Does insurance cover damage from lightning strikes?

Currently insured? Homeowners insurance generally does cover damage from lightning strikes, though there are some exceptions to keep in mind. Our guide explains how and when your insurance company would cover or pay out for lightning strikes, and what homeowners can do to mitigate damages or issues when filing claims.

Can I file a claim for lightning damage to my property?

You can use your homeowners insurance to file a claim after lightning has caused damage to your property, but there are also some things you can do to prevent or at least minimize the damage in the first place.

How do I file a lightning strike insurance claim?

Follow our tips for filing a lightning strike insurance claim: 1. Assess the damage. As soon as it’s safe to do so, take a look at the damage. The insurance claims adjuster will need to know what damage you’re claiming occurred, so be thorough, take photos and write down everything that happened, including the date and time of the incident. 2.

How soon after a car is struck by lightning can you claim?

Assuming you have comprehensive coverage, you'll want to file an auto insurance claim as soon as possible after your car is struck by lightning. Physical damage from lightning is a pretty clear indicator of the event, but electrical problems are harder to tie directly to a lightning strike.

What is it called when lightning strikes your home?

How many lightning bolts are there in a second?

How to protect yourself from Mother Nature's light?

Does insurance cover power surges?

Can lightning damage electronics?

How do you prove lightning damage?

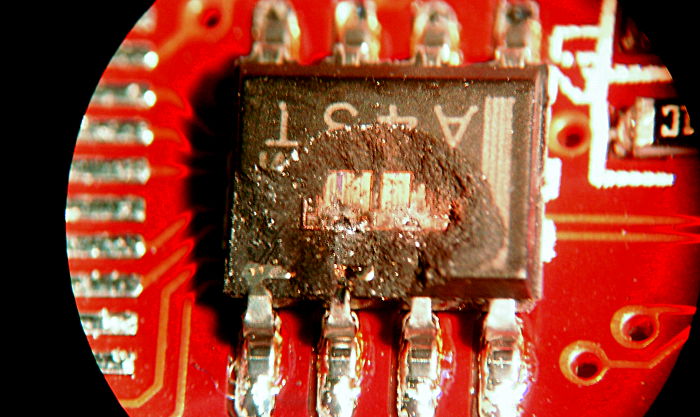

To prove that lightning has damaged your home and belongings, you will need to show proof. A hole, char marks, or other damage to the exterior of your home is great proof and should be photographed as soon as it is safe to go outside.

Is lightning damage covered by insurance?

Lightning strikes can cause fires inside or outside your home, ruin expensive appliances and electronics, damage wiring in the walls, and potentially shock and injure you or someone in your household. The good news is lightning is covered by almost all homeowners insurance policies.

Is there a deductible with lightning?

If you carry comprehensive coverage on your auto policy, you may be covered in the event of a lightning strike, minus the cost of your deductible. Comprehensive coverage protects against non-collision events that are outside of your control like theft, vandalism, and severe weather, including lightning strikes.

Does home insurance cover lightning surge?

The Insurance Information Institute (III) explains that some — but not all — homeowners policies cover power surges that occur when lightning strikes your home directly. Most homeowners policies include some protection against sudden, accidental damage from man-made electricity, according to the III.

What happens when lighting hits your house?

If the electricity from a lightning strike is conducted by a home's gutters, windows, concrete floors, and other exterior conductive materials, it can jump to the home's electrical system. A direct hit or one nearby can cause an explosive surge that will destroy the wires.

What kind of damage can lightning cause?

A direct lightning strike will cause significant damage to electrical and nonelectrical items in the home. In many instances, this will start a fire, often in the wiring within the walls or the attic. It can also cause structural damage to the roof, chimney, or sometimes the windows or foundation (Storm Highway).

What happens if your car is hit by lightning?

As long as you get out of the car after the lightning strike is over, nothing should happen. The car's body is made of metal, and it will have conducted the electrical charge from the lightning into the ground. It makes no difference to your safety whether the engine is running or not.

What happens if lightning strikes a building?

Lightning can easily fracture concrete, brick, cinderblock and stone. Brick and stone chimneys are commonly damaged severely by lightning. Lightning's shock waves can blow out plaster walls, shatter glass, create trenches in soil and crack foundations.

What should you do if lightning hits your car?

If there is no shelter around and you must stay on the road, pull over, turn off your engine, and turn on your hazard lights while you wait out the storm. Do not touch anything metal inside of your car. This includes the radio, cell phone chargers, mobile GPS devices, door handles, and the steering wheel.

How do you prove a power surge?

What are the Signs of a Power Surge?The device's clock or lights are flashing.The device is off or does not work.There is an acrid, burnt odor around the device or power source.A surge protector or power strip may require resetting.

What happens when lightning hits a tree?

