“There is a law called the Military Lending Act. Up until recently, there had been amendments passed to prevent military servicemembers and their dependents from obtaining certain credit services. This included gap insurance. However, parts of these amendments have been repealed to allow anyone in the military to obtain gap insurance.

Full Answer

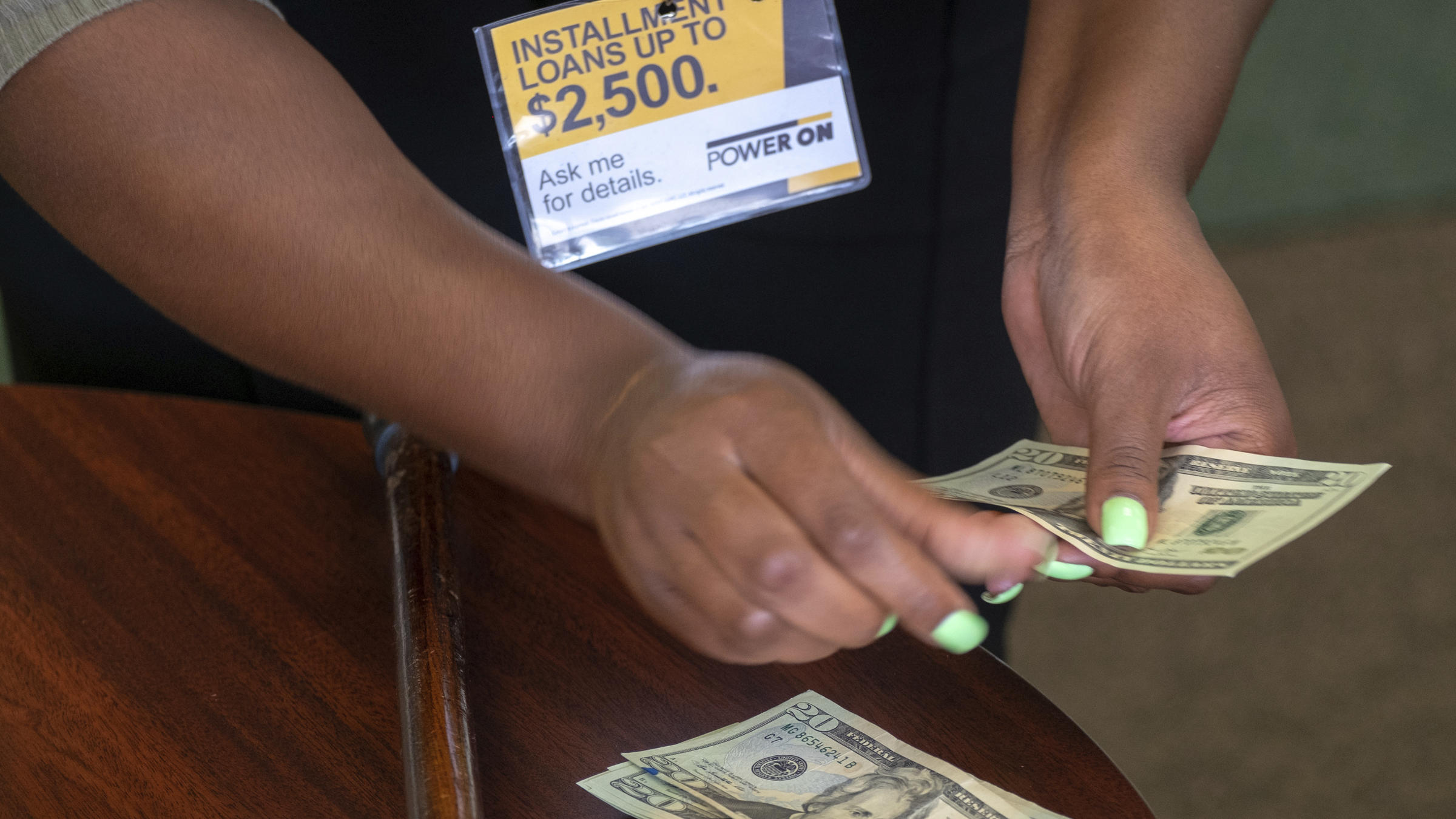

What kind of loans are covered by the Military Lending Act?

