Full Answer

Should you buy a house in a flood zone?

There’s no reason to buy a house in a flood zone if you can get all the same benefits from a home that’s less susceptible to disaster. Still, if you choose to buy a house in a flood zone, that is also alright ! It’s important, then, to understand how your home is built.

Should I get flood insurance if not in flood zone?

You should consider flood insurance even if you’re not required to purchase it or if you live outside a high-risk flood zone, called a Special Flood Hazard ... Those are are stuck there except the red van trying to get threw, Sept. 2, 2021.

Do you need flood insurance in preferred zones?

Do You Need Flood Insurance If You Live In A Preferred Flood Zone? Yes. Floods happen everywhere, and are caused by storms, hurricanes, water backup due to inadequate or overloaded drainage systems, as well as broken water mains.

What agency determines flood zones?

The agency who oversees flood zones is FEMA (Federal Emergency Management Agency). This agency works with a floodplain administrator and community officials to produce maps showing where the risk areas are. Over time, flood zones may change, and new maps are drawn. According to FEMA, a flood zone is a “Special Flood Hazard Area” and is commonly referred to as a 100-year floodplain.

Which of the following is not covered under flood insurance?

Furniture, electronics, clothing, and other personal items in a basement are not covered under a flood insurance policy.

Does everyone in Florida need flood insurance?

Flood insurance is not required for every home in Florida. Approximately 20% of flood insurance claims come from moderate- to low-risk areas where flood insurance may not be required.

Is flood insurance mandatory in Louisiana?

Flood insurance is not legally mandated in Louisiana. However, people who live in certain areas that are at high risk of flooding, such as along the bayou or the Mississippi River, may need to purchase it in order to qualify for a federally-backed mortgage.

Is flood insurance required in North Carolina?

According to state law, residents of North Carolina aren't required to buy flood insurance. But if your home is located in an area determined by FEMA to be at high risk of flooding, you may have to buy coverage in order to be eligible for a mortgage backed by the federal government.

Where in Florida do you need flood insurance?

If you're a homeowner in Florida, your mortgage lender may require you to purchase flood insurance if your house is located in a moderate- or high-risk flood zone. Flood insurance is still a good consideration even if it's not required, due to Florida's low elevation and high exposure to storms.

Do I need to take flood insurance?

Flood insurance is normally included as a standard part of your buildings insurance, which protects you in the event of damage to the structure of your property. But this doesn't include your belongings. If you want the contents of your home to be protected against flood damage too, you'll need contents insurance.

Why are floods not covered by insurance?

Water damage caused by flooding is not covered by homeowners or renters policies because it is considered a gradual event rather than sudden or accidental. As a rule of thumb, if the water first touches the ground before entering your home, it is considered flood damage.

Is it required to have homeowners insurance in Louisiana?

Is homeowners insurance required by law in Louisiana? No, homeowners insurance isn't required by law in Louisiana, but your mortgage company will most likely require it in order to get a loan.

Is Louisiana flood insurance going up?

Louisiana homeowners are projected to see a 122% percent increase in their flood premiums on average, phased in over multiple years, newly obtained data shows, under a remaking of the nation's flood insurance program that has prompted deep concern from local officials.

What insurance is required by law in NC?

North Carolina Motor Vehicle Law requires that Automobile Liability coverage be continuously maintained. The minimum coverage requirements are $30,000 Bodily Injury for each person, $60,000 total Bodily Injury for all persons in an accident and $25,000 for Property Damage.

Does North Carolina flood alot?

However, with an average of 54 inches of rainfall by the coast and 16 inches of snowfall in the mountains, North Carolina is subject to some of the most extreme flooding conditions in the nation.

What type of insurance is required by NC?

continuous liability insuranceAll vehicles with a valid North Carolina registration are required by state law (G.S. 20-309) to have continuous liability insurance provided by a company licensed to do business in North Carolina. Out-of-state policies are not accepted.

Does everyone in Florida need hurricane insurance?

Despite the high risk, Florida doesn't specifically require hurricane insurance. That's because hurricane insurance isn't a separate policy you can purchase. It's included in a standard property insurance policy.

Do I need flood insurance in the villages Florida?

If you want your home and property to be protected from flooding in The Villages, you'd need a flood insurance policy. No home is ever fully safe from flooding, especially in Florida. The Villages community contains some federally-designated flood zones, but even houses outside these areas are in danger.

What are the flood zones in Florida?

