How many homesteads can you have in Minnesota?

What happens if you fail to notify the assessor of your homestead?

Where to submit a relative homestead application?

Can relatives qualify for homestead?

Do you have to reapply for homestead?

See 2 more

About this website

Is homesteading legal in Minnesota?

If you own real estate property and you or a qualifying relative occupies the property by December 31, you may apply for homestead status by December 31. You can only homestead one residential parcel in the State of MN.

Can you homestead land in Minnesota?

To qualify for a homestead, you must: Own a property. Occupy the property as your sole or primary residence. Be a Minnesota resident.

How much does homestead exemption save you in Minnesota?

What are the Benefits of Homestead Classification? A homestead classification qualifies your property for a classification rate of 1.00% on up to $500,000 in taxable market value. Homesteads are also eligible for a market value exclusion, which may reduce the property's taxable market value.

What is the homestead Act in Minnesota?

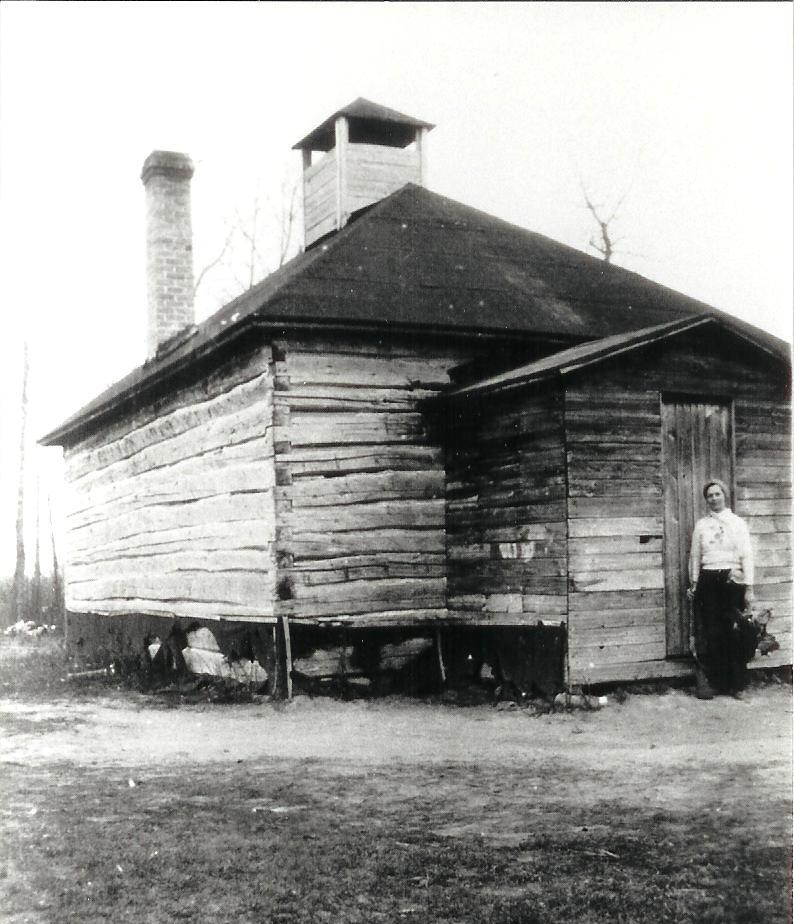

The Homestead Act of 1862 allowed settlers to claim land for free as long as they lived on it for five years and made improvements such as building a house. The act brought 75,000 people to Minnesota in its first three years, quickly settling the prairie and displacing the Dakota living there.

What is a homestead exclusion in MN?

The Market Value Exclusion reduces the taxable market value for property classified as homestead if it is valued below $413,800. By decreasing the taxable market value, net property taxes are also decreased. How the Exclusion Works [+] The exclusion reduces the taxable market value of qualifying homestead properties.

How many acres do you need to start a homestead?

