How do I issue a warranty deed?

How Do I Issue a Warranty Deed? 1. Engage the services of a title insurance company to do a title search of the real estate you intend to transfer using…. 2. Obtain a warranty deed form from the register of deeds office in the county where the real estate is located. 3. Fill out the warranty deed.

What are the benefits of a warranty deed?

- It guarantees that the grantor is the rightful owner and holds the title to the property, which is free and clear of any liens or mortgages.

- You can have confidence that the title will withstand any third-party claims of ownership.

- It guarantees that the grantor will do everything needed to ensure the grantee’s title to the property.

What is the difference between warranty deed and Trustee Deed?

What Is the Difference Between Warranty Deed and Trustee Deed?

- Warranty Deeds and Protection for Property Owners. When sellers transfer title with a warranty deed, there are two parties to the transaction: the seller or grantor, who signs the warranty ...

- Trustee Deeds and Protection for Lenders. Trustee deeds protect lenders' rights. ...

- Other Uses for Trustee Deeds. ...

Is a Trustee Deed as good as warranty deed?

This means there may be other outstanding loans against the property that will pass with it, putting the new owner on the hook for them. A warranty deed provides a guarantee that the title is clear. A trustee deed offers no such warranties about the title.

Who benefits the most from a warranty deed?

The buyerThe buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

What is another name for a warranty deed?

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee).

What is a warranty deed in Utah?

The Utah warranty deed is a form of deed that provides an unlimited warranty of title. It makes an absolute guarantee that the current owner has good title to the property. The warranty is not limited to the time that the current owner owned the property.

What is a warranty deed in Arkansas?

An Arkansas warranty deed—sometimes called a general warranty deed—transfers real estate with complete warranty of title. The current owner guarantees a good, clear title, and the guarantee covers the property's entire chain of title.

Which is more important title or deed?

Which is more important: title or deed? Both the title and the deed are of equal importance because they both have a purpose in the home selling process. For instance, a title search can note only confirm who owns the property, but also lists any liens, loans, or property taxes due.

Can you sell a house if you are on the deed but not the mortgage?

In contrast, if you owe money on a mortgage, you do have the deed but the mortgage lender has a lien on your property. You can sell your real property without satisfying those liens until the sale takes place, at which all liens are paid from the seller's payment and you receive the remainder.

What type of deed is most commonly used?

general warranty deedWhen committing to a general warranty deed, the seller is promising there are no liens against the property, and if there were, the seller would compensate the buyer for those claims. Mainly for this reason, general warranty deeds are the most commonly used type of deed in real estate sales.

What is warranty deed in mortgage?

A warranty deed is a document sometimes used in real estate, which offers the buyer of property the greatest amount of insurance. It guarantees or warrants that the property is owned by the owner free of any unpaid liens, mortgages, or other obligations against it.

What is a management warranty deed?

A deed transferring title and legal interest in real property from the grantor to the grantee with full covenants and warranties.

How much does a warranty deed cost in Arkansas?

In most cases, an Arkansas Warranty Deed costs $185 to prepare, and $15 for the first page and $5 for each additional page in recording costs. For a typical warranty deed, the total cost is $205 (a $185 lawyer fee and $20 in recording fees). Your deed will be prepared and recorded by a licensed Arkansas attorney.

How do you find out who owns a property in Arkansas?

ARCountyData.com is the fastest and easiest way to access Arkansas county property information. From the convenience of your office or home you can research property sales histories, commercial and residential building descriptions, and legal descriptions.

How do I record a warranty deed in Arkansas?

Recordable Instrument Requirements:Original Instrument.Notarized signature.Tax statement return address on document.Name of Instrument preparer.Revenue stamps on warranty deeds (if revenue changed hands)“I Certify” statement on all warranty deed (and any deed that has revenue stamps affixed)More items...

What are the three types of deeds?

The three most common types of deeds are: Grant Deeds. Quitclaim Deed. Warranty Deed.

Which of the following deed is also called as is deed?

Quitclaim Deeds A quitclaim deed is an instrument for conveying the interest in a property that doesn't come with a warranty. Think of it as an "as is" deed.

What is a warranty deed in Alabama?

The Alabama warranty deed is a form of deed that provides an unlimited warranty of title. It makes an absolute guarantee that the current owner has good title to the property. The warranty is not limited to the time that the current owner owned the property.

What is warranty deed in mortgage?

A warranty deed is a document sometimes used in real estate, which offers the buyer of property the greatest amount of insurance. It guarantees or warrants that the property is owned by the owner free of any unpaid liens, mortgages, or other obligations against it.

