As noted, PIP coverage is not available for purchase in California. However, there is an alternative option for California drivers who like the idea of a PIP policy. Med Pay policies function similarly to PIP policies for the most part and are offered by California insurance providers as an add on.

What is PIP insurance?

Why is PIP insurance compulsory?

What are the facts about liability insurance in California?

How long does it take for a PIP to be paid?

Is PIP a guarantee?

Do you need liability insurance for a hit and run?

Can you fail a PIP case?

See 2 more

Does California have PIP or MedPay?

No, personal injury protection (PIP) is not required in California. PIP is not even available in California. Instead of PIP insurance, California insurance companies offer medical payments insurance (sometimes called MedPay), which helps with hospital bills resulting from a car accident.

What states have no PIP?

As of December 2021, twelve US states – Delaware, Florida, Hawaii, Kansas, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, and Utah – require PIP coverage, according to credit monitoring agency Wallethub. All these states, except for Delaware, implement a no-fault system.

Is medical payments coverage required in California?

You must be offered this coverage, but you can choose not to buy it. Medical Payments Coverage pays limited medical expenses for people injured in the car you are driving when you have an accident, whether or not you are at fault.

What is the minimum property damage coverage in California?

$5,000Here are the minimum liability insurance requirements (per California Insurance Code §11580.1b): $15,000 for injury/death to one person. $30,000 for injury/death to more than one person. $5,000 for damage to property.

Does California have no fault insurance?

One of the first thoughts that many drivers have surrounding accidents is whether their state has a no-fault policy regarding crashes. California is one of 38 states that does not subscribe to a no-fault policy. This means whoever is responsible for the accident will be liable to pay for the damages.

Should you add PIP insurance?

In states where PIP is optional, it's generally a good coverage to have. That's because PIP can help cover expenses, such as your health insurance deductible, lost wages and replacement services for tasks you cannot perform due to your injuries, such as child care or house cleaning.

How does Med Pay work in California?

If you, or any of your passengers, are injured in an automobile accident in California, whether it is your fault, or the other driver's fault, your insurance with Med Pay coverage will be responsible for paying all of your (and your passenger's) reasonable and necessary medical bills as a result of any bodily injury ...

What happens if the person at fault in an accident has no insurance in California?

California maintains a “No Pay, No Play” rule for drivers that are involved in accidents and are uninsured. This rule limits the amount of compensation that uninsured drivers can recover in a crash.

What is considered full coverage insurance in California?

Full coverage insurance in California is usually defined as a policy that provides more than the state's minimum liability coverage, which is $15,000 in bodily injury coverage per person, up to $30,000 per accident, and $5,000 in property damage coverage.

Is GEICO leaving California?

There is no effect on claims, and our claims team remains available to assist all customers,” the company told RDN. “We continue to write policies in California, and we remain available through our direct channels for the more than 2.18 million California customers presently insured with us,” the carrier said.

Why did GEICO close in California?

The Chronicle reports that insurance industry magazines linked Geico's decision to close California sales offices to its failure to raise insurance prices in compliance with Sacramento regulations and other market forces.

What type of insurance is required in California?

What type of insurance is required in California? Liability insurance is the only type required for California drivers. They are required to have both bodily injury and property damage liability coverage.

Do you have to have PIP in Texas?

In Texas, personal injury protection (PIP) insurance is mandatory, unless you sign a waiver declining the coverage. Rejecting the coverage may leave you unprotected if you're suddenly injured in an accident and face high medical bills or lost wages.

Is PIP mandatory in Illinois?

Personal injury protection or PIP coverage is not required in Illinois. This coverage pays for the drivers and their passengers' medical injuries in case of an accident, regardless of who is at fault.

Does Louisiana have PIP?

No, personal injury protection (PIP) is not required in Louisiana. PIP is not even available in Louisiana. Instead of PIP insurance, Louisiana insurance companies offer medical payments insurance (sometimes called MedPay), which helps with hospital bills resulting from a car accident.

Is New York a PIP state?

New York is a no-fault state, and personal injury protection is a mandatory form of auto insurance for all drivers. New York PIP insurance covers three things: medical costs, economic losses and death benefits. The minimum amount of PIP you can purchase in New York is $50,000.

List of PIP States in 2022 - WalletHub

You need personal injury protection (PIP) insurance if you live in one of the 12 states that require it. You should also get PIP if your health insurance has low coverage limits or if you drive with passengers who could hold you responsible for their medical expenses in the event of an accident. … read full answer

What Does California Personal Injury Protection (PIP) Cover?

Apr.29.2021; Injury & Accident Articles; Hurt in an accident? Having personal injury protection (PIP) or Med Pay can help cover your injuries. Contact Wakeford Law today to schedule a free, no-obligation consultation: (415) 578-3510

Difference Between Med Pay and PIP Coverage | Infinity Insurance

You need to understand the difference between Med Pay and Personal Injury Protection when you are selecting your auto insurance coverage. Infinity Auto Insurance will be happy to provide you with additional details on these two types of coverage, with information directly related to your needs.

PIP vs. MedPay — Do I Need Both to Drive in Maryland?

We are pleased to communicate with you concerning legal matters. However, if you communicate with us through this website regarding a matter for which our firm DOES NOT ALREADY REPRESENT YOU, your communication may NOT be treated as privileged or confidential, and shall NOT be deemed to create an attorney/client relationship.

The Relationship Between PIP and Uninsured Motorist Coverage

If you are injured in an auto accident with an uninsured motorist, there are several coverages that may come into play with your claim. Of course, if you have uninsured motorist coverage (UM) , it will take the place of the liability insurance that the other driver should have had. But what if you also have personal […]

California Insurance Requirements

Each state in the US requires all drivers to maintain some form of automobile insurance policy. Insurance requirements ensure that all drivers maintain responsibility for the damages their vehicles cause or sustain. California is no different.

How PIP Differs from Other Forms of Insurance

PIP and Med Pay policies differ from general liability insurance policies in that they cover you, the policyholder, specifically. Generally, your basic liability insurance covers damage that you cause to others.

Med Pay: A California Personal Injury Protection Alternative

As noted, PIP coverage is not available for purchase in California. However, there is an alternative option for California drivers who like the idea of a PIP policy.

PIP and No-Fault Systems

In the US, there are two basic systems of liability assessment when it comes to car accidents: fault systems and no-fault systems. In a no-fault system, the question of who is at fault for an accident does not necessarily arise when assessing liability for damages.

At-Fault Systems and PIP

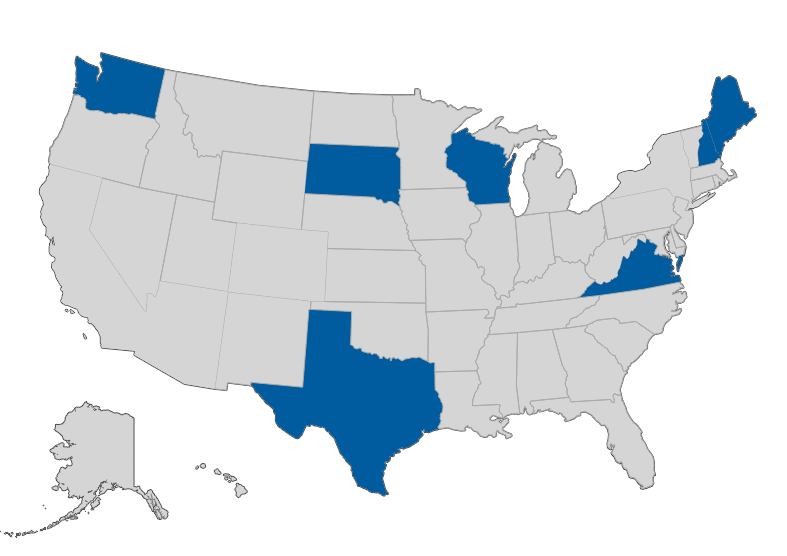

There are 29 states in the US, including California, where you cannot purchase a PIP policy. Most states that require drivers to have PIP policies use a no fault system in assessing liability for car accident damages.

After a Car Accident in California

A car accident can upend the normalcy of your life in an instant, but The Wakeford Law Firm can help you get back on track as soon as possible.

How much is PIP coverage?

The minimum PIP coverage you can buy is $1,000 for each person injured in an accident, while bodily liability insurance must be a minimum of what is known as “15/30” insurance according to California law. This means it covers $15,000 for bodily injuries or the death of anyone person or up to a maximum of $30,000 for the wrongful death ...

How Does PIP Coverage Work?

If you are injured in a motor vehicle accident, then the wisest option is often to use your PIP benefits to pay for your medical expenses before you claim from your other insurance. If you happen to live in a no-fault state where PIP insurance is mandatory, then you can’t claim from your health insurance until after you’ve filed a PIP claim.

What Is Personal Injury Protection?

Also known as PIP insurance and sometimes Med-Pay, it is a type of insurance that covers medical expenses for you and your passengers if you are involved in an accident – regardless of who caused the accident. Depending on your insurance provider and/or specific policy, there are several things that a Personal Injury Protection policy may cover. These usually include:

What Is the Difference Between PIP and Bodily Injury Liability Insurance?

Bodily injury liability insurance and personal injury protection are nearly identical, so it’s understandable why some people think they are the same thing. But when you find out that bodily injury liability coverage is mandatory in California and PIP is not, things start to get a little bit confusing.

How long does it take for a PIP to pay out?

A personal injury claim can take months to be settled and paid out. However, PIP insurance is designed to pay out as quickly as possible. This is especially true if there are medical expenses involved – making sure accident victims receive the payments and benefits necessary to ensure they receive the best care is the whole reason these policies exist.

What states require persona injury coverage?

There are 13 states, including Florida, Kentucky and Kansas, where persona injury cover is mandatory.

What happens if you have insurance that doesn't cover all the costs?

Some insurance policies already provide additional cover for if you happen to be involved in an accident with someone who is uninsured, or if the insurance they have doesn’t cover all the costs/damage they are liable for and they’re unable to cover the balance.

What is PIP insurance?

PIP insurance may overlap with another kind of car insurance known as Medical Payments, or MedPay. Like PIP, MedPay covers the costs of medical care resulting from of an accident, no matter who was at fault. Also like PIP, MedPay covers injuries to any passengers in your car.

Which states require PIP?

You will need personal injury protection (PIP) insurance if you live in one of the 12 states that require it. Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah all require PIP insurance. You may also need PIP if your health insurance has.

What is the maximum amount of PIP in Utah?

State limits on PIP vary widely, from $3,000 in Utah to New York’s $50,000 requirement. If your state has a low upper limit on PIP, MedPay coverage could act as a beneficial supplement. In a couple states – namely, Maine and New Hampshire – MedPay is used instead of PIP. show less.

What is PIP insurance in New Hampshire?

In New Hampshire, this minimum only applies to drivers who decide to purchase coverage. PIP insurance covers medical expenses for you and your passengers after an accident, no matter who is at fault. These expenses include ambulance fees, medical and surgical treatments, and prescriptions.

What is medical insurance in California?

Instead of PIP insurance, California insurance companies offer medical payments insurance (sometimes called MedPay), which helps with hospital bills resulting from a car accident. MedPay is similar to PIP insurance in that both handle your medical bills even if you cause a car accident. But MedPay covers less than personal injury protection, ...

Does PIP have a deductible?

If you are in a car accident, PIP often works in conjunction with your health insurance coverage. Most health insurance deductibles must be paid before benefits start to be paid out, but your PIP may have a cheaper deductible, or no deductible at all.

Does PIP cover medical expenses?

In the 20 states (plus Washington, D.C.) where it is required or offered as optional protection, PIP covers medical expenses for the policyholder and his or her passengers after an accident, no matter who was at fault. However, PIP is not available at all in the 30 other states.

Which states require PIP insurance?

The thirteen states that require PIP insurance, also known as personal injury protection, are Delaware, Florida, Hawaii, Kansas, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, and Utah.

What does PIP cover?

PIP insurance covers medical expenses for you and your passengers after an accident, no matter who is at fault. These expenses include ambulance fees, medical and surgical treatments, and prescriptions. PIP can also reimburse you for lost wages, home care expenses, and even funeral expenses.