Even small acreages of 2 – 4 acres can sustain a small family if managed well. Larger homesteads in the range of 20 – 40 acres can provide a greater degree of self-sufficiency by setting aside much of the land as a woodlot, and providing room for orchards, ponds, poultry and livestock.

How can I lower my property taxes in MN?

Homesteads. Homestead is a program to reduce property taxes for owners who also occupy their home and are a Minnesota resident. You can qualify for this tax reduction if you own and occupy your house as your main place of residence or are a relative of an owner living in the owner's house.

What is the income limit for Mn property tax refund?

For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

Who qualifies for a property tax refund in Minnesota?

To qualify, all of these must be true: You spent at least 183 days in Minnesota during the year. You cannot be claimed as a dependent on someone else's tax return. Your property was assessed property taxes or the owner made payments in lieu of property taxes.

What is the benefit of homestead exemption in Minnesota?

The homestead classification applies to properties that are physically occupied by the owner(s) as the principal place of residence. Classification as a homestead may qualify a property for a reduced classification rate, a reduced taxable market value, a property tax refund, and/or other special programs.

What does it mean when a property is in homestead?

A homestead can be defined as the house and adjoining land where the owner primarily resides. Legally, what constitutes as a homestead varies state by state. Properties that qualify as homesteads may also benefit from homestead exemptions, which can offer homeowners certain financial and legal protections.

What is the difference between homestead and non homestead taxes in Minnesota?

You'll remember from before that homesteads get a portion of their value excluded from property taxes altogether. They also get more favorable rates than non-homesteaded properties. The first $500,000 in taxable market value of a homesteaded property has a rate of 1.00% and the remainder has a rate of 1.25%.

What is the maximum number of acres that can be classified as homestead property in Minnesota?

No more than three acres of land may, for assessment purposes, be included with each dwelling unit that qualifies for homestead treatment under this subdivision.

What is the benefit of homestead exemption in Minnesota?

The homestead classification applies to properties that are physically occupied by the owner(s) as the principal place of residence. Classification as a homestead may qualify a property for a reduced classification rate, a reduced taxable market value, a property tax refund, and/or other special programs.

What is the difference between homestead and non homestead taxes in Minnesota?

You'll remember from before that homesteads get a portion of their value excluded from property taxes altogether. They also get more favorable rates than non-homesteaded properties. The first $500,000 in taxable market value of a homesteaded property has a rate of 1.00% and the remainder has a rate of 1.25%.

What is a homestead property?

A homestead can be defined as the house and adjoining land where the owner primarily resides. Legally, what constitutes as a homestead varies state by state. Properties that qualify as homesteads may also benefit from homestead exemptions, which can offer homeowners certain financial and legal protections.

Applying for the Homestead Classification: Minnesota Property Tax

Attorney Aaron Hall represents business owners and their companies. Businesses hire Aaron to advise and represent them in employment, intellectual property, litigation, and general business law.

Agricultural Homesteads First-Tier Valuation Limit | Minnesota ...

Minnesota Department of Revenue annually adjusts the first-tier valuation limit for agricultural homestead property, as required by law. Agricultural homestead property includes the "house, garage and first acre" (HGA) and the balance of homestead property, which is divided into two tiers for determining net tax capacity.

Classification of Property: Minnesota Property Tax

Tax Capacity. The Uniformity Clause of the Minnesota Constitution allows for different classes of property to be taxed at different rates. As the first step in calculating property taxes, the class rate is used to determine a property’s tax capacity.

Special Agricultural Homestead | Minnesota Department of Revenue

Farm property owned by an individual may qualify for a special agricultural homestead if: The owner and active farmer of the land are Minnesota residents and live within four townships or cities of the agricultural property.; The owner and their spouse (if married) do not claim another Minnesota agricultural homestead.; The active farmer is one of the following:

Maintaining farmland homestead classification | UMN Extension

1 Regular Agricultural Homestead is a single, one-time application requirement until law changes. See MS.273.124, subd. 1(a). 2 Active Farming Homestead, also referred to as Special Agricultural Homestead, is an annual application requirement. See MS.273.124, subd. 14(b), clause (i). The Minnesota Department of Revenue defines a person actively engaged in farming as “participat[ing] in the ...

