How do I do a wire transfer with Chase?

- After signing in, tap the menu in the top left corner.

- Tap “Wire Transfer” and then “Schedule transfer”

- Choose or add your recipient and tell us the account you would like to wire funds from.

- Enter the wire amount and date, then tap “Next”

- To complete, tap “Schedule Wire” and then “Close”

Full Answer

Can you do a wire transfer online with Chase?

When wiring money online with Chase you must first log into your online account. If you are not a Chase customer, you can enroll in wire transfers using the link available on their banking website. If you’re transferring money from a Chase account to an external account, you’ll choose a “Deliver by” date.

Does chase charge for wire transfer?

There are no wire transfer fees at Chase if you’re sending or receiving money either domestically or internationally between accounts at Chase. And, it’s also important to note that the above-mentioned values are for online transfers. If you visit a Chase branch in-person, international transactions are $50 each.

Does Chase do international wire transfers?

You can save up to 90% in total transfer fees. Chase offers comprehensive international wire transfer services between your account and beneficiaires around the world. You can make transfers via your Chase online banking service, the Chase app, by calling their customer service center or by visiting a branch.

What is the chase incoming wire transfer fee?

Wire Transfer Fees for Chase Bank. International and Domestic Wire Transfer Fees for Chase Bank are as follows. International. Incoming. $15 for each transaction. Outgoing. $45 for each transaction (if made at branch) $40 for each transaction (if made through chase.com) Domestic.

Can you wire transfer from Chase online?

Move money quickly and easily through Chase Commercial Online's Wire Transfer service. 1 Select U.S. dollars or eligible local currency to wire funds to most domestic or international recipients.

Can you do a wire transfer from the Chase app?

Activate the Chase Mobile® App to send wire transfers and add recipients: Sign in to the Chase Mobile® app, tap "Pay & Transfer" Tap "Wires & global transfers" , "Get started" and "Next"

How much can you wire transfer Chase online?

The most you're allowed to send in a single transaction is $50,000. If you attempt to wire more than $50,000 from a Chase Bank personal account, you'll get this error message.

Can I do wire transfer online?

A wire transfer is a simple and reliable way to send money. It can easily be done online – through an online bank account or a money transfer service.

How long does a Chase wire transfer take?

How long does a wire transfer take? Domestic wire transfers are often processed within 24 hours while international wire transfers can take between 1-5 business days. Wire transfer times may also vary depending on designated cut-off times, federal regulations, as well as weekends and bank holidays.

Does Chase charge for wire transfers?

Chase, for instance, charges $35 for domestic wire transfers set up for you by a banker and $25 for the same transfer if you do it yourself online.

Can I wire more than 25000 Chase?

How much money can I transfer? Most Chase accounts have a $25,000 per day limit. Chase Private Client and Chase Sapphire Banking limits are $100,000 per day.

Does a wire transfer happen immediately?

Transfers typically happen quickly. Generally, domestic bank wires are completed in three days, at most. If transfers occur between accounts at the same financial institution, they can take less than 24 hours. Wire transfers via a non-bank money transfer service may happen within minutes.

Is Zelle a wire transfer?

Zelle is a peer-to-peer, or P2P, money transfer service that allows individuals to send and receive money from each other via connected bank accounts.

How do I send a wire transfer chase?

Send a Wire TransferAfter signing in, tap "Pay & Transfer"Tap "Wires & global transfers"Choose or add your recipient and tell us the account you would like to wire funds from.Enter the wire amount and date, then tap "Next"To complete, review details and tap "Schedule Wire" then "Close"

What is the difference between a wire and a transfer?

What Is the Difference Between ACH and Wire Transfers? An ACH transfer is completed through a clearing house and can be used to process direct payments or direct deposits. Wire transfers allow for the movement of money from one bank account to another, typically for a fee.

Is a bank transfer the same as a wire transfer?

While wire transfers are used to send money overseas, bank transfers are mostly for transactions within country. Remember, you need to weigh in all the factors to select the best time for sending money online.

How do I transfer money from Chase app?

Transfer moneySign in to the Chase Mobile® app and tap "Pay & Transfer"Tap "Transfer" and then choose "Account or Brokerage Transfer"Enter the amount.Choose the accounts you want to transfer from and to.Enter the transfer date and add an optional memo.Tap "Transfer" and confirm.

Is Zelle a wire transfer?

Zelle is a peer-to-peer, or P2P, money transfer service that allows individuals to send and receive money from each other via connected bank accounts.

Is Chase wire transfer free Chase?

How much are Chase wire transfer fees? The Chase wire transfer fee you'll pay depends on how you're sending the transfer, and whether you're sending or receiving an international or domestic wire transfer. All transfers between Chase accounts are fee-free.

Can I wire more than 25000 Chase?

How much money can I transfer? Most Chase accounts have a $25,000 per day limit. Chase Private Client and Chase Sapphire Banking limits are $100,000 per day.

System requirements

To enjoy the best experience on Chase.com, be sure your web browser and operating system meet the recommendations in the table below. You can upgrade to the latest browser version by using these links:

Personalize your experience

Would you like a different type size, background or text color? Learn easy ways to change text size or colors in your browser.

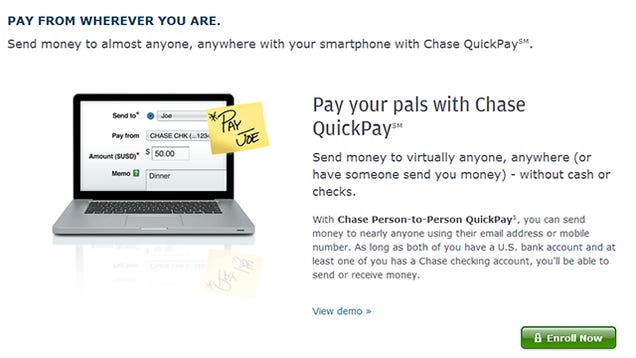

How to wire money to Chase Bank?

How to wire money with Chase Bank. When wiring money online with Chase you must first log into your online account. If you are not a Chase customer, you can enroll in wire transfers using the link available on their banking website.

How long does it take to receive a wire transfer?

3-5 business days. For domestic wire transfers it usually takes 1-2 business days for the funds to be received. For international wire transfers it can take anywhere from 3-5 business days. Be sure to take these timelines into account when wiring money online.

How to wire money online?

You then proceed with securely wiring money online. 1. Add a wire recipient. The first step involves entering the name and information of the wire recipient. Click on Add a wire recipient to get started.

Why wire money internationally?

Whether you are an American expat or simply need to send money abroad, wiring money internationally is a fast way to move funds in order to pay bills or send money to friends and family.

Does Chase Bank offer free international transfers?

Chase Bank offers "fee-free" international transfers over $5,000, but keep in mind that in these cases their exchange rate could be much worst than the mid-market rate. Then, it's possible that some customers might have special rates and fees.