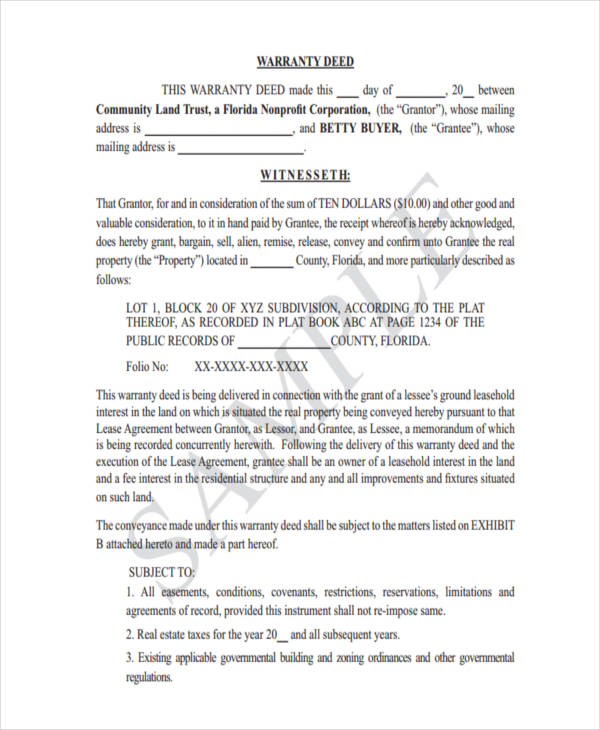

What Is a Warranty Deed?

A warranty deed is a document often used in real estate that provides the greatest amount of protection to the purchaser of a property. It pledges or warrants that the owner owns the property free and clear of any outstanding liens, mortgages, or other encumbrances against it.

How does a warranty deed work?

How Warranty Deeds Work. A deed is an important legal document that transfers property from one entity to another—often in the case of a real estate deal. A general warranty deed provides the buyer with the highest form of protection.

What is a quitclaim deed?

Quitclaim deeds offer less protection than a warranty deed. They release the owner or grantor's interest in the property and don't state whether they hold valid ownership in the first place. Instead, the assumption is that if the grantor ever did own it, any claim to the property is relinquished when the deed is signed. This type of deed also prevents the owner from any future interests in the property.

How many warranties does a special warranty deed have?

A special warranty deed is not nearly as comprehensive as its general counterpart, as it only conveys two warranties:

What is a deed pledge?

The deed pledges or warrants that the owner owns the property free and clear of any outstanding liens, mortgages, or other encumbrances. The grantor is responsible for a breach of any warranties and guarantees, therefore placing a great amount of risk upon the grantor.

What does a title company do?

A title company would provide a full title search and explore any other possible breaches before the property is transferred. Some of the covenants and protections granted through a warranty deed include: The grantor warrants that they the rightful owner of the property and has a legal right to transfer the title.

Why do you need title insurance on a deed?

For this reason, title insurance is used in most transactions to guard against possible claims and liens.

What Is a Warranty Deed?

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

How does a warranty deed work?

How Warranty Deeds Work. Warranty deeds provide the purchaser of the property with the highest form of protection, and are often used when a buyer wants to get financing for a mortgage or title insurance.

What are the two types of warranty deeds?

These two types of deeds are general warranty deeds and special warranty deeds.

Why is a warranty deed important?

Buying a house is a huge financial decision, so it’s important that certain precautions are taken to ensure your protection. A warranty deed is one precaution home buyers should be aware of, as it provides the greatest amount of protection to the buyer.

When is warranty deed required?

Warranty deeds may also be required when applying for a mortgage and when title insurance is used. This differs from the quitclaim deed because title insurance is not needed for this type of deed. A quitclaim deed is used when a property is transferred without a sale, for example, from one family member to another.

Who is the grantor of a property?

The grantor is the rightful owner of the property and has the legal right to transfer the title. The property is free and clear of all liens and outstanding claims. The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee’s title to the property.

Who owns the property on a warranty deed?

But generally, a warranty deed should specify: Who owns the property currently (also referred to as the grantor) The name of the person buying the home (also referred to as the grantee) A description of the property that’s being transferred.

Why do you need a warranty deed?

Warranty deeds are used to verify that there are no obstacles, such as outstanding liens, that could block the transfer of a property from the seller to the buyer. If you’re buying a home from someone you don’t know or selling a home, it’s important to understand how warranty deeds work and when they’re used.

