How Are Your Property Taxes Determined

- Your property assessment. Market value is the most common approach in determining residential, vacant and farm assessments. ...

- The total value of the town, village or city needs to be compiled. ...

- The total tax levy of each town, village, school or city needs to be compiled. ...

- The tax rate is now compiled.

How to calculate the total amount with tax?

- The first $9,950 is taxed at 10% = $995

- The next $30,575 is taxed at 12% = $3,669

- The last $5,244 is taxed at 22% = $1,154

How are property taxes determined and calculated?

How Property Taxes Are Calculated

- Assessing Property Tax. Different property types have various types of tax assessed on the land and its structures. ...

- Calculating Property Taxes. Property taxes are calculated using the value of the property. ...

- Mill Levy or Millage Tax. ...

- 3 Ways to Assess Property Value. ...

- Useful Property Tax Information. ...

- The Bottom Line. ...

How can I calculate payroll taxes?

To make calculating payroll taxes easier, invest in payroll services and software like QuickBooks to calculate payroll taxes. Payroll software is more accurate, less work, and offers tax penalty protection, meaning you can have peace of mind knowing your payroll taxes are in good hands.

How your property tax is calculated?

- Assess the value of every property in a given jurisdiction

- Determine each property’s taxable value

- Apply the local tax rate to each property’s taxable value

How is property assessed in Virginia?

In accordance with the Virginia Constitution, real estate is assessed in a uniform manner and at fair market value. The Board of Supervisors sets the general tax rate that applies to all real property in the county. Your tax bill might include other taxes related to special taxing districts and/or service fees.

How are property taxes assessed in NY State?

To estimate your annual property tax: Multiply the taxable value of your property by the current tax rate for your property's tax class. Property tax rates change each year, as well as the value of exemptions and abatements. The actual taxes you pay in July might be different.

What is the meaning of tax assessment?

Tax assessment, or assessment, is the job of determining the value, and sometimes determining the use, of property, usually to calculate a property tax. This is usually done by an office called the assessor or tax assessor. Governments need to collect taxes in order to function.

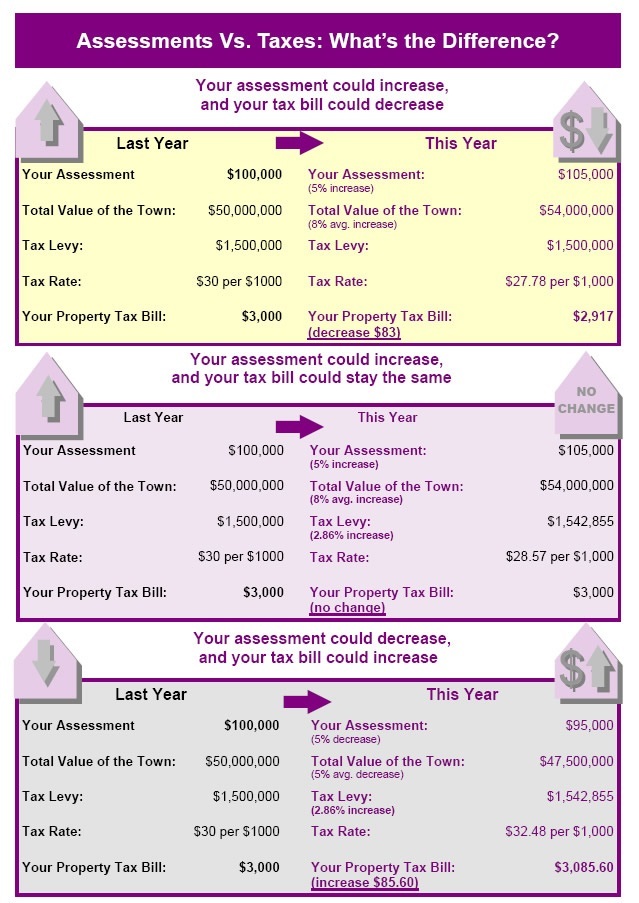

What is the difference between a tax and an assessment?

