Does Care Credit Hurt Your Credit? Does CareCredit do a hard pull? Well, if you only requested a prequalification, the process will only require a soft pull, so your credit score will not be impacted. However, to complete the entire CareCredit application, the process will trigger a hard pull. A hard pull will affect your credit score but generally no more than 10 points.

Full Answer

Is care credit a good card to have?

The CareCredit card is a winner if you need a convenient, flexible way to pay for one-time or recurring medical expenses. The no interest promotional financing is its most attractive feature but...

Do taxes affect your credit score?

“Tax liens no longer appear in credit reports, and therefore, do not influence credit scores,” said Rod Griffin, director of public education at Experian, in a news release. “That doesn’t mean the tax authorities won’t attempt to collect payment, it just means they are not part of your credit history anymore,” Griffin added.

Can refinancing affect your credit score?

Refinancing might lower your credit score by just a few points, but that’s inevitable when shopping for a new loan or credit account. Length of credit history – FICO monitors the age of your oldest credit account and newest account, and averages out the age of the others.

Do prepaid credit cards affect your credit score?

When you use a prepaid card, you use your own money, not an associated line of credit. Since you are not borrowing money, there is nothing to report to credit reporting agencies. On the bright side, using a prepaid card does not impact your credit score either.

Will CareCredit affect my credit score?

Plus, it's quick and there's no impact to your credit score to check. If you prequalify and then you apply, there will be a hard inquiry on your credit report.

How long does CareCredit stay on your credit report?

Once reported to your credit bureau, medical debt remains on your credit report for seven years, which is as long as any other collection debt.

Does CareCredit count as a credit card?

CareCredit is a healthcare credit card designed for your health and wellness needs for you, your entire family and your pets.

How much does CareCredit drop your credit score?

Does Applying For Care Credit Hurt (Or Affect) Your Credit Score? Applying for CareCredit creates a hard inquiry on your credit report — reducing your score by around 5 points.

What is the average credit score for CareCredit?

For the best approval odds with CareCredit, you'll need a credit score of 620 or higher. However, some users report approval with scores around 600. If you're score is lower than 600 you'll have a hard time getting approval.

Is CareCredit a hard or soft pull?

You can see if you prequalify by using our custom link or by going to carecredit.com. This is a soft inquiry and will have no impact on your credit score.

Will CareCredit raise my limit?

You can request a CareCredit Credit Card credit limit increase by calling customer service at (866) 893-7864. To raise your chances of being approved for a higher credit limit, pay your bill on time for at least six straight months, reduce your outstanding debt, and update the income Synchrony has on file.

Can CareCredit be used as a normal credit card?

In some sense, the CareCredit card works just like a regular credit card. The only difference is that you can only use it to cover traditional medical insurance copayments on covered services. The card can also be used for elective medical procedures that are not covered by traditional insurance plans.

Can I use CareCredit to buy anything?

Your CareCredit credit card can be used to pay for health, wellness and personal care items. This means you can use your card in the following departments: Pharmacy. Over-the-Counter (OTC) Medication.

What drops your credit score the most?

According to FICO data, a 30-day missed payment can drop a fair credit score anywhere from 17 to 37 points and a very good or excellent credit score to drop 63 to 83 points. But a longer, 90-day missed payment drops the same fair score 27 to 47 points and drops the excellent score as much as 113 to 133 points.

What is the lowest payment for CareCredit?

The CareCredit Credit Card minimum payment is $29 or 3.25% of the new balance – whichever is higher. More specifically, the CareCredit Credit Card minimum payment is the greater of: $29.

Does Amazon accept CareCredit?

No, Amazon does not accept Care Credit. Though they sell many health and wellness products, Care Credit cards are not accepted as a form of payment.

Is your credit cleared after 7 years?

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.

What is the 7 year credit rule?

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Does debt fall off after 7 years?

In most states, the debt itself does not expire or disappear until you pay it. Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that.

How long before credit card debt is written off?

Typically, a credit card company will write off a debt when it considers it uncollectable. In most cases, this happens after you have not made any payments for at least six months. However, each creditor has a different process for determining whether a debt is uncollectable.

Why is it important to know your credit score?

Staying aware of your credit scores helps you know whether or not you will be seen as an attractive borrower if you apply for financing. Landlords, potential employers, and insurance companies may also check your credit history, and your score can help them decide whether to rent to, hire, or do business with you.

How Many Credit Scoring Models are There?

There are also different credit scoring models used to assign you a credit score. Two of the most popular are:

How Many Credit Bureaus are There?

Here’s the breakdown. There are three major credit bureaus in the United States:

Do you need to keep track of all of your credit scores?

There’s little reason for you to try to keep track of every credit score you have, especially when lenders use their own proprietary scoring formulas. But, it’s a good idea to keep track of at least one or two of your scores.

What is credit utilization?

The amount of credit you’re using relative to the credit available to you (also known as “ credit utilization”)

Do All Credit Scoring Models Consider the Same Credit Score Factors?

While different scoring models may assign different weight to different criteria, all credit scoring models typically look at the same basic credit score factors to determine your credit standing.

Is the score on the letter accurate?

The score on the letter is "accurate;" however, what exactly it's accurate of, is hard to tell with the way the system works.

Can Care Credit use TU04?

The Care Credit application could've used either TU04, or TU08, and also a credit-enhanced pull. That could lead to a non-trivial variation in score; also, your inquiries may or may not have hurt you, it depends on whether they pulled the same bureau that GE did. It's also possible (again look at your letter) and see if the FICO trademark is on there or not... might've been an internal score though the range certainly matches a standard FICO pull.

What is a good credit score?

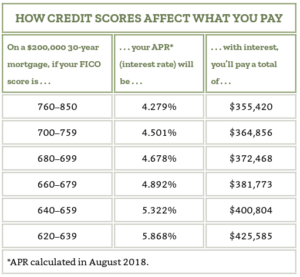

A healthy credit score (700 or above on a scale of 300 to 850) 1 helps consumers get credit at favorable interest rates, making it easier for them to handle large expenses with a credit card, get a mortgage on their dream home, or take out a loan to fund their education. Lower scores, on the other hand, can make it more difficult ...

How long does it take to bump up your credit score?

But a healthy credit score is a reflection of long-term financial stability. Expect the process to take a year or more. 7 Make it easier by keeping your old accounts open, even if you've paid them off. That way, your former successes will continue to impact your history.

What is the FICO score?

Your FICO Score, the number used by 90% of top lenders to determine whether you're a reasonable credit risk, 3 is most affected 4 by whether you make your payments on time. And that's not just your credit card payments, but also payments on your mortgage, utilities, and other bills.

What to do if your credit card balance keeps creeping up?

If the balance keeps creeping up, you can contact a credit counselor to help you successfully pay down your debt. 6.

Can lower credit score make it harder to get a loan?

Lower scores, on the other hand, can make it more difficult to get credit or loans, which can affect consumers' life plans and financial goals. It's possible to increase your credit score and keep it high by focusing on the five credit score factors: