Are You required to file FBAR form fincen114?

To file the FBAR as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an FBAR (FinCEN Report 114) for the reportable year. There is no need to register to file the FBAR as an individual. If you are NOT filing the FBAR as an individual (as in the case of an attorney, CPA, or enrolled agent filing the FBAR on behalf of a client) you must obtain an account to file the FBAR by registering to Become a BSA E-Filer .

Who must file FinCEN 114?

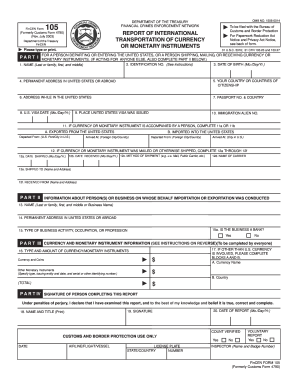

Originally numbered as TDF 90-22.1, up to 2013 and was filed on paper, since then it is required to be filed online and its name changed to FinCEN Form 114. FinCEN Form 114 is required to be filed by all US citizen, Green Card Holders and tax residents of the USA that meet the FBAR filing threshold requirement.

When must FinCEN Form 114 be filed?

When is the deadline to file FBARs/ FinCen Form 114? The deadline for filing FBARs is the same as your federal income tax return – April 15 th. There is also an option for an extension on this deadline, to October 15 th. You don’t need to request an extension to file the FBAR.

Do I need to file FinCEN Form 114?

Whether you live in the U.S. or abroad, if you are a U.S. person (U.S. citizens, Green Card holders, resident aliens) you are required to file FinCEN Form 114 (an FBAR) if the combined balance of all the foreign accounts you own or have a financial interest or signature authority is more than $10,000 at any point during the calendar year.

Do I need to file FBAR if less than 10000?

Who Must File the FBAR? A United States person that has a financial interest in or signature authority over foreign financial accounts must file an FBAR if the aggregate value of the foreign financial accounts exceeds $10,000 at any time during the calendar year.

What is the purpose of FinCEN Form 114?

FinCEN Form 114, Report of Foreign Bank and Financial Accounts, is used to report a financial interest in or signature authority over a foreign financial account.

How do I file FinCEN 114?

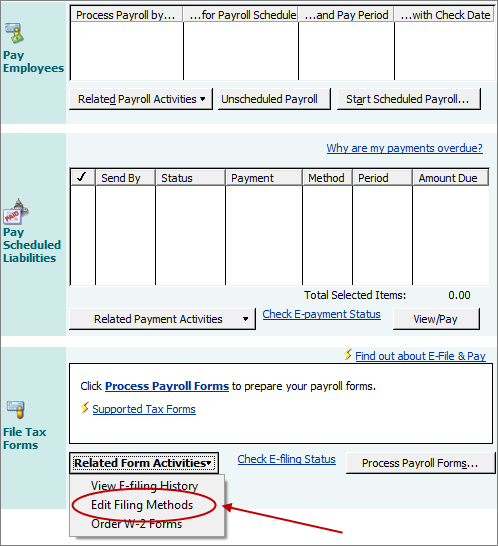

The Report of Foreign Bank and Financial Accounts (114) must be filed electronically using the BSA E-Filing System. Individuals can satisfy their filing obligation by using the no registration option within the E-Filing System.

Does FinCEN report to IRS?

Unlike Form 8938, the FBAR (FinCEN Form 114) is not filed with the IRS. It must be filed directly with the office of Financial Crimes Enforcement Network (FinCEN), a bureau of the Department of the Treasury, separate from the IRS.

Who must file a FinCEN report?

A United States person that has a financial interest in or signature authority over foreign financial accounts must file an FBAR if the aggregate value of the foreign financial accounts exceeds $10,000 at any time during the calendar year. See General Definitions, to determine who is a United States person.

Who is exempt from FBAR?

There are five types of accounts that are exempt from FBAR reporting requirements: U.S. government entity accounts. International financial institution accounts. U.S. military banking facility accounts.

Who files FinCEN 114?

Whether you live in the U.S. or abroad, if you are a U.S. person (U.S. citizens, Green Card holders, resident aliens) you are required to file FinCEN Form 114 (an FBAR) if the combined balance of all the foreign accounts you own or have a financial interest or signature authority is more than $10,000 at any point ...

What is the difference between FBAR and FinCEN?

FinCEN is simply the Treasury Department's Financial Crimes Enforcement Network, and it is the organization that enforces FBAR compliance.

Do I have to report foreign bank account to IRS?

The law requires U.S. persons with foreign financial accounts to report their accounts to the U.S. Treasury Department, even if the accounts don't generate any taxable income. They need to report by April 15 of the following calendar year.

Do I need to file FBAR in 2022?

U.S. citizens, resident aliens and any domestic legal entity with foreign financial accounts have a deadline to file their annual Report of Foreign Bank and Financial Accounts (FBAR) by April 15, 2022. Filers who miss the April deadline will receive an automatic extension until Oct. 15, 2022, to file the FBAR.