Answer: Payday loans, overdraft lines of credit, and most installment loans are covered by the Military Lending Act. If you’re a servicemember on active duty and decide to take out one of these loans, you have rights under the MLA, including a limit on the interest rate the creditor can charge.

What are my rights under the military Mortgage Act (MLA)?

Answer: The MLA applies to active duty servicemembers (including those on active Guard or active Reserve duty), spouses, and certain dependents. It limits the interest rates that may be charged on many types of consumer loans to no more than 36% and provides other important protections. Your rights under the MLA include: A 36% interest cap.

Is the Department of Defense regulating GAP insurance?

The Department of Defense is responsible for adopting regulations and significantly expanded the regulation's scope in 2015 to include credit cards and unsecured personal loans. Problems with the regulation (including those related to GAP insurance) persist despite the DoD's adoption of an "interpretive rule."

What does the DoD’s new guidance mean for gap dealers?

Under the new guidance released by the DoD, any loan made to an active duty service member, their spouse, or dependents that includes GAP, must now comply with the 36 percent MAPR mandate as well as other disclosure requirements under the MLA. So, what options do dealers have available to avoid falling under the requirements of the MLA?

Does military sell gap insurance?

Up until recently, there had been amendments passed to prevent military servicemembers and their dependents from obtaining certain credit services. This included gap insurance. However, parts of these amendments have been repealed to allow anyone in the military to obtain gap insurance.

What does the military Lending Act cover?

The Military Lending Act1 (MLA), enacted in 2006 and implemented by the Department of Defense (DoD), protects active duty members of the military, their spouses, and their dependents from certain lending practices. restricts loan rollovers, renewals, and refinanc- ings by some types of creditors.

Does military Lending Act waive annual fee?

Official statement: We have many different consumer card offerings both with and without annual fees. For those with an annual fee, we will waive the fee as part of our MLA compliance program.

Are car loans covered under MLA?

As stated by the Department of Defense, loans that include financing related to the vehicle being purchased are generally exempt.

What is the difference between military lending Act and SCRA?

MILITARY LENDING ACT (MLA) The MLA is different from the SCRA in that it applies to certain loans after a servicemember is on active duty. The MLA limits the interest rate and fees to 36 percent. This is called the Military Annual Percentage Rate or MAPR. Spouses and dependents are also protected by the MLA.

What is the military lending Act and what are my rights?

The Military Lending Act (MLA) says that you can't be charged an interest rate higher than 36% on most types of consumer loans and provides other significant rights. The MLA applies to active-duty servicemembers (including those on active Guard or active Reserve duty) and covered dependents.

What is excluded from MAPR?

Late payment fees and required taxes—i.e., fees that are not directly related to the cost of credit—are examples of items excluded from both the APR and the MAPR.

What is the max APR for military?

six percent1 – The six percent interest rate cap. 50 U.S.C. § 3937. The SCRA limits the amount of interest that may be charged on certain financial obligations that were incurred prior to military service to no more than six percent per year, including most fees.

Is Chase Sapphire free for military?

Chase Sapphire Benefits for Military All Chase personal credit cards are offered with no annual fees for active duty military servicemembers and their spouses. The top two choices are the Chase Sapphire Preferred or Sapphire Reserve cards.

What loans are exempt from the military lending Act?

Exemptions include loans to purchase or refinance a home, home equity lines of credit and auto finance loans where the loans is secured by the vehicle.

What loans are exempt from MLA?

Some loans are exempt from the MLA however. These include: • Residential mortgage loans; • A loan for the purchase of and secured by a motor vehicle; and • A loan for the purchase of and secured by personal property.

What are the requirements of the military lending Act?

Answer: The MLA applies to active duty servicemembers (including those on active Guard or active Reserve duty), spouses, and certain dependents. It limits the interest rates that may be charged on many types of consumer loans to no more than 36% and provides other important protections.

What is covered by MLA?

