How much tax is taken from lottery winnings in California?

The California Lottery will still withhold 24 percent of your winnings to pay federal taxes if you’re a U.S. citizen or resident alien, and 30 percent if you’re not. The California lottery taxes Scratcher winnings the same way if they're $600 or more.

What taxes are withheld from lottery winnings?

Withhold at the 24% rate if the winnings minus the wager are more than $5,000 and are from:

- Sweepstakes;

- Wagering pools;

- Lotteries;

- Wagering transactions in a parimutuel pool with respect to horse races, dog races, or jai alai, if the winnings are at least 300 times the amount wagered; or

- Other wagering transactions, if the winnings are at least 300 times the amount wagered.

How do you calculate taxes on lottery winnings?

To track your winnings and losses, try:

- Keeping a spreadsheet of wins and losses each time you play lotto.

- Include any online and casino winnings and losses on your spreadsheet.

- If you regularly play at certain casinos, join their membership or players club, and they can track your gambling losses.

- You can ask the casino to give you copies of those records for use when audited by the IRS.

How much tax you will pay on your lottery winnings?

Lottery winnings are taxed, with the IRS taking taxes up to 37%. Yet the tax withholding rate on lottery winnings is only 24%. Given that big spread, some lottery winners do not plan ahead, and can have trouble paying their taxes when they file their tax returns the year after they win.

What is the tax rate on lottery winnings in CA?

The state of California does not actually tax lottery winnings. This is good news if you hit those lotto-winning numbers. This means that if you're a resident of California and you win a lottery amount over $600, you won't have to pay any state taxes on that win.

Can I stay anonymous if I win the lottery in California?

The state of California does not permit lottery winners to hide their identities. California winners are compelled by law to reveal their names and locations. This places them at higher risk. Many people hope to keep their win private.

How long does it take to get lottery winnings in California?

seven to nine weeksPrize Claim Processing Time Current processing time for claims is seven to nine weeks. Claimants can help minimize claim processing time by following these tips: Watch this short video to ensure you complete your claim form correctly.

How much tax do you pay on $1000000?

Taxes on one million dollars of earned income will fall within the highest income bracket mandated by the federal government. For the 2020 tax year, this is a 37% tax rate.

Can a felon win the lottery in California?

A person with a felony conviction can play and collect winnings from the California Lottery. The rules for the California Lottery do not prohibit a convicted felon from playing games offered by the state lottery, which include Super Lotto Plus, Mega Millions and Powerball. Super Lotto Plus is exclusive to California.

What should I do if I win the lottery in California?

There are three ways to claim prizes $599 and under: visit a Lottery retailer, claim at a Lottery District Office or claim by mail. Option 1: Visit a Lottery Retailer Best Option! Take your winning ticket to a Lottery retailer and the clerk will hand you cash on the spot. Talk about easy!

Is it better to take lump sum or payments lottery?

Lump Sum vs. While both options guarantee a lottery payout, the lump-sum and annuity options offer different advantages. Choosing a lump-sum payout can help winners avoid long-term tax implications and also provides the opportunity to immediately invest in high-yield financial options like real estate and stocks.

How do you stay safe after winning the lottery?

Here are tips for big lottery winners to try to maintain their privacy.Handling your ticket. The standard advice is to sign the back of your ticket. ... Keep quiet. While you might be eager to share your exciting news, experts say the fewer people who know, the better. ... Money management. ... Plan an escape.

How do I give my family money to the lottery?

A lottery winner can make a gift of some of the lottery winnings. This is legal only up to the annual exclusion limit, or else it will need gift tax liability. Making yearly gifts in this fashion is a good way to share the winnings with family members and friends while mitigating the tax implications.

How much taxes do millionaires pay in California?

In California, high earners are taxed 9.3 percent plus an additional 1 percent surcharge on income over $1 million (this, and all millionaire taxes, are over and above the standard federal tax rate that applies). On the opposite coast, New York's upper class is taxed 8.82 percent on income over $1,077,500 in 2019.

How much tax do I pay on $250000?

Calculation Results:$250,000.00$89,703.1135.88%Gross Yearly IncomeYearly TaxesEffective Tax Rate

How much federal income tax do I pay on $200000?