What does PIP insurance cover?

PIP insurance covers the policyholder, other named drivers, and their passengers. Personal injury protection (PIP) will pay for the medical expenses of any covered individual after a crash, regardless of who was responsible.

What does PIP cover?

PIP insurance is available in 21 states and covers medical expenses, legal fees, and lost wages after a car accident regardless of who was responsible. Besides covering the policyholder, PIP applies to passengers in the policyholder's car, too. It also applies to named drivers on the policy who are hit by a car while biking or walking.

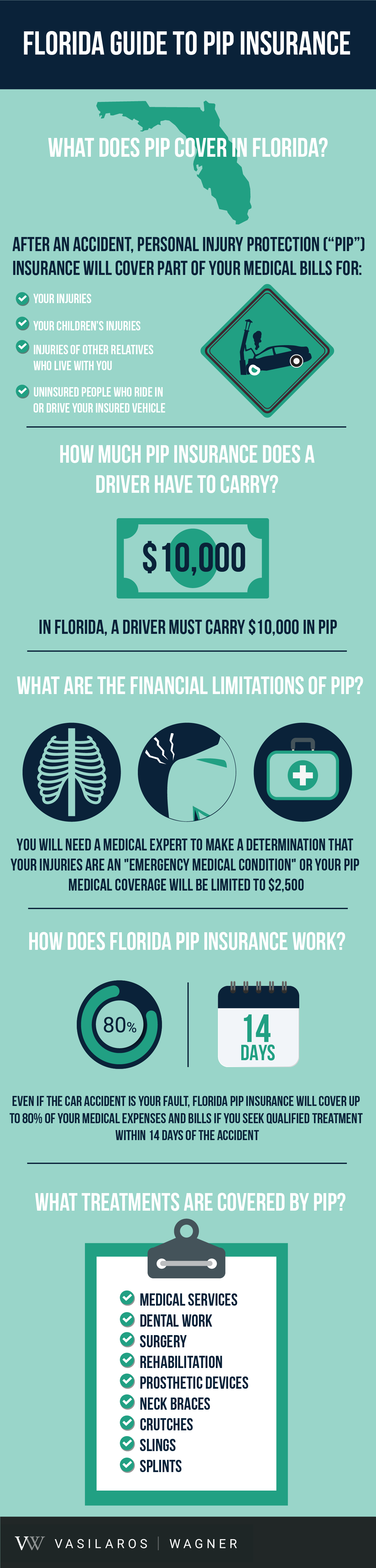

How much does Florida PIP cover?

Florida PIP is also different from other states because it covers only 80% of your medical expenses and 60% of your lost wages. For example, if your medical bills are $10,000, PIP will cover $8,000 of them. If your injury is not considered an emergency, your benefits are limited to only $2,500.

Does PIP cover long term expenses?

However, you should keep in mind that PIP also covers certain long-term expenses that don't typically fall under health insurance, like lost income and household services. Additionally, PIP can help cover the deductibles and copays that you're typically required to pay with health insurance, so you'll have fewer out-of-pocket costs.

Does PIP cover lost wages?

Also like PIP, MedPay covers injuries to any passengers in your car. However, it does not pay for lost wages, rehabilitation or home-care services, which PIP would cover.

Does PIP insurance cover medical bills?

While PIP insurance pays for the policyholder’s own medical bills, regardless of fault, bodily injury liability coverage pays for other people’s medical expenses when the policyholder is at fault in an accident. Bodily injury liability coverage is a main component of liability auto insurance and is required in almost every state

Do you have to pay for medical expenses if you are injured?

Most states that require PIP are no-fault states, which require each person to cover their own medical expenses if they’re injured in an accident, regardless of who is responsible. In these states, you only have to deal with your own insurance company for medical claims, since fault doesn’t affect your ability to get coverage. Additionally, you are not permitted to sue the other driver for compensation for your injuries unless they are severe.

Who is covered by PIP?

Who’s covered: You and household members who are injured or killed in your vehicle; people who aren’t members of your household if they don’t have their own PIP coverage; and pedestrians and cyclists struck by your car.

