- The appraisal begins by involving the employee and making them feel like a valued part of the process.

- The appraiser focuses on measurable outcomes, such as each individual project, instead of broad, baseless generalizations.

- Positives are the focus of the assessment.

- Areas for improvement are offered in a constructive and neutral format by referring to specific events in the employee’s day-to-day tasks.

- The employee is given the opportunity to problem-solve the situation and contribute to their own sense of self-development.

- Constructive solutions are offered so the employee has a clear idea on what they can do better next time.

What are appraisals and how do they work?

“Appraisals are one person’s opinion of value.” If the home doesn’t appraise out to at least the value it was agreed to be purchased for, you have the option to void the contract, negotiate the price down or come up with the difference in cash. An important thing to remember about appraisals is that they are one person’s opinion on the value.

How often should appraisals be done?

Whether you do performance reviews every 3, 6, or 12 months, we recommend that managers engage in regular weekly or monthly check-ins with their reports. After all, 85% of respondents in the Millennial survey said they would feel more confident if they could have more frequent conversations with their managers.

How long does an appraisal take and what to expect?

How Long Does a Home Appraisal Take? The home appraisal process typically takes seven to 10 days. The time frame depends on the property, the complexity of the appraisal, and the appraiser’s ...

How can I prepare for an appraisal?

Appraisal preparation is straightforward – most of the value of your home is already set and there isn’t much you can do at the last minute to improve the outcome. Three Short House Appraisal Tips: 1. Declutter so the appraiser can SEE your home. 2. Make sure each room is accessible. 3. Prepare a written list of recent improvements. FHA Note

What do they look for in a home appraisal?

Appraisers look at the size, shape and topography of the lot, including easements and encroachments. The appraiser will also note amenities such as street utilities and vehicular access. Part of the evaluation process includes an opinion of whether the home's characteristics are compatible with the market.

How are appraisals calculated?

The appraisal value is determined by the compilation of all the comps' net values. From this value, the price per square is derived.

What will fail a home appraisal?

Anything from deferred maintenance on the home to cool market conditions can lower a home appraisal. Recent sales in the neighborhood will help determine the market value of the home. So if sales have been slow, or if sellers have been accepting lower offers, the value of all homes in the area can be affected.

What hurts you for an appraisal?

Things that can hurt a home appraisal A cluttered yard, bad paint job, overgrown grass and an overall neglected aesthetic may hurt your home appraisal. Broken appliances and outdated systems. By systems we mean plumbing, heating and cooling, and electrical systems.

Does an appraiser know the offer price?

Therefore, the appraiser will most likely know the selling price of a home but this is not always the case. There are times that we have appraised properties for private sales where both the buyer and seller have declined to provide this information.

Does yard affect appraisal?

The curb appeal and general landscaping of the home also impacts the home appraisal value. If your home lacks curb appeal it could lower the value of the home. On the other hand if your yard is filled with hard to care for plants and a hazardous dead tree this could also negatively affect your home appraisal value.

Does cleanliness affect a home appraisal?

Unless the amount of clutter begins to affect the structural condition of a home, it will not affect an appraisal. The cleanliness of a home also has no impact on the value. It is not uncommon for an appraiser to walk into a cluttered, messy home.

Should I be worried about house appraisal?

Myth No. But don't fear: Even though the appraisal is meant to protect the buyer's lender from a bad deal, appraisers are trained to be unbiased and ethical. In fact, it's a crime to coerce or put any pressure on an appraiser to hit a certain value.

What should I do before an appraisal?

ByBe sure to have any safety equipment installed and working properly. ... Walk around your home before the appraisal with a critical eye. ... Inform your home appraiser of any home improvements you have done on your home. ... Do some sprucing up. ... Do some research on other homes in the neighborhood. ... Clean your heart out.More items...

Do appraisers take pictures of closets?

Do Appraisers Look in Closets? The short answer is yes, they will look in your closet… but only to determine the total living area. So while a clean, organized closet is a sign of respect for the appraiser (and a lot more pleasant to look at), a messy closet won't negatively affect home value.

Do appraisers look inside the house?

Exterior-Only appraisals do not require appraisers to measure a property or to inspect the interior, but appraisers are required to view and photograph the front of the property and the comparable sales.

What should you not say to an appraiser?

Just keep your communication to the appraiser about the facts of the home and neighborhood, how you priced the house, and any other relevant information you think the appraiser should know. And remember, don't discuss value. Don't pressure the appraiser to 'hit the value' and you'll be fine.

