If you apply for any new credit cards or loans after a default, your application will likely be denied because creditors think you are at risk of defaulting on any new credit obligations. In fact, some lenders will not approve you at all until you have cleared up the default balance (or it drops off your credit report ).

What does it mean to default on a credit card?

What is a credit card default? A credit card default is the failure to make at least the minimum payment on your statement balance over an extended period of time. Typically, when you’re fewer than 30 days late on a credit card payment, your card issuer will label your account delinquent — not a default.

How do I get Out of a defaulted credit card?

Options for Dealing With Credit Card Default Pay the account in full, if you have the money, of course. First, try negotiating a pay for delete where the credit card issuer removes the account from your credit report in exchange for payment. Settle the account for less than the amount due. Settling the debt is also a negotiation. File bankruptcy.

What happens if you don’t deal with a default?

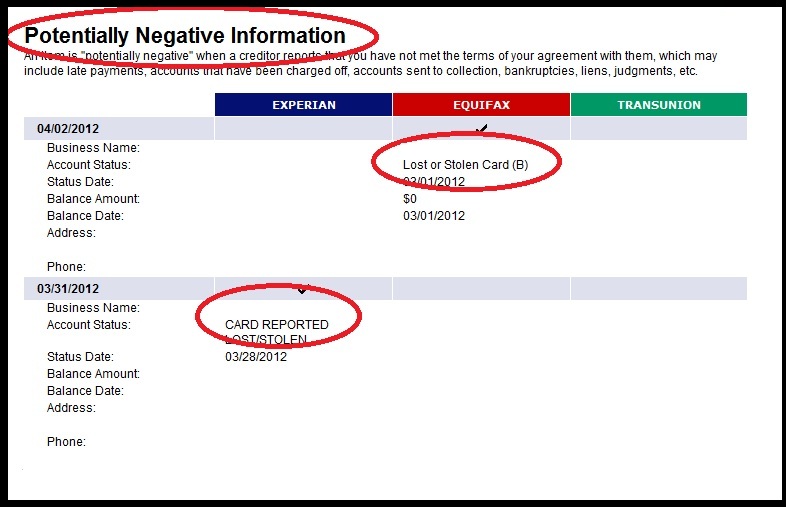

And if you don’t deal with it one way or another, you could get sued (see below). Also, the default will be reported to the three major credit bureaus. Your credit score will take a nosedive, and the blemish will stay on your credit report for up to seven years.

What happens to your credit score when you default?

In the months leading up to a default, your (late) payment status will be reported to the three major credit bureaus, and your credit score will be impacted by the lateness of your payments.

How bad does a default affect your credit?

When a default first shows up on your credit file, you'll likely see a big drop in your scores. That's because the more recent negative information is, the bigger the impact to your scores. The events leading up to the default, including missed payments, will also contribute to credit score harm.

How long after a default can I get credit?

six yearsA default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once your default is removed, the lender won't be able to re-register it, even if you still owe them money.

What happens when a credit card goes into default?

After a credit card company determines that you've defaulted on your credit card, they may close your account and transfer your debt to a collection agency. When they do this, your balance is no longer associated with the credit card company, and you must deal directly with the collection agency.

What does it mean when a credit card says default?

How credit card default happens. Before your account goes into default, it will become delinquent. This happens after missing a payment for 30 days. Default usually happens after six months in a row of not making at least the minimum payment due, which means your credit card is seriously delinquent.

Is it worth paying off a default?

Your credit score will improve gradually as your defaults get older. This doesn't speed up when you repay a defaulted debt, but some lenders are only likely to lend to you once defaults have been paid. And starting to repay debts makes a CCJ much less likely, which would make your credit record worse.

Can a default be removed if paid?

Can a default be removed if paid? No. Unless you take action within the first 14 day notice period, even if you pay off the debt, the default will remain on your credit file for 6 years.

How do I rebuild my credit after default?

Then consider these six basic strategies for rebuilding credit:Pay on time. Pay bills and any existing lines of credit on time if you possibly can. ... Try to keep most of your credit limit available. ... Get a secured credit card. ... Get a credit-builder loan or secured loan. ... Become an authorized user. ... Get a co-signer.

