People also ask, can you cash a savings bond that is not in your name? A savings bond isn't transferable, so signing it doesn't allow someone else to cash it. As protection against fraud, financial institutions require more than a signature to cash savings bonds. If you're unable to cash a bond yourself, a registered co-owner can do it, or you can give someone power of attorney. how do I cash a savings bond?

Can I cash a savings bond I don't own?

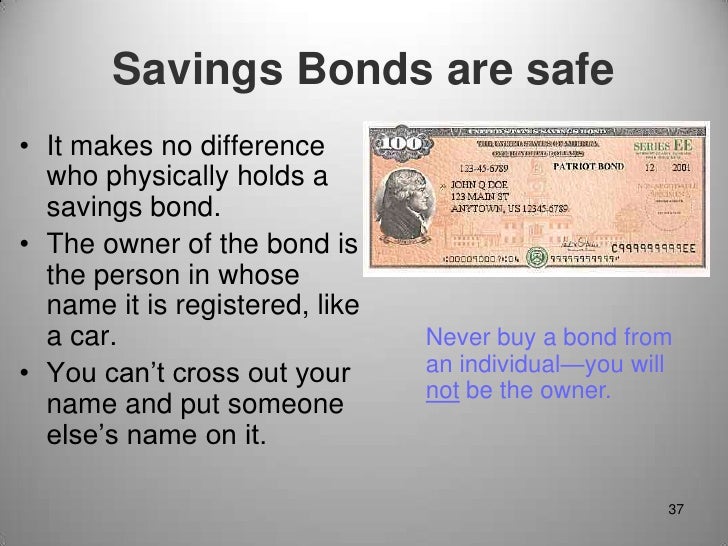

Regardless of where you cash your bonds, if you aren’t listed as the owner or co-owner on a bond, you have to submit legal evidence or other documentation to show you are entitled to cash the bond. (We don’t return legal evidence.) Note: Savings bonds cannot be transferred.

How do you cash in savings bonds after a name change?

Cashing the Bonds. Bring the reissued bonds to your bank. Sign your current name and your previous name on each savings bond if your name changed due to marriage and you did not reissue them. Some banks may require that you write your current name, followed by “changed by marriage from,” and then your former name.

Can I cash a savings bond that shows my maiden name?

The federal government knows that name changes are common, so as long as you produce the necessary documentation, you won’t have problems if you want to cash a savings bond that shows your maiden name. Check your bond to make sure it’s eligible for payment.

Can a bank cash a bond with a Social Security number?

A bank will only cash bonds of which you are a registered owner. You may be either the sole listed owner or a co-owner. The U.S. Treasury regulations also require that the Social Security number of the owner be listed on the bond. It is possible to write in your Social Security number, such as on a bond received as a gift.

Can you cash in someone elses savings bond?

A savings bond isn't transferable, so signing it doesn't allow someone else to cash it. As protection against fraud, financial institutions require more than a signature to cash savings bonds. If you're unable to cash a bond yourself, a registered co-owner can do it, or you can give someone power of attorney.

How do I cash a savings bond for a deceased person?

TO CASH BONDS FOR A DECEDENT'S ESTATE: If the bonds cannot be cashed at a local bank, the legal representative of the estate must complete a Special Form of Request for Payment of United States Savings and Retirement Securities Where Use of a Detached Request Is Authorized (FS Form 1522).

Can I cash my daughters savings bonds?

A parent or guardian can cash a minor's savings bond only if the child is too young to sign the bond on her own. A parent who wants to cash a child's bond probably should take the child to the bank to show the bank officials that the bond owner is not yet old enough to sign for herself.

How do you cash savings bonds if your name has changed?

Cashing the Bonds Bring the reissued bonds to your bank. Sign your current name and your previous name on each savings bond if your name changed due to marriage and you did not reissue them. Some banks may require that you write your current name, followed by “changed by marriage from,” and then your former name.

What happens to savings bonds when the owner dies?

If a survivor is named on the savings bond, it does not become part of the deceased person's estate. Rather, the savings bond belongs to the survivor, who can choose to do nothing, redeem the bond, or have it reissued. If the survivor does nothing, the bond will continue to earn interest until the bond matures.

How do I change ownership of a savings bond?

A U.S. savings bond will have the name of a single owner or two co-owners printed on the bond. Only a listed owner can cash in the savings bond. To change an owner on a savings bond, a reissue request must be sent in along with the bond to the U.S. Treasury.

Who can cash in a savings bond?

A parent or guardian of a child who is the bearer of a savings bond can redeem the bond, as long as the child is too young to sign his or her name. If the original owner of a bond has died, but someone else has been named as a beneficiary on the bond, the beneficiary can redeem the bond.

How much is a $50 savings bond worth?

Total PriceTotal ValueYTD Interest$50.00$69.94$3.08

How do you cash a savings bond for a child?

Requirements for cashing in a child's savings bond Second, the child must live with the parent, or the parent must have legal custody of the child. To redeem the bond, the Treasury advises that you write specific language on the back of the bond and sign it as parent on behalf of the child.

What do I need to cash a savings bond with my maiden name?

Regardless of where you cash the bond, bring your birth certificate (showing your maiden name) and marriage certificate to validate the discrepancy between your maiden name and married name. Sign the bond with your legal married name in the presence of a bank representative.

How do you cash a savings bond with two names on it?