How do I get the highest appraisal on my house?

A Few Tips for Improving Your Home Appraisal in the Year 2020Take advantage of first impressions. You can increase your home's perceived value by improving on its outside appearance. ... The inside matters even more. Don't stop with outside appearance when trying to increase your home's value. ... Highlight your upgrades.

What happens if the appraisal is lower than the offer?

Appraisal is lower than the offer: If the home appraises for less than the agreed-upon sale price, the lender won't approve the loan. In this situation, buyers and sellers need to come to a mutually beneficial solution that will hold the deal together — more on that later.

How accurate is an appraisal?

In markets with favorable conditions, the difference should be between 2% and 3% of the other values. For markets with challenging conditions, a 10% difference may be acceptable. However, this may vary from one case to another. All appraisals must provide an accurate opinion of a property's value.

How often do home appraisals come in low?

Low home appraisals do not occur often. According to Fannie Mae, appraisals come in low less than 8 percent of the time, and many of these low appraisals are renegotiated higher after an appeal, Graham says.

What is home appraisal?

Home appraisals are in-depth and accurate evaluations of your home’s worth. Typically, appraisers boasting prowess in the field of work, necessary licenses, and skills will analyze the exterior and interior features of your home. An appraisal includes a plethora of factors including your home’s age, size, floor plan functionality and bathroom ...

Why do you need an appraisal for a mortgage?

Home appraisals are critical to ensure your new mortgage is an accurate and justifiable price. In case you want to score other loans like cash and business loans, you’ll have to utilize your home as collateral. In this way, the bank makes sure the current value of your property supports the loan provided.

What happens if you receive an appraisal that is lower than your prediction?

On the flip side, if you receive an appraisal that’s lower than your prediction, you may cancel or delay the transaction. No matter the circumstance you find yourself in, a basic understanding of how the appraisal process works will prove to be useful when you’re making your first purchase.

Why do you need a pre-listing appraisal?

If homeowners are planning to put their house on the market, a pre-listing appraisal can help them get a better understanding of the latest market values. In this way, you can determine a realistic possible asking price. Ultimately, it helps the chances of a fast and successful sale.

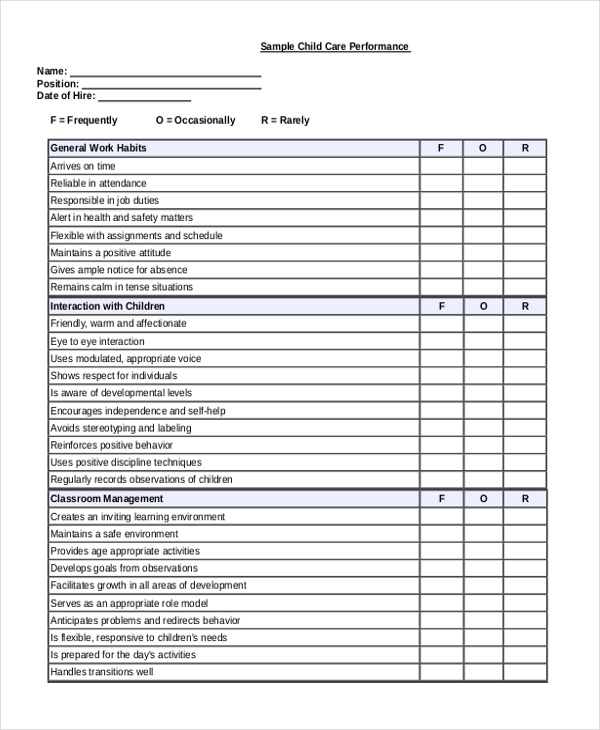

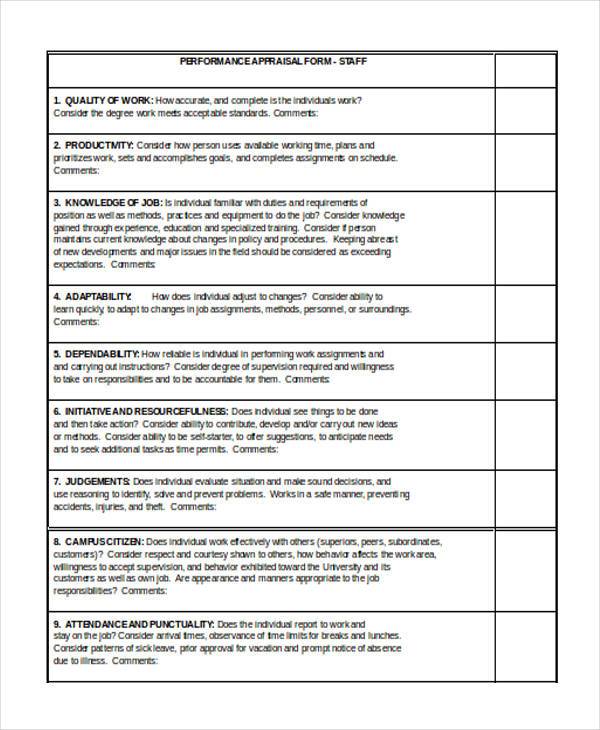

What is appraisal in management?

Settings. Appraisals are a standard part of measuring performance in many organisations; here's how to turn them from a tedious slog into a more positive experience for managers and employees.

How to prepare for an appraisal meeting?

How to prepare for the appraisal meeting. Many appraisal processes involve your team members submitting their own take on how they've been performing in the last year, six months, or shorter period. Make sure your team understand that you are taking this process seriously: give them the time to prepare.

Why is it important to look forward in appraisals?

It is important of course to look at previous performance (and work together on solving any performance issues) but it's also important that appraisals look forward. This is especially true if there are changes to an individual's role ahead, or broader changes for the organisation.

What should a manager do during an appraisal?

Listen, listen, listen. The manager should be doing less talking and more listening during an appraisal. You need to discuss the specifics of their performance from your point of view but it is also vital to hear what the individual has to say and to understand their position.

Should you spring surprises during an appraisal?

But while you should not be springing any surprises during an appraisal, it's quite possible that your staff will do just that. They may feel that they don't have many other options or opportunities for bringing up issues that have been worrying them. That might not be ideal in the context of the appraisal process but it is better that these issues are raised rather than remain simmering. However, it's also important to make sure staff are able to raise these issues on an ongoing basis; it may be worth you considering why they feel that they have to wait until now.

Is appraisal a good idea?

Appraisals can be a really good source of ideas, either in terms of personal development or good ideas for the business to explore further. However, these are often written down in the appraisal report and then forgotten until the next appraisal swings around. Make sure that there is an opportunity to follow up on the issues and ideas raised during the meeting (see the section Do your own appraisal homework first, above). If the team sees that you are taking the appraisal process seriously they are more likely to attempt to hit the performance targets that you have set, making the appraisal process easier next time around, as everyone can be clear about priorities and how to achieve them.

What does an appraiser do?

The appraiser, often a supervisor or manager, will provide the employee with constructive, actionable feedback based on the assessment. This in turn provides the employee with the direction needed to improve and develop in their job.

What is a Performance Appraisal?

A performance appraisal is the periodic assessment of an employee’s job performance as measured by the competency expectations set out by the organization.

Why is it important to use appropriate language and behavior in the appraisal process?

Because a performance appraisal is meant to provide constructive feedback, it is crucial that appropriate language and behavior are used in the process. Human Resources (HR) are the support system for managers and supervisors to be trained in tactfully handling the appraisal process.

What is positive assessment?

Positives are the focus of the assessment. Areas for improvement are offered in a constructive and neutral format by referring to specific events in the employee’s day-to-day tasks. The employee is given the opportunity to problem-solve the situation and contribute to their own sense of self-development.

Why is performance appraisal important?

The purpose of a performance appraisal is two-fold: It helps the organization to determine the value and productivity that employees contribute, and it also helps employees to develop in their own roles.

How does an employee assessment help an organization?

Employee assessments can make a difference in the performance of an organization. They provide insight into how employees are contributing and enable organizations to: Identify where management can improve working conditions in order to increase productivity and work quality.

What is self evaluation in interview?

Self-evaluation. In a self-evaluation assessment, employees first conduct their performance assessment on their own against a set list of criteria. The pro is that the method helps employees prepare for their own performance assessment and it creates more dialogue in the official performance interview.

When does an appraisal take place?

The appraisal takes place as early as possible after the two parties agree on a price, to allow enough time to schedule a property visit and production of the report. A lender will select a home appraiser who will contact the seller to set a time and date for a home visit.

What Is a Home Appraisal?

A home appraisal is a value analysis of your property from a certified or licensed appraiser hired by the lender during the home purchase or refinance process.

Why is an appraisal important?

