Can you file electronically on your own?

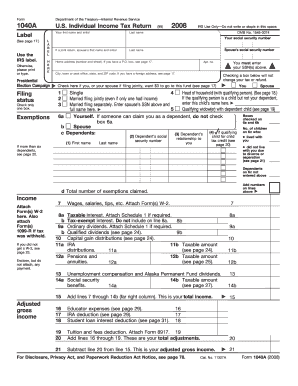

Mar 09, 2022 · Form 1040A may be best for you if: Your taxable income is less than $100,000. You have capital gain distributions. You claim certain tax credits; and. You claim adjustments to income for IRA contributions and student loan interest. Other Tips: Don’t forget to enter your Tax amount on line 28. Check the box, Full-year coverage, on line 38 if ...

When can I file taxes online?

TurboTax Online Free Edition lets you file your 1040EZ or 1040A for free! TurboTax Online Military Edition is free for pay grades E-1 through E-5. State return preparation fees are extra for all versions of TurboTax Online. However, the cost of e-filing the state return is built into the state preparation fee.

Can I efile directly with IRS?

Nov 03, 2021 · If you are eligible for Form 1040EZ filing, you can easily complete and file the form for free using TurboTax Online, H&R Block Online, or the IRS website. Who Can File a 1040EZ A taxpayer must meet all of the following to qualify to file Form 1040EZ: The taxpayer’s filing status must be single or married, filing jointly.

How can I file my taxes online?

How to file 1040EZ online form? Using 1040ez-form-gov.com, you can apply all our form-filling instruments to file the form as fast as possible. Our website lets you print the complete or a blank form, or send it via e-mail directly to the IRS. The printable 1040-EZ can be sent by mail to the nearest IRS office in your region.

How do I fill out a 1040EZ form 2020?

0:007:04How to fill out IRS Form 1040 for 2020 - YouTubeYouTubeStart of suggested clipEnd of suggested clipHis name and his address and his social security number is right here he is a single person. So hisMoreHis name and his address and his social security number is right here he is a single person. So his filing status is going to be single i'll check that box just like that.

How do I fill out a 1040EZ?

How to Fill Out a US 1040EZ Tax Return1 Determining if You Can Use the Form 1040EZ and Gathering Materials.2 Completing the Top Section.3 Completing the Income Section.4 Completing the Payments, Credits and Tax Section.5 Calculating Your Refund or the Amount You Owe.6 Finishing and Filing Your Return.

How much does it cost to file 1040EZ?

According to the National Society of Accountants' 2018–2019 Income and Fees Survey, the average tax preparation fee for a tax professional to prepare a Form 1040 and state return with no itemized deductions is $188. Itemizing deductions bumps the average fee by more than $100 to $294.Nov 9, 2020

Is TurboTax 1040EZ really free?

Is TurboTax Free Edition really free? Yes. You can pay nothing to file your simple federal and state taxes.

Is there a form 1040EZ for 2021?

Form 1040EZ has been discontinued by the IRS beginning with the 2018 income tax year. If you filed Form 1040EZ in prior years, then you will use the redesigned IRS Form 1040 or Form 1040-SR for the 2021 tax year.Dec 29, 2021

How do I fill out a 1040EZ 2021?

0:302:17Learn How to Fill the Form 1040EZ Income Tax Return for ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipIn the income. Section of your form 1040ez lists all income from paychecks salary or any amountsMoreIn the income. Section of your form 1040ez lists all income from paychecks salary or any amounts listed on your w-2. Form. List any taxable interest you may have accrued if the amount is over $1,500.

What is the minimum income to file taxes in 2021?

$12,550The minimum income amount depends on your filing status and age. In 2021, for example, the minimum for single filing status if under age 65 is $12,550. If your income is below that threshold, you generally do not need to file a federal tax return.

Is TurboTax good for filing taxes?

Tax-filing options with TurboTax TurboTax is the most expensive option for filing taxes online, but offers a high-quality user interface and access to experts. It's especially valuable for self-employed filers who use QuickBooks integration.Mar 23, 2022

Can I do my taxes myself?

Let IRS Free File do the hard work for you. IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It's safe, easy and no cost to you for a federal return.

Did 2021 have stimulus checks?

The government has deployed most of the third round of stimulus checks in amounts of up to $1,400 per person. The 2021 tax season offers an opportunity to claim those payments if you never received a check for which you were eligible or if your circumstances have changed and you now qualify for the money.Mar 30, 2022

Is TurboTax still free 2021?

Who qualifies for Free File? If your adjusted gross income was $73,000 or less in 2021, you can use free tax software to prepare and electronically file your tax return, according to IRS instructions online for the 2021 tax season. If you earned more, you can use Free File forms.Jan 6, 2022

When was the third stimulus check sent out?

The third stimulus check was sent out to eligible American families starting back in March 2021 as part of the American Rescue Plan Act.Jan 28, 2022

What Is The IRS 1040Ez Tax Form

The IRS offers three different forms to file your Individual Income Tax Return. The Form 1040, Form 1040A and Form 1040EZ are generally the forms U...

How to Get A 1040Ez Form Online

The Form 1040EZ can be prepared and filed using a few different methods:You can also use the printable version of the Form 1040EZ. You will fill ou...

