for assets used for business purposes on the basis of a concept known as “block of assets,” which allows tax payers to claim a deduction for the cost of acquisition of such assets. How do you record the sale of an asset that is fully depreciated?

What happens to depreciation when you sell an asset?

When a depreciable asset is sold, depreciation expense is changed to ensure that there is neither a gain nor a loss. If the sales proceeds are less than the net book value, a loss results. If the sales proceeds are greater than the net book value, a gain results. Is depreciation included in cost of sales?

When is no depreciation of a property Avilable?

no depriciation is avilable in the year of sale if all the assets in the block ends or if sale value is more than wdv of block. In that case, capital gain or loss has to calculate as per sec. 50

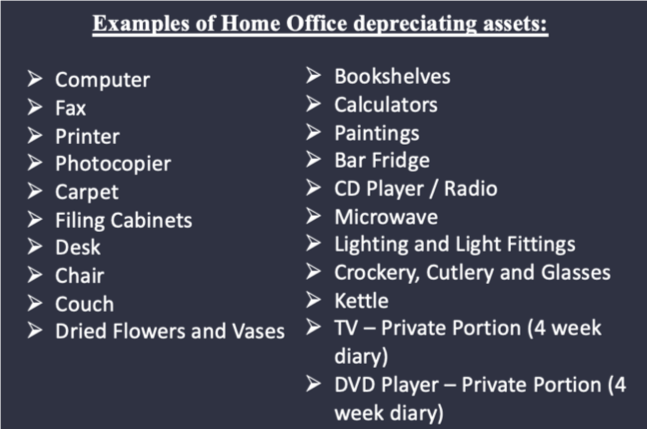

Which assets can be depreciated on tax return?

Only the business portion of the asset can be depreciated on your tax return. For example, if you use your car 60% for business use, depreciation can be claimed on 60% of the cost.

Can I claim depreciation on equipment that I rent or lease?

Yes, as long as you are responsible for making payments on the asset, you can take a depreciation deduction. Return to top. [6] Can I claim depreciation on equipment that I rent or lease for my business? If you are renting or leasing an asset, you can deduct your monthly rent/lease costs as an expense.

Is depreciation allowed in the year of sale of asset?

When net sale consideration on such asset's sale is reduced from the written down value (opening WDV + cost of assets acquired if any) of the block of the assets. And the written down value of the block of asset is not Nil. There is no capital gain on transfer of assets. Hence, normal depreciation will be allowed.

What happens to depreciation when you sell an asset?

When a company sells or retires an asset, its total accumulated depreciation is reduced by the amount related to the sale of the asset. The total amount of accumulated depreciation associated with the sold or retired asset or group of assets will be reversed.

Do you depreciate assets held for sale for tax purposes?

Assets classified as held for sale are no longer depreciated or amortized. For newly acquired assets, the carrying amount should be established based on the asset's fair value less cost to sell at the acquisition date.

How do you calculate depreciation in a case of sale of assets?

Section 32(1) of the Income Tax Act 1961 says that depreciation should be computed at the prescribed percentage on the WDV of the asset, which in turn is calculated with reference to the actual cost of the asset. When an assessee is acquiring the asset in the previous year then the actual cost becomes the WDV.

How do you record a sale of assets fully depreciated?

The accounting for a fully depreciated asset is to continue reporting its cost and accumulated depreciation on the balance sheet. No additional depreciation is required for the asset. No further accounting is required until the asset is dispositioned, such as by selling or scrapping it.

Can you sell depreciation?

“Depreciation recapture” refers to the Internal Revenue Service's (IRS) policy that an individual cannot claim a depreciation deduction for an asset (thereby reducing their income tax) and then sell it for a profit without “repaying the IRS” through income tax on that profit.

What happens when an asset is held for sale?

When an entity classifies an asset as held for sale, the entity measures the asset at the lower of its carrying amount and fair value less costs to sell. The entity measures the asset's carrying amount in accordance with applicable IFRSs right before its initial classification as held for sale.

Which assets Cannot be depreciated?

What Can't You Depreciate?Land.Collectibles like art, coins, or memorabilia.Investments like stocks and bonds.Buildings that you aren't actively renting for income.Personal property, which includes clothing, and your personal residence and car.Any property placed in service and used for less than one year.