Assessments not taxes - are determined by local assessors. Taxes are determined by school boards, town boards, city councils, county legislatures, village boards and special districts. These jurisdictions are responsible for taxes, not assessments.

How is assessed value determined in New York?

Your Assessed Value is based on a percentage of your Market Value. This percentage is known as the Level of Assessment or Assessment Ratio. Your Assessment Ratio depends on your tax class. Limits on Increases for Class 1, 2a, 2b and 2c properties.

At what age do you stop paying property taxes in New York?

65 years of age or overEach of the owners of the property must be 65 years of age or over, unless the owners are: husband and wife, or....Taxable status dateIncome tax year for eligibility in 2022April 15 or later20211 more row

What are the types of tax assessment?

Income Tax AssessmentSelf-assessment, section 140A.Summary-assessment, section 143(1)Scrutiny-assessment, section 143(3)Best judgment-assessment, section 144.Income escaping assessment, section 147.

What is the procedure of assessment?

Key termsTermDefinitionAssessment procedureConsists of a set of assessment objectives, each with an associated set of potential assessment methods and assessment objectsAssessment objectiveIncludes a set of determination statements related to the security control under assessment8 more rows

Why is income tax assessment important?

It is therefore of fundamental importance to understand what constitutes an assessment. In particular, identifying the nature of an assessment is important for the following reasons: An assessment crystallises the liability to pay tax and determines the time at which tax is due.

How do I find the assessed value of my home?

One way to find the assessed value of your property is to check your county or local government's website, which lists the assessed property values of real estate in the municipality's taxable area. Checking your assessed value is correct helps you ensure that you're not overpaying in property taxes.

What is assessment of property?

Definition: For the purpose of taxation, a property is assessed for its monetary worth. This ascertained price is known as assessed value. Description: This assessment is done at an annual basis, considering factors such as property values and market conditions in the neighboring areas.

What is tax assessment on Zillow?

This is the price the government tax assessor estimates the property would sell for on the open market as of the effective date for the assessed value for the year in question. The assessor's market assessed value is based on actual historical sales of similar properties for a specified study period.

How often are property taxes assessed in NY?

NYC's Property Tax (Fiscal) Year is July 1 to June 30. Finance mails property tax bills four times a year. You either pay your property taxes two or four times a year, depending on the property's assessed value. Bills are generally mailed and posted on our website about a month before your taxes are due.

Why are NYS property taxes so high?

What Contributes to Upstate New York's High Property Taxes? Assessments that may be higher than they should be due to a complex and flawed assessment process. Town, city, village, and school budgets that have steadily increased despite declines in population and school enrollments in many areas over past few years.

When you buy a house are the taxes reassessed NY?

Does New York State require reassessments? A. New York State's Real Property Tax Law addresses the issue of assessment equity. While it doesn't require assessments to be at 100 percent of market value, it does establish a standard that assessments be fair at a uniform percentage of market value.

What is the formula for determining the market value of a property?

Check Recent Sales Prices Divide the average sale price by the average square footage to calculate the average value of all properties per square foot. Multiply this amount by the number of square feet in your home for a very accurate estimate of the fair market value of your home.

How does the assessor determine the value of a property?

This is when the assessor determines your property value based on how much it would cost to replace it . If the property is older, assessors determine the amount of depreciation that has taken place and how much the property would be worth if it were empty. For newer properties, the assessor deducts any realistic depreciation and looks at the costs of building materials and labor, including these figures in the final value of the property.

How does an assessor work?

Once the assessor has the value, they work in two stages: First, they send the assessed value of the property to the owner; then, they follow it up with a tax bill.

How are mill levy rates calculated?

Tax levies for each tax jurisdiction in an area are calculated separately; then, all the levies are added together to determine the total mill rate for an entire region. Generally, every city, county, and school district each have the power to levy taxes against the properties within their boundaries. Each entity calculates its required mill levy, and they are then tallied together to calculate the total mill levy.

How often do tax assessors value property?

Typically, tax assessors will value the property every one to five years and charge the owner-of-record the appropriate rate following the standards set by the taxing authority. Assessors calculate that value using the mill levy–also called the millage tax–and the assessed property value.

