How do amortization schedules work and when are they used?

- Add extra dollars to your monthly payment. If your total mortgage loan is $100,000 and your fixed monthly payment is $500, add $100 or more to each monthly mortgage payment ...

- Make a lump-sum payment. There's no law that says you have to spend a raise, bonus or inheritance. ...

- Make bi-weekly payments. ...

How to calculate an amortization schedule?

Use the concept of amortization to make smart choices about your finances.

- Whenever possible, make extra payments to reduce the principal amount of your loan faster. ...

- Consider the interest rate on the debts you have outstanding. ...

- You can find loan amortization calculators on the Internet. ...

- Use the $10,000 figure and calculate your amortization over the remaining term of the loan. ...

How do I calculate the loan amortization schedule?

n = number of payments over the loan’s lifetime. Multiply the number of years in your loan term by 12 (the number of months in a year) to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments (30x12=360).

How to build your own amortization schedule?

- Keeping track of the total value of home equity (ownership) you have built up in the house. ...

- Keeping track of the percentage of ownership you currently have in the house (this is also called percent equity). ...

- Also, in Column D, as you pay off your monthly payments, record the monthly payment amounts in this spreadsheet. ...

Does amortization increase over time?

Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period of time.

How is amortization schedule determined?

To calculate amortization, start by dividing the loan's interest rate by 12 to find the monthly interest rate. Then, multiply the monthly interest rate by the principal amount to find the first month's interest. Next, subtract the first month's interest from the monthly payment to find the principal payment amount.

How do you update an amortization schedule?

9:5711:00How To Create an Amortization Table In Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd how the beginning balance and the end imbalance will change now once you create thisMoreAnd how the beginning balance and the end imbalance will change now once you create this amortization schedule you can play around with it you can adjust the interest rate of them of your loan.

Does amortization go up or down?

Typically, the majority of each payment at the beginning of the loan term pays for interest and a smaller amount pays down the principal balance. Assuming regular payments, more of each following payment pays down your principal. This reduction of debt over time is amortization.

Are there different types of amortization schedules?

Amortization methods include the straight line, declining balance, annuity, bullet, balloon, and negative amortization.

What does 10 year term 30-year amortization mean?

It provides you the security of an interest rate and a monthly payment that is fixed for the first 10 years; then, makes available the option of paying the outstanding balance in full or elect to amortize the remaining balance over the final 20 years at our current 30-year fixed rate, but no more than 3% above your ...

What happens if I make two extra mortgage payments a year?

Making additional principal payments will shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down faster, you'll have fewer total payments to make, in-turn leading to more savings.

Can I make my own amortization schedule?

You can build your own amortization schedule and include an extra payment each year to see how much that will affect the amount of time it takes to pay off the loan and lower the interest charges.

How can I pay my mortgage off quicker?

How to Pay Off Your Mortgage FasterMake biweekly payments.Budget for an extra payment each year.Send extra money for the principal each month.Recast your mortgage.Refinance your mortgage.Select a flexible-term mortgage.Consider an adjustable-rate mortgage.

How can I pay off my 30-year mortgage in 10 years?

How to Pay Your 30-Year Mortgage in 10 YearsBuy a Smaller Home. Really consider how much home you need to buy. ... Make a Bigger Down Payment. ... Get Rid of High-Interest Debt First. ... Prioritize Your Mortgage Payments. ... Make a Bigger Payment Each Month. ... Put Windfalls Toward Your Principal. ... Earn Side Income. ... Refinance Your Mortgage.More items...•

What is better 25 or 30-year amortization?

Improves purchasing power: A 30-year amortization improves purchasing power by approximately 16.6% versus a 25 year amortization. If it means getting into the right house, it could very well be worth it.

Do monthly mortgage payments decrease over time?

Tip: A mortgage payment doesn't decrease over time as it is paid off, like it might with a credit card or revolving account like a HELOC. Instead, the monthly payment is pre-determined for the life of the loan using an amortization schedule, even if you chip away at it along the way.

What is amortization schedule?

What Is an Amortization Schedule? An amortization schedule is a complete table of periodic loan payments, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the end of its term. Each periodic payment is the same amount in total for each period.

What happens if you have a shorter amortization period?