Answer: The MLA applies to active duty servicemembers (including those on active Guard or active Reserve duty), spouses, and certain dependents. It limits the interest rates that may be charged on many types of consumer loans to no more than 36% and provides other important protections.

What does the Truth in Lending Act apply to?

The Truth in Lending Act (TILA) protects consumers in their dealings with lenders and creditors. The TILA applies to most kinds of consumer credit, including both closed-end credit and open-end credit. The TILA regulates what information lenders must make known to consumers about their products and services.

What written disclosures are required under the military lending Act?

Mandatory Loan Disclosures (§ 232.6) Note that a payment schedule (in the case of closed-end credit) or account- opening disclosure (in the case of open-end credit) provided pursuant to Regulation Z satisfies this requirement.

What is the purpose of the MapR?

The main functions of the MapR Data Platform include storage, management, processing, and analysis of data for AI and analytics applications. It also provides increased reliability and ensured security over mission critical information. MapR is built for organizations with demanding production needs.

When did the DOD withdraw the reinsurance provision?

The American Bankers Association formally requested the DOD to withdraw the provision in 2018, writing that interpretation was inconsistent with the statute and the regulation, and created uncertainty, compliance burdens and substantial potential liability for dealers and lenders.

Does the Military Lending Act allow gap financing?

Military Lending Act revision permits GAP financing. The Department of Defense last week withdrew a provision to the Military Lending Act (MLA) that prevented adding guaranteed asset protection (GAP) warranties to vehicle loans for servicemembers. The move was celebrated by industry organizations as the liability for both lenders ...

What is the MLA for credit insurance?

For covered transactions, the MLA and the implementing regulation limit the amount a creditor may charge, including interest, fees, and charges imposed for credit insurance, debt cancellation and suspension, and other credit-related ancillary products sold in connection with the transaction. The total charge, as expressed through an annualized rate ...

How often is the application fee charged for a short term loan?

Any application fee charged to a covered borrower who applies for consumer credit, other than an application fee charged by a federal credit union when making a short-term, small amount loan provided that the application fee is charged to the covered borrower not more than once in any rolling 12-month period; and

What are the agencies that regulate the Federal Reserve?

These agencies include the Board of Governors of the Federal Reserve System, the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation, the National Credit Union Administration, the Office of the Comptroller of the Currency, and the Federal Trade Commission. State regulators also supervise state-chartered ...

What is the Military Lending Act?

The Military Lending Act (MLA), 10 U.S.C. § 987 (opens new window), enacted in 2006 and implemented by the Department of Defense (DoD), protects active duty members of the military, their spouses, and their dependents from certain lending practices.

Is consumer credit subject to MLA?

The current rule defines “consumer credit” subject to the MLA much more broadly, generally paralleling the definition in Regulation Z. Some examples of additional credit products now subject to MLA protections when made to covered borrowers include: Credit cards;

Is a credit agreement void if it violates the MLA?

Certain installment loans (but not installment loans expressly intended to finance the purchase of a vehicle or personal property when the credit is secured by the vehicle or personal property being purchased). Credit agreements that violate the MLA are void from inception.

Is a generic description of the payment obligation permissible?

Also note that for oral disclosures, a generic, clear description of the payment obligation is permissible. Determine whether the credit union provides the statement of the MAPR and the clear description of the payment obligation both in writing in a form the covered borrower can keep and orally.

MLA Questions from the Hotline

Are non-real estate secured (or cash-secured) LOCs covered by the Military Lending Act (MLA) Rule?

News

May I Send Adverse Action Notices to Joint Applicants at the Same Mailing Address—Even if They Reside at Different Addresses?

What is the Military Lending Act?

The Military Lending Act (MLA) is a Federal law that provides special protections for active duty servicemembers like capping interest rates on many loan products.

What is the MLA interest rate cap?

It limits the interest rates that may be charged on many types of consumer loans to no more than 36% and provides other important protections. Your rights under the MLA include: A 36% interest cap.

What is a loan to buy a motor vehicle?