32%2021 Tax Rate Schedule 2021 Tax Rate ScheduleTaxable Income1Federal Tax RatesMarried Filing JointSingle FilersFederal Income-$164,926 - $200,00032%$250,001 - $329,850-24%$329,851 - $418,850$200,001 - $209,42532%8 more rows

Are Lottery Taxes Deductible in California?

According to the California Tax codes, lottery winnings are not subject to state tax withholding. Similarly, losses incurred for purchasing lottery tickets are not tax- deductible. However, lottery winnings are still subject to federal tax deductions.

How to Claim Your Lottery Winnings in California

Lottery winners in California have three options on how to claim their prizes depending on the prize money.

Paying Taxes on California Lottery Winnings

While lottery winnings are not taxable in the state of California, the state withholds federal taxes. The federal tax rate is subject to revision from time to time but is currently as follows:

How to Report Lottery Wins and Other Prizes With DoNotPay

Filing lottery taxes and other gambling taxes is a hassle. Most people choose to hire a professional to help with filing to avoid accidentally cheating taxes. However, there 's a much better and simpler alternative with DoNotPay.

Why Use DoNotPay to Help You File Lottery Taxes

The IRS is very vigilant in prosecuting tax crimes. Failing to report your lottery winnings or underreporting is considered tax fraud and triggers an audit. A closer look at your finances by the IRS opens the floodgates to a lot of legal problems.

DoNotPay Can Help You Find More Money

Winning the lottery is just one way of getting money in your pocket. Proper budgeting and keeping track of your expenditure goes a long way in saving you more money. DoNotPay can help you achieve this by:

How much of your winnings are taxed in California?

The California Lottery will still withhold 24 percent of your winnings to pay federal taxes if you're a U.S. citizen or resident alien, and 30 percent if you're not. The California Lottery will mail you an IRS Form W-2G, Certain Gambling Winnings, by Jan.

Is Rumack $1,000 taxable?

If you win a sizable amount, it's common to receive the prize over time – perhaps paid as a certain amount each month for life. Rumack $1,000 monthly, was a tax-free amount.

Does California tax lottery winnings?

There is an exception to the general rule that lottery winnings are not subject to California taxes.

How much of your lottery winnings are taxed in California?

The California Lottery will still withhold 24 percent of your winnings to pay federal taxes if you're a U.S. citizen or resident alien, and 30 percent if you're not. The California lottery taxes Scratcher winnings the same way if they're $600 or more.

How much tax is taken from lottery winnings?

Furthermore, how much tax is taken from lottery? Lottery winnings are taxed, with the IRS taking taxes up to 37%. Yet the tax withholding rate on lottery winnings is only 24%. Given that big spread, some lottery winners do not plan ahead, and can have trouble paying their taxes when they file their tax returns the year after they win.

Is scratch offs worth it?

If you are looking at scratch-offs as a financial investment , then it is almost certainly not worth it. You could win the jackpot on the first ticket you buy (which is what makes them so attractive to play), but you could also play thousands of them and never hit the top prize.

How long does it take to get a California lottery payout?

Jackpots are set up to be paid in 30 installments by default. If you want the one-time cash value payout, you have to ask for it within 60 days of submitting your winning ticket.

How to become a jackpot captain in California?

To become a Jackpot Captain, you first have to be a registered player. To become a registered player, you just need to fill out a short form on the California Lottery’s website. Both registered players and Jackpot Captains have to have valid California addresses.

What happens if you don't live in California?

If you're not a California state resident but bought your winning ticket while vacationing in California, you’ll be subject to your home state’s tax laws.

Does California tax lottery winnings?

Despite having some of the highest taxes in the country, California does not tax lottery winnings. It’s one of a small handful of states that don’t. The winner has to be a California state resident to qualify for this exception.

Is lottery winnings considered income?

However, all lottery winnings are considered income and should be reported to the IRS as “other income” on Form 1099 MISC, Miscellaneous Income. The California Lottery will mail you an IRS Form W-2G, Certain Gambling Winnings, by Jan. 31, the year after you won the lottery. This form shows the amount of your winnings like a W-2 shows the amount ...

How much tax do you owe on lottery winnings?