What is required to be disclosed in a warranty deed?

For example, if the seller still has a mortgage on the property, owes outstanding property taxesor an easement exists those have to be noted in the warranty deed document.

How does a warranty deed work?

How Warranty Deeds Work. A warranty deed is essentially a tool for protecting the buyer when purchasing a home. Warranty deeds may be required as part of the underwriting process when financing a home purchase with a mortgage. You may also need one when purchasing title insurance for the property.

What does it mean to sign a warranty deed?

This usually means filing a lawsuit to prove there was a violation of the warranty deed terms.

What is a defective deed?

Deed documents are defective or faulty. An unrecorded deed or lien is later discovered. Title disputes can also occur if someone else lays claim to the property later. For example, say you buy a home from someone who offers a warranty deed. You buy the home, assuming there are no property claims.

What is quit claim deed?

In situations where the property is being transferred between two people who are related, they might use a quitclaim deedinstead. This type of deed essentially allows the seller to “quit” his or her interest in the home and transfer its ownership to someone else.

How does a warranty deed work?

While you might think of the parties involved in a real estate transaction as the seller and the buyer, a warranty deed uses more official legal language. The seller is the grantor - that's the current owner who's going to "grant" someone else the home - and the buyer is the grantee, the person who will now have complete stake in the property.

Example of a warranty deed

Let's say a plumber claims that he is still owed $800 for a job he performed when the previous owner occupied the home. A general warranty deed would stipulate that the previous owner must pay the bill.

General warranty deed vs. special warranty deed

There are two main types of warranty deeds: general warranty and special warranty.

Does a warranty deed mean you own the property?

A warranty deed doesn't technically mean you own the property; it means that the previous owner made you a guarantee that he or she owned it outright and that no one else can claim they are owed any money. The official evidence of your ownership of the property is the title.

How to get a warranty deed

Buying a home is a big deal - it'll likely be the biggest purchase you make in your life - so you want to make sure that no one else is going to challenge your rights to the property. Given what's at stake, a warranty deed is essential.

What is warranty deed?

A warranty deed is the most common type of deed used to transfer real property from a seller to a buyer in exchange for money or other assets. To explore this concept, consider the following warranty deed definition.

Why is a warranty deed so complicated?

A warranty deed can be complicated if the person creating it is inexperienced with real estate transactions. Many people enlist the assistance of a real estate attorney, or real estate professional to ensure there are no problems with the warranty deed.

What is a warranty on a property?

Just as the name implies, the buyer is given a full warranty from the seller that states that the property is not subject to any pending legal actions. This type of warranty is ideal for buyers who do not want to risk facing title challenges anytime in the future.

What is the primary deed type?

The primary deed types include the quitclaim deed, the grand deed, and the warranty deed. The warranty deed is the most comprehensive, as it not only transfers the seller’s ownership of the property, but also makes an explicit promise to the buyer that the property is free of liens or other claims of ownership.

What is statutory warranty deed?

A statutory warranty deed conveys the real property with the same covenants from the seller, including a promise that (1) he is the owner, (2) no one else possesses or has a claim to the property, and (3) that no one will interfere with the transfer. General and statutory warranty deeds work best in transactions where the buyer need assurances ...

What is a deed in real estate?

A deed is a legal document that transfers ownership of real property from one person or entity to another. There are several types of deed, each of which serves a different need of the parties involved in the transfer. The primary deed types include the quitclaim deed, the grand deed, and the warranty deed.

Who signs warranty deeds?

Whether the seller will retain an ownership interest until the time of his death. The completed warranty deed must be signed by the seller before a notary public, at which time it becomes a binding agreement. Finally, the deed must be filed with the county recorder of the county in which the property is located.

What is a special warranty deed?

A special warranty deed is a legal document that transfers ownership of real property from one person to another. This particular type of deed guarantees that there are no defects or problems with the title during the seller's ownership period, ...

What information is required on a special warranty deed?

Any type of deed has to contain the following information to be legal: Name and address of the person conveying the property, also known as the grantor. Name and address of the person receiving the property, also known as the grantee.

What happens when a bank forecloses on a property?

The bank forecloses on the property and then sells it to a new buyer. The special warranty deed that the bank provides to the new buyer provides no protection for the period of time before the bank took ownership of the property.

What is a grantor guarantee?

The grantor guarantees he or she has clear title only during his or her period of ownership and, if there is a problem with title during that period, the grantee is not entitled to compensation from the grantor. The guarantee does not cover the time period before the grantor owned the property.

How to protect yourself as a buyer?