Response of Trees to Lightning A tree's biological functions and/or structural integrity are affected by lightning strikes. Along the path of the strike, sap boils, steam is generated and cells explode in the wood, leading to strips of wood and bark peeling or being blown off the tree.

Do insurance companies still use act of God?

Because of the blurred lines between what does and does not constitute as an act of god, insurance companies nowadays try not to rely on the term 'act of god', but instead tend to be clearer with their policy terms and conditions and specifically outline what is and isn't included.

What happens if car gets hit by lightning?

Although every lightning strike is different, damage to the antenna, electrical system, rear windshield, and tires is common. The heat from a lightning strike is sufficient to partially melt the antenna of a vehicle and can cause what seems like a small explosion of sparks as tiny fragments of metal melt and burn.

What happens if lightning strikes a building?

Lightning can easily fracture concrete, brick, cinderblock and stone. Brick and stone chimneys are commonly damaged severely by lightning. Lightning's shock waves can blow out plaster walls, shatter glass, create trenches in soil and crack foundations.

Do insurance companies still use act of God?

Because of the blurred lines between what does and does not constitute as an act of god, insurance companies nowadays try not to rely on the term 'act of god', but instead tend to be clearer with their policy terms and conditions and specifically outline what is and isn't included.

Does insurance cover lightning strike to tree?

According to the Insurance Information Institute (III), a tree struck by lightning is typically covered under most homeowners insurance policies. The damage caused by the tree, as well as the contents of any structure that was damaged, are also generally covered.

How to make sure you identify all damage to your home or business caused by a lightning strike?

In order to make sure you identify all damage to your home or business caused by a lightning strike, have a public adjuster examine your property. Ask An Adjuster Claims Adjusting can send a licensed expert to your property and perform a thorough, 11-point inspection to determine everything and anything that was damaged by a lightning strike.

What is lightning protection?

Lightning protection systems protect homes and businesses. If you’re concerned about lightning damage to your home, consider installing a lightning protection system, which will provide safe paths for lightning to travel to the ground and protect your home from damage before it happens. 4. Remember your pets.

How to tell how far away a lightning strike is from you?

Do you know how to tell how far away a lightning strike is from you? If your answer is that all you have to do is count the seconds between the flash of lightning and the clap of thunder, you’re only partly right. First, count the number of seconds between the flash and the thunder, and then divide by 5. That’s how many miles you are from the lightning strike. Those strikes are a lot closer than you thought, aren’t they?

How to protect animals from thunderstorms?

Remember your pets. Make sure your animals have access to safe places during thunderstorms and aren’t trapped outside or somewhere they can be injured. 5. Use the 30-30 rule for outdoor activities. Do not use your swimming pool during a thunderstorm or at any time when you can see lightning and hear thunder.

How long is a lightning channel?

An average lightning channel can be anywhere between two and ten miles long . This means if you see lightning followed by thunder less than 30 seconds later, you need to get to shelter right away.

How far can lightning precede a storm?

Lightning can precede a storm by 10 miles. So just because you see dark clouds in the distance, don’t be fooled into thinking you’re safe. This is particularly important if you’re in an open area like the beach. Be safe and heed the warnings of the lifeguards.

Why is lightning attracted to things?

This means lightning is attracted to things which are a good conductor of electricity like metal items such as pipes or doors, and trees or people because of how much of our body mass is made up of water, another good conductor of electricity.

What are the different types of lightning damage?

There are four basic types of lightning damage: physical damage, secondary effect damage, electromagnetic effect damage, and damage caused by changes in ground reference potential. Each of these types of damage is eligible for coverage within lighting strike damage claims.

What happens to the area surrounding the point of a strike?

The surrounding area releases its charge to the point at which the strike occurred, causing a flow of current. This current flow can arc across any gaps in its path.

How many lightning claims are made in a year?

Recently, we learned that over 99,000 lightning damage claims are made each year on homeowner’s policies.

What to do when your home is damaged?

The first thing to do is to identify what has been damaged. Go throughout your home and test all of your electronic devices and gadgets. (TV’s, computers, iPads, etc.) Make a list of what is no longer operational. Hopefully, you have done a home inventory audit and have records of what everything cost you.

Do you get the whole $926 if you turn in a claim?

They hold off to make a claim for when they really need it. In fact, you might be surprised to learn that even if you turned the claim in you might not get the whole $926.

A standard home insurance policy provides coverage for:-

Personal Property: Many insurance companies offer to cover damages caused to personal belongings and properties including electronic appliances, apparatuses, furnishings, interiors, etc.

Classification Of Lightning

According to the insurance rules, there are basically 3 categories into which lighting is bifurcated. They are:-

How To File An Insurance Claim – The Process

The first step in the process is to assess the damage. Thus, once it is safe to go around the damaged area, make a visit, click pictures, and jot down all the crucial points regarding the event. This will be needed as the claiming adjuster will need to have thorough information regarding this.

