Do HMRC debts affect your credit score?

HMRC debts are simply money owed to the UK Government, but the UK Government hasn’t given you any credit. And for that reason, the debts you owe to HMRC will not impact your credit score. And thus, not reduce your chance of getting credit or even getting a mortgage.

What happens if you can’t pay HMRC?

But if you cannot pay what HMRC are asking you to pay, there are other options. HMRC usually offer their Time to Pay Arrangement so you can spread the cost of any HMRC debt over six months or a little more. It should be noted that HMRC is usually reluctant to offer Time to Pay Arrangements beyond one year.

Does not paying council tax affect credit score?

No. Unpaid taxes no longer have a direct impact on your credit anymore. However, unpaid tax can have more serious consequences. Does paying council tax build credit? No. Paying council tax does not build your credit just as avoiding taxes does not affect your credit score.

Can I get a mortgage with HMRC debt?

And for that reason, the debts you owe to HMRC will not impact your credit score. And thus, not reduce your chance of getting credit or even getting a mortgage.

Do tax returns affect credit score?

The Bottom Line. While paying taxes has no direct bearing on your credit scores, using credit to cover your tax payment can affect your credit indirectly, and failure to pay your taxes not only gets you in trouble with the IRS, it also jeopardizes your ability to get credit.

Do late tax payments affect credit score?

If you don't pay your taxes, the IRS can file a notice of federal tax lien with the credit bureaus. That's a huge negative on your credit reports. If you owe more than $10,000, the IRS automatically files the lien after taxes have gone unpaid for 30 days. At that point, you could see a dip in your credit scores.

Does tax debt show on credit report?

Tax liens, or outstanding debt you owe to the IRS, no longer appear on your credit reports—and that means they can't impact your credit scores.

What affects credit score the most?

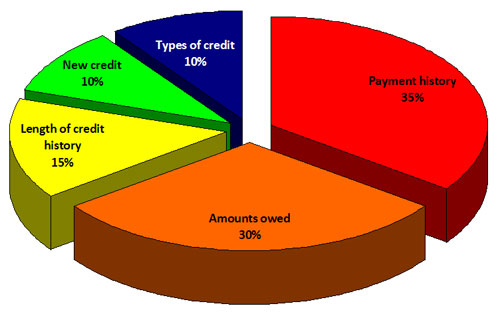

Payment history accounts for 35% of your FICO® Score☉ , the credit score used by 90% of top lenders. Amounts owed. Your credit usage, particularly as represented by your credit utilization ratio, is the next most important factor in your credit scores.

Does owing taxes affect buying a house?

If you have an IRS lien on your income or assets, it will greatly diminish your chances at getting approved for a mortgage. Lenders could see unpaid taxes as an indicator that the mortgage will also go into arrears.

Why did my credit score drop for no reason?

There are lots of reasons why your credit score could have gone down, including a recent late or missed payment, an application for new credit or a change to your credit limit or usage. The activities that affect your credit scores correspond to the way the credit scoring models calculate them.

What happens if I don't file taxes?

If you fail to file your taxes on time, you'll likely encounter what's called a Failure to File Penalty. The penalty for failing to file represents 5% of your unpaid tax liability for each month your return is late, up to 25% of your total unpaid taxes. If you're due a refund, there's no penalty for failure to file.

What happens if you don't pay taxes?

The charges accrue at a rate of 5% of the unpaid taxes for each month or part of a month that a tax return is late. The charges max out after five months, at which point the failure-to-file penalty is 25% of the unpaid tax liability. As you can see, filing late does not pay off, with or without an extension.

What is a good credit score?

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What 5 things make up credit score?

The 5 Factors that Make Up Your Credit ScorePayment History. Weight: 35% Payment history defines how consistently you've made your payments on time. ... Amounts You Owe. Weight: 30% ... Length of Your Credit History. Weight: 15% ... New Credit You Apply For. Weight: 10% ... Types of Credit You Use. Weight: 10%

What will not hurt your credit score?

Using a debit card, rather than a credit card, to pay for items typically won't impact your credit history or credit scores. When you pay with a credit card, you're essentially borrowing the funds to pay back later. With a debit card, you're using money you already have in an account. No borrowing is involved.

What makes your credit score go up?

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit.

Can I get a mortgage if I owe HMRC?

Yes. As HMRC debts do not affect your credit rating, getting a mortgage will not be affected either.

Does paying tax late affect credit rating?

No. Unpaid taxes no longer have a direct impact on your credit anymore. However, unpaid tax can have more serious consequences.

Does paying council tax build credit?

No. Paying council tax does not build your credit just as avoiding taxes does not affect your credit score.

How does HMRC payment plan affect credit rating?

It shouldn’t, but we cannot say for sure as we aren’t financial advisors and do not know specifically why you are on a payment plan with the HMRC.

Your questions about coronavirus

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.