When you do cash it, you'll simply sign both names at the bank. Your name is misspelled on the bond? When you are ready to cash the bond, simply sign with your correct name at the bank.

Can you retitle savings bonds?

Individual savings bonds may not be split and must be reissued in full.

When Can I Redeem My EE and E Bonds?

After they are 12 months old. 1. If you redeem an EE bond before it is five years old, you will lose the last three months of interest. 2. EE bonds...

What Are My EE and E Bonds Worth?

If you hold an electronic Series EE (or Series I) bond in TreasuryDirect, you can find the bond’s current value there. Use the “Current Holdings” t...

How Much Can I Redeem at One time?

For electronic bonds in TreasuryDirect, you can redeem a minimum of $25 or any amount above that in 1-cent increments. If you redeem only a portion...

What Will I Need to Redeem A Paper Bond?

If you plan to take your bonds to a local bank, check with the financial institution beforehand to see whether it redeems savings bonds. If it does...

Can I Find Out If An EE Or E Bond Has Already been Redeemed Or replaced?

Start with your local financial institution. It may be able to tell you if the bond is eligible for redemption. If the bank can’t help, you may con...

What to do if your bank can't help you?

If the bank can’t help, you may contact us. If you are the owner or co-owner, send a signed request to the address below. Be sure to include the serial number of the bond. If the owner or both co-owners have died, you must provide proof such as a copy of the death certificate for each deceased person.

How long do EE bonds earn interest?

EE bonds earn interest for 30 years if you don't cash the bonds before they mature. So the longer you hold the bond (up to 30 years), the more it is worth. If you've been affected by a disaster, special provisions may apply. All E bonds and some EE bonds have stopped earning interest and should be cashed.

Can you cash a savings bond?

Note: Savings bonds cannot be transferred. If you find a bond that belongs to someone else or buy a bond on an online auction site, you cannot cash it. (If you inherit a bond through the death of the bond owner, see Death of a Savings Bond Owner .)

What to do if you don't have a savings bond?

When you cash a savings bond at a bank with which you have an account, the bank has an easier time identifying you. If you don’ t have an active account at a bank, bring suitable documentation to prove your identity – passport, driver’s license, Social Security card or state identification card. Regardless of where you cash ...

Can you cash a savings bond with your maiden name?

You can count on a fixed rate of return as long as you hold onto the bonds for a minimum period. The federal government knows that name changes are common, so as long as you produce the necessary documentation, you won’t have problems if you want to cash a savings bond that shows your maiden name.

How to cash a savings bond?

Cash by Mail. The U.S. Treasury will redeem savings bonds by mail, sending you a government check for the cash value of the bond. To use this method to cash a bond, you must first go to a bank -- any bank -- and have your identification verified on the bond by a bank officer. The mail alternative allows you to take a large value savings bond ...

How much can a bank cash in savings bonds?

The maximum dollar amount of savings bonds a bank can cash for a non-customer is $1,000. If your savings bond has a redemption value of more than $1,000, the bank will not redeem it. You can cash several smaller bonds as long as the total is less than $1,000.

Can you cash your own bonds?

Only Cash Your Own Bonds. A bank will only cash bonds of which you are a registered owner. You may be either the sole listed owner or a co-owner. The U.S. Treasury regulations also require that the Social Security number of the owner be listed on the bond. It is possible to write in your Social Security number, such as on a bond received as a gift.

How to get a replacement savings bond?

If your savings bonds are lost or stolen, you can request a replacement by filling out Form PDF 1048 and mailing it the address on the form. You'll need to supply the serial numbers if you have them. Otherwise, the Treasury Department can look up your bonds if you provide your Social Security number, the month and year you bought them, the complete name or names on the bond, and your mailing address. New bonds are only available in electronic form, so you'll need to open a Treasury Direct account if you don't have one.

How much can a bank cash in bonds?

At its discretion, a bank can cash up to $1,000 worth of bonds based on identification only. To cash amounts larger than $1,000, the bank must know the bondholder as a customer for at least six months. Alternately, another regular bank customer can identify the person cashing the bond.

What documents are needed to cash savings bonds?

Some acceptable documents for identification include an employee picture ID, a government-issued trade license, a driver's license, a state ID card, a U.S passport or a green card. At its discretion, a bank can cash up to $1,000 worth of bonds based on identification only.

Can you cash a savings bond after death?

The registered beneficiary on a savings bond can cash it after the owner's death . Banks can cash the Series I, E and EE bonds, while H and HH bonds must be redeemed by mail after certification by a bank official. The beneficiary must present Form PDF 1522 and an official copy of the owner's death certificate to cash the bonds.

Who can redeem a savings bond?

A parent or guardian of a child who is the bearer of a savings bond can redeem the bond, as long as the child is too young to sign his or her name. If the original owner of a bond has died, but someone else has been named as a beneficiary on the bond, the beneficiary can redeem the bond.

Can a bank refuse to issue a bond?

This is typically someone acting on behalf of a deceased person's estate. There are circumstances under which a bank can refuse to issue payment for a bond, or in fact may be legally unable to do so. In these cases, the bearer may have to visit a Federal Reserve Bank Savings Bond Processing Site to redeem the bond.

Can you cash in savings bonds?

Remember that savings bonds can't be sold, traded or given away. The person whose name is on the bond is the only person who can cash it in (with some exception, which we'll get to shortly).