Why is diversification reduces or eliminates firm specific risk?

There are two reasons why diversification reduces or, at the limit, eliminates firm-specific risk. The first is that each investment in a diver- sified portfolio is a much smaller percentage of that portfolio than would be the case if you were not diversified. In this regard, why does diversification reduce firm specific risk?

Why should you diversify investments?

Why You Should Diversify Your Investments

- Mitigate Risk. If you invest all of your money in one company’s shares and it goes bankrupt, you’ll lose all of your cash.

- You Can Invest According to Your Risk Appetite. Risk appetite refers to the level of risk that an individual or entity will face. ...

- Further Diversification within Asset Classes. ...

Why should a company diversify?

Why diversity matters

- A better hiring process. Focusing on diversity inside your hiring process can inspire changes in how you evaluate potential employees.

- Attract more people. Diverse groups are a sign of a healthy and inclusive culture. ...

- A more welcoming workplace. ...

- Spark creativity and empathy. ...

What are the advantages of diversification?

The following are the reasons why firms opt for diversification:

- For growth in business operations

- To ensure maximum utilization of the existing resources and capabilities

- To escape from unattractive industry environments

Does diversification reduce systematic or unsystematic risk?

In the context of an investment portfolio, unsystematic risk can be reduced through diversification—while systematic risk is the risk that's inherent in the market.

How is systematic risk reduced?

BusinessDictionary.com notes systematic risk “cannot be circumvented or eliminated by portfolio diversification but may be reduced by hedging. In stock markets systemic risk (market risk) is measured by beta.” Owning different securities or owning stocks in different sectors can reduce systematic risk.

Does systematic risk increase with diversification?

Portfolio diversification seems to lower risk for individual investors, but it increases systemic risk.

How does diversification affect systematic and unsystematic risk?

Systematic risk is unpredictable and unavoidable. Unsystematic risk is limited to the risks associated with trading a specific security or asset class and can be mitigated through diversification, which protects a portfolio from the fluctuations of one particular investment.

Which type of risk Cannot be eliminated by diversification?

Market risk, also called "systematic risk," cannot be eliminated through diversification, though it can be hedged in other ways, and tends to influence the entire market at the same time. Specific risk, in contrast, is unique to a specific company or industry.

Which of the following types of risk is not reduced by diversification?

Systematic Risk Investors cannot reduce some risks through diversification. These risks are called systematic risks. Systematic risk is inherent to the entire market, which means it is always present. Systemic risk is also called undiversifiable risk.

What increases systematic risk?

Factors that can trigger systematic risk include interest rate changes, inflation, and unfavorable exchange rate changes, while unsystematic risks are triggered by industry-specific regulatory changes, the sudden emergence of a formidable competitor, product recalls and illegal activities.

What increases systemic risk?

Systematic risk is the overall, day-to-day, ongoing risk that can be caused by a combination of factors, including the economy, interest rates, geopolitical issues, corporate health, and other factors.

What causes systemic risk?

According to the model, the main drivers of systemic risk are the presence of correlated shocks from the real economy and market contagion that manifests in terms of fire sales of assets. We also highlight how the interaction amongst different contagion channels can significantly increase the level of systemic risk.

How do you manage systematic and unsystematic risk?

Systematic risk can be substantially controlled through techniques like Hedging. Hedging is achieved by taking the opposing position in the market. read more and Asset allocation. Conversely, unsystematic risk can be eliminated through diversification of a portfolio.

How do you separate systematic and unsystematic risk?

Key Differences Between Systematic and Unsystematic Risk Systematic risk is uncontrollable whereas the unsystematic risk is controllable. Systematic risk arises due to macroeconomic factors. On the other hand, the unsystematic risk arises due to the micro-economic factors.

Why is it not possible to eliminate systematic risk?

Key Takeaways. Systematic risk cannot be eliminated through diversification since it is a nonspecific risk that affects the entire market. The beta of a stock or portfolio will tell you how sensitive your holdings are to systematic risk, where the broad market itself always has a beta of 1.0.

What are the 3 ways in risk reduction?

Let's talk about four different strategies to mitigate risk: avoid, accept, reduce/control, or transfer.Avoidance. If a risk presents an unwanted negative consequence, you may be able to completely avoid those consequences. ... Acceptance. ... Reduction or control. ... Transference. ... Summary of Risk Mitigation Strategies.

What are 3 ways to reduce risk?