The Agricultural Homestead Exemption - Minnesota

In Minnesota, agricultural homestead property is taxed at a lower rate than agricultural non-homestead property. In 2008, the defendant changed the property tax classification of farmland owned by a family farm corporation from agricultural-homestead to agricultural non-homestead property. Here, the farm corporation owned three parcels of land totaling 300 acres.

How much can you claim as a homestead in Minnesota?

Minnesota statute allows homeowners to claim up to $390,000 in property value, or $975,000 if agricultural, as a "homestead." State law limits this exemption to 160 acres, which in practice may apply to farms, but has removed what was once a half-acre limit on property within city limits. Minnesota does not allow married couples to double the homestead exemption amount as many other states do, but the exemption amount is already quite generous compared to other states.

Why are homestead laws important?

State homestead laws in the present day are much different and used by homeowners to protect a limited portion of their home's equity from confiscation by creditors. The main thrust of these laws is to prevent homelessness, while continuing to encourage home ownership. State laws typically designate a certain amount of acreage or a home's value that may be claimed as a homestead and therefore protected.

How to appeal homestead in Minnesota?

The county auditor shall send a notice to the person who owned the affected property at the time the homestead application related to the improper homestead was filed , demanding reimbursement of the homestead benefits plus a penalty equal to 100 percent of the homestead benefits. The person notified may appeal the county's determination by serving copies of a petition for review with county officials as provided in section 278.01 and filing proof of service as provided in section 278.01 with the Minnesota Tax Court within 60 days of the date of the notice from the county. Procedurally, the appeal is governed by the provisions in chapter 271 which apply to the appeal of a property tax assessment or levy, but without requiring any prepayment of the amount in controversy. If the amount of homestead benefits and penalty is not paid within 60 days, and if no appeal has been filed, the county auditor shall certify the amount of taxes and penalty to the county treasurer. The county treasurer will add interest to the unpaid homestead benefits and penalty amounts at the rate provided in section 279.03 for real property taxes becoming delinquent in the calendar year during which the amount remains unpaid. Interest may be assessed for the period beginning 60 days after demand for payment was made.

Who can claim homestead?

When one or more dwellings or one or more buildings which each contain several dwelling units is owned by a nonprofit corporation subject to the provisions of chapter 317A and qualifying under section 501 (c) (3) or 501 (c) (4) of the Internal Revenue Code, or a limited partnership which corporation or partnership operates the property in conjunction with a cooperative association, and has received public financing, homestead treatment may be claimed by the cooperative association on behalf of the members of the cooperative for each dwelling unit occupied by a member of the cooperative. The cooperative association must provide the assessor with the Social Security numbers of those members. To qualify for the treatment provided by this subdivision, the following conditions must be met:

How long does it take to notify the assessor of a property in Minnesota?

When dwelling units no longer qualify under this subdivision, the current owner must notify the assessor within 60 days. Failure to notify the assessor within 60 days shall result in the loss of benefits under this subdivision for taxes payable in the year that the failure is discovered. For these purposes, "benefits under this subdivision" means the difference in the net tax capacity of the units which no longer qualify as computed under this subdivision and as computed under the otherwise applicable law, times the local tax rate applicable to the building for that taxes payable year. Upon discovery of a failure to notify, the assessor shall inform the auditor of the difference in net tax capacity for the building or buildings in which units no longer qualify, and the auditor shall calculate the benefits under this subdivision. Such amount, plus a penalty equal to 100 percent of that amount, shall then be demanded of the building's owner. The property owner may appeal the county's determination by serving copies of a petition for review with county officials as provided in section 278.01 and filing a proof of service as provided in section 278.01 with the Minnesota Tax Court within 60 days of the date of the notice from the county. The appeal shall be governed by the Tax Court procedures provided in chapter 271, for cases relating to the tax laws as defined in section 271.01, subdivision 5; disregarding sections 273.125, subdivision 5, and 278.03, but including section 278.05, subdivision 2. If the amount of the benefits under this subdivision and penalty are not paid within 60 days, and if no appeal has been filed, the county auditor shall certify the amount of the benefit and penalty to the succeeding year's tax list to be collected as part of the property taxes on the affected buildings.

