HOW TO REFINANCE A VA LOAN TO A CONVENTIONAL LOAN

- Make sure you have some equity. Lenders may not require you to have 20% equity in your home, but it can help. ...

- Check your credit score. Your credit score is a substantial factor when getting a new loan. ...

- Lower your DTI ratio. You’ll need a low-to-average debt-to-income ratio. ...

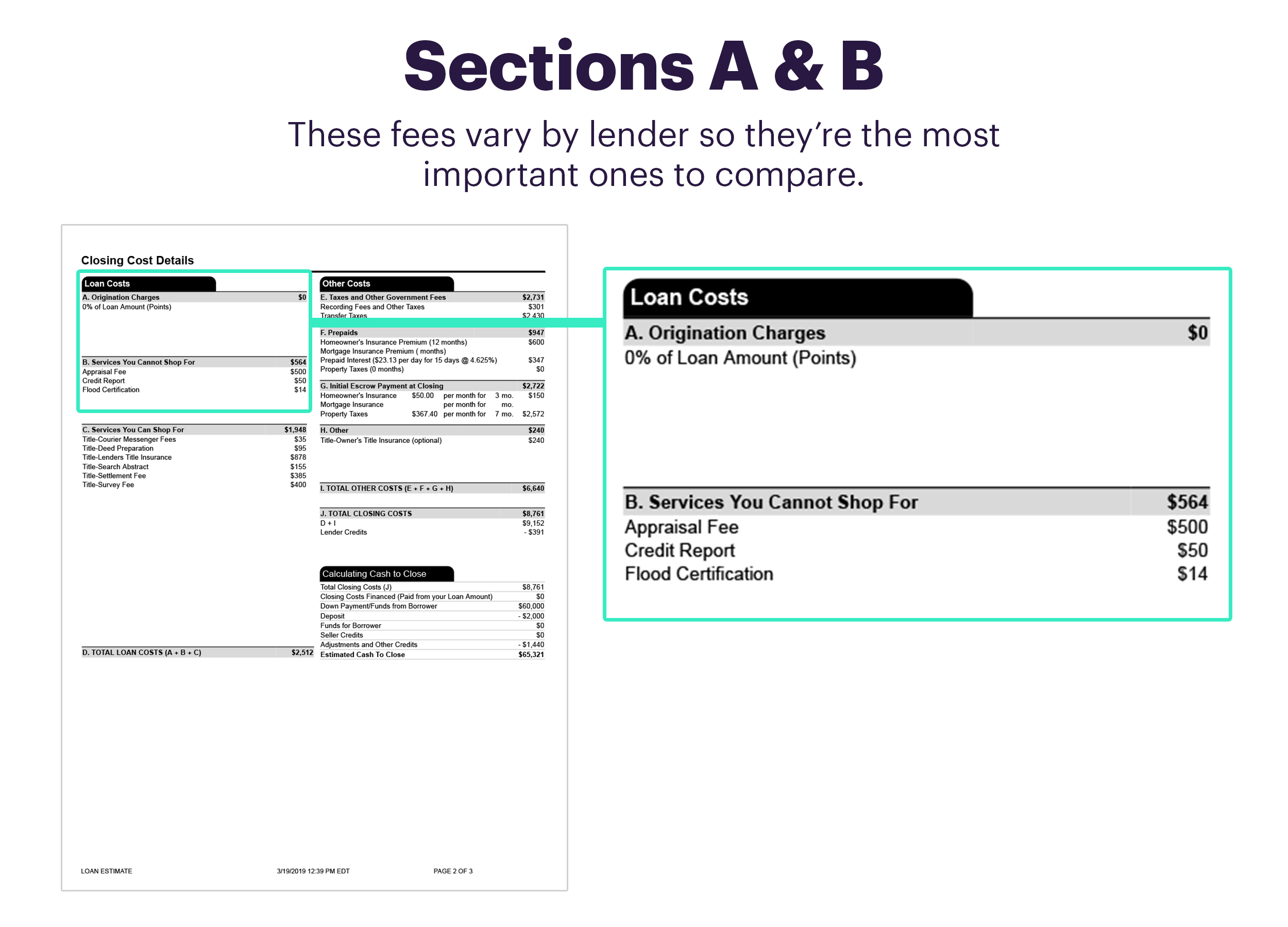

- Shop around. ...

