Trading in your car can hurt your credit score. Trading in your vehicle can cost you if you're not careful. Sometimes the dealership tells you they'll pay off the financing on your trade-in vehicle when you finance a new vehicle through them.

What are the risks of trading in a car with a loan?

There are some risks associated with trading a car with a loan. Considering the risks can help you decide if trading in your car is the right decision right now: Taking out another car loan could stretch your budget. Getting into more debt could put you into negative equity. The Federal Trade Commission explains negative equity in this article.

Does trade in affect your credit score?

You decide to trade your vehicle in after 12 months of ownership. You trade in your current vehicle and take out another loan for a new vehicle. Does this process have any negative or positive effect on your credit score? On one hand, you are paying off your loan in full, due to the trade in value paying off the remainder of the car loan.

Can you trade in a car with a loan?

A car with a loan is an automobile that you're still paying off in installments. You can trade in almost any car for a new set of wheels, including a car with a loan. A car with a loan is an automobile that you're still paying off in installments.

Does paying off a car loan affect your credit score?

Paying off the old loan, and taking out a new one, will affect your score more than how you dispose of the previous car. Though trade-in rarely gives you the best price. (It's convenient, but also an opportunity for the dealer to grab some additional cash out of your pocket.

How long does it take to trade in a car?

Do you pay off your car loan in full?

Does paying off a car loan in full hurt your credit?

About this website

What happens when you trade a car in that you still owe on?

If your auto loan payoff amount is more than the dealer is willing to give you for your trade-in then you will still have to pay off what you owe on your old vehicle even if you trade it in.

What are the disadvantages of trading in a car?

The major drawback when it comes to trading in your car is money. Simply put, your vehicle is only worth what the dealer is willing to give you, and there is little room for negotiation. Factors that affect trade-in-value include: The Profit Margin The dealer needs to sell your trade-in and make a profit.

How does a trade in affect your car payment?

When trading in a car with negative equity, you'll have to pay the difference between the loan balance and the trade-in value. You can pay it with cash, another loan or — and this isn't recommended — rolling what you owe into a new car loan.

Is it better to trade in a car or pay it off?

In almost every case, it's best to pay down or pay off your auto loan before selling it or trading it in. The main concern is whether you have positive or negative equity on your loan. With negative equity, you will want to pay off your auto loan before you trade in your car.

Why you should not trade in your car?

The dealer charges a premium for the convenience it offers you to take your used car off your hands. And used cars obtained on trade-ins carry a very high profit margin for dealers when they put them on their used car lot or sell them wholesale.

When should you not trade in your car?

It is best not to trade in your vehicle when you purchased it very recently. As soon as you drive a new vehicle off the lot, it loses around 10% of its value and up to 20% of its value within the first year. If you purchased a new, not used, vehicle within the last year and are thinking of trading it in, just don't.

How much should you put down on a $12000 car?

10% and 20%“A typical down payment is usually between 10% and 20% of the total price. On a $12,000 car loan, that would be between $1,200 and $2,400. When it comes to the down payment, the more you put down, the better off you will be in the long run because this reduces the amount you will pay for the car in the end.

Is it smart to trade in a car that isn't paid off?

Trading in a Car That is Not Paid Off: Is it Possible? Yes, it's possible. If you're considering trading in a car that is not paid off, you're in one of two situations: the car is worth more than the amount you owe on your loan (positive equity) or the car is worth less than what's owed (negative equity).

Will a dealership buy my car if I still owe?

What happens if I still owe money on my trade in car? It's important that you know the pay-off amount – how much you still owe – and the trade value of the car – how much the dealer is willing to offer you. A dealer will then pay off your old loan and give you a credit for the value of your trade vehicle.

Is trading in a vehicle worth it?

A key benefit of trading in your vehicle is that it could end up requiring less work on your part. The process generally involves heading to one or more dealerships to get estimates, choosing where you want to trade in your car, and closing the deal at the dealership by completing sales paperwork.