Can you take depreciation in year of disposal?

Under this convention, a taxpayer treats all property placed in service or disposed of during a tax year as placed in service or disposed of at the midpoint of the year. As such, a one-half year of depreciation is allowed for the year the property is placed in service or disposed of.

Can depreciation be claimed in the year of sale in India?

Depreciation in the year in which asset is purchased Deprecation is allowed only if the asset is put to use in the year of purchase. Degree of utilisation of assets will not be considered while determining whether the asset is put to use or not.

How do you treat sale of fixed assets?

When there is a gain on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and credit the gain on sale of asset account.

When can you claim depreciation?

Claiming a deduction for depreciation Generally, you can claim a deduction for the decline in value of depreciating assets each year over the effective life (unless you're eligible to claim an immediate or accelerated deduction using a tax depreciation incentive).

What happens when you sell a depreciated vehicle?

Since depreciation of an asset reduces ordinary income, a portion of the gain from the disposal of the asset must be reported as ordinary income, rather than the more favorable capital gain. There is no depreciation recapture if a loss was realized on the sale of a depreciated asset.

How do you avoid depreciation recapture on a business?

One of the best ways is to use a 1031 exchange, which references Section 1031 of the IRS tax code. This may help you avoid depreciation recapture and any capital gains taxes that might apply.

Do I have to pay back depreciation?

The only time you don't owe depreciation recapture tax is if you sell the home for a loss. Let's say the market dropped drastically and you can't afford to keep the home any longer. You cut your losses and sell for what you can, selling for an amount less than you paid originally.

How can depreciation recapture be avoided?

Investors may avoid paying tax on depreciation recapture by turning a rental property into a primary residence or conducting a 1031 tax deferred exchange. When an investor passes away and rental property is inherited, the property basis is stepped-up and the heirs pay no tax on depreciation recapture or capital gains.

What form do you report a sale of a business?

You should report the sale of the business or rental part on Form 4797, Sales of Business Property. Form 4797 takes into account the business or rental part of the gain, the section 121 exclusion and depreciation-related gain you can't exclude.

What is a 527?

Additional Information: Publication 527, Residential Rental Property (Including Rental of Vacation Homes) Publication 535, Business Expenses.

What is a rental property?

Answer: Rental property is income-producing property and, if you're in the trade or business of renting real property, report the loss on the sale of rental property on Form 4797, Sales of Business Property.

What form do you use to claim business use of an automobile?

You can claim business use of an automobile on: Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) , if you're a sole proprietor. You may also need to use Form 4562, Depreciation and Amortization. If a farmer, use Schedule F (Form 1040), Profit or Loss From Farming and Form 4562.

How to defer gain in a like-kind exchange?

To successfully defer gain in a like-kind exchange, you must comply with certain requirements under section 1031 of the IRS Code and the regulations thereunder. For example, when you sell your rental property, you can't take actual or constructive receipt of the sale proceeds. You can avoid actual or constructive receipt of the proceeds if you comply with one of the safe harbors, such as using a qualified intermediary or a qualified trust to hold and use the sale proceeds to acquire the replacement property, as set forth in the Income Tax Regulations or certain other publications of the IRS.

What is a 2106?

Form 2106, Employee Business Expenses, if you’re an Armed Forces reservist, state or local government official paid on a fee basis, or a qualified performing artist.

How does a like-kind exchange work?

A like-kind exchange, when properly executed, can postpone the recognition of gain (and resulting current tax) essentially by shifting the basis of property sold to like-kind replacement property. You do this by acquiring a like-kind property, which may be of lesser or greater value.

How much did Adam buy a bulldozer?

Adam bought a bulldozer from a local contractor for $6,000. He paid $2,000 in cash, borrowed $3,000 from thebank, and agreed to dig the foundation for the seller’s lake cabin. Adam’s basis is $6,000. Note: Adam will alsoinclude $1,000 in income in the year he digs the foundation.

How much did Shawn buy a used pickup?

Shawn bought and placed in service a used pickup for $15,000 on March 5, 1998. The pickup has a 5 year classlife. His depreciation deduction for each year is computed in the following table.