- Process and close the loan

How to refinance a conventional mortgage into a VA loan?

Specifically, we’ll discuss the following:

- VA Loan Overview

- Conventional Loan Overview

- Reasons to Refinance from VA Loan to Conventional

- How to Refinance Your VA Loan to Conventional

- Final Thoughts

Can you refinance a VA loan to a conventional loan?

Yes, refinancing a VA loan to a conventional loan is possible. When asking yourself can I combine a VA loan with a conventional loan, remember… It only makes sense in certain situations. Before we get into that, let’s look at how to qualify. Conventional loans have stricter guidelines.

Can I combine VA home loans and conventional financing?

If you have a VA loan on your current home, you can refinance it into a conventional loan-- but it might only make sense in a few, very particular situations.Since conventional loans typically have higher interest rates and charge monthly private mortgage insurance (PMI) premiums, you probably wouldn’t want to refinance your VA loan just to save money on your mortgage payments.

How do I refinance a conventional loan?

With a conventional refinance, homeowners can:

- Refinance a primary residence, second home, or investment property

- Turn the home’s equity into cash at closing

- Eliminate private mortgage insurance (PMI)

- Cancel FHA mortgage insurance

- Shorten the home loan term

Can you convert a VA loan to a FHA loan?

The short answer is yes. At this stage, the question on some VA borrowers' minds is rightly whether FHA loan occupancy requirements might be a problem for the refinance loan because military duty might take the borrower away from the local area.

Can you switch from conventional loan to VA loan?

The VA provides a single option for refinancing from a conventional to VA loan and it's simpler to use than you may think. It comes as a surprise to some, but one of the myriad benefits of VA loans is that qualified veterans with non-VA home mortgages can refinance into a VA loan and reap the program's benefits.

Should I switch from VA to conventional?

If you are eligible, a VA loan is often better than a conventional loan. The main benefits of VA over conventional? You can buy a home with no down payment, a higher debt-to-income ratio, and no private mortgage insurance. You're also likely to have a lower mortgage rate and cheaper monthly payments.

How many times can you refinance a VA loan to a conventional loan?

If you're a VA eligible borrower, you only typically have one credit you can use to get a VA home loan. While you can use this credit over and over again, you can't use it more than once at the same time.

How can I get out of my VA home loan?

You can take your existing VA loan and turn it into a conventional loan so that you can use the property for rental. Then you can turn around and use your VA eligibility to purchase a new primary home. There are a few things that you need to keep in mind before you do this.

Can you convert a VA appraisal to conventional?

Yes, and technically it is not a “transfer” and does not need to follow the steps in these procedures. So long as a VA appraisal exists (completed by a VA appraiser) it can be transferred to another lender through the VA Portal.

Why do sellers prefer conventional over VA?

Some agents advise home sellers to take conventional loan or cash offers, even if they are lower than VA offers, because those options are perceived as less hassle than VA loans.

Are VA loans more expensive than conventional?

Mortgage rates For 30-year fixed-rate loans closing in November 2020, VA loans had an average rate of 2.72%, compared with 2.99% on a conventional mortgage for the same term, according to mortgage data provider Ellie Mae.

What are the disadvantages of a VA loan?

What are the Disadvantages of a VA Loan?You May Have Less Equity in Your Home. ... VA Loans Cannot be Used for Vacation or Rental Properties. ... Seller Resistance to VA Financing. ... The Funding Fee is Higher for Subsequent Use. ... Not All Lenders Offer – or Understand – VA Loans.

Can I refinance my VA loan and get cash back?

Did you know that you can refinance a VA loan just like any other mortgage? You can refinance a VA loan to lower your interest rate, change the length of your loan repayment schedule, or to get cash back.