How many methods can an assessor use to determine the market value of a property?

The assessor can estimate the market value of the property by using three different methods, and they have the option of choosing a single one or any combination of the three.

What does an assessor look for in a property?

The assessor will review all relevant information surrounding your property to estimate its overall value. To give you the most accurate assessment, the assessor must look at what comparable properties are selling for under the current market conditions, how much the replacement costs for the property would be, the maintenance costs for the property owner, any improvements that were completed, any income you are making from the property, and how much interest would be charged to purchase or construct a property comparable to yours.

What is property tax?

Property taxes are a major source of income for local and state governments and are used to fund services such as education, transportation, emergency, parks, recreation, and libraries. Cities, counties, and school districts in a region each have the power to levy taxes against the properties within their boundaries.

How Does a Property Tax Assessment Work?

Local governments use your assessment as the basis for calculating your annual property tax bill. Assessments are usually prepared on a specific date each year, and they're often based on recent sales of comparable properties in the area.

What are the three methods used to assess a property?

Governments typically assess a property by one of three methods: the replacement method, the sales comparison method, or (for business property) the income method. 6

Why does my property appraisal go down?

It might happen because you've qualified for certain exemptions that are subtracted from the assessed value.

How often does property tax increase?

You can usually expect that your property's assessed value will increase somewhat, raising your property tax bill, especially if assessments only occur once every few years. Your property may be appreciating in value. Assessments can go down on occasion for a variety of reasons.

How much can you deduct on property taxes?

As of 2019, you can claim a deduction for up to $10,000 total in property, state, and local taxes. All these taxes are included under the same $10,000 umbrella. 8

What is market method?

The market method is very similar to that used by lenders to appraise property for mortgage purposes. Business property is typically assessed using the income method—the amount of income the property typically generates adjusted by factors such as business taxes, insurance costs, and operating and maintenance expenses.

What is the sales comparison method?

The sales comparison method, also called the market approach, is based on the sales prices of similar properties in the immediate area. The value is adjusted upward or downward, depending on the assessed property's unique attributes or the lack of them. The assessed value will increase if the assessed property has a swimming pool and comparable sales in the area don't share this feature. The assessed value will decrease if the property doesn't have a pool but comparable sales do.

What to do if your assessment is too high?

If you feel your assessment is too high, you should discuss it with your assessor and consider contesting your assessment.

Can you grieve your property tax?

Property owners often confuse property taxes and assessments. For instance, some taxpayers attempt to "grieve" their taxes. You can grieve your assessment, but not your taxes. Assessments not taxes - are determined by local assessors.

What is taxable assessment?

Taxable assessment: Your property's taxable assessment is the assessed value of your property as determined by your local assessor minus any exemptions that have been granted to you. Property tax rate: the percentage at which your property is taxed.

How to determine tax rate?

To determine the tax rate, the taxing jurisdiction divides the tax levy by the total taxable assessed value of all property in the jurisdiction. Because tax rates are generally expressed as " per $1,000 of taxable assessed value ," the product is multiplied by 1,000:

How much is a property tax bill of $150,000?

Tax bill for property with a taxable assessment of $150,000 = $7,500. Equalization rates are necessary to calculate tax rates for counties. because they include multiple municipalities, and for school districts, because most cross municipal boundaries.

Why are equalization rates necessary?

Equalization rates are necessary to calculate tax rates for counties. because they include multiple municipalities, and for school districts, because most cross municipal boundaries.

What determines the amount of revenue collected from all sources other than the property tax?

The taxing jurisdiction determines the amount of revenue collected from all sources (state aid, sales tax revenue, user fees, etc.) other than the property tax.

What is the taxing jurisdiction?

The taxing jurisdiction determines the amount of revenue collected from all sources (state aid , sales tax revenue , user fees, etc.) other than the property tax. The total amount of revenue is subtracted from the budget.

Why does my tax bill change every year?

Your tax bill may vary each year. The total amount of your tax bill will likely change every year due to changes at the school district or local government level. Changes to the following will directly impact the amount of taxes you owe each year: Changes in your assessment or exemptions can also impact your tax bill.