How far away from each other is a homestead?

To qualify under clause (3), the spouse's place of employment or self-employment must be at least 50 miles distant from the other spouse's place of employment, and the homesteads must be at least 50 miles distant from each other. (f) The assessor must not deny homestead treatment in whole or in part if:

What is homestead classification?

When a building containing several dwelling units is owned by an entity which is regulated under the provisions of chapter 80D and operating as a continuing care facility enters into residency agreements with persons who occupy a unit in the building and the residency agreement entitles the resident to occupancy in the building after personal assets are exhausted and regardless of ability to pay the monthly maintenance fee, homestead classification shall be given to each unit so occupied and the entire building shall be assessed in the manner provided in subdivision 3 for cooperatives and charitable corporations.

When can a homestead property be reclassified?

When there is a name change or a transfer of homestead property, the assessor may reclassify the property in the next assessment unless a homestead application is filed to verify that the property continues to qualify for homestead classification.

How many acres of land is considered homestead?

Homestead treatment must be afforded to units occupied by members of the cooperative association and the units must be assessed as provided in subdivision 3, provided that any unit not so occupied shall be classified and assessed pursuant to the appropriate class. No more than three acres of land may, for assessment purposes, be included with each dwelling unit that qualifies for homestead treatment under this subdivision.

What is the exclusion for a homestead?

The residential homestead market value exclusion applies to class 1a residential homesteads, class 1b blind/disabled homesteads, and class 2a agricultural homesteads (the portion including the house, garage, and immediately surrounding one acre of land). For a homestead residence valued at $76,000 or less, the exclusion is 40 percent of market value, yielding a maximum exclusion of $30,400 at $76,000 of market value. For a homestead valued between $76,000 and $413,800, the exclusion is $30,400 minus 9 percent of the value over $76,000. The exclusion is therefore phased out for properties valued at $413,800 or more.

What are the Benefits of Homestead Classification?

A homestead classification qualifies your property for a classification rate of 1.00% on up to $500,000 in taxable market value. Homesteads are also eligible for a market value exclusion, which may reduce the property’s taxable market value. Homestead properties also qualify for other programs such as the disabled veterans’ market value exclusion, senior citizens’ property tax deferral, and property tax refunds.

What Should I Do If I Move, Transfer My Property, or Change My Marital Status?

If your property is sold, if you change your primary residence, or if occupancy by a spouse changes, state law requires you to notify the assessor within 30 days. If you fail to notify the assessor within 30 days, the property may be assessed taxes due as if the property were non-homestead.

What If My Property is Held Under a Trust?

Property held under a trust may also qualify for homestead. Contact your County Assessor for more information.

What is a Minnesota fact sheet?

This fact sheet is intended to help you become more familiar with Minnesota tax laws and your rights and responsibilities under the laws. Nothing in this fact sheet supersedes, alters, or otherwise changes any provisions of the tax law, administrative rules, court decisions, or revenue notices. Alternative formats available upon request.

Can you homestead in Minnesota?

No; you may only have one homestead in the state of Minnesota. If you change your primary residence during the year, you may apply for homestead at the new residence. You must notify the County Assessor that your primary residence has changed, and you will need to complete and sign a new homestead application. As stated previously, you must own and occupy a property by December 1 and apply by December 15 to qualify for taxes payable in the following year.

