Do Discover credit cards come with rental car insurance?

The only Discover card that offers primary rental car insurance is the Escape card; all other Discover cards provide secondary auto rental insurance only.

What car rental companies accept Discover?

Table of contents

- What is the requirement to apply for credit card in Malaysia?

- Can International apply for credit card?

- What is the requirement to apply for credit card?

- Can unemployed apply for credit card in Malaysia?

- Can foreigner apply credit card?

- Which bank gives credit card for international students?

- Are international students eligible for credit cards?

Does discover offer any debit cards?

The Discover Cashback Debit Account is a checking account that comes with a debit card that allows you to earn cashback on all of your purchases – which has traditionally been reserved for credit cards. You’ll earn 1% cashback on your purchases, up to $3,000 per month.

Is the Discover Card car rental insurance reliable?

Notably, Discover—one of the largest credit card issuers around—doesn’t offer rental car insurance with any of its cards. When you’re filling out the paperwork to get the keys to your rental car, the agent will often try to upsell you on optional rental car insurance.

How do I know if my credit card offers car rental insurance?

Understanding your credit card's coverage for rentals may be as simple as calling the phone number on the back of your card and asking the issuer. You could also check the "guide to benefits" provided by your card issuer.

Does Discover Card cover CDW?

Discover. Discover cards limit CDW coverage to $25,000 and don't cover loss of use fees. The Escape by Discover Card offers slightly better benefits. The rental period covered is 31 days, and you must decline rental insurance.

What credit cards take off rental car insurance?

The best credit cards for rental car insuranceChase Sapphire Reserve.Chase Sapphire Preferred Card.Capital One Venture X Rewards Credit Card.Ink Business Preferred Credit Card.Ink Business Cash Credit Card.Ink Business Unlimited Credit Card.United Explorer Card.United Quest Card.More items...•

What are the benefits of having a Discover card?

Spending rewardsCash back in popular areas.Redemption flexibility.A long 0% intro APR period.A valuable sign-up bonus for new cardholders.No late fee the first time you pay late.No foreign transaction fees.An account-freezing function.Social Security number alerts.More items...

