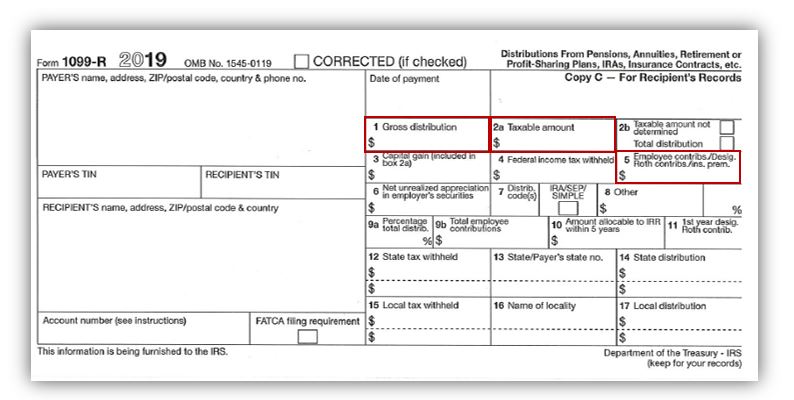

Yes, you should receive a 1099-R for a 401 (k) distribution to be entered in the below area:

- · Type in 1099-r in the search box, top right of your screen,

- · Hit the Enter key

- · Click jump to 1099-r in the search results

- · Follow the prompts and online

Will I get a 1099 for 401k withdrawal?

The IRS requires issuers to file a 1099-R whenever they make an eligible distribution of $10 or more from … This means that your retired grandparents who regularly make withdrawals from their IRAs or 401 (k)s to fund their lifestyle in retirement should get a 1099-R for every plan they draw on.

Are there retirement plans for 1099 independent contractors?

Whether you're a freelancer, independent contractor or a budding entrepreneur, you have access to several retirement plans. While an IRA is always an option, Individual 401(k) and SEP IRAs can provide additional benefits for 1099 contractors.

When are 1099 are due to IRS?

Paper filers must report 1099 to the IRS by February 28, 2022, except for W-2 which are due January 31, 2022.* IRS form 1099 e-file due date is March 31, 2022, except for W-2 which are due January 31, 2022.* With Tax1099.com, you have an option to schedule your e-file transmission date to the IRS.

Do rollovers generate a 1099?

You should receive Form 1099-R any time you move money in your individual retirement account. Even rollovers to another retirement plan, such as converting a traditional IRA to a Roth IRA, usually will generate a 1099-R. Do I have to report an IRA rollover on my taxes?

How to report 401(k) rollover?

The important thing is to make sure that the 1099-R was prepared correctly. If you did a rollover, look in box number seven of your 1099-R. Ideally, you will see the letter “G” in the box. If so, they have correctly reported the transaction as a rollover.

What does the letter G on a 1099-R mean?

Tip: Make sure you see the letter “G” on your 1099-R form (in Box 7), which indicates that you did a rollover. This is especially confusing when financial institutions use the word “distribution” for your rollover.

Do you have to file 1099-R for 401(k) rollover?

In fact, you will receive a 1099-R when you do a 401 (k) rollover, and it’s not a mistake. The investment company that held your money is required to send the form and to report the distribution to the IRS. The good news: if you roll the money over to another retirement account (such as an IRA, 401 (k), 403B, SEP, etc.) you generally won’t have to pay any income taxes — the form is just for reporting.

Do you have to know about 1099-R after 401(k)?

1099-R Anxiety. Most people are surprised to see a 1099-R after a 401 (k) rollover. The thinking is that they rolled money directly to another retirement account, so the IRS doesn’t need to know about it. Whenever the IRS is involved, people they think they’ll owe income taxes.

Do you have to pay taxes on a 403B?

The good news: if you roll the money over to another retirement account (such as an IRA, 401 (k), 403B, SEP, etc.) you generally won’t have to pay any income taxes — the form is just for reporting.

Do I need a 1099-R if I rolled over my 401(k)?

If you rolled over a 401 (k) last year, you should get a 1099-R form from your (previous) investment provider. Naturally, you’ll wonder: Has there been a mistake? Will I owe taxes on the transaction? If the rollover was processed correctly, you should not owe taxes.

How much does a SOLO 401(k) cost?

"Solo 401 (k) plans can have higher administration costs, which can range from $250 to $1,500, depending on which provider you choose.

Do self employed people need to take extra steps to save for retirement?

Self-employed workers need to take extra steps to save for a comfortable retirement.

Can you withdraw money from a savings account without penalty?

Savers can withdraw money without tax or penalty at any time, but interest can only be withdrawn at 59½ or under certain conditions. Once the account reaches $15,000, it must be transferred to a private-sector Roth IRA, and interest earned may not be quite as high as other investments.

Is Solo 401(k) tax deductible?

It's good for business owners with 100 or fewer employees, and allows tax-deductible employer matches of 1 to 3 percent. It's cheap to set up and maintain and doesn't require a plan administrator, Hatch says, but contributions count against your 401 (k), and penalties can reach 25 percent if you withdraw within the first two years. Solo 401 (k).

Do 1099 workers have to file annual statements?

And the 1099 worker is not required to file annual statements.

Services Online Password

If you need a password to log into your Services Online account, or you need your password reset, please click here: Reset your password for OPM Retirement Services Online | OPM.gov

Write to us

Please make sure your first and last name, phone number, email address, claim number, and signature are included in any inquiries or documents you mail to us. We usually respond within 1 to 3 weeks after we receive your mail.

Visit us in person

Due to the COVID-19 public health crisis and for the safety of our customers, we have temporarily closed our walk-in customer support center. Please contact us a different way for support.

What is the code for a 1099-R?

If you take a distribution before you turn age 59 1/2, then your 1099-R will typically have code 1 , which corresponds to an early distribution for which no known exception to the 10% penalty applies. For 401 (k)s, if your employer knows that you have separated from service and are at least 55, then a penalty exception applies, ...

Can you cash in your 401(k)?

If you cash in your 401 (k), the IRS will know. So don't try to cheat your way out of paying tax. Instead, do the smart thing and keep your retirement money where it belongs.

Does the IRS have to double check?

The IRS knows that taxpayers won't always voluntarily comply with the tax laws, so whenever it can, it builds redundancy into the system. Most taxable income comes from employment, and so dual mechanisms that require both employers and employees to report income items make it far easier for the IRS to double-check on everyone involved ...