When should I receive my 1098 T?

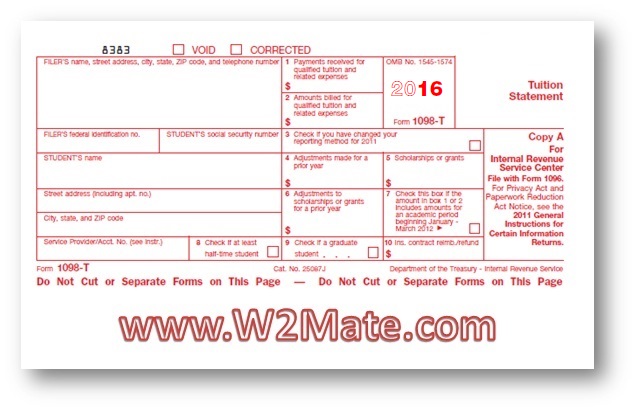

• Eligible post-secondary institutions must send Form 1098-T to tuition-paying students by January 31 and file a copy with the IRS by February 28. • Schools use Box 1 of the form to report the payments received.

Is the 1098t supposed to increase my tax refund?

The 1098-T form is important for filing your taxes because it could help you increase your tax refund. What is a 1098-T form? The 1098-T form shows the amount you paid for qualified educational expenses during a tax year.

When to expect 1098 T?

When can I expect to receive my 1098T form? The IRS requires us to mail your 1098T tax form by January 31. We will send a notification to your GCC e-mail account once your 1098T has been mailed. At that time, a representation of the actual form will be made available for viewing on your “MyGCC” account.

How can I get a copy of my 1098-T?

How can I get a copy of my 1098-T form? Go to OneStop Select the "Student" tab Select "Student Account" Select "Tax Notifications 1098-T" Select year that you're needing the 1098-T for

Who is required to file a 1098?

What is Form 1098? Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest, mortgage insurance premiums, or points during the tax year. Lenders must file a separate Form 1098 for each mortgage you hold.

What happens if you don't put your 1098 on your taxes?

If you forgot to enter your 1098-T and are not going to claim the education credit AND did not have taxable scholarship income (scholarships that exceeded the tuition paid) you do not have to amend your tax return. Keep a copy of it with your tax records for at least three years.

Does 1098 affect tax return?

WILL THIS AFFECT ME? No. The address shown on Form 1098-T is irrelevant for IRS income tax filing purposes. The single most important information on the form is your Social Security Number.

Does a 1098 count as income?

If the amount in Box 5 (your scholarships) is GREATER THAN the amount in Box 1 (or Box 2, whichever is filled in on your 1098-T), then you cannot use any expenses to reduce your tax bill. You must report the excess as taxable income on your federal return.

When Is an IRS Form 1098 Not Needed?

On the other hand, there are naturally exceptions to the rule. You do NOT need to file an IRS Form 1098 if you:

When Do You Need to File IRS Form 1098?

If the transaction doesn’t fall within one of these exceptions, the IRS will most likely expect you to file Form 1098.

What Happens If You Fail to File Form 1098?

Will something bad happen to you? The IRS can technically start issuing penalties starting at $250 per failure to those who don’t follow through with this requirement. That is, if they ever find out about it).

How to complete IRS 1098?

How to Complete IRS Form 1098. To complete the filing process, you will need to order blank copies of IRS Form 1098 and IRS Form 1096. These forms need to be printed with a very specific type of paper and ink, and while it’s possible to reproduce these documents from home, it’s usually a lot easier to just order these forms from the IRS.

What is the purpose of a 1098?

The whole purpose of IRS Form 1098 is to ensure that borrowers are able to claim the appropriate tax write off from the interest they’ve paid to their lender (s) each year. When a lender submits a 1098 to the IRS and the borrower each year, it helps both parties verify how much interest expense can be claimed by the borrower when they file their ...

How long does it take to get IRS forms?

The forms are free and the IRS will send them to you by mail, usually arriving within about a week. It takes less than a minute to order. Here’s the link.

What is a 1098?

IRS Form 1098 is also known as a “Mortgage Interest Statement” and the instructions repeatedly refer to “mortgage interest”.

What Is Form 1098: Mortgage Interest Statement?

Form 1098: Mortgage Interest Statement is an Internal Revenue Service (IRS) form that is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amount totals $600 or more. Related expenses include points paid on the purchase of the property. Points refer to prepaid interest made on a home loan to improve the rate on the mortgage offered by the lending institution.

How to deduct mortgage interest?

To deduct mortgage interest, you must be the primary borrower on the loan, and be actively making payments. If you are itemizing your deductions and plan to claim a mortgage interest deduction, Form 1098 helps you calculate the amount of your mortgage payments that have gone towards interest. Other 1098 tax forms include Form 1098-C (charitable ...

What is prepaid interest on a 1098?

Points refer to prepaid interest made on a home loan to improve the rate on the mortgage offered by the lending institution. Form 1098 serves two purposes: Lenders use it to report interest payments in excess of $600 they received for the year.

How many boxes are there on a 1098?

If you’re receiving a Form 1098 for the first time, you may wonder how to make sense of it. There are 11 boxes to take note of when reviewing your statement. Box 1: Mortgage interest received from the borrower. This box shows how much interest you paid to your lender for the year. Box 2: Outstanding mortgage principal.

What is box 5 in mortgage insurance?

Box 5: Mortgage insurance premiums. If you’re paying private mortgage insurance or mortgage insurance premiums for the loan, those amounts are entered here.

What is box 1 in mortgage?

Box 1: Mortgage interest received from the borrower. This box shows how much interest you paid to your lender for the year.

What is real property?

Real property is land and anything that is built on, grown on, or attached to the land. 3. The property for which the mortgage interest payments must meet IRS standards, which define home as a space that has basic living amenities: cooking and bathroom facilities and a sleeping area.

What is the box to complete when securing a mortgage?

If the address of the property securing the mortgage is the same as the payer’s/borrower’s mailing address, either check the box or leave the box blank and complete box 8. If the address or description of the property securing the mortgage is not the same as the payer’s/borrower’s mailing address, complete box 8.

What is TIPany cash part of a patronage dividend from the National Consumer Cooperative Bank?

TIPany cash part of a patronage dividend from the National Consumer Cooperative Bank must reduce the interest to be reported on each tenant-stockholder's Form 1098 by a proportionate amount of the cash payment in the year the cooperative receives the cash payment. See Rev. Proc. 94-40, 1994-1

What is a 1098 mortgage?

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor. Report only interest on a mortgage, defined later.

Do you report a mortgage on a 1098?

Do not report in box 1 of Form 1098 any interest paid by a seller on a purchaser's/borrower's mortgage, such as on a “buy-down” mortgage. For example, if a real estate developer deposits an amount in escrow and tells you to draw on that escrow account to pay interest on the borrower's mortgage, do not report in box 1 the interest received from that escrow account. Also, do not report in box 1 any lump sum paid by a real estate developer to pay interest on a purchaser's/borrower's mortgage. However, if you wish, you may use box 10 to report to the payer of record any interest paid by the seller. See

Do you report interest on a mortgage?

Report all interest received on the mortgage as received from the borrower, except as explained under Seller Payments, later. For example, if the borrower's mother makes payments on the mortgage, the interest received from the mother is reportable on Form 1098 as received from the borrower.

Who is the payer of record?

The payer of record is the individual carried on your books and records as the principal borrower. If your books and records do not indicate which borrower is the principal borrower, you must designate one.

Who files 1098-T?

Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

Who files the tuition reimbursement form?

Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

What to do if you have not received a 1099?

If you are a recipient or payee expecting a Form 1099-MISC and have not received one, contact the payor.

What is cash payment for fish?

Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish

What is the phone number for TTY?

Persons with a hearing or speech disability with access to TTY/TDD equipment can call 304-579-4827 (not toll-free).

What is a 1099-R distribution?

Distribution from a retirement or profit plan or from an IRA or insurance contract ( Form 1099-R)

How much direct sales are required for a 1099?

You made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment ( Form 1099-MISC)

What Is Form 1098: Mortgage Interest Statement?

Who Can File Form 1098: Mortgage Interest Statement?

How to File Form 1098: Mortgage Interest Deduction

Other 1098 Tax Forms

What Is a 1098 Tax Form Used For?

How Do I Get My 1098 Form?

Do I Need to File 1098?

- No, you don't have to actually file Form 1098—that is, submit it with your tax return. You only have to indicate the amount of interest reported by the form. And you generally only report this interest if you are itemizing deductions on your tax return.

What Is a 1098 Tax Form From College?

Does the Parent or Student Claim the 1098-T?