If a borrower chooses a shorter amortization period for their mortgage —for example, 15 years—they will save considerably on interest over the life of the loan, and they will own the house sooner. Also, interest rates on shorter-term loans are often at a discount compared to longer-term loans.

What is the majority of each payment in a mortgage schedule?

However, early in the schedule, the majority of each payment is what is owed in interest; later in the schedule, the majority of each payment covers the loan's principal . The last line of the schedule shows the borrower’s total interest and principal payments for the entire loan term.

How long is a short amortization mortgage?

Short amortization mortgages are good options for borrowers who can handle higher monthly payments without hardship; they still involve making 180 sequential payments (15 years x 12 months). It's important to consider whether or not you can maintain that level of payment.

How to calculate monthly payment?

How to calculate the total monthly payment 1 i = monthly interest rate. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 6%, your monthly interest rate will be .005 (.06 annual interest rate / 12 months). 2 n = number of payments over the loan’s lifetime. Multiply the number of years in your loan term by 12. For example, a 30-year mortgage loan would have 360 payments (30 years x 12 months).

How does amortization work?

How do amortization schedules work? Amortization is the simplest way to pay off a large loan, like a home loan. Financial lenders use amortization schedules to present a loan repayment timeline based on a specific maturity date.

Why is amortization important?

At its core, loan amortization helps you budget for large debts like mortgages or car loans. It’s also a useful tool to demonstrate how borrowing works. By understanding your payment process up front, you can see that sometimes lower monthly installments can result in larger interest payments over time, for example.

What is amortization on a home loan?

When it comes to home loans, amortization is simply the long-term process of paying off a debt with regular fixed payments. An amortization period is the period in which it takes to reduce or pay off your debt. Amortization payments usually remain consistent over time and are determined by an amortization schedule.

Is amortization important for a home buyer?

In addition to earning you a zillion Scrabble points, amortization is an important concept for every home buyer to comprehend. After all, it’s the secret to understanding your mortgage loan and paying it down over time. And for a debt as large as a home, that’s a secret you should know! If you’re taking on a mortgage, ...

Why does amortization schedule matter?

“Amortization matters because the quicker you can amortize your loan, the faster you will build equity and the more money you can save over the life of your loan ,” says real estate investor and flipper Luke Smith.

How does amortization work?

How mortgage amortization works. If the amount you borrow for a mortgage loan is scheduled to be repaid in installments, your loan is amortized. “Loan amortization is the process of calculating the loan payments that amortize — meaning pay off — the loan amount,” explains Robert Johnson, professor of finance at Heider College of Business, ...

What is amortization on a mortgage?

What is mortgage loan amortization? “Mortgage loan amortization” is the process of paying a home loan down to $0. A mortgage — or any other type of loan — is “amortized” if it’s paid in regular installments and will be fully paid off after a set period of time. Your mortgage amortization schedule determines when your home will be paid off ...

Why do most lenders not offer amortized loans?

Most lenders don’t offer these — and most home buyers don’t want them — because these loans are riskier and don’t help the borrower build equity as quickly. With an amortized loan, your mortgage is guaranteed to be paid off by the end of the term as long as you make all your payments over the full life of the loan.

What are the benefits of a short term loan?

Benefits of a short-term loan. The obvious benefit of a shorter amortization schedule is that you’ll save a lot of money on interest. For example, consider a $250,000 mortgage at a 3.5% interest rate: A 30-year fixed loan would cost you $154,000 in total interest. A 15-year loan would cost you only $46,000 in total interest.

What happens if you take out the same loan with a 15 year term?

If you took out the same loan amount ($250,000) with a 15-year term instead of a 30-year term, you will have paid off half the loan’s principal in year 9. So a shorter repayment schedule doesn’t just help you save money on interest — it also helps you build tappable home equity more quickly.

Is a mortgage fully amortized?

Almost all mortgages are fully amortized — meaning the loan balance reaches $0 at the end of the loan term. The exceptions are uncommon loan types, like balloon mortgages (which require a large payment at the end) or interest-only mortgages.

What happens if you have a shorter amortization period?