A loan to buy a motor vehicle when the credit is secured by the motor vehicle you are buying; and. A loan to buy personal property when the credit is secured by the property you’re buying, like a home appliance. Read the MLA Applicability Flow Chart.

What is an overdraft line of credit?

Overdraft lines of credit but not traditional overdraft services; Installment loans but not installment loans expressly intended to finance the purchase of a vehicle or personal property when the credit is secured by the vehicle or personal property being purchased; and. Certain student loans.

Can you pay back a military loan early?

No mandatory allotments. A creditor can’t require you to create a voluntary military allotment in order to get the loan. No prepayment penalty. A creditor can’t charge a penalty if you pay back part – or all – of the loan early.

Can a creditor waive a waiver?

No mandatory waivers of certain legal rights. A creditor can’t require you to submit to mandatory arbitration or give up certain rights you have under State or Federal laws like the Servicemembers Civil Relief Act. No mandatory allotments.

Can you be subject to penalties under the MLA?

Answer: Generally, yes. If the loan exceeds the 36% interest cap or if the loan violates other provisions of the MLA, creditors that give you the loan could be subject to penalties under the MLA.

What is a reverse mortgage?

These loans include: Residential mortgages (financing to buy or build a home that is secured by the home), mortgage refinances, home equity loans or lines of credit, or reverse mortgages; A loan to buy personal property when the credit is secured by the property you’re buying, like a vehicle or home appliance.

Is a payday loan covered by the Military Lending Act?

Payday loans, overdraft lines of credit, and most installment loans are covered by the Military Lending Act. As of October 3, 2016, most types of consumer loans offered to active-duty servicemembers and their dependents have to comply with the Military Lending Act (MLA).

When did credit card companies comply with the MLA?

NOTE: Credit card companies didn’t have to comply with the MLA until October 3, 2017. If you’re a servicemember on active duty and decide to take out one of these loans, you have rights under the MLA, including a limit on the interest rate the creditor can charge.

Overview

- The Military Lending Act (MLA), 10 U.S.C. § 987(opens new window), enacted in 2006 and implemented by the Department of Defense (DoD), protects active duty members of the military, their spouses, and their dependents from certain lending practices. The DoD regulation, 32 CFR Part 232(opens new window), implementing the MLA contains limitations on a...

Associated Risks

- Compliance risk can occur when the credit union fails to implement the necessary controls to comply with the MLA. Reputation riskcan occur when members of the credit union learn of its failure to comply with the MLA.

Examination Objectives

- Determine the credit union’s compliance with the provisions of the MLA, as applicable.

- Assess the quality of the credit union’s compliance risk management systems and its policies and procedures for implementing the provisions.

- Determine the reliance that can be placed on the credit union’s internal controls and procedures for monitoring the credit union’s compliance with the provisions.

- Determine the credit union’s compliance with the provisions of the MLA, as applicable.

- Assess the quality of the credit union’s compliance risk management systems and its policies and procedures for implementing the provisions.

- Determine the reliance that can be placed on the credit union’s internal controls and procedures for monitoring the credit union’s compliance with the provisions.

- Determine corrective action when violations of law are identified or when the credit union’s policies, procedures, or internal controls are deficient.

Examination Procedures

- Determine Applicability of the Regulation

1. Determine if the credit union offers or purchases consumer credit covered by 32 CFR 232(opens new window). 1.1. If the credit union does not offer or purchase the types of credit that would be consumer credit within the meaning of the MLA, the regulation does not apply and no f… - Evaluate Compliance Management System

1. Determine the extent and adequacy of the credit union’s policies, procedures, and practices for ensuring and monitoring compliance with the MLA. 2. Determine the extent and adequacy of the training received by individuals whose responsibilities relate to compliance with the MLA. Revie…

Footnotes

- The MAPR is calculated in accordance with 32 CFR §232.4(c).(opens new window) 32 CFR §232.4(b).(opens new window) The MAPR largely parallels the APR, as calculated in accordance with Regulation Z, with some exceptions to ensure that creditors do not have incentives to evade the interest rate cap by shifting fees for the cost of the credit product away from those categorie…