The best way to protect yourself as a buyer is to buy title insurance when you purchase the property. The title insurance company will research the title to ensure it is clear and then provide insurance so that you have protection should there ever be an old claim that is brought against your title. A special warranty deed provides the buyer ...

Who is the legal owner of a property?

The grantor is the legal owner of the property and has the legal right to transfer the property. There are no outstanding claims against the property by any creditor or anyone else that were instituted during the grantor 's ownership period. The grantor guarantees he or she has clear title only during his or her period of ownership and, ...

Is there a warranty on a title deed?

A general warranty deed promises there are no title defects at all, during any time period.

What is warranty deed?

Warranty deeds are the most comprehensive type of deed, and they give the buyer a lot of protection.

What is a warranty deed in California?

In California, warranty deeds are called grant deeds. There is only one type of grant deed, but it combines the general warranty deed and the special warranty deed by using a blank space where the term of the warranty would have appeared. The parties fill in the specific time agreed upon. In theory, any date range could be written in, although usually, it's either the period covered by a standard general or special warranty deed. The California grant deed contains two specific words found in warranty deeds: convey and warrant.

How many types of grant deeds are there?

There is only one type of grant deed, but it combines the general warranty deed and the special warranty deed by using a blank space where the term of the warranty would have appeared. The parties fill in the specific time agreed upon.

What are the two words in a California grant deed?

The California grant deed contains two specific words found in warranty deeds: convey and warrant.

What happens if the seller can't settle a claim?

What this means is that if for some reason the seller can not settle a claim, he may have to reimburse the buyer the full cost of the property, including any costs the buyer incurred in the interim such as maintenance, repair, tax, insurance and loan interest. Get the Best Mortgage Rate for You | SmartAsset.com.

What Is a Warranty Deed?

- A warranty deed is a legal real estate document that protects the buyer and ensures that the sell…

The two parties involved in a warranty deed are the seller, known as the grantor, and the buyer, or the grantee, and either party can be an individual or a business. - Most lenders require a warranty deed for properties they finance.

A warranty deed protects the buyer and ensures that the seller holds a free and clear title to a property without any outstanding liens or mortgages.

How Warranty Deeds Work

- A deed is a legal document that transfers real estate property from one entity to another as a sel…

A warranty deed holds the seller, or grantor, responsible for any breach after the title search, even if the breach occurred without their knowledge or during a period before the grantor owned the property. It ensures that the buyer will not be responsible for any past title defects or encumbran…

Types of Warranty Deeds

- • The grantor warrants that they are the rightful owner of the property and have the legal right to …

• The grantor warrants that the property is free and clear of all liens and that there are no outstanding claims on the property from a creditor who may claim it as collateral. - • A guarantee that the title can withstand any third-party claims to ownership of the property.

• Conveys that the grantor holds the title and there has been no encumbrance of the property during the grantor’s ownership period of the property.

How to Get a Warranty Deed

- A real estate agent or real estate lawyer can help both buyers and sellers obtain a warranty deed…

As a seller or grantor, having a warranty deed in place will give potential buyers some assurance concerning the property. A buyer will likely look for the highest level of protection and peace of mind when investing in real estate. If there are no outstanding liens or claims on the title of the p…

Other Types of Deeds

- The quitclaim deed transfers property from one individual to another without a sale, usually bet…

A deed in lieu transfers the property to the lender through a deed in lieu of foreclosure when a borrower defaults on their mortgage and avoids registering a foreclosure on the borrower's credit history.

What Is the Difference Between Title Insurance and a Warranty Deed?

- A title company completes a title search and examines public records for any issues or errors. The guarantees and disclosures in a general warranty deed allow the new owner to hold the former owner responsible if there is a title defect or if a claim is made against the title. Title insurance covers a wider range of potential claims than the general warranty deed does, includin…

What Are Examples of Claims That Are Protected by Warranty Deeds?

- A buyer, or new owner, will be protected from previous owner's fines issued because of code violations, or if a previous owner failed to pay HOA fees.

What Are the Risks of a Special Warranty Deed?

- Unlike a general warranty deed, the seller is not liable for any title issues that could have occurred before they took ownership. This creates a risk for a buyer because they will have no legal protection for any potential title issues that could arise after the real estate transaction is complete.

The Bottom Line

- A warranty deed is a real estate document that ensures that the property has a clear title and the seller has no outstanding liens or mortgages. A combination of a warranty deed, a title search, and title insurance provides the highest protection to a buyer of real estate and ensures that defects in the title do not exist and that there will be no future claims to the property title.