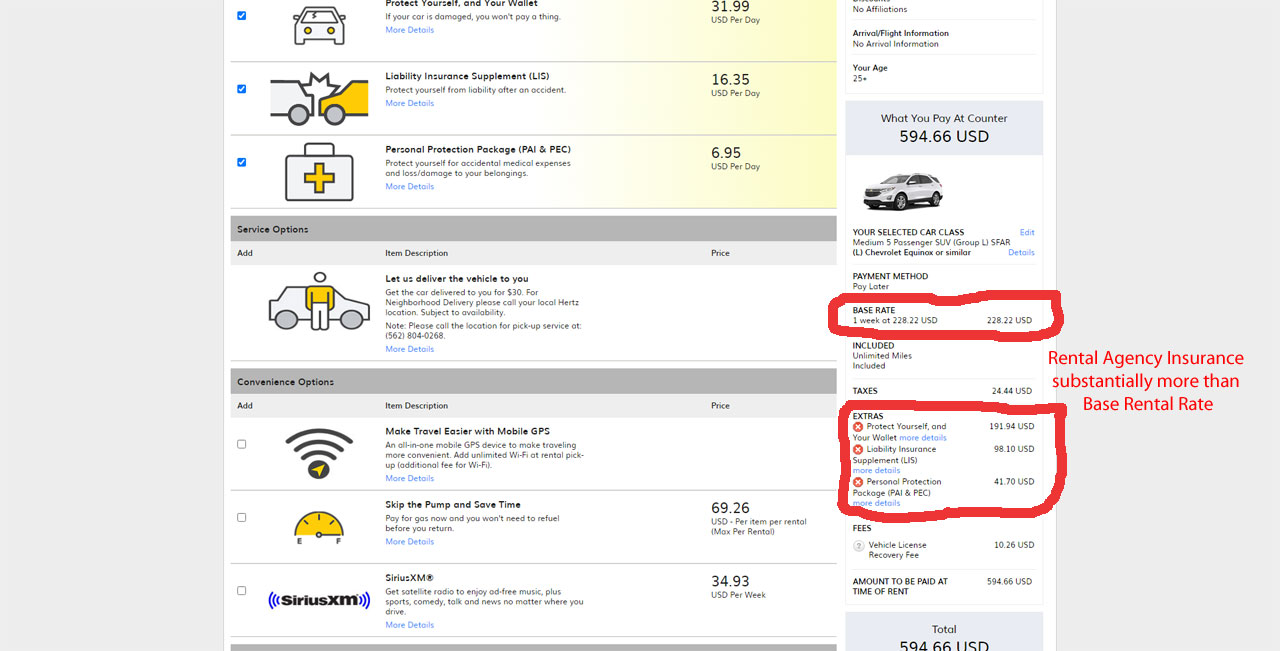

How much does rental car insurance cost?

Rental car insurance costs vary depending on the vehicle and location. But, in a word, it's expensive — overall, prices range from $31 to $60 per day for rental insurance from these providers.

Does Chase Freedom have rental car insurance?

The Chase Freedom Flex℠ and Chase Freedom Unlimited® both offer insurance coverage for the financial cost of damage or theft to a rented vehicle. However, coverage through the collision damage waiver (CDW) is secondary insurance -- it only kicks in after other forms of insurance (like your personal car insurance).

Can you rent a car with Apple credit card?

You can rent a car with the Apple Care anywhere Mastercard is accepted. If you are physically going to a store to rent one and they don't accept Apple Pay then you will need the physical card.

Does my car insurance cover international rental cars?

Most U.S. auto insurers won't cover you while you're driving abroad, with the possible exceptions of Canada and Mexico. So unless you have a credit card that offers rental car insurance, you'll probably need to purchase your insurance from the rental company itself.

What does it mean when you have primary car rental coverage?

If you have primary car rental coverage with your credit card, it means you can make a claim with your card provider’s benefit administrator first in the event of a theft or accident. You don’t have to contact your personal insurer first, which would be the case if your card coverage was secondary.

Does Discover offer car rental insurance?

Discover no longer offers car rental insurance with any of its cards. It discontinued the benefit on February 28, 2018, citing a lack of cardholder use. Previously, the benefit offered maximum reimbursement of $25,000 for up to 31 consecutive days or 45 consecutive days for employees of eligible businesses.

How many miles can you earn on a Discover card?

If you travel often, look into credit cards that offer travel rewards. The Discover it® Miles Travel Credit Card, for example, earns 1.5 Miles per dollar spent on purchases and, at the end of the first year of card membership, Discover doubles all the Miles you’ve earned — and there’s no limit on how many Miles you can earn. You can also turn Miles into cash, or redeem as a statement credit for travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more. You can also redeem Miles to pay any part of your monthly bill, including your minimum payment. However you redeem, Miles have the same value and never expire.

What are the benefits of using a credit card to book travel?

Credit cards offer two big incentives when you use them to book travel: points and protection. Not only can your purchases earn you points or miles toward future travel, but your travel credit card may offer benefits like protection for unauthorized purchases.

How long does it take to match Discover miles?

Discover Match®: We’ll match all the Miles rewards you’ve earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or 365 days , whichever is longer, and add it to your rewards account within two billing periods. You’ve earned Miles rewards only when they’re processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; rewards transfers from Discover checking or other deposit accounts; or rewards for accounts that are closed. This promotional offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums.

What are the two types of travel cards?

There are generally two main types: cards that offer points redeemable only with particular hotels or are tied to a particular airline, and cards that offer generic points or miles that can be redeemed for most travel expenses.

Do you have to let your credit card company know before you travel?

TIP: Be sure to let your credit card issuer know before you travel. Because they keep an eye out for suspicious transactions, purchases made away from your home area might be flagged by the fraud department. TIP: See all the travel benefits that come with Discover rewards credit cards.

Does a credit card cover collision repair?

Some credit cards will cover collision repair if you rent the car with your card. Several credit cards also offer discounted rates on car rentals when you book through your issuer’s rewards portal, but coverage varies and limitations apply, so make sure to check with your issuer.

Does rental insurance cover collisions?