Is it smart to trade in a car?

A vehicle trade-in may be all or some of the down payment you make on your vehicle purchase. Like a cash down payment, a trade-in can reduce the cost of your new car, which cuts down how much you need to borrow and your monthly payment. If you want, you can provide a mix of trade-in value and cash as your down payment.

How much money do you lose when you trade in a car?

The quick answer is car owners “lose” an average of $2,340 on used vehicles. But this is a just an average. It all depends on the details, such as the age, model, and mileage of the car. The figure is based on the latest data from NADA, which sets the average profit on used-vehicle sales at about 11.7%.

How does trading in a recently purchased car affect my credit?

I thought I did my research when I bought my used car last June, but clearly I was mistaken. I financed a car for $17,500 at 72 months, but I've recently come to find that the upgraded version of the model I currently own was well within my budget.

Does trading in car affect credit? - AskingLot.com

1 Answer. Paying off your loan in full will most likely not help your credit score, and could potentially even hurt it. Because car loans are installment loans (and thus differ from consumer credit), lenders really only like seeing that you responsibly pay off your loans on time.

Can a Vehicle Trade In Hurt You? | Auto Credit Express

Trading in your vehicle won’t necessarily hurt you during the car buying process unless you have negative equity, in which case you may not be able to trade it in at all.. Trading in with Negative Equity. If your trade-in has negative equity, you may be able to roll over the difference into the new loan.But not all lenders are willing to do this, so make sure you ask beforehand.

How to Trade in a Car with Negative Equity and Bad Credit

Content Manager. David Topham is the Automotive Content Manager for Internet Brands. He works as the lead editor for CarsDirect and Auto Credit Express, and contributes to those sites alongside other Internet Brands' properties like The Car Connection.

How Negative Equity Works With a Trade-In

With rare exceptions, cars decrease in value with age. Depending on other factors, like accidents, repairs, or other damage, the value of a car may decrease even faster. If you borrowed money to buy a car, you might owe more on your car loan than its current value. When that happens, you have negative equity in the car.

Dealing with Negative Equity

Here are some steps to take if you think you might have negative equity in a car youd like to trade in:

Report a Problem

For problems with dealer advertising and sales and finance contracts, contact:

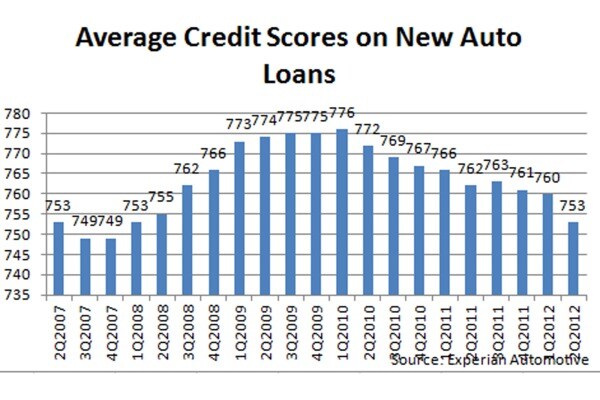

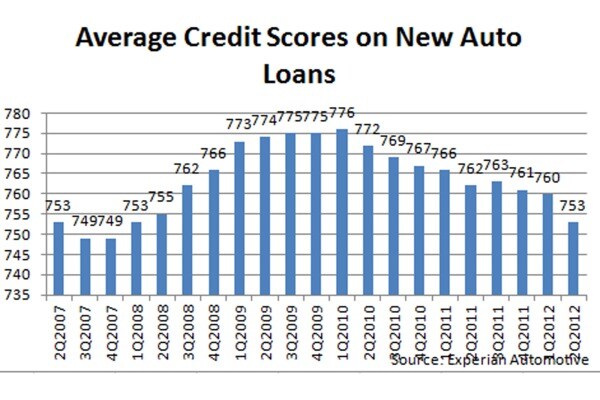

What is a good credit score to buy a car in Canada?