What is the deadline to file FinCEN Form 114?

April 15To implement the statute with minimal burden to the public and FinCEN, FinCEN grants filers failing to meet the FBAR annual due date of April 15 an automatic extension to October 15 each year.

Can the IRS see my foreign bank account?

Yes, eventually the IRS will find your foreign bank account. When they do, hopefully your foreign bank accounts with balances over $10,000 have been reported annually to the IRS on a FBAR “foreign bank account report” (Form 114).

What is the difference between FBAR and FinCEN?

FinCEN is simply the Treasury Department's Financial Crimes Enforcement Network, and it is the organization that enforces FBAR compliance.

Does FBAR need to be filed every year?

The FBAR filing obligation is NOT ONLY triggered only if the maximum aggregate balance exceeds $10,000 at year-end. The reporting obligation is triggered if the maximum aggregate balance exceeds $10,000 at any time during the calendar year.

What is the due date for the FBAR FinCEN report 114?

The annual due date for filing Reports of Foreign Bank and Financial Accounts (FBAR) for foreign financial accounts is April 15. The date change was mandated by the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015, Public Law 114-41 (the Act).

What is the full form of FinCEN?

The Financial Crimes Enforcement Network (FinCEN) prevents and punishes money laundering and related financial crimes.

What to do if you haven’t filed FinCen Form 114 or reported foreign financial accounts?

If you discover that you have delinquent FBARs, you need to act on this immediately. You will file an FBAR form in a previous year electronically using the BSA E-Filing System website, as soon as possible. You will be able to enter the calendar year for which you are reporting and an explanation for delinquency. The IRS will then determine whether you had reasonable cause for late filing, and if so, you will not face a penalty assessment. Contact a tax professional to minimise the risk of FBAR penalties.

When is the deadline to file FBARs/ FinCen Form 114?

There is also an option for an extension on this deadline, to October 15 th. You don’t need to request an extension to file the FBAR.

When do I have an FBAR filing requirement?

Has a financial interest in or signature authority over a foreign financial account outside of the US

What are the consequences of not filing FBARs or reporting foreign accounts?

If you fail to comply with FBAR requirements, you face serious penalties and fines from the IRS. You could face huge monetary penalties and criminal charges.

What information do I need to report foreign financial accounts?

For each account reported on the FBAR, you will need the following information:

Are there filing exceptions for FinCen Form 114?

You will need to complete and sign FinCen Form 114a, to let your spouse file on your behalf. Form 114a does not need to be sent with your FBAR filing, but you should keep a copy to provide to the IRS if requested.

How long can you backdate your child's tax return?

It’s for American citizens that didn’t know they had to file U.S. tax returns each year, and have therefore fallen behind. Some more than 30 years! With the IRS Streamlined Procedure, say goodbye to overdue tax returns, late fees, and penalties. If you have children, we can backdate your Child Tax Credit Refund for 3 years.

When do you have to file a FBAR extension?

Additionally, if you are unable to file the form by April 15, there is no need to file an extension, as you are allowed an automatic extension until October 15. Also, it does not matter whether one is filing Single or Married Filing Jointly – the threshold for the FBAR is the same for each person.

What is the FBAR filing obligation?

Specifically, if you have a financial interest or are a signatory on at least one financial account located outside the United States and if the aggregate value of all of those financial accounts exceeds $10,000 at any time during the year, you have an FBAR filing obligation.

What is the penalty for not filing a timely FBAR?

And what are the penalties for not filing a timely FBAR? For each violation that is not non-willful (meaning that the taxpayer can prove that they did not intentionally avoid filing an FBAR), the current maximum penalty is $12,921.

Does FBAR require Form 8938?

However, just because you have an FBAR filing requirement does not automatically mean you would have a Form 8938 filing requirement, mostly because the threshold for filing a Form 8938 is higher than that of the FBAR.

What is FinCen Form 114?

If you’re an American citizen or green card holder who is living or working abroad, you might have heard of FinCEN Form 114. You might know this form as the FBAR, but the full name of this document is the Financial Crimes Enforcement Network 114, Report of Bank and Financial Accounts.

Where is the FinCEN Report 114 filed?

Rather, the FinCEN Form 114 is filed separately from the tax return to the Financial Crimes and Enforcement Network (FinCEN). Unlike Form 8938, which is a related financial assets reporting form, the FBAR is a filing requirement even if a taxpayer is not required to file a 1040.

What information is included in a 114?

It’s important to include information about all your relevant financial accounts. For the purposes of Form 114, the following types of accounts are reportable. If you have a financial interest or signature authority over accounts such as: other types of foreign financial accounts.

Who completes Form 114A?

Form 114a should be completed by you or the entity granting filing authorization, or by the third party authorized to perform such services (if, for example, you want your attorney or accountant to file on your behalf). Any third party or entity that you want to file on your behalf must be registered with FinCEN BSA E-File system.

What is the form for a foreign bank account?