Rental insurance: It’s also worth checking if your card has car rental coverage. You may be able to forgo the added expense of secondary rental insurance and use your credit card’s built-in car coverage. Some credit cards will cover collision repair if you rent the car with your card. Several credit cards also offer discounted rates on car rentals when you book through your issuer’s rewards portal, but coverage varies and limitations apply, so make sure to check with your issuer.

When was Discover car insurance discontinued?

The Discover card rental car insurance benefit was discontinued for all Discover credit card accounts on February 28, 2018. The last day to file a claim was May 29, 2018 for incidents that happened on or before February 28. Prior to that date, Discover card rental car insurance provided up to $25,000 in coverage for rental cars that were damaged or stolen. Cardholders had to pay for the rental with a Discover card or Discover card rewards to be covered. They also had to decline the rental agency’s insurance offer to be eligible.

Does Capital One offer travel insurance?

All credit cards offered by Capital One offer travel insurance.

Is Discover card bad?

They axed travel insurance, rental car insurance, purchase protection, extended warranties and return protection. But that doesn’t mean Discover cards are bad now. They still offer excellent rewards and low fees.

Does Discover have rental car insurance?

The other three major credit card networks still offer rental car insurance. But credit card issuers are the ones that set the specific coverage terms. Discover, like American Express, happens to be both an issuer and a network.

What is travel accident insurance?

Travel accident insurance reimburses you for death or serious injury caused by a travel provider. Trip cancellation and interruption insurance helps you get money back after your trip is stopped by factors out of your control. Baggage insurance can protect your valuables.

What is the heckout feature on Discover?

heckout” feature that allows cardholders to withdraw cash when making a purchase with a Discover card at specific retailers. Withdrawals are limited to $120 every 24 hours. They are charged at the card’s regular purchase APR, rather than the higher cash advance APR.

How much money can you get for a trip accident?

The amount of money you can get varies, but it could be as much as $500,000 with certain cards. But not all cards will have this benefit.

Does Discover offer travel insurance?

No, there is no Discover card travel insurance. Discover used to offer $500,000 in travel accident insurance and $25,000 in coverage for rental car collision or theft. But they discontinued those benefits for all Discover cards in February 2018. They also discontinued purchase protection, return protection and extended warranties.

Is travel insurance still available?

Travel insurance and auto rental coverage are no longer available as of February 28, 2018. Purchase protection, extended warranties, and return guarantee protection were also dropped at that time. The price protection benefit was cut on October 31, 2018.

Does Discover have a foreign transaction fee?

The Discover card benefits include no annual fee and no foreign transaction fees on any card, along with security features such as SSN alerts and the ability to freeze your account on demand. Discover will also match all the rewards you earn in your first year. Plus, there’s a “Cash at C.

Does Visa have travel insurance?

Yes, the Visa credit card travel insurance is pretty good. It covers all Visa credit card users for damage or theft of rental cars. Some cards also provide coverage for accidents while traveling, trip cancellation and lost luggage. Plus, Visa credit card travel insurance never costs extra. You just have

Why did Discover cut travel insurance?

Why Discover cut travel insurance. According to Discover, it made the cull due to "prolonged low usage.". For an issuer, card benefits can be expensive to administer, which was apparently the dynamic with this company. The Discover travel insurance benefits getting the axe were the following:

How long does it take for Discover to protect against theft?

Purchase protection -- Purchases of up to $500 made on a Discover card were covered against theft or damage within 90 days of when the purchase was made.

Does the Ascent cover all offers?

The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. American Express is an advertising partner of The Ascent, a Motley Fool company.

Will Discover bring back travel benefits?

At the moment, there is no indication that Discover will bring back its travel-related benefits -- or, for that matter, the other card extras it has cut. When eliminating those benefits, the issuer did take pains to point out that it had recently introduced a new perk, the Social Security Number Alert.

Does Discover charge an annual fee?

No annual fee -- In a world where it's not unusual to spend hundreds of dollars on an annual fee for a decent credit card, Discover distinguishes itself by not charging an annual fee for any of its plastic.

Is Discover the best travel card?

The combination of Discover's lack of travel insurances and its lower level of acceptance at merchants means it's not the best travel card for international travel.

Does the Ascent credit card have an annual fee?

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, you’ll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent's full review for free and apply in just 2 minutes.

What credit cards have perks like expedited access to cars?

