Are taxpayers required to file Form 8606?

Regardless of the reason, the taxpayer must file IRS Form 8606 to notify the IRS that the contribution is non-deductible (counting as after-tax assets). To report the after-tax contribution , the ...

When to file retirement plan tax form 8606?

When to file retirement plan tax form 8606? File Form 8606 with your annual tax return, usually due on or around April 15. You can file it by mail or online. Technically, the penalty for filing a late Form 8606 is $50 through the 2019 tax year, but the IRS is willing to waive this penalty if you can show reasonable cause for the delay. 3 ...

How to fill out form 8606?

Your Best Solution to Fill out IRS Form 8606

- Shrink the PDF files with Optimize feature.

- Convert files from or to PDF documents without quality loss.

- Smart form filler to fill any official form.

- Password protect to secure your high-sensitive PDF documents.

How to fill out IRS Form 8606?

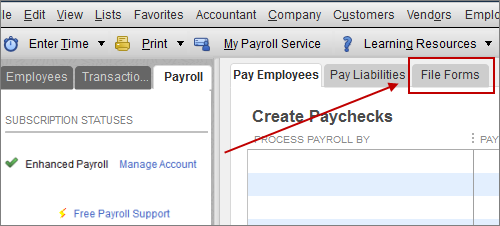

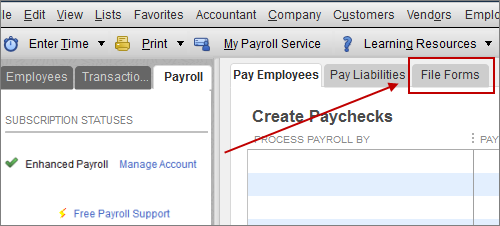

- Open your return if it isn't already open.

- Inside TurboTax, search for this exact phrase, including the comma: 8606, nondeductible ira contributions

- Select the Jump to link in the search results.

- Proceed through the IRA section, answering questions as you go.

- When you reach the screen Any nondeductible contributions to your IRA? ...

What is IRS Form 8606?

What is a 8606?

What is the penalty for not filing 8606?

Is a 8606 tax deductible?

Why is it important to retain copies of 8606?

Who is responsible for keeping track of pre-tax and after-tax assets?

Can you rollover after tax to a traditional IRA?

See 4 more

About this website

Does form 8606 have to be filed every year?

You must file Form 8606 for every year when you contribute after-tax amounts (nondeductible contributions) to your traditional IRA. Conversions from traditional, SEP, or SIMPLE IRAs also must be reported on Form 8606.

What happens if you forget to file 8606?

So what if you forgot to file tax form 8606? The total absence of filing can create an unnecessary tax liability. There is an opportunity to amend such an omission by later filing Form 8606 (possibly with an amended tax return). The penalty for late filing a Form 8606 is $50.

Do I need to file 8606 for Roth?

You don't have to file Form 8606 solely to report regular contributions to Roth IRAs. But see What Records Must I Keep, later. File 2021 Form 8606 with your 2021 Form 1040, 1040-SR, or 1040-NR by the due date, including extensions, of your return.

Can you file 8606 retroactively?

If your client hasn't filed Form 8606 for prior years, that form can be filed on a standalone basis, and even past the usual three-year limit for requesting a refund. There may be a $50 penalty for failing to file Form 8606 when it was required, but it's possible to have that penalty waived for reasonable cause.

Does Turbotax fill out form 8606?

We'll automatically generate and fill out Form 8606 (Nondeductible IRAs) if you reported any of these on your tax return: Nondeductible contributions made to a traditional IRA.

What is the purpose of IRS form 8606?

Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs. Distributions from traditional, SEP, or SIMPLE IRAs, if you have ever made nondeductible contributions to traditional IRAs. Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs.

How does IRS verify IRA contributions?

Form 5498: IRA Contributions Information reports your IRA contributions to the IRS. Your IRA trustee or issuer - not you - is required to file this form with the IRS by May 31.

How do I keep track of nondeductible IRA contributions?