If you are a citizen (resident or non-resident) of the United States, green card holder, or resident alien who has a financial interest in or signature authority over a foreign financial account or accounts whose combined value is $10,000 or more in any calendar year, then you must file Form FinCEN 114 : “Report of Foreign Bank and Financial Accounts (FBAR).”

What is Fincen in banking?

FinCEN is the shortened name for the Financial Crime Enforcement Network. Like the IRS, it is a Bureau of the US Treasury Department and was created in 1990 to enforce the provisions of the “Bank Secrecy Act” (BSA), which was passed in 1970.

What are foreign financial accounts?

Foreign financial accounts include not only bank accounts, but brokerage accounts, mutual funds, trusts, or other types of foreign accounts, including some foreign retirement arrangements.

Can a parent file a child's 114A?

If the child cannot file due to age or other reasons , a parent or guardian may file on the child’s behalf. Separate authorization via Form 114a is not required under these circumstances as there is simply a checkbox on the Filer Tab of the FinCEN 114.

Who must file a FBAR?

Anyone who owns foreign assets (or has signatory authority over them) and is required to file a US tax return must file an FBAR if the aggregate value of the account (or accounts) equals or exceeds $10,000 (the threshold established by the BSA) in any calendar year.

Can a spouse file a FBAR?

Another common reporting error is spouses filing a joint FBAR when they are not actually permitted to do so. Under the FBAR rules, joint filing is allowed only in limited circumstances (see Page 6 of the FinCEN 114 instructions). To authorize your spouse or a third party to file on your behalf if joint filing is not permitted, you must complete and file Form 114a, “Record of Authorization to Electronically File FBARs.”

Who must file a FBAR?

Who Must File. A United States person, including a citizen, resident, corporation, partnership, limited liability company, trust and estate, must file an FBAR to report: a financial interest in or signature or other authority over at least one financial account located outside the United States if. the aggregate value of those foreign financial ...

What is the law that requires foreign financial accounts to be reported to the Treasury Department?

Every year, under the law known as the Bank Secrecy Act , you must report certain foreign financial accounts, such as bank accounts, brokerage accounts and mutual funds, to the Treasury Department and keep certain records of those accounts. You report the accounts by filing a Report of Foreign Bank and Financial Accounts (FBAR) on FinCEN Form 114.

What is the form 2848?

You can file Form 2848, Power of Attorney and Declaration of Representative , if the IRS begins an FBAR examination as a result of an income tax examination (Title 26). Complete Line 3, acts authorized, as follows:

When is the FBAR due?

The FBAR is an annual report, due April 15 following the calendar year reported. You’re allowed an automatic extension to October 15 if you fail to meet the FBAR annual due date of April 15. You don’t need to request an extension to file the FBAR.

Can you use Fincen Report 114A?

You don’t submit FinCEN Report 114a when filing the FBAR; just keep it for your records and make it available to FinCEN or IRS upon request.

Can you file a FBAR with your federal tax return?

You must file the FBAR electronically through the Financial Crimes Enforcement Network’s BSA E-Filing System. You don’t file the FBAR with your federal tax return. If you want to paper-file your FBAR, you must call FinCEN’s Regulatory Helpline to request an exemption from e-filing.

Can you extend your FBAR due date?

If you are affected by a natural disaster, the government may further extend your FBAR due date. It’s important that you review relevant FBAR Relief Notices for complete information.

What are specified foreign financial assets?

What is a specified foreign financial asset? A specified foreign financial asset is: 1 Any financial account maintained by a foreign financial institution, except as indicated above 2 Other foreign financial assets held for investment that are not in an account maintained by a US or foreign financial institution, namely: Stock or securities issued by someone other than a U.S. person, any interest in a foreign entity, and any financial instrument or contract held for investment with an issuer or counterparty that is not a U.S. person.

What is a foreign financial account?

Any financial account maintained by a foreign financial institution, except as indicated above

What is the threshold for reporting a tax return?

This threshold is higher for individuals who are married or live outside of the United States.

Is Form 8938 a separate form?

Important: Forms Fincen 114 and 8938 are two separate filings. Filing Form 8938 doesn’t relieve you from filing the Foreign Bank Account Report online on Form Fincen 114 through the treasury BSA website. Penalties apply to each separate form for failure to file.

Do you have to file Form 8938 for married filing joint taxes?

Thresholds are different for married filing joint tax returns. Taxpayers who do not have to file an income tax return for the tax year do not have to file Form 8938, regardless of the value of their specified foreign financial assets. Full-year U.S. nonresident taxpayers do not have to report their foreign financial assets.

Do nonresidents have to report foreign assets?

Full-year U.S. nonresident taxpayers do not have to report their foreign financial assets. Form 8938 is filed per year per tax return and not per spouse if filing jointly. The instructions of the form 8938 clearly state that unless an exception applies, you must file Form 8938 if you are a specified individual that has an interest in specified ...

Do you have to disclose a joint account with a nonresident alien?

Accounts jointly owned with non-resident alien: if you have a joint account with a nonresident alien who is not required to file a tax return, you are still required to disclose the full account balance. Generally, nonresident aliens are not required to file the form FBAR.