Many premium credit cards like the The Platinum Card® from American Express, the Chase Sapphire Reserve® and the Citi Prestige® Card * come with upgraded status in a number of rental car loyalty programs when you enroll. This status comes with perks like expedited access to cars at many locations, car upgrades and return grace periods. Being a preferred member of a car rental loyalty program can help save you hours by skipping the line at airport car rental locations and even increase your chances for getting a rental car.

How many points do you get on Lyft with Chase Sapphire?

Plus, through March 2022 you'll earn a total of 5 points per dollar on Lyft rides

What is Chase Sapphire Reserve?

The Chase Sapphire Reserve card is a go-to travel credit card that delivers on rental car benefits. The card starts with primary rental car coverage of up to $75,000 worldwide on rentals less than 31 consecutive days with no country restrictions when you pay for your rental with your card. In addition, the card earns the following rewards: 5 points per dollar on air travel and 10 points per dollar on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® immediately after the first $300 is spent on travel purchases annually. Earn 3 points per dollar on other travel and dining and 1 point per dollar spent on all other purchases.

Do international rental cars require proof of insurance?

When renting internationally, it is also a good idea to ensure that you are carrying proof of coverage. Many international rental car counters are not familiar with collision damage waivers provided by credit cards. Additionally, international rentals often have terms and conditions requiring you to either purchase a collision/damage waiver from the rental car company or provide proof of coverage. Your experience will vary widely; some international rental agencies will not even offer you additional collision damage waiver coverage, but some will aggressively try to sell you coverage, even if you provide proof of insurance coverage. In every case, having written proof of insurance that states that it is valid in the country you are renting in will ensure that your international rental experience is as smooth as possible.

Does rental car insurance cover business trips?

Whether you are renting your car for a business trip or for a vacation can affect your eligibility for your credit card’s car rental insurance coverage. Many credit cards limit their car rental insurance coverage based on the purpose of your trip. This is especially common among small business credit cards, where the terms stipulate that coverage only applies to rentals made for business purposes. Check the terms of your credit card’s collision/loss damage waiver coverage to ensure that your trip qualifies for your card’s rental car collision damage waiver insurance.

Do credit cards cover collisions?

Many credit cards offer some form of collision/loss damage waiver coverage for car rentals when you decline the car rental company’s coverage and charge the full amount of the rental to your credit card. This is perhaps the most valuable car rental benefit of most credit cards, as it can protect you against substantial financial loss in the event that you damage a rental car and help you avoid paying $10 to $25 per day with the car rental company for its insurance.

Do credit cards help people renting cars?

Banks have invested heavily in marketing credit cards toward frequent travelers, so it should be no surprise that many credit cards come with benefits for people renting cars. If you are planning on renting a car during your travels, your existing credit cards probably offer benefits that will save you money at the rental counter.

How to get proof of coverage for car rental?

It’s often a good idea to request a proof-of-coverage letter from your credit card car rental insurance benefit administrator and print a copy. Call Citi at 866-918-4670 to request a proof-of-coverage letter from your benefit administrator.

How to use Citi car rental insurance?

How to use Citi’s car rental insurance with a cobranded card. Call 866-918-4670 immediately after your rental car is stolen or damaged. A representative will inquire about your claim and advise you what to do next. If necessary, they’ll let you know which documents to send for your claim.

How much does Costco card cover?

Key exceptions include the cobranded Costco cards, which offer up to $50,000 in coverage against eligible thefts or accidents worldwide. Internationally it applied before your auto insurance kicks in.

How long does it take to file a police report for a rental car?

Take photos if your car is damaged. If necessary, file a police report, as this might be required for your claim. Submit the requested information within 180 days.

How long is a car rental agreement good for?

You’re covered for however long your car rental agreement lasts, with a maximum of 31 consecutive days.

Can I rent a car with a Citi card?

If you plan to rent a car with your Citi card, don’t expect to get the added perk of insurance. Citi is one provider that’s taken a big ax to its car rental insurance benefit — however, you can still get coverage with your Costco card. (Citi is a finder.com advertising partner.)

What to do if your car is damaged?

Take photos if your car is damaged. If necessary, file a police report, as this might be required for your claim.