If any of your contributions are nondeductible, you must report them on Part I of IRS Form 8606. Form 8606 keeps a running tally of nondeductible contributions. This running tally, known as your IRA basis, helps you track how much of your IRA has already been taxed.

Do I pay taxes on non deductible IRA contributions?

Form 8606 for nondeductible contributions Any money you contribute to a traditional IRA that you do not deduct on your tax return is a “nondeductible contribution.” You still must report these contributions on your return, and you use Form 8606 to do so. Reporting them saves you money down the road.

How do I know if my inherited IRA has a basis?

Look for Form 8606 “Nondeductible IRAs,” which is filed to report and keep track of nondeductible contributions. This form will show the decedent's basis in the IRA, which passes to the beneficiary. Those last three years of tax returns should establish consistency.

How do I send 8606 to IRS?

If you aren't required to file an income tax return but are required to file Form 8606, sign Form 8606 and send it to the IRS at the same time and place you would otherwise file Form 1040, 1040-SR, or 1040-NR. Be sure to include your address on page 1 of the form and your signature and the date on page 2 of the form.

Can I file form 8606 online?

Can IRS Form 8606 Be E-Filed? You can e-file Form 8606 with the rest of your annual tax return when you e-file your 1040 and any other tax forms, along with any payments due.

Can I file Form 8606 online?

Can IRS Form 8606 Be E-Filed? You can e-file Form 8606 with the rest of your annual tax return when you e-file your 1040 and any other tax forms, along with any payments due.

How do I report a recharacterized IRA contribution?

If the recharacterization occurred in 2021, include the amount transferred from the traditional IRA on 2021 Form 1040, 1040-SR, or 1040-NR, line 4a. If the recharacterization occurred in 2022, report the amount transferred only in the attached statement, and not on your 2021 or 2022 tax return.

Solved: Did not file form 8606 in prior years - Intuit

If you made a non-deductible contribution ( and in fact did not take any deduction on prior year tax returns ) and failed to file a Form 8606, you will need to go back and file a Form 8606 for each year this happened.

About Form 8606, Nondeductible IRAs | Internal Revenue Service

Information about Form 8606, Nondeductible IRAs, including recent updates, related forms, and instructions on how to file. Form 8606 is used to report certain contributions and distributions to/from specific types of IRAs.

How do I complete form 8606 – Nondeductible IRAs? – Support

Form 8606 is used to report nondeductible traditional IRA contributions and traditional to ROTH IRA conversions, as well as calculate the taxable portion of a nonqualified distribution from your ROTH IRA.

2021 Instructions for Form 8606

and its instructions). / • and •

Understanding IRS Form 8606: Nondeductible IRA's - Jackson Hewitt

What gets reported on Form 8606? Form 8606 is used to report a variety of transactions related to traditional individual retirement agreements (IRAs), Roth IRAs, and other types of retirement plans like SEP-IRAs and SIMPLE IRAs.. The main reasons for filing Form 8606 include the following: Contributing to a nondeductible traditional IRA

What is IRS Form 8606: Nondeductible IRAs - TurboTax

Taxpayers use Form 8606 to report a number of transactions relating to what the Internal Revenue Service (IRS) calls "Individual Retirement Arrangements" and what most people just call IRAs. These are accounts that provide tax incentives to save and invest money for retirement.

How much is the penalty for filing a 8606?

If you are required to file Form 8606 to report a nondeductible contribution to a traditional IRA for 2020, but don’t do so, you must pay a $50 penalty, unless you can show reasonable cause.

What is the new form 1040-NR?

Form 1040-NR, U.S. Nonresident Alien Income Tax Return, is being redesigned for 2020 to look like Form 1040. Like Forms 1040 and 1040-SR, 2020 Form 1040-NR will be supplemented by Schedules 1, 2, and 3 (Form 1040).

When did you receive your 30,000 disaster distribution?