The trick with lottery winnings is that larger wins count as income that can put your household in a higher tax bracket. So, while the IRS will withhold the standard 25 percent, you can end up owing 37 percent in taxes (future tax rates may change) if your income shoots into the range of the highest bracket. There may not be much effect on your household income if you win $1,000, but a win of $100,000 can easily change your tax bracket so that you owe more than what was withheld.

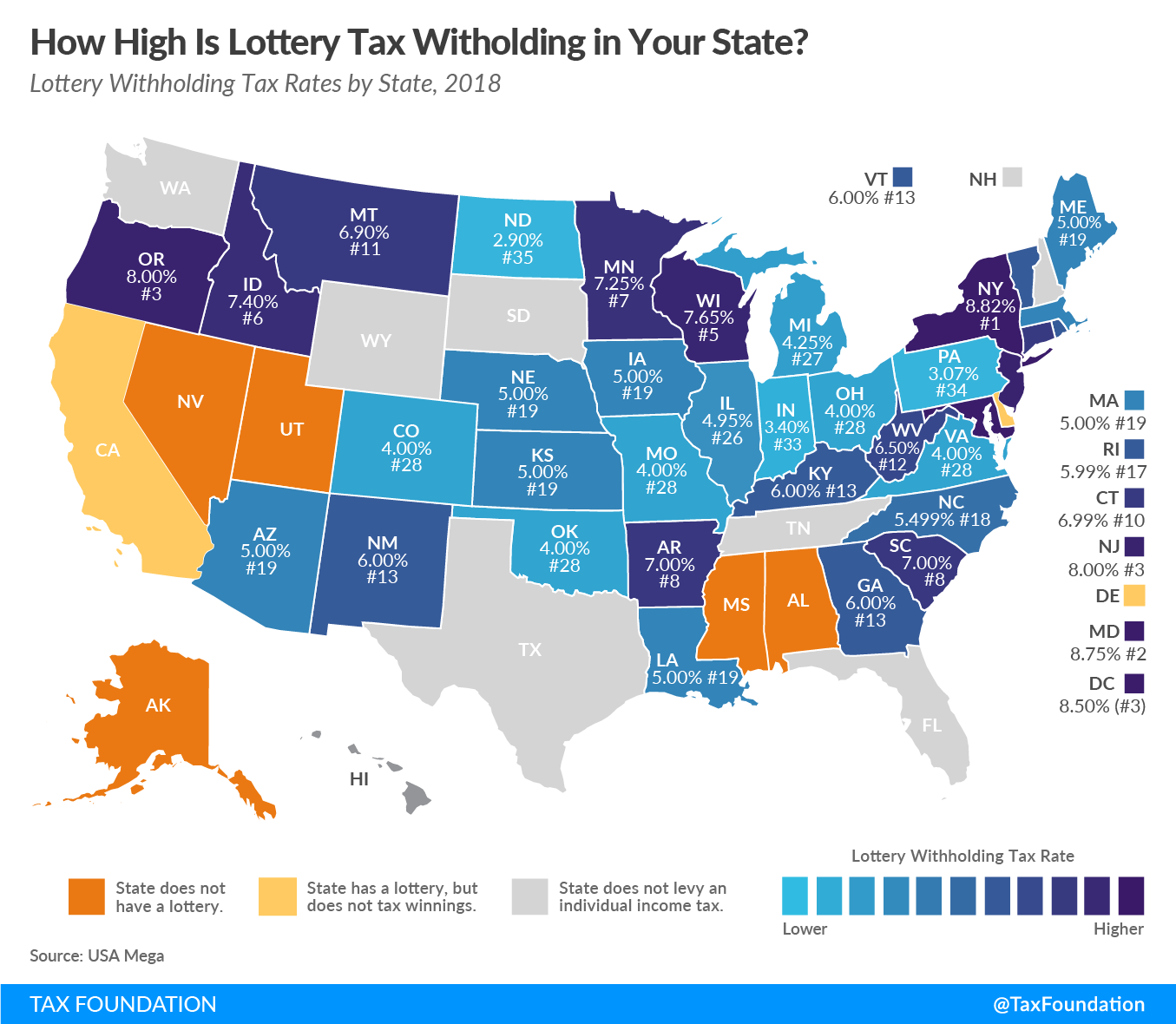

Which states don't withhold taxes on lottery winnings?