Can you refuse to provide homestead information?

You may refuse to provide this information, however refusal will disqualify you from receiving homestead classification.

What is Minnesota homestead credit?

The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes.

Can you get a refund if you have an interest in your home?

If you retain an ownership interest in your home, you may qualify for the property tax refund regardless of who pays the property taxes.

What is homesteading in Tennessee?

The rural parts of Tennessee offer some of the most beautiful homesteading locations in the United States . In Tennessee you will have the pleasure of fully experiencing every season while obtaining a plentiful harvest for about nine months out of the year. Tennessee has a lot to offer in terms of low property costs and taxes, favorable state laws, and growing your own food. The state government allows people to collect rainwater and offers many other freedoms for what you can do on your property.

How to choose a homestead location?

Choosing the ideal homestead location depends on your needs, wants and likes. One out of the fifty U.S. states will surely have what you’re looking for. Narrow down your list starting with the states that meet your needs, and go from there. Once you have an idea of what state might be a good match for you, research all your questions and make sure you have a clear understanding before making a final decision. It might help to take a road trip and explore the state in person and get to know the locals in the rural towns.

What are the best homesteading conditions?

Many factors can influence your decision on where to settle in for your off-grid journey. Consider what your priorities are in becoming self-reliant. Are you looking to disappear off the map completely or do you still want to live somewhat near the rest of civilization? Do you want to buy a cheap property with lots of acreage? Or do you want to grow your food in the most favorable conditions? Answering these questions first will help you narrow down on a state that best meets your wants and needs.

Which state is homeschooling friendly?

Connecticut is also homeschooling-friendly, so if you’re looking for a place to raise and homeschool your children, this may be the state for you! 6. Michigan. Michigan is a diverse state which offers the experience of all four seasons although winters may feel longer than the other three seasons.

Which state has the best soil for homesteading?

1. Idaho. Idaho is the state with some of the best soil in the country, making it my top choice for homesteading. The state is beautifully green with hills and mountain sides. If you like living away from people but not too far that you’re completely isolated, this is the perfect location for you!

Is Michigan a homestead state?

There are many homesteaders in Michigan so you are sure to find many like-minded people. Most people that live in Michigan love it there, even though the higher cost of living and the strict state regulations are forcing some people to migrate to states like Missouri.

Is there one state that provides everything we could possibly want?

There is not one state that provides everything we could possibly want, otherwise all the homesteaders would probably move there! We will have to give up some desires in exchange for some benefits.

When did the Homestead Act start?

The Homestead Act first came into effect in 1862 when President Abraham Lincoln signed the bill to promote homesteading where a homesteader would be provided with a land to build a home, farm the land for a minimum of 5 years and make some improvements. This Act provided 160 acres of land to the people willing to homestead in exchange ...

What is the purpose of the Homestead Act of 2010?

Reaping benefits from the original Homestead Act of 1862, this city has incorporated the Homestead Act of 2010 to promote homesteading so that the neglected properties can be put to use and also generate utility fees and taxes. Free lots are provided on a first-come-first-serve basis where the applicant needs to stay for at least five years. The population is around 12500, and the city is very accessible.

How long does it take to build a home on a free lot?

Free lands are on offer for homesteading requiring you to apply the same. Once you are allotted a designated lot, you need to start building your home within 120 days and completing it within 12 months. You also need to live in the home for at least a year.

Is it free to own farmland?

Though the lands are not free nor will you become the owner, this is mentioned because it is extremely cheap. The Government has begun this initiative to offer cheap farmlands with a lease for 60 years. The farmlands are protected along with a house already built, and the average rent is between $500 and $1000 per month.

Is homesteading difficult?

So, you might think that homesteading can be difficult and incur huge costs in today’s times. To some extent this is true, but there are still free land available in the US in this 21st century providing the opportunity for homesteading though limited in number.