Here are three strategies you can take to minimize those risks.Understand what situations involving risk may be worth taking vs. those that aren't.Look outwards and inwards to study potential risks that could hurt the business.Have a proactive risk management plan in place.Keep Risk Where It Belongs.

What are the 4 principles of risk reduction?

Four principles Accept risk when benefits outweigh the cost. Accept no unnecessary risk. Anticipate and manage risk by planning. Make risk decisions in the right time at the right level.

What are the four risk reduction strategies?

There are four common risk mitigation strategies. These typically include avoidance, reduction, transference, and acceptance.

How does diversification reduce risk?

Diversification reduces risk by investing in vehicles that span different financial instruments, industries, and other categories.

What Is Diversification in Investing?

Diversification is a technique that reduces risk by allocating investments across various financial instruments, industries, and other categories. It aims to maximize returns by investing in different areas that would each react differently to the same event.

What Is an Example of a Diversified Investment?

A diversified investment portfolio includes different asset classes such as stocks, bonds, and other securities. But that's not all. These vehicles are diversified by purchasing shares in different companies, asset classes, and industries. For instance, a diversified investor's portfolio may include stocks consisting of retail, transport, and consumer staple companies, as well as bonds—both corporate- and government-issued. Further diversification may include money market accounts and cash.

Why is it important to diversify among different asset classes?

You can reduce the risk associated with individual stocks, but general market risks affect nearly every stock and so it is also important to diversify among different asset classes. The key is to find a happy medium between risk and return. This ensures you can achieve your financial goals while still getting a good night's rest.

What is the second type of risk?

The second type of risk is diversifiable or unsystematic. This risk is specific to a company, industry, market, economy, or country. The most common sources of unsystematic risk are business risk and financial risk. Because it is diversifiable, investors can reduce their exposure through diversification. Thus, the aim is to invest in various assets so they will not all be affected the same way by market events.

What are the sources of unsystematic risk?

The most common sources of unsystematic risk are business risk and financial risk. Because it is diversifiable, investors can reduce their exposure through diversification. Thus, the aim is to invest in various assets so they will not all be affected the same way by market events.

What is systemic risk?

Systematic risk affects the market in its entirety, not just one particular investment vehicle or industry. The second type of risk is diversifiable or unsystematic. This risk is specific to a company, industry, market, economy, or country. The most common sources of unsystematic risk are business risk and financial risk.

Why Does Diversification of Investments Reduce Risk?

If you’re thinking about investing money, the chances are that you’ll have encountered the term “diversification” but might not know exactly what it means or why it’s important. Why does diversification reduce risk?

Why is diversification important?

While diversification may sound like a fund manager’s buzzword, it’s actually a crucial investment technique that aims to minimise the impact of financial risk on your invested capital.

How diverse should your portfolio be?

There are a few key points to consider when you’re trying to achieve the most appropriate level of diversification for your needs.

What is a well diversified portfolio?

Broadly speaking, a well-diversified portfolio is stronger than a portfolio that’s focused on one particular area of investment.

Why is it important to have a broad range of investments?

With a broad range of investments, you’ll be in a better position to cope with market fluctuations than if you direct your financial resources towards a small number of asset classes. As a result, you should benefit from more stable returns in the long run.

What happens if you overdiversify your investments?

If you over-diversify your investments, you’ll spread your capital too thinly – and may find that the fund management costs are too high to make investing worthwhile. This is a particularly important consideration for investors with small amounts of capital.

Is a stock more volatile than a bond?

Some types of asset are riskier than others. For example, stocks tend to be more volatile than bonds but have more potential for growth. You need to decide whether or not you’re comfortable with the idea of including high-risk investments in your portfolio.

How does diversification help manage risk?

How diversification helps manage risks. The idea behind diversification is simple: by diversifying your investment portfolio, you are spreading your risks around. Hence, a dip in a single security or asset class will not have as large a negative effect.

Why is diversification important?

Diversification can help manage the unsystematic risk component of your portfolio and, to a certain extent, the systematic risk as well; but you will always be exposed to the systematic risk of the larger global market. The two main ways to diversify your portfolio are:

What is a well diversified portfolio?

A well-diversified portfolio thus consists of groups of assets which are lowly or negatively correlated with each other. An investor holding a portfolio of 30 different technology stocks is not diversified at all. But an investor with a 30-stock portfolio covering a range of industries, bonds and real estate, has a decent level of diversification.