While there isn’t a golden rule for the best credit score you need to buy a car, it’s good to know how your credit will affect your car loan.

Tips for rebuilding your credit score

Wanting to improve your credit score? Trading in your vehicle is just one option. Here are some other ways you can rebuild your credit and gain financial freedom.

How to determine if a car trade in has negative equity?

If you’re allowed to roll over the negative equity, know that it won’t magically go away – you’re still responsible for paying the original loan off on top of the new one. You can determine if you have negative equity by subtracting the amount you owe on the loan from your car’s appraised value.

Can you apply a trade in to a new car?

You can apply the trade-in to the new loan – If your trade-in has equity, you can apply it as a down payment on your new car. This will help lower the overall cost of your new loan, making it more affordable.

Is a car worth less than its cash value?

Your car may be worth less – Your vehicle’s appraised value could be lower than the its actual cash value. While this is common, you can typically still try to negotiate with the dealer to get more money for your trade-in.

What car did Richard Williams trade in?

Richard Williams says a trade-in deal he made with Route 6 Automax in Markham caused him months of mayhem and lowered his credit score. "Once they got the car off the lot and received the check for it and the commission it seems like you just don't exist with any problem that you had," Williams said. Williams Traded in his 2007 Cadillac Escalade ...

Does trading in a car hurt your credit?

Trading in your car can hurt your credit score. Trading in your vehicle can cost you if you're not careful. Sometimes the dealership tells you they'll pay off the financing on your trade-in vehicle when you finance a new vehicle through them.

Why is it easier to sell a car privately?

That's because the dealer wants to make money on your vehicle.

What is a car with a loan?

A car with a loan is an automobile that you're still paying off in installments. You can trade in almost any car for a new set of wheels, including a car with a loan. A car with a loan is an automobile that you're still paying off in installments.

Why wait until you have your car?

Waiting until you've had your car a little while helps the value even out. If you wait a little, you won't take such a financial hit. You'll get penalized. Some lenders charge prepayment penalties for paying out loans before the end of the loan period.

Does a car loan disappear if you trade in?

Your car loan doesn't disappear if you trade in your car. However, the trade-in value of your car becomes credit towards your loan. This credit might cover the whole balance. If it doesn't, your dealer will roll over your loan, combining the deficit with the amount owing on your new car. Consolidating what you owe into a single new loan helps you ...

Is it smart to trade in a car with a loan?

Whether trading in a car with a loan is the right decision for you depends on your circumstances. Trading in a car with a loan might be the smartest thing if: Your car has high ownership costs. If your car uses a lot of gas, often needs repairs, or needs specialty parts, it can be financially savvy to trade it in.

Does a dealership have incentives?

The dealership has great incentives. Dealers often have promotions that make trading in your vehicle more attractive, according to Birchwood Credit. For example, many dealers have end of financial year deals to clear old stock and make way for new models. You've done your research.

Can I transfer my car title to a personal loan?

Since you don't have a dealer working on your behalf, you'll have to transfer your car's title to its new owner. The transfer of ownership form is on the back of most car titles.

How long does it take to trade in a car?

2. The situation: The term length of your auto financing is 36 months. You decide to trade your vehicle in after 12 months of ownership. You trade in your current vehicle and take out another loan for a new vehicle.

Do you pay off your car loan in full?

On one hand , you are paying off your loan in full, due to the trade in value paying off the remainder of the car loan. On the other hand, your automobile financing company is doing a "hard pull" on your credit in order to approve you.

Does paying off a car loan in full hurt your credit?

Active Oldest Votes. 0. Paying off your loan in full will most likely not help your credit score, and could potentially even hurt it. Because car loans are installment loans (and thus differ from consumer credit), lenders really only like seeing that you responsibly pay off your loans on time.