What are IRS reporting rules about sale of gold coins?

- Coins and currency that are US legal tender.

- Coins and any other currency with a face value of more than $500.

- Gold, silver, and platinum bullion whose price exceeds $500 is not taxable.

Do you have to pay taxes on selling gold?

You pay taxes on selling gold only if you make a profit. A long-term gain on collectibles is subject to a 28 percent tax rate, though, instead of the 15 percent rate that applies to most...

Are gold sales reported to IRS?

The purchaser has met a reporting requirement, and a report (Form 8300) must be filed with the IRS. When a gold purchase is required to be reported, the dealer will be the one to report it. Form 8300 requires information about the gold buyer, including name, social security number, address, and license number.

Is selling gold coins taxable?

This applies to gold bullion coins and bars even though their value depends only on the metal content and not on rarity or artistic merit. You pay taxes on selling gold only if you make a profit. A long-term gain on collectibles is subject to a 28 percent tax rate, though, instead of the 15 percent rate that applies to most investments.

How can I sell my gold coins without paying taxes?

You can trade an unlimited amount of gold and not pay the tax when using the self-directed Roth retirement account. Or, you can postpone the gold taxes with the 1031 IRS exchange. The Internal Revenue Service (IRS) requires you to report any physical gold sales on Form 1099-B.

Are gold coin sales reported to IRS?

There are only a few coins that are required to be reported to the IRS. Reportable coins include the following: 1 oz Gold Maple Leaf (minimum of 25 coins) 1oz Gold Krugerrand Coins (minimum of 25 coins)

Do you pay taxes on the sale of coins?

As previously mentioned, selling precious metal coins, rounds, and bullion can serve as an additional source of income for many clients. Therefore, in the eyes of the IRS, any profits a customer acquires through the sale of their precious metal assets is considered taxable and is therefore subject to a form of tax.

How much gold can you buy without reporting?

However, no government regulations require the reporting of the purchases of any precious metals, per se. If payment is made by cash greater than $10,000, however, it becomes a “cash reporting transaction.” It is not the gold that the government wants reported but the cash.

How do I cash in gold coins?

Sell them at an online auction or marketplace. If you are looking to get the most back in value for trading your coins, selling them online is the best route to go. You also have the flexibility of trading one coin at a time or a collection, depending on how you want to trade your coins.

How much do you lose selling gold coins?

Gold coins are bought through traditional coin dealers with around 7 to 10 percent 'spread'. That's the difference between the dealers' selling price and their buy-back price. 7 to 10 percent is what you lose when you buy gold as gold coins, and it's a very high transaction cost for a modern investment.

How much gold can I keep at home?

There is no limitation on owning gold jewellery of any quantity, according to a press release from the Central Board of Direct Taxes (CBDT) dated December 1, 2016. CBDT clarifies that as long as the investment or inheritance source can be substantiated it is not illegal for one to hold any amount of gold.

Can gold coins be traced?

So, can gold bars be traced? Gold bars are not traceable. They do have serial numbers but it can't be used to determine the gold bar's location, nor is it a proof of ownership by itself. In the USA sellers have to report gold purchases exceeding $10.000 in cash.

What happens when you sell gold?

In general, you have to pay tax when you sell gold if you make a profit. According to the IRS, precious metals like gold and silver are considered capital assets with financial gain from their sale seen as taxable income.

Is buying a gold coin a good investment?

It is not just a low-risk investment option but also offers better security, hence making it a stress-free way of investment. Gold is said to be a tangible asset and has always commanded a good market value for centuries. Hence, buying gold coins for investment lets you stay assured of good future returns.

Does JM Bullion report to IRS?

Certain products that JM Bullion may buy back from customers are reportable to the IRS. These reportable items require the filing of a Form 1099-B. In order for the Form 1099- B to be filed with the IRS , the customer will need to complete a Form W-9.

Do gold dealers report purchases?

Information the IRS Will Require When a gold purchase is required to be reported, the dealer will be the one to report it. Form 8300 requires information about the gold buyer, including name, social security number, address, and license number.

Do Coin Dealers Report Gold / Silver Coin Sales?

Although most of the time coin dealers do not report gold / silver sales, you still want to do your homework before buying any specific investment so you aren’t surprised down the road.

How to keep track of when you bought gold?