States that don't have an individual income tax, like Texas, Florida and Tennessee, also won't withhold anything for state taxes.

Do retailers withhold taxes on lottery winners?

Retailers do not withhold any taxes or collect information from winners. For prizes of $600 or more, winners must file a claim form with the state lottery agency, and the state must report those prizes to the Internal Revenue Service. Federal income tax will be withheld on prizes of $5,000 or more.

Do you have to pay taxes on lottery winnings in California?

California lottery winnings are exempt from state and local income taxes. But the federal government considers gambling winnings taxable income. Winners are expected to claim lottery prizes as income and pay taxes on them -- regardless of the size of the prize, whether the state reported it to the IRS and whether any tax was withheld. Winners can claim a refund when they file their tax returns if the 25 percent withholding was excessive for their tax rate; if it's too little, winners will owe tax when they file.

Is California lottery winnings taxable?

California lottery winnings are exempt from state and local income taxes. But the federal government considers gambling winnings taxable income. Winners are expected to claim lottery prizes as income and pay taxes on them -- regardless of the size of the prize, whether the state reported it to the IRS and whether any tax was withheld.

Does California have state taxes on lottery winnings?

What Is the Tax on Lotto Winnings in California? Lottery players pick their numbers at different retailers. California is one of only a handful of states that do not impose any state income tax on lottery winnings. Federal income taxes still apply, however, and for larger prizes, the state will withhold money for federal taxes.

Can you split a lottery prize?

When several individuals win a prize while playing the lottery as a group, they may be eligible to receive separate payments, with taxes withheld for each person, if necessary. This option is available only for scratch-ticket annuity prizes, SuperLotto Plus jackpots and MEGA Millions jackpots. Group winners of those prizes can split payments by filling out the state's Multiple Player Ownership Claim form. Group winners of all other prizes must choose someone to handle distribution of prize money. The IRS has developed Form 5754 for assessing the tax liability in such situations.

Can you deduct gambling losses that are more than your winnings?

Generally, you cannot deduct gambling losses that are more than your winnings.

Can gambling losses be deducted from winnings?

Gambling losses are deducted from the winnings as an itemized deduction.

Are There Any Other Possible Fees Or Deductions On Lottery Winnings?

Some cities have additional taxes on lottery winnings. (For example New York City charges an additional 4%.)

Do You Always Have To Pay Taxes on Lottery Winnings?

Smaller prizes are tax-free. You don't have to pay federal taxes for winnings under $600. If you have any unpaid alimony or child support it can also be automatically deducted from your winnings before payout.

What is the tax rate for lottery winnings?

The tax brackets are progressive, which means portions of your winnings are taxed at different rates. Depending on the number of your winnings, your federal tax rate could be as high as 37 percent as per the lottery tax calculation.

How are lottery winnings taxed under federal and state?

Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. That means your winnings are taxed the same as your wages or salary. And you must report the entire amount you receive each year on your tax return.

Do lottery winnings count as earned income for Social Security purposes?

Lottery winnings are not considered earned income, no matter how much work it was purchasing your tickets. Therefore, they do not affect your Social Security benefits.

Does winning the lottery affect my tax bracket?

Winning the lottery can affect your tax bracket in a big way. An average family’s top federal tax rate could go from 22 percent to 37 percent . But remember, if that happens, you likely won’t pay the top rate on all of your money.

What are the benefits of taking a lump sum payment versus annuity payments?

If you take a lump sum, you have more control over your money right now. You can choose to invest it into a retirement account or other stock option to generate a return. You could also use it to buy or expand a business.

Why do you take lump sum lottery winnings?

Several financial advisors recommend taking the lump sum because you typically receive a better return on investing lottery winnings in higher-return assets, like stocks . If you elect annuity payments, however, you can take advantage of your tax deductions each year with the help of lottery tax calculator and a lower tax bracket to reduce your tax ...

How much of your winnings are taxed?

Note: Before you receive one dollar, the IRS automatically takes 25 percent of your winnings as tax money. You’re expected to pay the rest of your tax bill on that prize money when you file your return.