How to protect your home from lightning?

A little common sense can go a long way toward shielding you from lightning-related dangers: Have working smoke detectors, flashlights and fire extinguishers on each floor of your home. Plug your key appliances and electronics into compatible surge protectors.

Who installs lightning protection?

Installing advanced lightning protection should be done by an experienced electrician or contractor who is UL-listed and LPI-certified. Installation plus equipment costs typically equate to less than 1% of the home's value.

How does a lightning protection system work?

Lightning protection systems work to intercept a lightning strike and offer a safe and efficient path that dissipates dangerous electricity to the ground, detouring it from traveling through the structure's electrical or plumbing system.

What is considered personal property in a lightning strike?

Personal property, which can include electronics, appliances, furnishings, or other interior possessions damaged or destroyed by a lightning strike. Most insurers provide coverage for personal possessions at approximately 50 to 70 percent of the amount of insurance you have on the structure of your home.

What happens if my home insurance exceeds my deductible?

If the cost to repair your home exceeds the deductible of your policy, you will need to make a decision whether to file a claim. If you choose to file a claim, the adjuster will offer you a settlement for repairs. You receive the settlement from your insurance company in two increments.

How many checks do you get for damage to your home?

When both your home's structure and personal property are damaged, you generally receive two separate checks from your insurance company – one for each category of damage. You should also receive a separate check for additional living expenses you might incur if your home in not uninhabitable until repairs are made.

When does lightning strike?

Be aware of the season — lightning usually strikes more frequently on late summer afternoons and evenings. Lightning strike: when a bolt of lightning enters and passes through your home or other property on its way from the atmosphere to the ground.

Types of lightning damage

There are a few different ways lightning can damage your home. Below are some common types of lightning damage and how home insurance can help with each.

How to make a claim for lightning damage

Below are the steps you should take when filing a claim for lightning damage.

How to protect your home from lightning damage

After lightning damage to your property, you can make a claim with your homeowner’s insurance, but there are certain things you can take to prevent or at least minimize the damage in the first place.

Lightning Safety Tips for You and Your Property

As a home or business owner, your loved ones aren’t the only valuables you want to keep safe from lightning storms. Here are five tips for how to protect your family and your property from lightning damage.

Can You File a Property Insurance Claim for a Lightning Strike?

Yes. In the last three years, Floridians filed more than 250,000 insurance claims for property losses due to lightning damage, resulting in more than $2.6 billion paid out on those claims.

How does car insurance cover lightning damage?

Comprehensive coverage protects against non-collision events that are outside of your control like theft, vandalism, and severe weather, including lightning strikes. If you don't carry comprehensive coverage, you won't be covered in the event of a lightning strike and will have to pay for any repair costs out of pocket.

What happens when lightning strikes a car?

The lightning may also destroy one or more tires as it exits the vehicle and enters the ground.

What happens if your car isn't repairable?

If your vehicle isn't repairable and declared a total loss (also known as totaled ), they'll give you an amount equal to the actual cash value of your vehicle.

What happens if you don't have comprehensive coverage?

If you don't carry comprehensive coverage, you will have to pay for any damage out of pocket.

Can a car be struck by lightning?

Yes, a car can be struck by lightning. Depending on the severity of the strike, the lightning can cause no damage, minor damage, or completely total the vehicle. The damage may not be visible, so it's important to get your car checked out by a mechanic if you think it's been struck by lightning.

Can you drive a car in a thunderstorm?

Cars with a metal frame are generally safe to be inside of during a thunderstorm. However, you should avoid leaning on the vehicle's doors so you don't accidentally get in the path of a lightning strike.

Can lightning damage a car?

In other cases, the damage will be more subtle, but still could be dangerous. The high electrical voltage of a lightning bolt can damage the car's electrical system, including safety equipment, sensors, and other important components. Cars struck by lightning may also have trouble starting. Outward signs of physical damage can accompany this kind of electrical damage, but sometimes the damage isn't visible.

What does a lightning insurance policy cover?

Your policy includes coverage for things like: Damage to personal property. If your personal property, like appliances or electronics, is damaged from lightning, you’ll typically be reimbursed for the actual cash value — which is what you’d pay for a similar item today taking depreciation into account.

What happens when lightning strikes your home?

If a lightning strike makes its way through your home or property while it passes from the atmosphere to the ground, this is considered a lightning strike — and is usually what causes the most damage . Among other things, strikes can cause fires or charring, so these types of claims are typically easy to collect since evidence of damage is clear.

How to prevent lightning strikes?

Make sure your smoke detectors are working. Place fire extinguishers around your home so in the event lightning strikes and starts a fire, you’re prepared. Get surge protectors for your most valuable appliances and electronics — or unplug them. Stay indoors if there is thunder and lightning.