Because you have to pay taxes on the sale of gold coins and bullion, record the price that you paid as well as the date and seller information in your financial records. That is your cost basis, and you only are taxed on profits above that amount.

How much is gold taxed?

(The idea is that when you buy a stock you are boosting the economy, so they tax you at a lower rate; not so with collectibles) Generally you will be taxed 28% on the profits made from the sale ...

How much tax do you pay on gold coins?

Generally you will be taxed 28% on the profits made from the sale of your gold coins and gold bullion.

What to do if you bought gold from a coin shop?

If you bought gold from a coin shop, consider keeping the original receipt stapled to a regular size piece of paper in your files.

Do you pay capital gains tax on gold coins?

A: Yes, gold and silver coins are taxed as a collectible by the IRS and you have to pay capital gains tax of 28% on the profit.

Why is Uncle Sam nervous about gold and silver?

Why? Because it’s a very private and powerful form of money; not easily tracked on a bank brokerage account, and not created (out of thin air?) by the Federal Reserve.

How do I avoid capital gains taxes on precious metals like gold and silver?

There are a couple of ways to sell gold without paying taxes or at least defer the payment.

Do I have to pay taxes if I sell gold?

In general, you have to pay tax when you sell gold if you make a profit. According to the IRS, precious metals like gold and silver are considered capital assets with financial gain from their sale seen as taxable income.

Is Gold Taxable?

Yes. Gold is considered a collectible by the IRS similar to art or antiques and is taxable in the same way.

How much is capital gains tax on precious metals?

The capital gains tax on precious metals is equal to your marginal tax rate, up to a maximum of 28%. This means that people in the 33% or 39.6% bracket only have to pay 28% on their physical gold or silver sales. These individuals are taxed at ordinary income rates for short-term holdings.

How long are capital gains taxed?

The short-term capital gains are taxed depending on your total income , with applicable taxes being levied under your elected tax slab. If the holding period for the precious physical metal is less than three years since the date of purchase, the gains are short-term.

How does the amount of tax liability for the sale of precious metals affect the tax liability?

The amount of tax liability for the sale of precious metals will depend on the metal's cost basis, which is equal to the price paid for those specific metals. The IRS does allow you to add some specific costs to this basis in order to reduce your tax liability on future sales.

What is gold mutual fund?

Exchange-traded funds invest in physical gold and track the price of gold. Gold mutual funds, meanwhile, invest in other ETFs like investing (or not) in gold ETF. Gains from both types of investment are taxed the same as gains from owning physical gold.

What is digital gold?

Digital gold is a new way to buy and save up for gold. Banks, wallets, and brokerages have joined with MMTC-PAMP or SafeGold to sell gold through their apps. Gains from digital gold are taxed just like physical gold or other types of investments in physical/mutual funds or ETFs.

How to tax gold?

Tax on Gains From Physical Gold Via Jewelry and Coins. Gold can be bought in three ways: jewelry, coins, or bars. The most common way is to buy it as jewelry and coins. This will shift how much you need to pay in taxes. If you sell the gold within three years of buying it, this is considered short-term.

What items are required to be filed for a tax return?

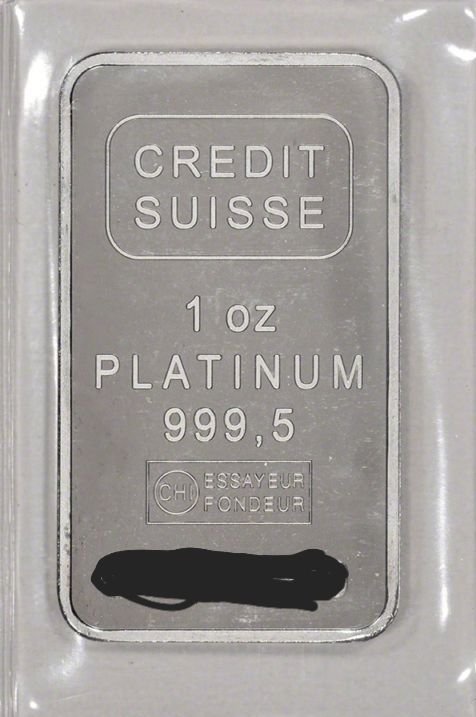

This is because sales of metals are considered income. Items that require filing include $1,000 face value of ninety-percent silver dime or quarter/half dollars and 25 or more 1-ounce Gold Maple Leaf, Krugerrand, or Mexican Onza. Gold and silver bars that weigh 1 kilogram or 1,000 troy ounces need to be filed.

What is gold ETF?

Gold ETFs. Exchange-traded funds that invest in physical gold and other precious metals are treated the same way as an investment in the metal itself. Like conventional mutual funds, gold ETFs pass tax liability to shareholders. This means that when a gold ETF sells some of the gold it holds, you have a short-term or long-term gain or loss.

How long is gold taxable?

Report gains from selling gold using Form 1040, Schedule D. If you owned the gold for more than one year, it is a long-term capital gain and subject to the 28 percent collectibles capital gains tax rate. If you owned the gold for one year or less, you have a short-term gain. Short-term gains are taxed at the ordinary income tax rates that apply to other income such as wages. You can report any loss from selling gold on Schedule D and use it as a tax deduction.

What is the tax rate for long term gains on collectibles?

A long-term gain on collectibles is subject to a 28 percent tax rate, though, instead of the 15 percent rate that applies to most investments.

What happens if the cost basis is less than the net proceeds from selling the gold?

If the cost basis is more than the net proceeds, the result will be a negative number and represents a capital loss.

Do you pay taxes on gold?

The IRS classifies precious metals, including gold, as collectibles, like art and antiques. This applies to gold bullion coins and bars even though their value depends only on the metal content and not on rarity or artistic merit. You pay taxes on selling gold only if you make a profit. A long-term gain on collectibles is subject to a 28 percent tax rate, though, instead of the 15 percent rate that applies to most investments.

Does ETF have a 1099?

Gains are subject to the same tax rates that apply when you sell physical gold. The ETF will send you a 1099 form stating sales so you can report gains and losses. 00:00. 00:06 20:19.

Where is W D Adkins?

Based in Atlanta, Georgia, W D Adkins has been writing professionally since 2008. He writes about business, personal finance and careers. Adkins holds master's degrees in history and sociology from Georgia State University. He became a member of the Society of Professional Journalists in 2009.

How long do you have to hold gold coins?

Correctly classifying the holding period for your coins as short or long term is essential since it directly affects the amount of tax you may have to pay on a gain. If you owned the gold coins for one year or less, you'll report it on Schedule D as a short term gain, with any holding period in excess of one year reported as a long term gain. The rate of tax on net long term capital gains can change from one year to the next, but as of this writing, most taxpayers pay a 15 or 20 percent capital gains tax on gold coins or any other asset. Net short term gains are always taxed at ordinary income rates like most of your other income. Losses, however, can offset other capital gains, with any excess being deductible up to $3,000 per year, or $1,500 if you're married and filing separately.

How much is capital gains tax on gold?

The rate of tax on net long term capital gains can change from one year to the next, but as of this writing, most taxpayers pay a 15 or 20 percent capital gains tax on gold coins or any other asset. Net short term gains are always taxed at ordinary income rates like most of your other income.

What form do you use to report gold coins?

Two forms, Schedule D on the 1040 form and Form 8949, are used to report the gold coin transaction and must accompany your tax return. On Form 8949, you'll enter specific details about the coins, such as the date you originally purchased and sold them, the price you obtained in the sale, your basis and the resulting gain or loss.

What is the basis of gold coins?

This will first require you to determine your basis in the gold coins. The tax basis is generally the price you paid for the coins, but you can increase it for any sales tax and shipping costs you incurred as well.

Is coin collecting taxable income?

If coin collecting is one of your hobbies, meaning you acquire the gold coins for leisure rather than investment purposes, or if the sale is an ordinary transaction in your business, all profits are taxed as ordinary income – not capital gains. Hobby income is reported on the “other income” line of your 1040, whereas reporting business income depends on the type of entity you use, if any, and the tax form required for it.

Where is hobby income reported on a 1040?

Hobby income is reported on the “other income” line of your 1040, whereas reporting business income depends on the type of entity you use, if any, and the tax form required for it. 00:00. 00:05 20:19. GO LIVE. Facebook.

Do you report gold coins on your taxes?

There is no one standard way of reporting the sale of gold coins on your tax return. How you report the sale and any possible tax owed depends on your specific circumstances. The tax rules are different for people who regularly sell gold coins with the intent of earning profits, for those who collect coins as a hobby and for taxpayers who hold onto ...