What is the income requirement for homesteading?

Under its homesteading land program, you need to have a gross income of below $84,200 if you are a family or two (or less ). For families of three or more, the gross income should be less than $96,830.

When was the Homestead Act passed?

Well, the answer to that question can be traced back to 1862. Are you familiar with the Homestead Act of 1862 ? If you recall your American history, the Homestead Act was a law that gives free land to anyone who’s willing to move west and till the land for five years. This law was in effect for over a hundred years.

How many acres of land were granted under the Homestead Act?

During its entire effectivity, there were more than 200 million acres of land granted to recipients under the Homestead Act. The last approved claimed was in 1988 for 80 acres of land situated in Southeastern Alaska.

How long does it take to build a house?

You need to start building your home within 180 days from getting the land and complete it within a year. There are also residential design standards and occupancy requirements to comply.

When was the last land claim approved?

The last claim was approved in 1988 . Today, you can still take advantage of free land. However, please note that the land is subject to different requirements before it can be given out for free. But that’s free land for you. So it pays to study and learn about the details.

Do rural towns give out free land?

There are many small towns in the rural countryside that still give out free or nearly free lands. However, if you’re interested, you may still need to conduct your own due diligence. A lot of lands in good locations have been scooped up.

Is land free in the US?

The land is given for free. However, you need to pay the corresponding property taxes.

Which states have homesteading?

States in particular who have a large number of homesteading opportunities are Kansas, Nebraska, Iowa, Michigan, and Minnesota. The great thing about many of these properties is that they come completely free and some even come with extended tax benefits. There are literally acres of land begging to be homesteaded.

How to find homesteading opportunities?

The best way to find these particular homesteading opportunities is to contact local governments. Many have offerings listed on the web, but there are many more that may be available if you make the effort to search them out.

How does the Alaska DNR sell land?

There are three ways the Alaska DNR sells their land: first, by a sealed-bid auction, where potential buyers submit a sealed-bid with their highest price and the highest bid wins the right to buy the piece of property; secondly, by a over-the-counter (OTC) sales system, where land is sectioned off and then sold for directly at or under the appraised value; and finally through a site staking system, where you actually get to go and stake a claim for a property, which is then assessed and sold to you for the appraised market value.

How many acres of land did the Homestead Act give?

Most people associate the word with the Homestead Act of 1862, a land program that gave potential farmers 160 acres of free lots as long as they were willing to work and live on the land. While the offer of 160 acres of free land has long since passed, if you know how to find homestead land, you can still come out with a small farm or ranch setup, ...

What are the causes of the decline in tick populations in Minnesota?

Studies are underway trying to figure why. Currently the culprits are most likely winter tick infestations, brain worms, bacterial infections, to even liver flukes.

Where to go to find a homestead in Alaska?

If you are looking for a homestead for hunting, fishing, or camping, your first stop should be the Alaska Department of Natural Resources (DNR).

Can you sit on prime land in an up and coming community?

But, if those are things you are willing to work with, you can be sitting on prime land in an up-and-coming community for little to no cost on the property.

How many homesteads can you have in Minnesota?

You may only have one homes tead per married couple in the state of Minnesota. Homesteads are administered by counties. field_block:node:page:field_paragraph. Qualifications

What happens if you fail to notify the assessor of your homestead?

If you fail to notify the assessor within 30 days , the property may be subject to a penalty. Relative Homestead. Some relatives may qualify for homestead classification. For residential properties, qualifying relatives include:

Where to submit a relative homestead application?

Submit relative homestead applications to the county assessor in the county where the property is located.

Can relatives qualify for homestead?

Some relatives may qualify for homestead classification.

Do you have to reapply for homestead?

Once granted homestead classification, you do not need to reapply. The county assessor may at any time ask you to submit an additional application or provide other documentation to verify that you continue to meet the requirements for homestead classification. Special Situations