What is unsystematic risk?

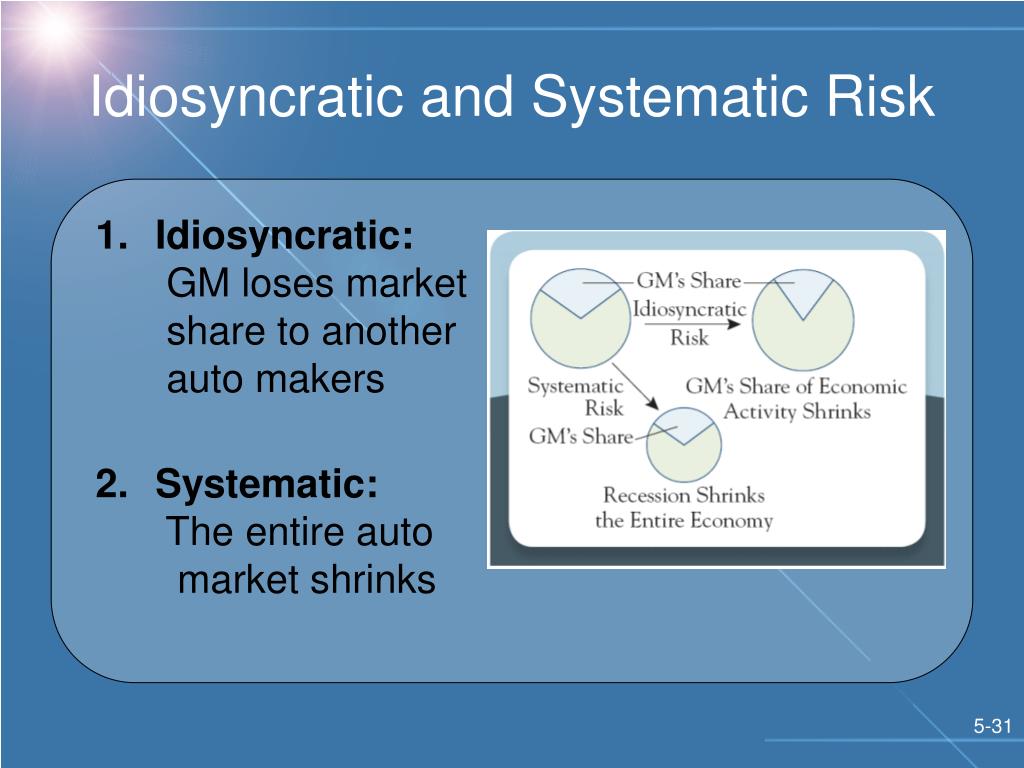

Unsystematic risk, also referred to as specific or idiosyncratic risk, is specific to a particular asset like a stock or property, or a similar group of assets such as technology or airline stocks. The factors that contribute to each type of risk are different.

What are the two types of risk?

Understanding two broad types of risks – systematic and unsystematic. Let’s first understand the two major risk categories, systematic and unsystematic risks. Systematic risk is the type of risk that underlies an entire system, be it the stock market, the real estate market or even the global economy. Unsystematic risk, also referred ...

How can investors mitigate systematic risk?

Investors can somewhat mitigate the impact of systematic risk by building a diversified portfolio.

How to know how much systematic risk a particular security, fund or portfolio has?

If you want to know how much systematic risk a particular security, fund or portfolio has, you can look at its beta, which measures how volatile that investment is compared to the overall market. A beta of greater than one means the investment has more systematic risk than the market, while less than one means less systematic risk than the market. A beta equal to one means the investment carries the same systematic risk as the market.

What Is Systematic Risk?

Systematic risk refers to the risk inherent to the entire market or market segment. Systematic risk, also known as “undiversifiable risk,” “volatility” or “market risk,” affects the overall market, not just a particular stock or industry.

What is the difference between unsystematic and systematic risk?

While systematic risk can be thought of as the probability of a loss that is associated with the entire market or a segment thereof , unsystematic risk refers to the probability of a loss within a specific industry or security.

How to identify systematic risk?

An investor can identify the systematic risk of a particular security, fund, or portfolio by looking at its beta. Beta measures how volatile that investment is compared to the overall market. A beta of greater than 1 means the investment has more systematic risk than the market, while less than 1 means less systematic risk than the market. A beta equal to one means the investment carries the same systematic risk as the market.

