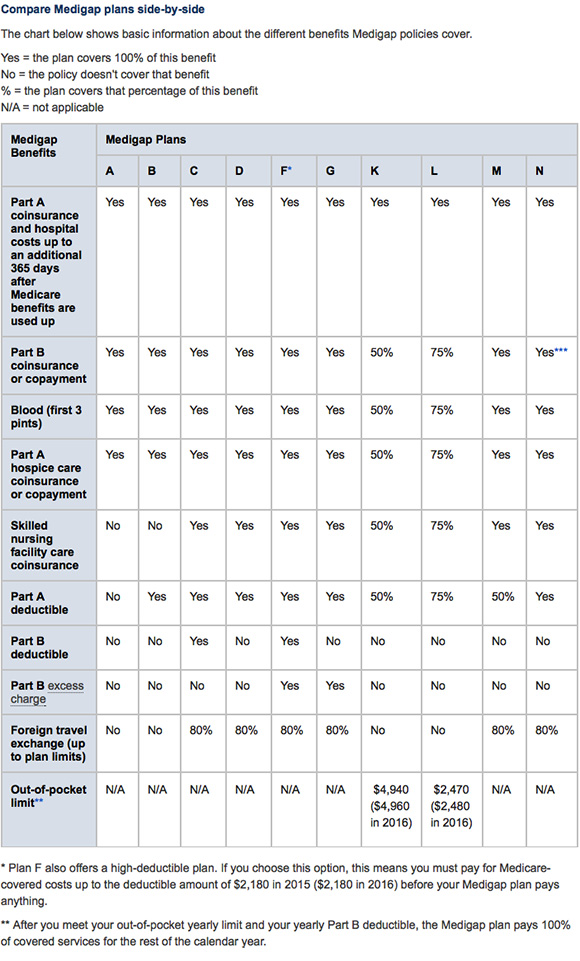

What does plan F cover?

Medigap Plan F may cover:

- Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers

- Part A hospice care copayment or coinsurance costs

- Part A deductible

- Part B copayment or coinsurance costs

- Part B deductible

- Part B excess charges

- First three pints of blood

- Skilled nursing facility (SNF) care coinsurance costs

What does Medicare supplement plan F cover?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years.

Is Medicare Plan G better than Plan F?

Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible. What’s the top Medicare Supplement plan for 2022?

How much is plan F Medicare?

The high deductible Plan F comes with an annual deductible of $2,490 in 2022. This means you must spend $2,490 out of pocket on covered services before the plan coverage kicks in. In exchange for the higher deductible, the average premium for high-deductible Plan F was just $57.16 per month in 2018 ( $686 per year), as noted in the chart above.

Does plan F cover Medicare deductible?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the plan F deductible for 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490.

Is there a deductible for plan F?

Medicare Supplement Plan F and High Deductible Medicare Supplement Plan F are almost identical Medigap plans. The only difference in plan details is that High Deductible Plan F requires you to meet a deductible before it begins covering you ($2,490 in 2022), whereas Plan F provides coverage immediately.

What is the deductible for plan F in 2021?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the average cost of Medicare Plan F?

How much does it cost for Medigap Plan F? The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.

What is the average cost of Medigap plan F?

The national average cost for Medigap Plan F is $1,712 annually, which is around $143 a month.

Does AARP Medicare Supplement plan F cover Part B deductible?

Plan F covers Medicare Part B approved services at the doctor's office, such as: Medicare Part B coinsurance and copayment. Medicare approved doctor's office fees. Part B deductible.

What is difference between plan G and plan F?

With Plan F, the Medicare Supplement plan pays for the Part B deductible. Under Plan G, you are responsible for the Part B deductible only. Otherwise, all Part A deductibles, copays, and coinsurance are covered. Under Part B, after the deductible, the plan pays all other approved coinsurance and copays.

What is the difference between high deductible Plan F and G?

The only difference between Plans F and G is that Plan G does not cover your small Part B annual deductible ($198 as of 2020).

Does high deductible Plan F pay Part B deductible?

Medicare Supplement High Deductible Plan F Costs The first $233 out of pocket covers the standard Medicare Part B deductible. After that, Medicare Part B will cover 80% of your healthcare costs. Then, you will pay the remaining 20% of the expenses until you pay a total of $2,490 out-of-pocket.

Is Medicare Plan F still available 2022?

Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020. If you were already enrolled in Medigap Plan F, you can keep the plan and the benefits.

What is the Medicare copay for 2022?

Part D premiums vary depending on the plan you choose, with an average of $33. The maximum Part D deductible for 2022 is $480 per year (though some plans waive the deductible completely)....Medicare Part D Premiums and Deductible.Yearly Income in 2020Monthly Surcharge in 2022married, $750,000 or above$77.9013 more rows

What is the deductible for Medicare Part D in 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

What is the difference between high deductible Plan F and G?

The only difference between Plans F and G is that Plan G does not cover your small Part B annual deductible ($198 as of 2020).

What is the Medicare Part B deductible for 2022?

$233 inMedicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the high deductible plan for Medicare Supplemental?

The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

When is high deductible G available?

High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

How much is Medicare Part A deductible?