If you choose a shorter amortization period— for example, 15 years —you will have higher monthly payments, but you will also save considerably on interest over the life of the loan, and you will own your home sooner. Also, interest rates on shorter loans are typically lower than those for longer terms.

What is amortization period?

The amortization period refers to the length of time, in years, that a borrower chooses to pay off a mortgage. While the most popular type is the 30-year, fixed-rate mortgage, buyers have other options, including 25-year and 15-year mortgages.

How does amortization affect a mortgage?

The amortization period affects not only how long it will take to repay the loan, but how much interest will be paid over the life of the mortgage. Longer amortization periods typically involve smaller monthly payments and higher total interest costs over the life of the loan.

Can you pay off a mortgage faster with an accelerated amortization?

Even with a longer amortization mortgage, it is possible to save money on interest and pay off the loan faster through accelerated amortization. This strategy involves adding extra payments to your monthly mortgage bill, potentially saving you tens of thousands of dollars and allowing you to be debt-free (at least in terms of the mortgage) years sooner.

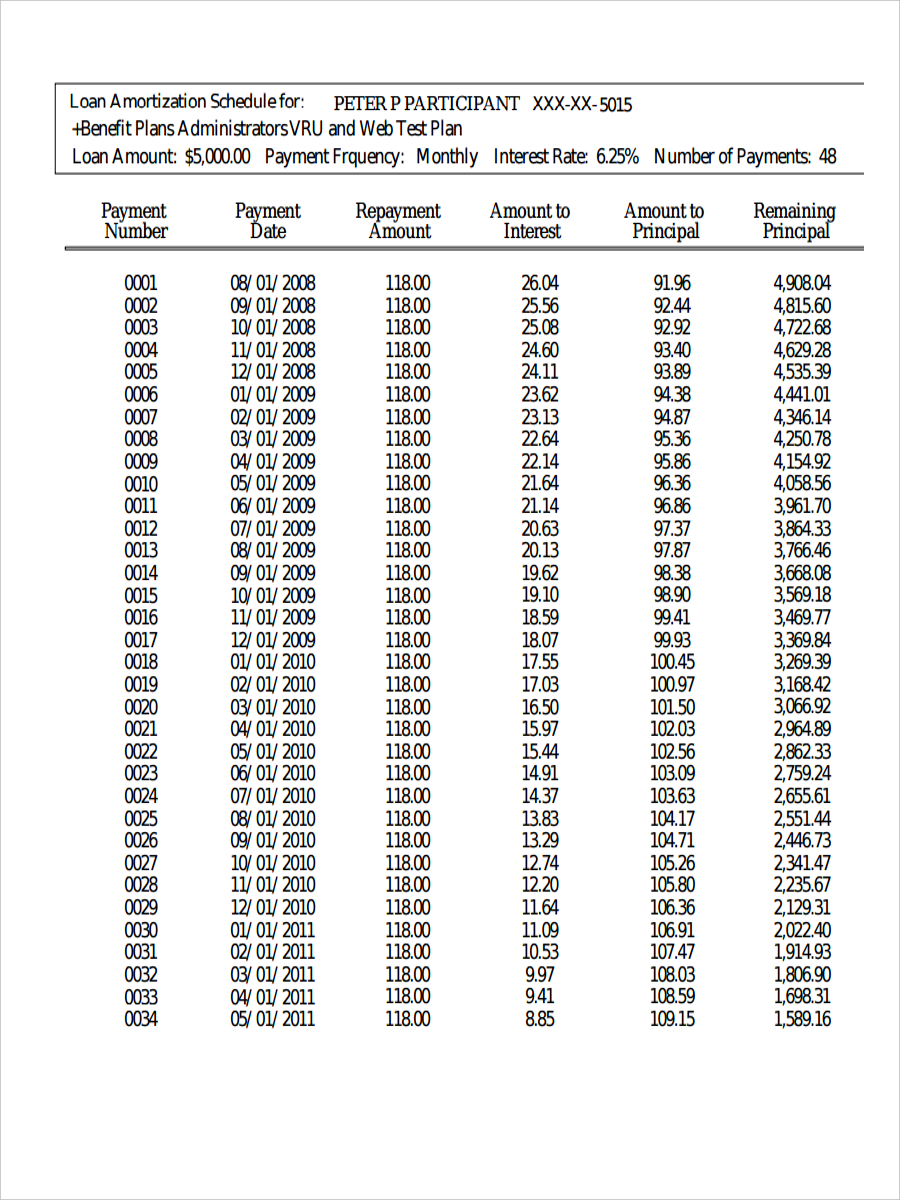

What is an amortization table?