What is PIP insurance?

But variations in state laws can make PIP tricky to pin down. Many states require PIP as part of their “no-fault auto insurance” laws, which limit your ability to sue someone for car crash injuries.

What is the death benefit for Florida PIP?

Death benefits are $5,000 per person and are in addition to the medical and disability benefits.

How much is PIP coverage in Kentucky?

Who’s covered: Any person injured in a vehicle that has PIP coverage, or any pedestrian struck by the vehicle. Details: The minimum Kentucky PIP coverage is $10,000 for medical expenses, lost wages up to $200 per week, replacement services and survivor’s benefits.

What is a PIP claim in Connecticut?

PIP is optional and called basic reparations coverage in Connecticut. Average PIP claim: $4,989. Who’s covered: You and relatives living with you who are injured or killed in a car accident. Details: In Connecticut you can choose basic reparation insurance or medical payments coverage, or neither.

How much is a PIP in Kansas?

PIP is required in Kansas. Average PIP claim: $4,013. Who’s covered : You, relatives in your household, anyone driving your car, passengers in your car and anyone struck by your car while not riding in it. Details: Here’s how Kansas breaks down the minimum PIP benefits required by law.

What is PIP for car accident?

Funeral expenses and survivor benefits. A goal of PIP is to provide prompt payment for car accident injuries.

What is PIP insurance?

Personal Injury Insurance outside of California (in the “No-Fault States”) Personal injury insurance, also called personal injury protection insurance, or PIP, for short, is a type of insurance that protects you from the costs associated with a traffic accident, whether you are at fault or not. In 13 U.S. states, like Florida, Kentucky ...

Why is PIP insurance compulsory?

The reasoning behind compulsory PIP cover in these states is to limit the number of personal injury lawsuits, court time taken up by such lawsuits and the amount of compensation which can be demanded in such lawsuits. Most PIP insurance covers: the cost of personal medical treatment; compensation for lost earnings;

What are the facts about liability insurance in California?

Typically, there are two firm facts that most motorists agree upon. Those are that: 1. No one likes insurance (especially paying for it); and 2. No one wants to be involved in an accident! These two facts are interrelated, because it is compulsory to take out liability insurance for any street-legal motorized vehicle in California, whether you think you are likely to ever have an accident or not. At the same time you would never want to be in a situation where you did get into an accident and you weren’t insured. Liability insurance covers the possibility in which you are at fault and cause an injury to someone else, but what about personal injury insurance that protects YOU if someone else is at fault?

How long does it take for a PIP to be paid?

A personal injury claim may take months or even years if a lawsuit is filed.

Is PIP a guarantee?

However, if the person who caused the accident doesn’t have good insurance coverage, you still won’t get compensated for your pain and suffering. So, med-pay coverage is a “guaranteed” coverage.

Do you need liability insurance for a hit and run?

In the case of an injury caused by a hit and run incident, there is very little that can be done unless the hit and run driver is found by the police and brought to justice. Even if this does eventuate, there would still be a need for the at-fault driver to have sufficient liability insurance. Whatever the charges made against the hit and run driver by law and enforcement authorities it is not going to really help you, the injured victim. So, do yourself a favor and make sure you have personal injury insurance (med-pay, uninsured and underinsured) coverage today!

Can you fail a PIP case?

Not to mention, your case could fail if the amount of evidence you have that the other driver was responsible for your injuries is insufficient to convince the insurer or a judge if the lawsuit goes to court. That sort of outcome could leave a seriously injured accident victim out of pocket and struggling to survive financially. With PIP (or med-pay) you won’t be left high and dry.

California Insurance Requirements

How Pip Differs from Other Forms of Insurance

Med Pay: A California Personal Injury Protection Alternative

Pip and No-Fault Systems

At-Fault Systems and Pip

- There are 29 states in the US, including California, where you cannot purchase a PIP policy. Most states that require drivers to have PIP policies use a no fault system in assessing liability for car accident damages. Conversely, the states where PIP coverage is not available all use an at-fault system in assessing car accident liability. Med Pay i...

After A Car Accident in California