Flood Zone DefinitionsZoneDescriptionIN100-year floodplain, no BFEs determined.B, X500500-year floodplain (0.2% annual chance of flooding)C, XOutside 100-year and 500-year floodplain.D, UNDESPossible but undetermined flood hazards.9 more rows

What is Florida's minimum requirement for coverage?

be insured with PIP and PDL insurance at the time of vehicle registration. have a minimum of $10,000 in PIP AND a minimum of $10,000 in PDL. Vehicles registered as taxis must carry bodily injury liability (BIL) coverage of $125,000 per person, $250,000 per occurrence and $50,000 for (PDL) coverage.

What is a moderate flood zone?

Moderate Flood Zones are labeled by Zone B and Zone X. The areas of minimal flood hazard, which are areas outside the SFHA and higher than the elevation of the 0.2% annual chance flood, are labeled Zone C or Zone X. These moderate and minimal zones are preferred and flood insurance is not required by federal mortgage programs, however, ...

How many options are there for flood insurance in Florida?

The Flood Insurance industry has grown, changed, and vastly developed in the last five years. You now have three different options when it comes to Florida flood insurance:

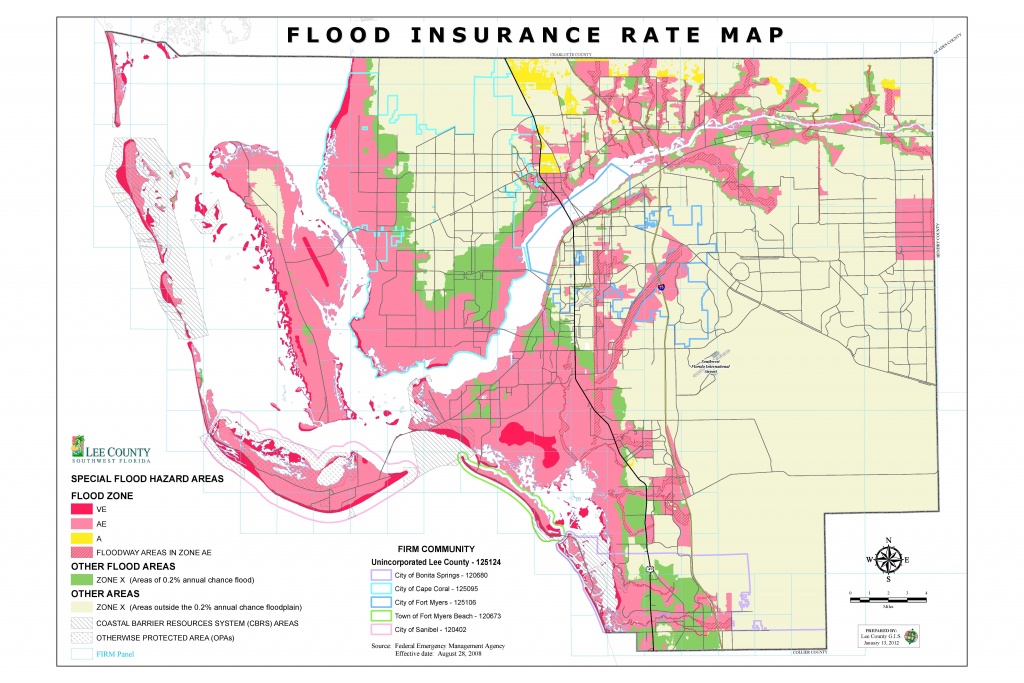

What is a FEMA flood hazard?

According to FEMA, Flood hazard areas are identified on the Flood Insurance Rate Map (FIRM) are identified as a Special Flood Hazard Area (SFHA). SFHAs have a 1% chance of flooding in any given year and are sometimes referred to as areas of “100 year flood.”

What are the preferred and moderate flood zones?

Preferred and Moderate Flood Zones include: Zones B, C, and X are areas of minimal flood hazard from the principal source of flood in the area and determined to be outside the 0.2 percent annual chance floodplain. (X is used on new and revised maps instead of C).

What is SFHA zone?

SFHA Zones include: SFHA Flood Zones explained further: Zone A- Areas subject to a 1% or greater annual chance of flooding in any given year. Because detailed hydraulic analyses have not been performed on these areas, no base flood elevations are shown. Zone AO- Areas subject to a 1% or greater annual chance of shallow flooding in any given year.

How to find out what flood zone your property is located in?

Find out what flood zone your property is located in, visit FEMA’s Flood Map Service Center.

How deep is a flood?

Flooding is usually in the form of sheet flow with average depths between one and three feet. Average flood depths are shown as derived from detailed hydraulic analyses. Zone AH- Areas subject to a 1% or greater annual chance of shallow flooding in any given year.