We’ll talk more about benefit periods in the next section. Your deductible for each period in 2019 is $1364. That means you’ll be charged up to that amount for any services provided during your inpatient stay at the hospital. The same deductible applies for each benefit period if you’re admitted as an inpatient at a skilled nursing facility for a period of time.

What does Medicare Part A cover?

Medicare Part A (Hospital Insurance) helps cover inpatient care in hospitals or skilled nursing facilities, in hospice, or home health care. For example, if you have an infected appendix and you are admitted to the hospital for a surgeon to perform an appendectomy, Part A will help cover the costs during your stay, ...

How long does it take to get a deductible after an appendectomy?

Your deductible goes back into effect for each benefit period. If you require additional inpatient care within 60 days , it extends the benefit period from your appendectomy. The countdown starts over again when you get discharged.

What is Medicare for seniors?

Medicare is the primary hospital and medical insurance coverage for tens of millions of Americans aged 65 or older or under 65 who qualify due to disabilities.

Is it reasonable for Medicare to know about deductibles?

Any cost above what appears in their normal budget poses a risk to their financial security. Given those circumstances, it is reasonable for Medicare recipients to want to know about what, if any, kind of deductibles apply to their Medicare coverage.

What does Medicare Plan F cover?

In addition to the deductibles and copayments, Medicare Plan F also covers things like hospice care coinsurance, skilled nursing facility coinsurance, up to three pints of blood, and foreign travel emergency care.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover , says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What is Medigap insurance?

Medigap is supplemental insurance that helps Original Medicare beneficiaries pay out-of-pocket costs.

What is the best alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers, except for the Medicare Part B deductible. Plan G doesn’t cover the Part B deductible, which was a selling point with Plan F. The cost of Plan F and Plan G is very similar, so that’s a good alternative to Plan F.

Is Medicare Plan F still available?

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

What is Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card ...

What does Plan F cover?

Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services. This includes durable medical equipment, lab work, tests, mental health care, home health, chiropractic adjustments and much more. There is no overall cap on what Plan F will cover, although Medicare itself does impose some caps on certain things like ...

What Does Plan F Cover at my Doctor’s Office?

All of your preventive care is covered 100% by Medicare Part B. This includes items like:

Does Plan F cover long term care?

No Medicare does not cover any long-term care, and therefore Medicare supplements also cannot supplement the cost of long-term care.

Do Different Insurance Companies Have Different Plan F Benefits?

Fortunately NO. We get questions all the time about this – for instance a caller may ask us whether an AARP Plan F is the same as a Mutual of Omaha Plan F or Aetna Plan F. Rest assured that Medigap plans are standardized by the government. The benefits for a standard Plan F are the same whether you buy that policy from one insurance company or another. This allows you to shop based on price and a few other factors.

What is Plan F insurance?

Plan F coverage also includes your other doctor visits for illnesses and injuries. Medicare Part B first pays 80%. Then your Plan F supplement pays your deductible and the other 20%. Some doctors charge a 15% excess charge beyond what Medicare pays. Plan F covers that for you.

How much is Plan F for 2021?

Here’s a list view of your Plan F coverage at the hospital: Hospital deductible ($1,484 in 2021) and coinsurance. 365 days of additional hospital coverage after Medicare’s coverage is exhausted. Hospice care at any hospice facility. Blood (if needed in a transfusion)

What Does High Deductible Plan F Cover?

In terms of benefits, the high deductible Plan F option offers the exact same coverage as the standard Plan F version once you meet the deductible.

What is the average premium for Medigap Plan F?

In 2019, the average premium for high-deductible Plan F was $57.16 per month. In 2019, the average premium for standard Plan F was $169.14 per month. 1. If you are interested in enrolling in a high-deductible Medigap Plan F, you should consider a few things.

What happens if you meet your deductible on Medigap?

Once you meet your deductible, your Medigap insurance company will begin paying the benefits offered in the plan. Before you choose the high-deductible Plan F, you should consider how likely you are to use enough medical services to meet the yearly deductible. Then evaluate how much coverage you would need after the deductible is met.

How much will Medicare cover in 2021?

You must pay for Medicare-covered costs up to $2,370 in 2021 before your plan coverage will kick in. For example, if you need a blood transfusion, a traditional Medigap plan will cover the cost of the first three pints, and Medicare will cover the cost of pints four and beyond.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why Choose Plan F?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare Supplement plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.)

What insurance carriers are in Plan G?

Our agency works with about 30 carriers in every state. These include Mutual of Omaha Medicare Supplements, Aetna Medicare Supplements and Cigna Medicare Supplements. All three of these carriers have competitive Plan G rates in 2021. You’ll easily learn which insurance carriers offer you the greatest long-term savings and benefits.

How much does Medicare cost for a 65 year old?

Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we find pricing around $120 – $140/month for a female turning 65, but it’s always important to get quotes for Medicare Plan F cost in your area.

Which Medicare Supplements are good value?

However, there are other Medicare Supplements that provide great value as well, such as Plan G and Plan N.

Does Medicare Supplement pay after Medicare?

A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your deductibles, copays, and coinsurance that you would otherwise be responsible for. Medigap plans do not replace your Medicare Part B. You must be enrolled in both Part A and Part B first, then you are eligible to enroll in Medicare Supplement Plan F.