You received a $30,000 qualified disaster distribution on October 1, 2020, from your traditional IRA. On November 25, 2020, you made a repayment of $10,000 to your traditional IRA. The value of all of your traditional, SEP, and SIMPLE IRAs as of December 31, 2020, was $50,000. You had no outstanding rollovers.

Is a fellowship taxable in 2019?

For tax years beginning after December 31, 2019, taxable compensation includes certain non-tuition fellowship and stipend payments. For details, see 2020 Pub. 590-A, Contributions to Individual Retirement Arrangements (IRAs).

Can a qualified employer plan have a Roth IRA?

If in 2020 you had a deemed IRA, use the rules for either a traditional IRA or a Roth IRA depending on which type it was. See Pub. 590-A for more details.

Recent Developments

Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic -- 14-APR-2020

Other Items You May Find Useful

About Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs)

What is a 8606 form?

The form is used to determine the prorated after-tax and pretax amounts distributed.

What happens if you don't file Form 8606?

Failure to file Form 8606 for a distribution could result in the IRA owner (or beneficiary) paying income tax and the additional 10 percent early distribution penalty tax on amounts that should be tax-free.

What is the penalty for not filing a 8606?

Penalties. Without reasonable cause, if an IRA owner fails to file a Form 8606 when required, the IRA owner owes a $50 penalty. Additionally, if an IRA owner overstates his/her nondeductible contribution amount on Form 8606 without reasonable cause, a $100 penalty is owed.

Can a SEP be transferred to an IRA?

All or a portion of a traditional, SEP, or SIMPLE IRA was transferred from an IRA of one spouse to an IRA of the other spouse due to a divorce or separation instrument, and the transfer resulted in a change of basis for either spouse

Can an IRA owner file Form 8606?

It is not an IRA custodian/trustees’ responsibility to inform an IRA owner of the need to file Form 8606 or provide the form to an IRA owner. With this said, an IRA owner may not be aware he/she must file Form 8606. Thus, an IRA custodian/trustee may inform the IRA owner of the requirement and how it relates to the IRA and recommend ...

What is IRS Form 8606?

IRS Form 8606 is a tax form distributed by the Internal Revenue Service and used by filers who make nondeductible contributions to an IRA. Any taxpayer with a cost basis above zero for IRA assets should use Form 8606 to prorate the taxable vs. non-taxable distribution amounts. It is important to retain copies of your supporting documents ...

What is a 8606?

Form 8606 should be filed each year that a distribution occurs from a traditional, SEP, or SIMPLE IRA if any of these IRAs hold after-tax amounts. Failure to file Form 8606 could result in the individual paying income tax and an early-distribution penalty on amounts that should be tax and penalty-free. Distributions of after-tax assets are also reported in Part l of the form.

What is the penalty for not filing 8606?

An individual who fails to file Form 8606 to report a non-deductible contribution will owe the IRS a $50 penalty. Additionally, if the non-deductible contribution amount is overstated on the form, a penalty of $100 will apply.

Is a 8606 tax deductible?

An individual who is eligible for the deduction may decide not to claim it so that their future distributions of the amount are tax- and penalty-free. Regardless of the reason, the taxpayer must file IRS Form 8606 to notify the IRS that the contribution is non-deductible (counting as after-tax assets). To report the after-tax contribution, the ...

Why is it important to retain copies of 8606?

It is important to retain copies of your supporting documents and Form 8606, as it may prove helpful in the future for determining how your transactions were treated for tax purposes.

Who is responsible for keeping track of pre-tax and after-tax assets?

If your assets are in a qualified plan with your employer, then your plan administrator or other designated professional is assigned the responsibility of keeping track of your pre-tax versus after-tax assets. For your IRAs, the responsibility rests with you as the owner.

Can you rollover after tax to a traditional IRA?

Rollover of After-Tax Assets From Qualified Plans. One of the things that many people don't know about IRAs is that they may roll over after-tax assets from their qualified plan accounts to a traditional IRA. According to IRS Publication 590 -A: "Form 8606 isn't used for the year that you make a rollover from a qualified retirement plan ...