What is a close call lightning strike?

Close call lightning strike. When lightning strikes near your home but doesn’t hit it directly, this is considered a close-call lightning strike, or near miss. In these cases, the damage is usually less, making it more difficult for your insurer to conclude the cause of damage.

How to write down a claim on an insurance claim?

As soon as it’s safe to do so, take a look at the damage. The insurance claims adjuster will need to know what damage you’re claiming occurred, so be thorough, take photos and write down everything that happened, including the date and time of the incident. 2.

How to file a claim with American Family Insurance?

At American Family Insurance, you can file your claim online, by contacting your agent, or by calling 1-800-MYAMFAM (1-800-6 92-6326) . You can also file through MyAccount or the MyAmFam app. Your company will send an adjuster to your property to assess the damage. 3. Consider your deductible.

When is lightning most common?

Keep in mind, lightning strikes are most common on late summer afternoons and evenings. Connect with an American Family agent to ensure your homeowners coverage is set up to protect your home from lightning damage.

How to file a claim for damage to your home?

Contact your insurance company to file a claim and secure coverage for the damage. You may need to pay a deductible before your insurer can pay the rest, which is the out of pocket money you’re responsible for before insurance kicks in.

What happens if lightning strikes your refrigerator?

If a lightning strike fries your appliances or belongings, like your refrigerator or TV, home insurance can help pay to repair or replace them

What does a claims adjuster do?

The claims adjuster inspects the damage to your home, either in person or remotely, and evaluates whether or not your policy will cover the cost of repairs.

What would happen if a power strike caused a power surge?

If the strike also caused a power surge, dwelling coverage would cover damage to any built-in appliances, like your dishwasher or oven. And then your loss-of-use coverage would pay for you to stay in a hotel if your home was unlivable while your roof was being repaired.

What is loss of use insurance?

Loss of use coverage reimburses you for any additional living expenses if you need to relocate temporarily while repairs are being made to your home. That includes any extra living expenses you might incur while your home is unlivable, including meals at a restaurant if you have to eat out more, or reimbursement for laundry services if you can’t use your own washing machine.

Does insurance cover lightning damage?

Most homeowners probably won’t have to file a claim for lightning damage. But if you ever have to, you should know that lightning is generally covered by most standard homeowners insurance policies. Your dwelling coverage can cover damage to the structure of your home and your loss-of-use coverage can pay for you to stay elsewhere ...

Can lightning strike your home?

Close call or near-miss strikes don’t directly hit your home or other structures on your property. Near miss lightning strikes usually cause minimal damage. It can be hard to prove near miss strikes to your insurance company, since it’s difficult to find the exact cause of damage if it didn’t strike your home directly.

What is it called when lightning strikes your home?

With direct strikes, the damage is clear and evident. When lightning strikes in an area near the home, it is called a near miss, and while it can cause electrical damage, it is more difficult to trace. The same is true for ground surges.

How many lightning bolts are there in a second?

Lightning may be spectacular to watch from a distance, but when your home is struck by lightning it’s anything but pretty. According to National Geographic, about 100 lightning bolts strike Earth’s surface every single second, and each bolt can contain up to one billion volts of electricity.

How to protect yourself from Mother Nature's light?

Safeguard yourself against Mother Nature’s light shows in three straightforward steps. Secure a homeowners policy through a qualified agent (link to agent locator), know the lightning protection in the policy you select and understand your provider’s claims process. Then allow your focus to be on the things in life that really matter knowing your home and belongings are protected.

Does insurance cover power surges?

It’s important to know that some insurers do not cover electrical components, electronic circuitry and transistors in the event of an artificial surge. These items are largely responsible for making large appliances like refrigerators and stoves work, so they would not be covered. It is best to reach out to your agent and get a complete understanding of your policy’s coverages.

Can lightning damage electronics?

In the case of a near-miss lightning strike, lightning damage can be difficult to pin point and showcase as the cause of damage to electronics or wiring. This most often occurs when lightning strikes near a property and is not a direct hit. In these situations, a lightning affidavit may be necessary to process your insurance claim. The lightning loss affidavit is completed by a service provider (usually a licensed electrician) who inspects the damage and confirms under oath that lightning was the source of the damage.

A Standard Home Insurance Policy Provides Coverage for:-

Classification of Lightning

- According to the insurance rules, there are basically 3 categories into which lighting is bifurcated. They are:- 1) Lightning Strikes:This type of lightning causes the maximum and visibly evident damages. Its effects are high and generate heavy losses and damages. This one is easiest to claim as it exhibits noticeable destruction. 2) Close Call/ Ne...

How to File An Insurance Claim – The Process

- The first step in the process is to assess the damage. Thus, once it is safe to go around the damaged area, make a visit, click pictures, and jot down all the crucial points regarding the event. Th...