Specifically, the amortization table shows how much you are paying toward the principal and how much you are paying toward interest in each scheduled payment. The amortization table is essentially a visualization of the amortization schedule. An amortization schedule is a specific type of payment schedule.

What is the difference between an amortizing loan and a non-amortizing loan?

The difference between an amortizing and a non-amortizing loan is that the interest does not compound on a non-amortizing loan. In other words, the amount of interest you pay each payment period remains the same.

What is a payment schedule?

A payment schedule is simply a schedule of all the payments you have to make throughout the term of the loan. It shows the dates of each of your payments and the payment amount—the first four to six columns from the amortization schedule above, basically. However, it doesn’t break down how much of your payment goes towards interest ...

What happens when you go down the length of your payment?

As you go down the length of your payment, you can watch the principal portion increase while the interest amount decreases. That’s because your beginning balance drops with each payment, so naturally the interest on that amount is lower.

Can you pay back a non-amortizing loan early?

The main benefit of an amortizing loan is that often it can be paid back early—thereby saving the borrower from paying additional interest on the loan. Non-amortizing loans cannot be prepaid (or have penalties for prepayment ), to ensure that the lender receives full interest on the loan.

Do you pay interest upfront on an amortizing loan?

If you have an amortizing loan, every payment you make isn’t equally split between principal and interest. In fact, with amortizing loans, borrowers usually pay more of the interest upfront, leaving the principal for the end of a loan’s term. In other words, while you might be paying the same amount for that loan every week or month, ...

Is compounded interest higher than the first payment?

It comes down to the fact that the amount you owe when you make your first payment is greater than the amount you owe when you make subsequent payments. So when you apply the compounded interest rate to your initial balance, you come out with a much higher interest payment than for the balance of the last payment.

What is amortization in mortgage?

Loan amortization is the reduction of debt by regular payments of principal and interest over a period of time. For example, if you make a monthly mortgage payment, a portion of that payment covers interest and a portion pays down your principal. Typically, the majority of each payment at the beginning of the loan term pays for interest ...

Why is paying down the principal on a fixed rate loan important?

Because interest is calculated against the principal balance, paying down the principal in less time on a fixed-rate loan reduces the interest you’ll pay. Even small additional principal payments can help. Here are a few example scenarios with some estimated results for additional payments.

What is amortization in mortgage?

Mortgage amortization is the process of the principal balance declining as you make payments. In the early years of a mortgage, the majority of your payment is applied towards interest. Most mortgages amortize automatically, provided you make the minimum payments.

What happens when you refinance a mortgage?

When you refinance, the amortization schedule is recalculated to reflect the terms of the new loan. If you can lower your payment by locking in at a lower rate, consider applying some of the money you save towards the loan to pay it off faster. References. The Truth About Mortgage: Rate and Term Refinance.

What to do if you can't commit to a biweekly payment schedule?

If you cannot commit to a bi-weekly payment schedule, consider making a higher loan payment when you can afford it. Use a gift, bonus or your tax refund to make the additional payment annually. Along with your payment, include a note indicating that you want the extra money applied towards the principal.

Understanding Amortization Schedules

Example of Amortization Schedule

- Consider a $30,000 fully amortizing loan with a term of five years and a fixed interest rate of 6%. Payments are made on a monthly basis. The following table shows the amortization schedule for the first and last six months. The loan is fully amortized with a fixed total payment of $579.98 every month. The interest payment for each month can be calculated by multiplying the periodic …

Methods For Amortization Schedule

- There are multiple methods to amortize a loan. Different methods lead to different amortization schedules.

More Resources

- Thank you for reading CFI’s guide to Amortization Schedule. To keep advancing your career, the additional resources below will be useful: 1. Free Fundamentals of Credit Course 2. Annual Percentage Rate (APR) 3. Loan Structure 4. Interest Expense 5. Non-Amortizing Loan