Do you need flood insurance?

However, many property owners, particularly those in high-risk flood areas, may be required to have flood insurance.

Does flood insurance pay for disasters?

FACT: Flood insurance will pay claims regardless of whether or not there is a Presidential Disaster Declaration.

Have you received disaster assistance?

If you live in a high-risk flood area and have received federal disaster assistance – including grants from the Federal Emergency Management Agency (FEMA) or low-interest disaster loans from the U.S. Small Business Administration (SBA) – you must maintain flood insurance in order to be considered for any future federal disaster aid.

What percentage of flood claims are in low risk areas?

Additionally, 20% of flood claims happen in moderate-to-low-risk areas, according to the III. If you live in a state that borders the Gulf or a Southern Atlantic coastal state, you may want to consider flood insurance even if you don’t live in a flood hazard area.

When will flood insurance rates increase?

The rate changes kick in for existing policies once they renew on or after April 1, 2022, so the cost of most active flood policies is still based on the old rating method.

How much does flood insurance cost in 2021?

As of 2021, the average cost of flood insurance through the National Flood Insurance Program is around $738 per year, according to an analysis of FEMA policy data. The amount you pay for flood insurance will depend on:

What is excess flood insurance?

Excess flood insurance increases your coverage limits if damage to your home exceeds $250,000 or damage to your personal belongings exceeds $100,000. It also generally includes replacement cost coverage for your home and personal belongings and additional coverage components like loss assessment and loss of use coverage.

How much damage does one inch of water do?

Additionally, all it takes is one inch of water in a home to cause more than $25,000 in damage, according to FEMA. If you live in a moderate-to-low-risk flood zone, the chances of your residence being flooded are significantly less, but you should still consider flood coverage. For starters, flood insurance in low-risk areas is cheap, ...

How much risk of floods in a 30 year mortgage?

Over the course of a 30-year mortgage, homes in floodplains have a 25% chance of being flooded, and are five times more likely to incur flood damage than fire damage, according to the Insurance Information Institute (III). And that likelihood may be even higher if you live on the coast or by a river.

Is private flood insurance cheaper than NFIP?

Some insurance companies have their own flood insurance independent of the federal government. Private flood insurance coverage limits are typically higher than NFIP policies, and in some cases the policies are cheaper. Private flood insurance is typically available in the form of a standalone policy or endorsement ...

When does FEMA require flood insurance?

As soon as possible. FEMA urges you to buy flood insurance before a flood event occurs. NFIP cannot pay a claim if you don’t have a policy in effect when damage occurs. An insurance policy from NFIP becomes effective 30 days after you buy it, unless the purchase is associated with the origination, renewal or extension of a federally backed loan on property in a high-risk area.

What is preferred risk flood insurance?

You are eligible to purchase a flood policy with the same coverage you would receive if you lived in a high-risk area. A Preferred Risk Policy (a lower-cost flood insurance policy) provides both building and contents coverage for properties in moderate-to-low risk areas for one price.

How much is NFIP coverage?

NFIP policy holders can choose their amount of coverage. The maximum for 1-4 family residential structures is $250,000 in building coverage and $100,000 in contents coverage. For residential structures of 5 or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage. The maximum for businesses is $500,000 in building coverage and $500,000 in contents coverage.

How much advance payment can you get for a hurricane?

Some were able to get advance payments up to $20,000 if they had photos/video of the damage and receipts or a contractor’s estimate. FEMA also increased the fees paid to adjusters by an average 26 percent to be competitive with industry standards and to ensure that customers received the best care possible.

What can an insurance agent talk about?

Your insurance agent can talk with you about cost of coverage for your property. There are ways to lower your cost and your insurance agent can discuss your options.

What is a flood zone in Texas?

Flood zones are areas where there is a higher statistical probability of a flood occurring, but that doesn’t mean floods don’t occur elsewhere. In fact, in Texas over the last five years, a number of floods exceeded the statistical probability, putting more homes and properties in harm’s way than were expected.

How to contact FloodSmart?

Visit www.FloodSmart.gov or call 800-621-3362 (press 2) from 5 a.m. to midnight. Additional resources on repairing/rebuilding safer and stronger are available at www.fema.gov/Texas-disaster-mitigation.

Who sells flood insurance?

FACT: Most federal flood insurance is sold and serviced directly by Write Your Own (WYO) companies. These companies write and service policies on a non-risk-bearing basis through a special arrangement with the Federal Insurance Administration.

How long do you have to wait to buy flood insurance?