What is the MACRS method?

MACRSprovides a uniform method for all taxpayers to compute the depreciation. Using the basis, class life, and theMACRS tables, you can compute the deduction for each asset in the year it is placed in service and eachsubsequent year of its class life. See Publication 946, How to Depreciate Property.

When is property put in service?

Property is placed in service when it is ready and available for use in your business even if you have notbegun using it. This date determines when you can begin to depreciate the asset.

Can you claim mileage depreciation separately?

The standard mileage rate covers all the expenses of operating your vehicle. Therefore you do not claimdepreciation seperately. However, if you use the actual expense method (see the Travel and EntertainmentFAQ's) to compute your vehicle expenses, you will be allowed to claim depreciation.

Is there a limit on yearly depreciation?

There are not any overall limitations on yearly depreciation. However, if an asset is considered ListedProperty, your annual deduction is limited. Listed property is a term for business assets that are often usedfor personal purposes. Under the MACRS rules, depreciation is limited for listed property, such as:

Can you deduct major improvements in one year?

The cost of major improvements is not deductible all in one year. They must be capitalized and depreciated.The total improvements you made this year are handled as though you purchased a new building. You wouldrecover the cost of the improvement using the depreciation methods in effect for the tax year you made them.

What is termination value reduced by GST payable?

The termination value is reduced by the GST payable if the balancing adjustment event is a taxable supply. It can be modified by increasing or decreasing adjustments.

What is termination value?

Termination value. Generally, the termination value is what you receive or are taken to receive for the asset when a balancing adjustment event occurs. It is made up of: the market value of any non-cash benefits (such as goods or services) you receive for the asset.

What happens if an asset is less than its adjustable value?

If the asset’s termination value is less than its adjustable value, you can claim a deduction for the difference.

How to calculate balancing adjustment?

You calculate the balancing adjustment amount by comparing the asset's termination value (for example, the sale proceeds) with its adjustable value (the cost of the asset less depreciation deductions).

What happens when you cease to hold a depreciating asset?

If you cease to hold or use a depreciating asset, a balancing adjustment event may occur. A balancing adjustment event occurs for a depreciating asset when:

When you dispose of a depreciating asset, do you need to make a balancing adjustment?

When you dispose of a depreciating asset (that is, it's sold, lost, destroyed, or you stop using it, or expect never to use it again), you may need to make a balancing adjustment (the adjustable value minus termination value).

What is the market value of an asset?

the market value of any non-cash benefits (such as goods or services) you receive for the asset.

How much can you deduct from a 179?

If you acquire and place in service more than one item of qualifying property during the year, you can allocate the section 179 deduction among the items in any way, as long as the total deduction is not more than $1,040,000. You do not have to claim the full $1,040,000.

What is depreciation on taxes?

Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property. It is an allowance for the wear and tear, deterioration, or obsolescence of the property.

What is the maximum deduction for 179?

For tax years beginning in 2020, the maximum section 179 expense deduction is $1,040,000 ($1,075,000 for qualified enterprise zone property). This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,590,000.

How much depreciation is required for second generation biofuels?

You can take a 50% special depreciation allowance for qualified second generation biofuel plant property (as defined in section 40 (b) (6) (E) of the Internal Revenue Code). The property must meet the following requirements.

What is depreciable property?

To be depreciable, your property must have a determinable useful life. This means that it must be something that wears out, decays, gets used up, becomes obsolete, or loses its value from natural causes.

What is the basis of a property?

The basis of property you buy is its cost plus amounts you paid for items such as sales tax (see Exception below), freight charges, and installation and testing fees. The cost includes the amount you pay in cash, debt obligations, other property, or services.

How much is the maximum vehicle weight for 2020?

You cannot elect to expense more than $25,900 of the cost of any heavy sport utility vehicle (SUV) and certain other vehicles placed in service in tax years beginning in 2020. This rule applies to any 4-wheeled vehicle primarily designed or used to carry passengers over public streets, roads, or highways that is rated at more than 6,000 pounds gross vehicle weight and not more than 14,000 pounds gross vehicle weight. However, the $25,900 limit does not apply to any vehicle: