How much closing costs can seller pay?

The average closing costs a home seller will pay is between 8-10 percent of the home’s sale price, including commission. The highest closing cost a seller will pay is the real estate commission. Real Estate commissions make up the largest portion of the typical closing costs for a homeowner.

What are typical closing costs in New Jersey?

The average closing costs for a buyer in NJ are between $7,000 and $12,000. The reason for the large range is because this varies slightly depending on the purchase price and the types of inspections you order for the home. Keep in mind that these costs are NOT part of your down payment.

How much are closing costs for the buyer?

What are the typical real estate closing costs for buyers?

- Closing costs for buyers. Here is a quick breakdown of home buyer closing costs.

- Appraisal fees. ...

- Credit report fees. ...

- Mortgage origination fee. ...

- Title insurance policy fees. ...

- Escrow fees. ...

- Home inspection fee. ...

- Attorney fees. ...

- Documentation fees. ...

- Loan discount point fees. ...

Who should pay closing costs?

Typically, a buyer should expect to pay all home loan-related fees, ranging from 2% to 5% of a home's value. U.S. homebuyers of single-family homes spend $6,837 on average for closing costs ...

Who pays closing costs in NJ buyer or seller?

In New Jersey, as in most states, it's common for both the buyer and seller to have their own closing costs during a home sale. It's typical for sellers to pay for the real estate agent commissions, transfer fees relating to the sale of the home, and (in some cases) their own attorney fees.

How do I calculate seller closing costs in NJ?

The average cost to sell a house in New Jersey is 6.22% of a home's final sale price, which includes realtor commission (5.13% of the sale price) and seller closing costs (1.1%).

Does the seller pay closing costs?

Typically, buyers and sellers each pay their own closing costs. A home buyer is likely to pay between 2% and 5% of their loan amount in closing costs, while the seller could pay 5% to 6% of the sale price to their real estate agent. But it doesn't always work out that way.

What taxes do you pay when you sell a house in NJ?

Sales Tax: Sales Tax is not due on home sales. Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

Who pays for title insurance in NJ?

Q: Who pays for Title insurance? A: In most cases the buyer pays for the insurance premium on the owner's policy and the lender's policy. The insurance premium is part of the closing costs. In New Jersey the lender's policy cost is only a nominal fee added to the owner's premium.

Who pays title costs in NJ?

"In the state of NJ, they do charge a settlement fee. Usually, it's charged to the buyer and seller- normally it's between $250 and $300 and the title company will just charge the buyer," explains Geschwein. "This fee that they charge on both sides is kind of unique to NJ, and may come as a surprise to homebuyers."

Who pays transfer tax in NJ?

Generally, in New Jersey, the Seller pays the Transfer Tax. If you qualify for an exemption, you are entitled to pay a reduced amount. Consult your attorney to see if any of these exemptions apply to you. Note:If purchase price is over 1 million dollars, a 1% mansion tax may be due.

How can I avoid paying NJ exit tax?

New Jersey exit tax exemptions If you remain a New Jersey resident, you'll need to file a GIT/REP-3 form (due at closing), which will exempt you from paying estimated taxes on the sale of your home. Instead, any applicable taxes on sales gains are reported on your New Jersey Gross Income Tax Return.

Is there an exit tax in NJ?

Despite the confusion caused by calling it an exit tax, the law simply requires the seller to pay state tax in advance, calculated as follows: New Jersey withholds either 8.97% of the profit or 2% of the selling price, whichever is higher.

How can I avoid paying NJ exit tax?

New Jersey exit tax exemptions If you remain a New Jersey resident, you'll need to file a GIT/REP-3 form (due at closing), which will exempt you from paying estimated taxes on the sale of your home. Instead, any applicable taxes on sales gains are reported on your New Jersey Gross Income Tax Return.

How is NJ realty transfer tax calculated?

The RTF is calculated based on the amount of consideration recited in the deed, or in certain instances, the assessed valuation of the property conveyed, divided by the Director's Ratio. The RTF applies to every conveyance of title to real property in New Jersey, unless the deed or transfer meets an exemption.

Does NJ have a exit tax?

Despite the confusion caused by calling it an exit tax, the law simply requires the seller to pay state tax in advance, calculated as follows: New Jersey withholds either 8.97% of the profit or 2% of the selling price, whichever is higher.

How much is real estate transfer tax in NJ?

The most current Realty Transfer Fee law enacted is Chapter 33, Laws of 2006, which imposes a 1% fee on buyers in transfers of Class 4A "commercial property" as defined in N.J.A. C.

What Are Closing Costs?

Closing costs are the fees that one pays to buy or sell a home. Some examples of closing costs include include attorney fees, agent commissions, title fees, and transfer fees.

Closing Costs in New Jersey: Who Pays What?

Here is a breakdown of who pays which closing costs when buying or selling a home in NJ.

NJ Buyer Closing Costs Breakdown

Below is a table of the typical costs paid by the buyer when closing on a home in NJ.

New Jersey Seller Closing Costs Breakdown

Below is a table of the typical costs a seller will pay when selling a home in NJ.

How To Save Money on NJ Closing Costs

Many of the fees associated with closing costs in NJ are fairly standard, however, there are some small ways to save money.

Now that you know who usually pays for closing costs in NJ, you can better budget as you are looking to either buy or sell a home

Each party in a transaction in NJ is responsible for paying certain fees in the process of buying or selling a home. Being knowledgeable and prepared will help you avoid surprises at the closing table.

How Much are Typical Seller Closing Costs in New Jersey?

According to Zillow, the median home in NJ sold for $327,700. Here’s how you can save approximately $9,500 in commissions on an average NJ home by selling it For Sale By Owner on Houzeo.com!

What Are the Different Home Seller Closing Costs in New Jersey?

Here are the typical closing costs in New Jersey, ordered by how big they are.

What is a deed in real estate?

The Deed: This document enables the legal transfer of title from the seller to the buyer. Read this document carefully, verifying all details including the legal description of the property, the deed book, deed book page, and the Property Identification Number (PIN), if any. We know of a case where a Seller sold a $94,000 property, but the deed also legally transferred over the Seller’s 5 other homes worth $680,000 over to the Buyer. There was a huge scramble post-closing to correct this mistake. It could have been a nightmare for the Seller if the Buyer didn’t honestly transfer the rest of the properties back to the Seller.

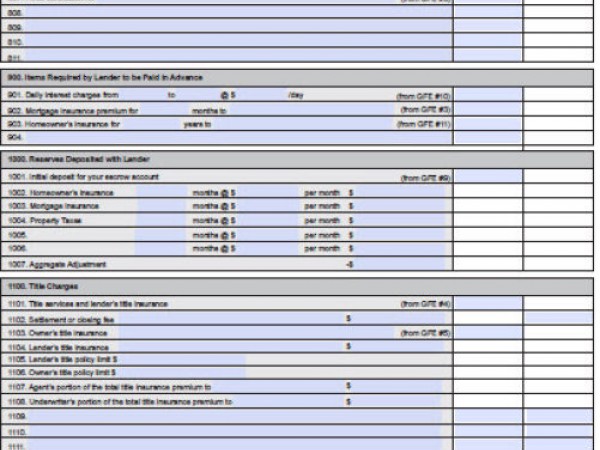

What documents do you sign at closing in New Jersey?

Here are some key documents you’ll likely sign at closing: The HUD-1 or Closing Disclosure: Most New Jersey homes are purchased with a mortgage. If this is the case on your transaction, you’ll get the Closing Disclosure summarizing the costs in detail. If your transaction is all cash, you may get the HUD-1, although this is less common.

What is a closing cost statement?

Statement of Closing Costs: This statement summarizes all the expenses involved in the transaction. This document is easier to understand vs. the HUD-1/Closing Disclosure, but they should tie.

What is included in a mortgage payoff?

It includes items like the principal balance, interest accrued from the last payment to the day of closing, recording fee, and any statement fee the lender might charge.

What is the commission for a realtor in New Jersey?

Real Estate Broker Commissions: The biggest expense for New Jersey home sellers is the broker/agent commission. In New Jersey, the typical commission is between 5-6% with generally half going to the listing agent and the other half to the buyer’s agent. The buyer’s agent commission is also called the Cooperating Agent Commission. If you’re selling FSBO via Houzeo, congratulations… You’ve likely saved thousands by paying $0 in listing agent commission! Go on. Pop a bottle of the finest Champagne or Scotch. You deserve it.

Can the Seller Pay Some of the Buyer’s Closing Costs?

Whether the seller can pay a portion of the buyer’s closing costs will depend on the lender that the buyer is using. With most loans, the seller can contribute some amount toward the buyer’s costs. Depending on the mortgage this can vary from around 3 percent to 6 percent.

What are the costs associated with closing and title insurance?

Costs associated with closing and title insurance such as the title search, title insurance premiums for the buyer’s policy as well as the mortgage holder’s, administrative fees charged by the closing office, and the property survey

What are the costs associated with a mortgage?

Costs associated with the mortgage such as application fee, mortgage points, appraisal, prepaid interest, private mortgage insurance, recording fees, and other miscellaneous costs

What is a real estate transaction in New Jersey?

A real estate transaction is one of the largest investments of a lifetime… and most expensive. You never want to pay more than necessary. Getting the assistance of a New Jersey real estate lawyer can ensure that. At the Matus Law Group, we will guide you through your real estate transaction, review your contract, and ensure that the lender has properly disclosed the closing costs you are paying. If you are a seller, we can make sure that your contract and title documents are properly drafted, executed, and filed. Contact us to learn more.

What is closing cost in New Jersey?

If you are buying or selling a home in New Jersey, keep in mind that “closing costs” is a generic term used for anything that gets paid over and above the purchase price, usually at the end of the transaction, the so-called closing table. Although some closing costs can be negotiable between a buyer and seller, ...

What is mortgage payoff?

Mortgage payoff, accrued interest, and recording of the satisfaction — if the seller had a mortgage on the home, this is paid off from the proceeds of the closing.

Do you need a smoke detector certificate in New Jersey?

Smoke detector/carbon monoxide certificate — the seller must obtain a certificate in compliance with New Jersey Fire Code .

How much does a mortgage cost before closing?

You’ll complete these steps before your closing date. Mortgage-specific fees include the: Mortgage application fee ($300 to $600) Property appraisal ($400 to $600) Miscellaneous mortgage costs ($100 to $600)

How much is a point on a mortgage?

Some buyers choose to pay for points in an effort to “buy down” the interest rate on their mortgage. One point equals 1% of your total mortgage. For example, one point on a $500,000 mortgage equals $5,000. In addition, you’ll pay to have the property in question inspected, incurring the following fees before closing:

What are pre-paid expenses?

These include one year of homeowner’s insurance, which your insurance agent or provider can quote. Also, expect to pay for up to two months of escrow on your homeowner’s insurance.

How much does a water inspection cost?

As the seller, it’s your responsibility to foot the bill for the property’s water inspection. This can cost between $450 and $700 depending on the location.

How much is the NJ mansion tax?

Buying a home worth more than $1,000,000? If so, you’ll pay the NJ Mansion Tax, equal to 1% of the total consideration.

How many state parks are there in New Jersey?

Whether you’re an outdoor enthusiast or you prefer the fast-paced city life, you’ll find it all in New Jersey. Home to more than 50 state parks as well as a booming job market, it’s no wonder that so many residents choose to call the Garden State home.

Do you have to pay closing costs for moving?

In addition to paying your real estate agent and any costs you’ll incur during the actual moving process, it’s important to set aside money to cover these payments. Let’s take a high-level look at the costs you’ll see at closing, keeping in mind that an official seller closing cost calculator can give you a more accurate picture of your exact charges.

What are closing costs in New Jersey?

Closing costs for home sellers in New Jersey can range from 0.5-3.0%, according to our research. These closing costs are an assortment of taxes and fees charged when home sales are finalized. Both buyers and sellers have closing costs that they are responsible for paying, but who pays for what is 100% negotiable.

What percentage of the sale price is a seller concession?

Most commonly, seller concessions come in the form of seller credits towards the buyer’s closing costs — 2-3% of the home’s sale price is common — or home warranty policies. However, they can also include compromises that don’t hold monetary value, such as an agreement to close on a date that’s preferable to the buyer.

How much does a real estate transfer cost in New Jersey?

Calculating realty transfer fees in New Jersey can be a bit tricky as there are different rate schedules depending on how much your home sells for. For a home that sells for $358k, the fee would be around $3k. For a precise estimate of these fees, we recommend that you use the New Jersey REALTORS® calculator.

What is the purpose of home selling prices?

Home selling prices provided are meant to give prospective home sellers a ballpark figure of their costs. We utilized the following datasets to provide the analysis in this article:

Why is it so hard to sell a house?

It’s often difficult to sell a home in need of major repairs because there are fewer buyers interested in homes like these.

What to do if you don't have time to fix your house?

If you don’t have the time or funds to deal with organizing repairs, the other option is to list your home as-is. This will indicate to potential buyers that what they see is what they get, and you won’t handle any repair requests.

How much is the mansion tax?

NOTE: For homes that sell for more than $1,000,000, there is an additional tax — called the mansion tax — that is equal to 1% of the sale value. This tax is paid by the home buyer.

What are seller concessions?

Seller concessions are closing costs that the seller agrees to pay and can substantially reduce the amount of cash you need to bring on closing day. Sellers can agree to help pay for things like property taxes, attorney fees, appraisal inspections and mortgage discount points to lower your interest rate.

Why are some houses on the market too long?

Even in a seller’s market, some houses simply have been on the market too long, either because the asking price was too high to begin with or the property is in poor condition. In those cases, too, sellers might have to offer some financial incentive to buyers who are willing to consider these slow-moving homes.

Can you get a home appraisal with seller concessions?

Yes, seller concessions can make the appraisal process difficult. If you offer to buy the home for a higher price in return for seller concessions, you may have a problem getting an appraisal that justifies the additional costs, which in turn will make it difficult to get the financing you need.

What is closing cost?

Closing costs are all of the fees and expenses that must be paid on closing day. The general rule of thumb is that total closing costs on residential properties will amount to 3% – 6% of the home’s total purchase price, although this can vary depending on local property taxes, insurance costs and other factors.

When do you receive a closing disclosure?

If a fee is associated with the mortgage process, it’s the buyer’s responsibility. Three days before closing, buyers receive a Closing Disclosure that will give a final breakdown of all the costs associated with the mortgage loan.

Can you split closing costs?

Although buyers and sellers generally split closing costs, some localities have developed their own customs and practices about how to split closing costs. Be sure to discuss what closing costs look like with your real estate agent early in the home buying process, which may help you negotiate seller concessions.

Do sellers pay closing costs?

Here’s how it works: Sellers don’t agree to pay for closing costs out of the goodness of their hearts. Generally, sellers agree to pay in return for a higher sales price. Buyers might prefer this because it frees them from a demand for cash at a time when there are many financial demands.

How much does a buyer pay for closing costs?

Buyer closing costs: As a buyer, you can expect to pay 2% to 5% of the purchase price in closing costs, most of which goes to lender-related fees at closing. More on buyer closing costs later. Seller closing costs: Closing costs for sellers can reach 8% to 10% of the sale price of the home. It’s higher than the buyer’s closing costs because ...

What is a credit toward closing costs?

This is also called a seller assist or seller concession.

How much does escrow cost?

Escrow providers charge either a flat fee (between $500 and $2,000, depending on where you live), or about 1% of the home sale price to manage the closing of the transaction, which includes the signing and recording of the closing documents and the deed, and the holding of all the purchase funds. There are usually some additional charges — think office expenses, fees for transferring funds, the copying of documents, and notary charges.

What is seller assist?

This is also called a seller assist or seller concession. The credit you offer them goes to cover some of their closing costs, effectively lowering the amount of cash they need to close on their house. If this was part of your deal-making, expect to see it as a line item on your closing.

How much does closing cost for a home?

The average closing costs for a seller total roughly 8% to 10% of the sale price of the home, or about $19,000-$24,000, based on the median U.S. home value of $244,000 as of December 2019.

Why are closing costs higher than closing costs?

It’s higher than the buyer’s closing costs because the seller typically pays both the listing and buyer’s agent’s commission — around 6% of the sale in total. Fees and taxes for the seller are an additional 2% to 4% of the sale. However, seller closing costs are deducted from the proceeds of the sale of the home at closing, ...

What are closing costs?

When are closing costs due? Seller closing costs are a combination of taxes, fees, prepayments and services that vary depending on your location. Closing costs can differ due to variations in local tax laws, lender costs, and title and settlement company fees.

Typical Seller’S Closing Costs

Typical Buyer’s Closing Costs

- The buyer’s closing costs will vary depending on whether the buyer is getting a mortgage, who the lender is, and what type of loan it is. When a buyer applies for a mortgage, the lender is required to give them what is called a good-faith estimate of their closing costs. Some are paid at closing and some are paid in advance. Typical closing costs paid by the buyer are:

Can The Seller Pay Some of The Buyer’s Closing Costs?

- Whether the seller can pay a portion of the buyer’s closing costs will depend on the lender that the buyer is using. With most loans, the seller can contribute some amount toward the buyer’s costs. Depending on the mortgage this can vary from around 3 percent to 6 percent. In most cases, however, the market will determine whether a seller chooses to contribute to a buyer’s closing c…

Getting The Assistance of A New Jersey Real Estate Attorney

- A real estate transaction is one of the largest investments of a lifetime…and most expensive. You never want to pay more than necessary. Getting the assistance of a New Jersey real estate lawyer can ensure that. At the Matus Law Group, we will guide you through your real estate transaction, review your contract, and ensure that the lender has properly disclosed the closing costs you ar…