How long does a default last?

Defaulted accounts and your credit file A default will appear on your credit file for six years, even if you pay off the debt in full. This means it'll be harder to get credit cards, loans or bank accounts because the default tells the creditor there's a greater risk of you not paying.

What happens if I don't pay my credit card for 5 years?

You could end up with a debt collection lawsuit and a judgment if you don't pay your credit card bill over time.

Does your credit score go up when a default is removed?

Does your score go up when a default is removed? Defaults are a serious form of negative marker, and if you only have one on your Credit Report, you are likely to see an improvement in your Credit Score once it has been removed, provided there are not more serious negative markers such as a CCJ present.

How can I get out of paying my credit card debt?

Whether you work with a credit counselor or on your own, you have several options for eliminating debt, known as debt relief:Apply for a debt consolidation loan. ... Use a balance transfer credit card. ... Opt for the snowball or avalanche methods. ... Participate in a debt management plan.

What happens if you fail to pay back credit card debt?

If this happens: Your lender will contact you to demand the missing payments are made. Then if you don't make the payments they ask for, the account will default. And if you still don't pay, further action may be taken, such as employing debt collection agents to recover the money you owe them.

How do I rebuild my credit after default?

Then consider these six basic strategies for rebuilding credit:Pay on time. Pay bills and any existing lines of credit on time if you possibly can. ... Try to keep most of your credit limit available. ... Get a secured credit card. ... Get a credit-builder loan or secured loan. ... Become an authorized user. ... Get a co-signer.

Can lenders see defaults after 6 years?

After six years, the defaulted debt will be removed from your credit file, even if you haven't finished paying it off. Some creditors will refuse your application when they see the default on your credit file.

How many points does a default affect your credit score?

350 pointsA missed payment on a bill or debt would lose you at least 80 points. A default is much worse, costing your score about 350 points.

Is it true that after 7 years your credit is clear?

Highlights: Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

What to do if you defaulted on a credit card?

Options if you’ve already defaulted. Once you’ve defaulted on a credit card bill, you can proceed in a few ways: Do nothing. You can choose to do nothing about your debt, but this is a terrible idea. Eventually, the debt collector could sue you for what you owe.

How to recover from a credit card default?

Remember that once you’ve defaulted on a credit card bill, the damage to your credit is already done. You’ll be stuck with the default on your credit report for seven years, but there are steps you can take in that time to start recovering. These include: 1 Paying your bills on time – this should be one of your top financial priorities 2 Paying your credit card bills in full every month 3 Keeping the balances on your credit cards low – make frequent payments to accomplish this 4 Applying for credit very sparingly 5 Checking your credit report at least once per year to track your progress

What happens if you fail to pay your credit card?

Here's the gist: After you’ve failed to make a payment on your credit card for 180 days, your issuer assumes you’re probably never going to. At this point, the issuer can (and usually does) close your account, write off what you owe as bad debt and sell your account to a collections agency.

How to get a debt collector off your back?

It will get the collector off your back, and you won’t have to worry about getting sued. If you choose to pay, be sure to get proof from the collector that you actually owe the debt. They are required to provide it. Then, pay in full. Making only a partial payment could cause your debt to be re-aged, which could reset the clock on the statute of limitations. Also, after the payment clears, get a written confirmation from the collector that you’re no longer carrying a balance with them.

What to do if you have multiple bills and can't repay them?

Declare bankruptcy. This is a drastic move, but it is a way to keep your debt collector at bay. If you’re totally in over your head on multiple bills and there’s no hope you’ll be able to repay it, contact an attorney and start moving forward with bankruptcy.

What happens if you only pay partial debt?

Making only a partial payment could cause your debt to be re-aged, which could reset the clock on the statute of limitations. Also, after the payment clears, get a written confirmation from the collector that you’re no longer carrying a balance with them. Settle the debt.

Why should every purchase be on a credit card?

by Virginia C. McGuire, Paul Soucy. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. And no, you don't have to go into debt, and you don't have to pay interest. Explore Credit Cards.