How to manage systemic risk?

To help manage systematic risk, investors should ensure that their portfolios include a variety of asset classes, such as fixed income, cash, and real estate, each of which will react differently in the event of a major systemic change. An increase in interest rates, for example, will make some new-issue bonds more valuable, while causing some company stocks to decrease in price as investors perceive executive teams to be cutting back on spending. In the event of an interest rate rise, ensuring that a portfolio incorporates ample income-generating securities will mitigate the loss of value in some equities.

What asset classes are considered systematic risk?

While systematic risk is both unpredictable and impossible to completely avoid, investors can manage it by ensuring that their portfolios include a variety of asset classes, such as fixed income, cash and real estate, each of which will react differently to an event that affects the overall market.

What Is Diversification in Investing?

- Diversification is a technique that reduces risk by allocating investments across various financia…

Most investment professionals agree that, although it does not guarantee against loss, diversification is the most important component of reaching long-range financial goals while minimizing risk. Here, we look at why this is true and how to accomplish diversification in your p… - Diversification reduces risk by investing in vehicles that span different financial instruments, indu…

Unsystematic risk can be mitigated through diversification while systematic or market risk is generally unavoidable.

Understanding Diversification in Investing

- Let's say you have a portfolio that only has airline stocks. Share prices will drop following any ba…

This action of proactively balancing your portfolio across different investments is at the heart of diversification. Instead of attempting to maximize your returns by investing in the most profitable companies, you enact a defensive position when diversifying. The strategy of diversification is ac… - Diversifying Across Sectors and Industries

The example above of buying railroad stocks to protect against detrimental changes to the airline industry is diversifying within a sector or industry. In this case, an investor is interested in investing in the transportation sector and holds multiple positions within one industry.

How Many Stocks You Should Have

- There is no magic number of stocks to hold to avoid losses. In addition, it is impossible to reduc…

There is discussion over how many stocks are needed to reduce risk while maintaining a high return. The most conventional view argues that an investor can achieve optimal diversification with only 15 to 20 stocks spread across various industries. Other views contest that 30 different …

Different Types of Risk

- Investors confront two main types of risk when they invest. The first is known as systematic or m…

The second type of risk is diversifiable or unsystematic. This risk is specific to a company, industry, market, economy, or country. The most common sources of unsystematic risk are business risk and financial risk. Because it is diversifiable, investors can reduce their exposure t…

Benefits of Diversification

- Diversification attempts to protect against losses. This is especially important for older investors …

Diversification is thought to increase the risk-adjusted returns of a portfolio. This means investors earn greater returns when you factor in the risk they are taking. Investors may be more likely to make more money through riskier investments, but a risk-adjusted return is usually a measurem…

Problems With Diversification

- Professionals are always touting the importance of diversification but there are some downsides …

Diversification can also be expensive. Not all investment vehicles cost the same, so buying and selling will affect your bottom line —from transaction fees to brokerage charges. In addition, some brokerages may not offer specific asset classes you're interested in holding.

Why Is Diversification Important?

- Diversification is a common investing technique used to reduce your chances of experiencing losses. By spreading your investments across different assets, you're less likely to have your portfolio wiped out due to one negative event impacting that single holding. Instead, your portfolio is spread across different types of assets and companies, preserving your capital and increasin…

What Does Diversification Mean in Investing?

- Diversification is a strategy that aims to mitigate risk and maximize returns by allocating investment funds across different vehicles, industries, companies, and other categories.

What Is an Example of a Diversified Investment?

- A diversified investment portfolio includes different asset classes such as stocks, bonds, and other securities. But that's not all. These vehicles are diversified by purchasing shares in different companies, asset classes, and industries. For instance, a diversified investor's portfolio may include stocks consisting of retail, transport, and consumer staple companies, as well as bonds…

What Happens When You Diversify Your Investments?

- When you diversify your investments, you reduce the amount of risk you're exposed to in order to maximize your returns. Although there are certain risks you can't avoid such as systematic risks, you can hedge against unsystematic risks like business or financial risks.

The Bottom Line

- Diversification can help an investor manage risk and reduce the volatility of an asset's price mov…

You can reduce the risk associated with individual stocks, but general market risks affect nearly every stock and so it is also important to diversify among different asset classes, geographical locations, security duration, and companies. The key is to find a happy medium between risk an…