H&R Block Free Online Tax Filing

H&R Block offers a free online software to assist in preparing and e-filing your Form 1040EZ. For Form 1040EZ tax returns, H&R Block provides a gre...

Is the 1040A still available?

For tax years beginning with 2018, the 1040A and EZ forms are no longer available. They have been replaced with new 1040 and 1040-SR forms. For those who are filing prior year returns, you can continue to use form 1040A or EZ for tax years through 2017. YouTube.

Can I file my taxes on a 1040EZ for free?

Hello, I’m Scott from TurboTax with some important information on how you can file your taxes on a 1040EZ form for free. Most taxpayers prefer to file their tax return on the shortest and least time-consuming tax form possible. This is why the IRS allows some taxpayers to use the 1040EZ form instead of the longer 1040. And maybe even better is the money you can save if you are eligible for free e-filing.

Can you claim dependents on 1040EZ?

Also be aware that when using the 1040EZ, you cannot claim dependents, itemize deductions or take any adjustments to income. In addition, there are limitations on the types of tax credits you can take.

How to file 1040EZ?

A taxpayer must meet all of the following to qualify to file Form 1040EZ: 1 The taxpayers filing status must be single or married filing jointly. 2 The taxpayer cannot claim any dependents. 3 The taxpayer cannot claim any adjustments to income (see IRS.gov/taxtopics) 4 The taxpayer can only claim the earned income tax credit (EIC). No other credits can be claimed with the Form 1040EZ. 5 The taxpayer must be under age 65 and not blind at the end of the tax year. 6 The taxpayer’s taxable income (line 6 of Form 1040EZ) must be less than $100,000. 7 The taxpayer’s income consisted of only wages, salaries, tips, taxable scholarship or fellowship grants, unemployment compensation, or Alaska Permanent Fund dividends.

What is a 1040EZ?

The Form 1040, Form 1040A, and Form 1040EZ are generally the forms US taxpayers use to file their income tax return. Form A is a hybrid of the Form 1040 and Form 1040EZ. The Form 1040EZ is a very simplified version of the tax return, and the Form 1040A allows for additional adjustments to income and credits available.

How old do you have to be to file Alaska taxes?

The taxpayer must be under age 65 and not blind at the end of the tax year. The taxpayer’s taxable income (line 6 of Form 1040EZ) must be less than $100,000. The taxpayer’s income consisted of only wages, salaries, tips, taxable scholarship or fellowship grants, unemployment compensation, or Alaska Permanent Fund dividends.

How many pages are there in a 1040?

It’s a one-page form with a few sections. The regular Form 1040 is two-pages and but can get much longer and more complicated depending on the transactions you had during the tax year. The Form 1040 usually has additional schedules and forms.

Can you claim a 1040EZ tax credit?

Since the Form 1040EZ doesn’t allow for tax credits, the only credit that you are able to claim is the Earned Income Credit (EIC) Note: The EIC is a refundable credit, which means that if your tax liability is at $0, any additional EIC you can use will result in a refund. See the EIC table here.

Does H&R Block have free software?

H&R Block offers free online software to assist in preparing and e-filing your Form 1040EZ. For Form 1040EZ tax returns, H&R Block provides an exellent service with free features such as W-2 photo capture, and free guidance during the preparation process. This can speed the process of preparing and filing your return. The H&R Block free filing software can be found here.

Can you be married on 1040EZ?

To claim a “married filing jointly” status on Tax Form 1040EZ, the taxpayers: or be considered legally married as of the last day of the tax year , and the taxpayer’s spouse died before the return was filed.

What is a 1040EZ?

The 1040-EZ Form (also called Income tax return for single and joint filers with no dependents) is designed by the IRS to be used as an attachment to the core 1040 Form. It’s one of the simplest ways to report your income if it’s lower than $100,000, you’re filing jointly or separately, and you don’t claim to have any dependents.

What is a 1040 form?

The 1040 form is a core document designed by the Internal Revenue Service to gather information about the taxable income of employees and other entities during the last tax year. It allows the IRS to count the right amount of tax that should be withheld from the taxpayer and to reveal the debt or the need for tax refunds.

When was the last revision of the 1040EZ form made?

Unfortunately, the last revision of the IRS gov 1040EZ form was made in 2017. The IRS informs that for years starting from 2018, the forms 1040A and EZ are no longer used. Instead, you should use the forms 1040 and 1040-SR. If you need to file returns for years prior to 2017, you can keep using both 1040A and EZ forms.

Free File is Now Closed

Check back January 2022 to prepare and file your Federal taxes for free.

What Is IRS Free File?

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

Who must mail 1040-X?

Currently, taxpayers must mail a completed Form 1040-X to the IRS for processing.

How many 1040-X are filed each year?

About 3 million Forms 1040-X are filed by taxpayers each year. Taxpayers still have the option to submit a paper version of the Form 1040-X and should follow the instructions for preparing and submitting the paper form.

Use a Free Tax Return Preparation Site

The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs offer free tax help and e-file for taxpayers who qualify.

Find an Authorized e-file Provider

Tax pros accepted by our electronic filing program are authorized IRS e-file providers.