FACT: You can purchase flood coverage at any time. There is a 30-day waiting period after you’ve paid the premium before the policy is effective, with the following exceptions: If the initial purchase of flood insurance is in connection with the making, increasing, extending or renewing of a loan.

How much is NFIP insurance?

The average annual premium for an NFIP policy is about $700, which is less than the annual interest on most low-interest disaster loans. If you are uninsured and receive federal disaster assistance after a flood you must purchase flood insurance to receive disaster relief in the future.

What is the maximum flood insurance for a single family home?

FACT: Flood insurance is available to protect homes, condominiums, apartments and non-residential buildings, including commercial structures. A maximum of $250,000 of building coverage is available for single-family residential buildings; $250,000 per unit for multi-family residences. The limit for contents coverage on all residential buildings is $100,000, which is also available to renters. Commercial structures can be insured to a limit of $500,000 for the building and $500,000 for the contents.

What is covered flooding?

FACT: The NFIP defines covered flooding as a general and temporary condition during which the surface of normally dry land is partially or completely inundated. Two adjacent properties or two or more acres must be affected. Flooding can be caused by any one of the following:

Can you buy flood insurance if you are in a high risk area?

MYTH: You can’t buy flood insurance if you are located in a high-risk flood area.

Does NFIP cover loss in progress?

The policy does not cover a “loss in progress” defined by the NFIP as a loss occurring as of 12:01 a.m. on the first day of the policy term. In addition, the amount of insurance coverage cannot be increased during a loss in progress.

What Is a Flood Zone?

A flood zone is a designated area with a low, moderate or high likelihood of flooding, based on an area's history, its proximity to water sources, base elevation and other factors.

What Is a Special Hazard Area (SHFA)?

Special Flood Hazard Areas (SHFA) are locations where residents are required to buy flood insurance. SFHAs are labeled as Zones A, AO, AH, AE (A1-A30), A99, AR, AR/AE, AR/AO, AR/A1-A30, AR/A, V, VE and V1-V30.

Types of Flood Zones and Flood Risks

The Federal Emergency Management Agency (FEMA) assesses locations throughout the nation to determine where flooding occurs. FEMA divides flood zones into 15 basic categories, and assigns each category a letter or letter-number designation, such as VE or A99.

Do Flood Zones Affect Insurance Rates?

The flood zone you live in significantly determines your flood insurance rate. If your property covers two or more zones, the flood insurer will rate your premium based on the most hazardous zone.

Buy Flood Insurance To Protect Your Belongings

Many homeowners believe they only need flood insurance in high-risk areas, but every area is, in a sense, a flood zone – it's just a question of how much flooding may occur and when. Before the unexpected occurs, consider adding flood insurance to your homeowners insurance policy.

What is the flood risk for a home in Zone A?

Zone A: Homes that are located in Zone A have a 1% chance of flooding annually and a 26% chance of flooding over the course of a 30-year mortgage. Depending on where you live, your home in Zone A may have an additional classification that tells you more about your flood risk. All flood zones with a designation beginning with an “A” require flood insurance.

What Are Flood Zones?

Flood zones indicate how likely a home in any given area is to flood on an annual basis and over the course of a 30-year mortgage loan. When you shop for a home, you may see online listings indicating which flood zone a home is in and whether you’ll need to purchase high-risk flood insurance. You can also search for your address using FEMA’s Search Map here .

What is lemonade home insurance?

Lemonade home insurance provides a top-rated homeowners insurance experience that’s easy and hassle free. Award-winning customer service and digital, super-fast everything from just $25 a month.

What is Zone D flooding?

Zone D: Homes in Zone D have not been assigned a unique flooding risk. No flood analysis has been conducted in these areas, so you’ll need to decide for yourself if you believe that there is a risk of flooding.

What is the best site to get insurance?

Finding the right company for your situation means considering all of your options and getting the right advice. Policygenius makes it easy to get personalized quotes from top insurers and apply for your best policy all in one place. Their combination of online tools and support from unbiased, licensed experts makes Policygenius the best site to help you get insurance right.

What is the difference between Zone A and Zone V?

The difference between Zone A and Zone V is that the flooding risk associated with Zone V is associated with the home’s situation near a coastal area. These homes also have increased flooding risks associated with storms and storm waves.

Which zone is the lowest risk of flooding?

Zone C and X (unshaded): Homes located in Zone C and Zone X that are unshaded carry the lowest risk of flooding. Though a flood can occur in any part of the country due to seasonal weather hazards, most homeowners who live in these areas choose to skip flood insurance.