How long do you have to live in a house with a VA loan?

12 monthsThere is no set required time for occupancy, but the paperwork will state that the borrower must live in the residence for at least 12 months. Special circumstances can be arranged with the VA lender.

Can I rent my house with a VA loan?

You just have to prove that you used it as a primary residence for a set period of time. Most VA home loan agreements stipulate that you occupy the house for at least 12 months. At the end of that 12 months, you'll likely be able to rent the house to a tenant, even if they're not affiliated with the military.

How to contact NASB for VA refinance?

If you’re ready to refinance your VA mortgage loan, NASB can help you secure the right loan for you. Click here or give us a call at 855-465-0753. See how easy it is to start your VA Refinance to a conventional loan today! Click here!

What credit score do I need to refinance a VA loan?

For instance, you will need at least a credit score of 640 to qualify for a conventional conforming refinance program.

Why refinance to conforming loan?

Other Reasons to Consider Refinancing to a Conventional Conforming Loan. If you have owned your home for a long time and built up equity, you might be able to get a better interest rate now than what the VA offered back when you took out the loan. If you have multiple mortgages, there’s also the possibility that you may not qualify for ...

How much equity do you need to put down for a conforming loan?

Conventional Conforming loans usually require that you put down 20% of the home's purchase price (have at least 20% equity in your home) to forgo paying PMI. If your home's value has significantly increased over the time you’ve lived there, it is possible that the home now has at least 20% equity.

Can I refinance a VA loan to a conventional loan?

A common reason for refinancing a VA loan to a conventional loan is to purchase a rental property. VA loans don’t allow you to use your eligibility to buy a second property for just any purpose. You can take your existing VA loan and turn it into a conventional loan so that you can use the property for rental.

Can I refinance a VA loan with multiple mortgages?

If you have multiple mortgages, there’s also the possibility that you may not qualify for the VA’s IRRRL program, so a conventional loan refinance may be a better choice. Whatever the reason, make sure you are following the regulations and guidelines that are in place on these loans.

How to get a VA loan certificate?

Download Form 26-1880, Request for a Certificate of Eligibility, from the Veterans Benefits Administration website. Complete the form by providing your name and address, details about your service in the military and information on any other VA loans. Eligibility for a VA loan depends on the length of time you served in the military and whether you are on active duty or honorably discharged.

What percentage of your income is required to qualify for a VA loan?

To qualify for a VA loan, your debt-to-income ratio cannot be more than 41 percent.

How long does it take to pay off a VA loan?

Sign the mortgage documents. After a three-day grace period , also known as the Right to Rescission, the lender will pay off your conventional loan and open your new VA loan. If you refinanced your mortgage with another lender, the title agent will handle the money transfer.

Can veterans get a VA loan?

Active military and eligible former members of the Armed Forces can take advantage of home loan opportunities available through the Department of Veteran Affairs. When approved for a VA loan, veterans can borrow money with no money down, a lower interest rate and flexible credit requirements, without having to pay for private mortgage insurance .

VA loan vs. conventional loan overview

When it comes to VA loans vs. conventional loans, it’s often an easy choice: VA, if you’re eligible.

VA loan vs. conventional loan: Which is better?

If you are eligible, a VA loan is often better than a conventional loan.

VA loan vs. conventional loan comparison chart

To more easily compare a VA loan to a conventional loan, take a look at this chart:

Differences between VA loans and conventional loans

There are several differences between VA loans and conventional loans.

Pros and cons of VA loans

VA loans have their good and bad points. On the plus side, there is no required down payment, no mortgage insurance required, and no maximum loan amount.

Pros and cons of conventional loans

When it comes to conventional loans, they typically close faster than VA loans.

When is a VA loan better?

If you qualify for a VA home loan, chances are that it’s going to offer a better financing deal for you than a conventional loan. That’s because you don’t have to put any money down, pay any PMI, or worry about exceeding a maximum loan amount.