Do I Have to File a 1098 T With My Taxes?

- Non-resident alien students If you are a non-resident alien student, the IRS requires you to file a 1098-T with your taxes. ...

- Half-time students If you are a student, you may not need to file a 1098-T with your taxes. ...

- Graduate students Graduate students must file a 1098-T with their federal income taxes. ...

- Non-resident alien students not required to file 1098-T ...

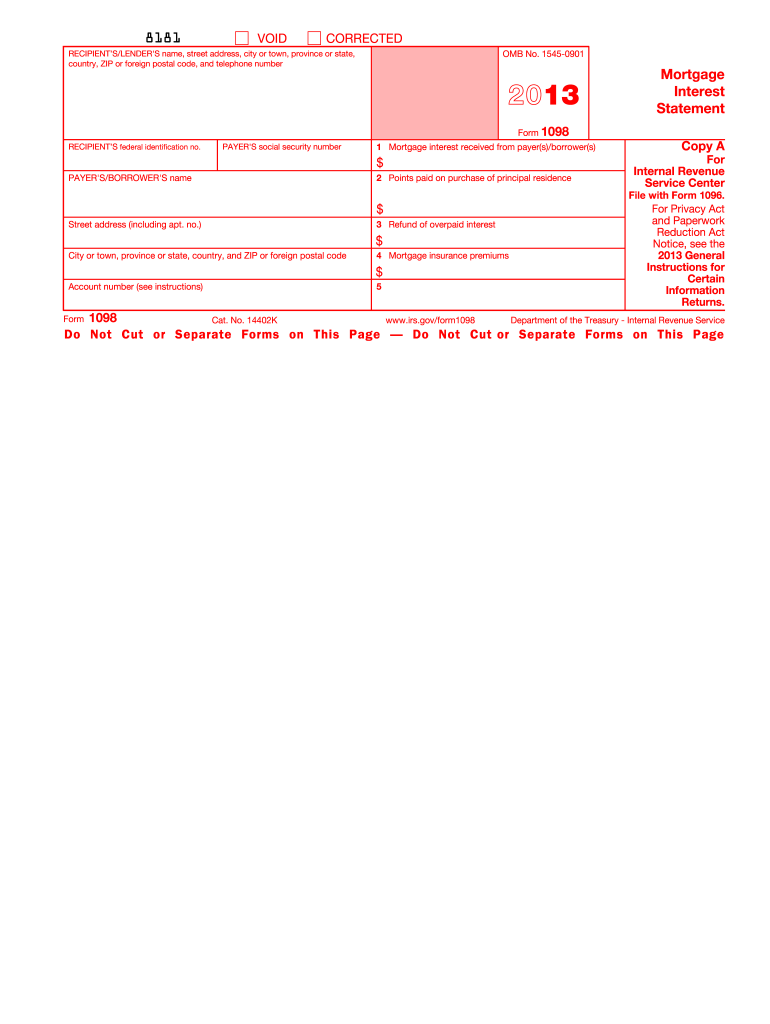

When will I get Form 1098?

Your mortgage lender sends your Form 1098 to you, generally by the end of January of the filing year. Do I Need to File 1098? No, you don't have to actually file Form 1098—that is, submit it with your tax return.

What is Line 10 on a 1098?

Yes - if a real estate taxes paid amount was reported to you in Box 10 of your Form 1098, this represents the amount of real estate taxes you paid on your residence during the tax year, which are claimable as an itemized deduction on your federal income tax return, on Form 1040 Schedule A, Itemized Deductions, Line 6, (Real estate taxes).

How do I handle multiple 1098 mortgage forms?

- With TurboTax open enter 1098 in the search box

- Click on Jump to 1098 in the results box

- Follow the prompts to enter your first Form 1098

- When you have completed the first Form 1098 click Add another 1098

- When you have added the last 1098 click on Done

Where to find real estate taxes paid on 1098?

Some lenders report Real Estate Taxes paid on the back side of the statement. If you cannot locate the amount of the real estate taxes paid anywhere on your Form 1098, contact your local city or county assessor and get a receipt of real estate taxes paid for the year.

What is Form 1098?

Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest, mortgage insurance premiums, or points during the tax year. Lenders must file a separate Form 1098 for each mortgage you hold.

What is a 1098 form?

The 1098 form and its variants are used to report certain contributions and other possible tax-deductible expenses to the IRS and taxpayers. In particular, they cover mortgage interest payments; contributions of motor vehicles, boats, or airplanes; student loan interest paid; and tuition and scholarship information.

When might a mortgage lender not be obligated to provide Form 1098?

Lenders do not have to provide a Form 1098 if they received less than $600 in interest, mortgage insurance premiums, or points during the year. Additionally, interest received from a corporation, partnership, trust, estate, association, or company (other than a sole proprietor) does not require filing a Form 1098. If you bought a property with owner financing, the seller might not file a Form 1098. Regardless of why you may not have received a Form 1098, you typically can still deduct qualifying mortgage interest.

What qualifies as related expenses for a Form 1098-T?

In addition to qualified tuition, the IRS defines related expenses for this form as fees and course materials required to be enrolled at or attend an eligible educational institution.

What is a 1098 mortgage statement?

Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest, mortgage insurance premiums, or points during the tax year. Lenders must file a separate Form 1098 for each mortgage you hold.

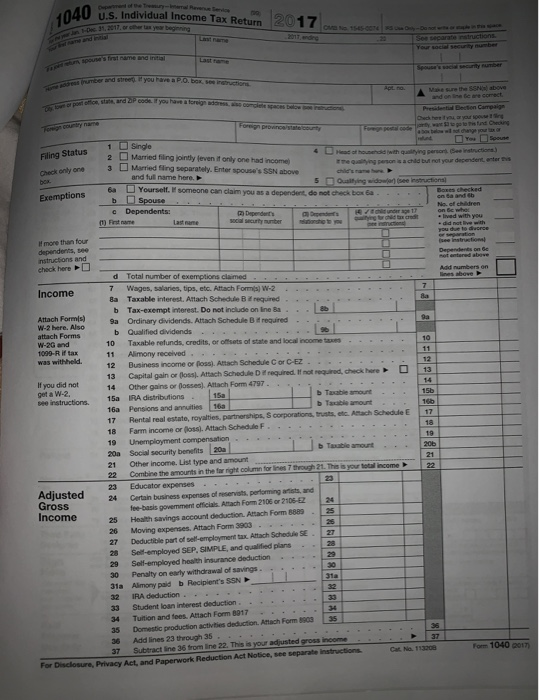

What information is on a tax return?

The form reports: The lender's name, address, phone number, and taxpayer identification number. The borrower's name, address, account number, and taxpayer identification number.

What is a 1098-E student loan?

Form 1098-E Student Loan Interest Statement reports student loan interest received from you by a lender throughout the year. Lenders are required to fill out this form if you paid them $600 or more in interest over the year. This interest may be deductible as an adjustment when calculating your Adjusted Gross Income (AGI).

What is the 1098-T?

When you enter your 1098-T, we use this and other information to determine the educational benefits you may be eligible for on your tax return, such as the American Opportunity Credit, the Lifetime Learning Credit and the Tuition and Fees Deduction.

Is a grant or scholarship taxable?

Technically if grants/scholarships are more than tuition and fees only, that amount is taxable, because it counts as income. Even though we get grants and scholarships for living expenses that our (and parent's) income don't make up for, it counts as income which is taxable.