What is the tax rate for precious metals?

Gains on collectibles that are held for more than one year are treated as long-term and taxed at a maximum rate of 28%. So if you are in a federal tax bracket of 28% or greater, your net long-term gains from collectibles are taxed at 28%. If you are in a federal tax bracket lower than 28%, your net long-term gains from collectibles are taxed at your regular rate. The “collectibles” designation includes most forms of investment grade gold and silver, including:

What is considered a collectible?

The “collectibles” designation includes most forms of investment grade gold and silver, including: • All denominations of precious metal bullion coins and numismatic coins, bars, wafers, etc. • Precious metal “rounds” and commemorative coins. • Certificates such as those from the Perth Mint.

Why is it important to check with a certified public accountant about taxes on gold investments?

• Rules can and do change. Getting it wrong can be very costly ( not to mention the stress of dealing with the IR S). • Your tax bracket and other personal considerations may make a difference.

Do precious metals have to be reported to the IRS?

The International Council for Tangible Assets (ICTA) has published guidelines for which precious metals transactions must be reported to the IRS based on negotiations it had with the IRS. While ICTA believes they reflect the spirit of their discussions with the IRS, they are only guidelines, not a ruling, and are thus open to interpretation by the IRS and subject to change without notice. As you likely know things aren’t always black and white with the IRS, which is why it’s important to check with your tax professional.

Is silver jewelry a collectible?

Gold and silver jewelry, like bullion, is also considered a collectible. So if you sell your bullion jewelry for a profit, it is subject to the same maximum 28% capital gains rate for precious metals and must be reported on your income tax return.

Do you report precious metals on your taxes?

for a profit, you are required by U.S. law to report that profit on your income tax return, regardless of whether or not the dealer has any reporting obligation.

Can you sell precious metals overseas?

When you sell precious metals overseas, the laws of the country in which you sell will apply to the sale. When you sell precious metals in the U.S., there are two different sets of reporting guidelines—one applies to the dealer through which you sell, and the other applies to you.

Is the former a tax issue?

The former is a tax issue and will be discussed below. The latter is an anti-money laundering issue and is not the subject of this post.

Is a metal asset taxable?

Capital Gains Tax. The IRS considers any profits a customer gains through the sale of their precious metal assets as taxable and is subject to "capital gains" taxes. "Capital gains" refers generally to any profits that resulted from the sale of property or an investment.

Do you report coins to the IRS?

When compared to bars and rounds, the reporting criteria for coin sales by customers is slightly more straightforward since the restrictions are so specific. There are only a few coins that are required to be reported to the IRS. Reportable coins include the following:

Do precious metals dealers have to report to the IRS?

There are two circumstances in which precious metals dealers are legally obligated to report consumer transactions to the IRS: when a consumer sells reportable quantities of specific bullion or coins; and. when a consumer buys goods from a dealer and pays $10,000 or more in cash for the goods.

How to Avoid Gold Taxes?

If you don’t like current US federal tax statues, you have a few options I suppose.

How much is bullion taxed?

Often claiming bullion is taxed at a 28% rate. Although they often forget to attach the word ‘maximum’ to that claim. Currently you have to be making over $155k a year as a single tax filer, or over $300k year filed jointly, to be taxed that highly on your bullion profits.

What happens if you sell bullion in an IRA?

Physical bullion IRA tax exceptions aside. In general, if a US citizen sells bullion for more than they bought it for, the IRS will want it’s cut of the profits.

What happens if your cost basis is lower than what you sold your bullion for?

If your cost basis was lower than what you sold your bullion for, a portion of the profit goes to the IRS.

How much can you write off against capital gains?

You can currently write off up to $3,000 USD per year against other capital gains and as well carryover additional losses into subsequent years to come based on the current IRS website. Again consult your tax pro, not this post nor my amateur tax research.

When bullion and physical precious metals get over valued versus other asset classes, what happens?

When bullion and physical precious metals get over valued versus other asset classes simply sell some. Then reallocate and move the proceeds elsewhere, of course after taxes.

Should bullion stackers be net sellers?

In my opinion, most bullion stackers today, should not be net sellers of bullion for other asset classes until commodity values rise while other asset classes and currency bubbles come back down to reality.