The appraisal is also important to the buyer and seller because an appraisal value that comes in lower than the agreed-upon price could prompt a buyer to reopen price negotiations. An appraiser typically evaluates the property–exterior and/or interior–conducts research and addresses any special requests from the lender.

What is an appraiser?

Unless it is a cash-only home purchase, an appraiser is an impartial third party who can confirm or complicate the deal by providing an evaluation of the home’s value. Lenders rely on professional home appraisals to determine whether the home is at least equal to the value of the agreed-upon price.

How many closing delays did appraisals cause in 2020?

However, appraisal issues were responsible for 18% of home purchase closing delays and 9% of terminated contracts in June 2020, according to a National Association of Realtors study.

Why do appraisers review the interior and exterior of a home?

Traditionally, appraisers review both the exterior and interior of a home to make sure it is in good structural shape, to confirm there are no safety issues, to make note of the number of rooms and to see if there have been major upgrades since the last real estate transaction.

How to get comparative information?

To get comparative information, appraisers typically review government records as well as home sale information from the Multiple Listing Service (MLS). MLS is a real estate database that includes home listing and sales information posted by real estate professionals. Although the database is technically private, much of the information is available online for free.

What Is a Home Appraisal?

An appraisal is an unbiased professional opinion of a home's value. Appraisals are almost always used in purchase-and-sale transactions and commonly in refinance transactions. In a purchase-and-sale transaction, an appraisal is used to determine whether the home's contract price is appropriate given the home's condition, location, and features. In a refinance transaction, an appraisal assures the lender that it isn't handing the borrower more money than the home is worth.

How Long Does a Home Appraisal Take?

The appraisal process takes an average of seven to 10 days. The appraiser visits the property and spends an hour or two inspecting the home's interior and exterior, measuring the square footage, and evaluating the home's features and fixtures. The appraiser also compares the home to other similar, recently sold homes in the neighborhood (aka "comps"). After doing the physical inspection and running the comps, the appraiser writes an appraisal report. The amount of time it takes for the entire process depends on the complexity of the appraisal and the appraiser's workload or schedule.

What Is an Appraisal Report?

The report asks the appraiser to describe the interior and exterior of the property, the neighborhood, and nearby comparable sales. The appraiser then provides an analysis and conclusions about the property's value based on their observations. 2

Why do lenders order appraisals?

Because the appraisal primarily protects the lender's interests, the lender will usually order the appraisal. An appraisal costs several hundred dollars and, generally, the borrower pays this fee.

What happens when appraisal value is lower than expected?

When the appraisal value is lower than expected, the transaction can be delayed or even canceled.

What is a qualified appraiser?

A qualified appraiser creates a report based on a visual inspection, using recent sales of similar properties, current market trends, and aspects of the home (e.g., amenities, floor plan, square footage) to determine the property’s appraisal value.

Can you overpay for a home if you don't have an appraisal?

Holding out for an all-cash buyer who doesn't require an appraisal as a condition of completing the transaction is unlikely to net you a higher sales price. No one wants to overpay for a home. Unfortunately, if your surrounding area has experienced recent distressed sales, that can lower your home's appraisal value.

What is an appraisal?

An appraisal is an independent assessment of the value of the property.

When do you get a copy of appraisals?

When you borrow money to buy or refinance a home, your lender may need to get a new appraisal and may require you to pay for it. Your lender may also use other ways to check the value of the home. For a typical home loan (that is, a loan secured by a first mortgage on your residential real estate), you are entitled to receive a copy of appraisals and opinions of value your lender gets. You should receive them soon after they are delivered to the lender in complete form—no later than three days before closing.

How soon after a loan is delivered should you receive the appraisal?

You should receive them soon after they are delivered to the lender in complete form—no later than three days before closing. You can’t be charged a fee for copies of an appraisal or other valuation. But you can be charged a reasonable fee for the lender’s cost of preparing the appraisal or other valuation.

How much does an appraisal cost?

The average cost is between $300 and $550 for a single-family home, so be sure to factor that price into your homebuying and closing cost budget.

How should I prepare for a home appraisal?

The best way to prepare for the home appraisal is by understanding what’s involved. You might also want to do your own research on the home and its surrounding neighborhood to get an idea of what you think it’s worth. If refinancing, you should make sure the property is in clean and in good condition before the appraiser arrives.

What is a home appraisal?

In real estate, a home appraisal represents the estimated value of a home as determined by a professional appraiser. When purchasing a home, your lender may require an appraisal of the home you’re pursuing to determine its worth and how much to lend you.

How does a home appraisal determine a house’s value?

The appraiser will make his/her value determination by examining the condition of the property and by looking at “comparables”. Comparables are the prices of recently sold homes, with similar characteristics, within close proximity of the property. Appraisers use their own judgment and expertise to determine a reasonable home valuation.

How long does a home appraisal take?

From there to the preparation of the appraisal report, it will all depend on the appraiser’s workload. The whole process can range from a couple of days to a few weeks, depending on the amount of volume the appraiser is managing.

What does an appraisal report reveal?

An appraisal report can reveal one of three things: The home’s value is higher than the sales price you and the seller agreed on. The property’s value is equal to the sales price. The appraisal value is less than the sales price.

What do appraisers look for when estimating a property's value?

Here are some of the most common items appraisers look at when estimating a property’s value: Home age and overall condition. Layout, design, and floor plans. Appliances, including their age and condition. Construction materials used to build the home. Size of the lot.

What is an appraisal?

Despite working out a price between you and the seller, an appraisal report is created by a licensed third-party appraiser to determine the fair market value of the home. Appraisals are typically required by a mortgage lender so they can properly value the home to determine how much they are willing to lend, but sellers will sometimes have appraisals done prior to the listing so they can price their property accordingly.

How much does an appraisal cost?

The buyer typically pays for any appraisal required by the lender, which costs anywhere from $300 to $400 on average, though Daniels says it can run upwards of $500 to $900, especially if the home is located in a rural location, which will cost a larger trip fee. The lender is the one who will hire an appraiser and will receive the appraisal report.

What goes down during the appraisal?

There are three key components to the home appraisal report: The physical inspection, the comparable sales selection, and the evaluation of data.

How long does it take to get an appraisal?

Depending on the size of the home and current housing market, an appraisal can take anywhere from a few days to a few weeks, according to Tom Cullen of Cullen Real Estate and Appraisal Company, an appraiser for more than 30 years. Here’s the general timeline of what to expect:

What happens if the appraised value is lower than the offer?

Congratulations! On the other hand, if the appraisal is lower than your offer, it could be an opportunity for you to renegotiate the sales price with the seller — or you may have to make up the difference in cost.

What does an appraiser look for in a home?

Once you set up a time, the appraiser will stop by the property and look at the interior and exterior of the home, noting physical attributes, quality, amenities, size, and any extra features.

What are the components of a home appraisal?

There are three key components to the home appraisal report: The physical inspection, the comparable sales selection, and the evaluation of data. Physical inspection. This is where the appraiser will examine the actual property.

Who pays for appraisals?

The buyer usually pays for the home appraisal. Even though it's usually the lender that requires an appraisal, they still pass the cost to the buyer. The amount is paid at closing, but you can sometimes negotiate with the seller to cover the cost. If a seller wants to get an appraisal for their own purposes, they pay for it.

What is the purpose of appraisal?

The primary purpose is to put an estimated value on a property based on the condition of the home and the comparable properties in the area. The estimated value from an appraisal is most commonly used by mortgage lenders, who want to make sure the loan amount is in line with what the home is worth. For instance, a lender would not want ...

Why do you need an appraisal when buying a home?

A lender usually requires an appraisal to make sure the loan amount isn’t higher than what the home is worth. If you’re a buyer it helps protect you from overpaying for a home. If you're a seller, an appraisal gives insight into what steps you can take to increase ...

How to get a home valuation?

The most common method of getting the valuation is a home appraisal. During the appraisal a licensed assessor will visit the property and give their opinion on what the house is worth. This amount is then used by lenders to decide how much to lend for a mortgage on the property. A home appraisal is conducted by a certified assessor who comes to ...

How to get a lower appraisal?

If an appraisal comes in lower than expected and the mortgage is denied, there are a few things to consider: 1 Double-check the appraisal for any mistakes. 2 Make sure any improvements to the home are listed. 3 As a seller, you can lower the asking price. 4 As a buyer, you can offer to pay cash to make up the difference.

What is the difference between an appraisal and a home inspection?

A home appraisal differs from a home inspection, which is usually done before closing on a property to make sure there are no problems that need to be addressed, like roof leaks, a broken HVAC unit or plumbing issues.

What is the most important part of an appraisal?

One of the most important parts of an appraisal is the comparison to similar homes. The appraiser will look at the items in your home and see how the condition compares to other properties recently sold in the area. Comparable properties are usually similar in size, number of bedrooms, year built and the neighborhood.