What is property tax assessment?

Property Tax Assessment is the process through which the assessed value of a property is determined in order to calculate the property taxes due. In Alabama, property tax is based on property classification, millage rates, and exemptions.

How are Alabama taxes calculated?

Your Alabama taxes are calculated using your property’s assessed value. This is determined by multiplying the appraised value by the corresponding property classification, which is also known as the assessment rate.

How to determine millage rate?

Millage rates are determined by the county commissions and other taxing agencies. Millage is the tax rate expressed in decimal form.

Does the Property Tax Division take responsibility for millage rates?

Please note: The Property Tax Division takes no responsibility for and makes no assertions as to the accuracy of the millage rate information.

How to find out property tax?

If you’re considering buying a home, look on the real estate listing for assessment and tax information, or go to the county website to find out the annual property tax.

How often do tax assessors calculate home value?

Tax assessors can calculate a home’s current assessed value as often as once per year. They also may adjust information when a property is sold, bought, built, or renovated, by examining the permits and paperwork filed with the local municipality.

What is a home’s fair market value?

The market value of a home is basically the amount a knowledgeable buyer would pay a knowledgeable seller for a property, assuming an arm’s-length transaction and no pressure on either party to buy or sell. When a property sells to an unrelated party, the sales price is generally assumed to be the fair value of the property.

What is taxable value?

The taxable value of your house is the value of the property according to your assessment, minus any adjustments such as exemption amounts.

What happens if you believe the assessor has placed too high a value on your home?

If you believe the assessor has placed too high a value on your home, you can challenge the calculation of your home’s value for tax purposes. You don’t need to hire someone to help you reduce your property tax bill. As a homeowner, you may be able to show how you determined that your assessed value is out of line.

How much is the assessed value of a home?

In general, you can expect your home’s assessed value to amount to about 80% to 90% of its market value. You can check your local assessor or municipality’s website, or call the tax office for a more exact figure for your home. You can also search by state, county, and ZIP code on publicrecords.netronline.com.

What affects property taxes?

One factor that affects your property taxes is how much your property is worth. You probably have a good understanding of your home’s market value—the amount of money a buyer would (hopefully) pay for your place. (You could also enter your address in a home value estimator to get a ballpark figure.) Still, tax municipalities use a slightly ...

What is property assessment?

Your property's assessment is one of the factors used by your local governments and school district to determine the amount of your property taxes.

What happens if the assessor does not reduce your assessment?

If the assessor does not reduce your assessment, you can contest your assessment.

What is the difference between assessment and market value?

Assessments and market value. A property's assessment is based on its market value. Market value is how much a property would sell for under normal conditions. Assessments are determined by the assessor, a local official who estimates the value of all real property in a community.

What to do if your assessment is higher than the price you can sell your home?

If your assessment or the estimated market value for your property is higher than the price for which you can sell your home, you should discuss it with your assessor. See How to estimate the market value of your home.

When is the tentative assessment roll made public?

You should check your assessment on the tentative assessment roll each year. (In most communities, the tentative roll is made public on May 1 , but you should check with your assessor for the specific date for your community.)

Who determines the value of a property?

Assessments are determined by the assessor, a local official who estimates the value of all real property in a community. Most assessors work for a city or town, though some are employed by a county or village.

Is real estate assessed?

All real property, commonly known as real estate, is assessed. Real property is defined as land and any permanent structures attached to it. Examples of real property: Personal property (cars, jewelry, etc.) is not subject to property taxes in New York State.

What percentage of your estimated tax payment should be on your previous year's tax return?

You should also look at the total tax you paid if you are going to base your estimated tax payments on 100 or 110 percent of your previous year's taxes.

What percentage of your estimated tax bill should you pay?

If you expect your income this year to be less than last year and you don't want to pay more taxes than you think you will owe at year end, you can choose to pay 90 percent of your estimated current year tax bill. If the total of your estimated payments and withholding add up to less than 90 percent of what you owe, you may face an underpayment penalty. So you may want to avoid cutting your payments too close to the 90 percent mark to give yourself a little safety net.

How much of your income should you pay in taxes?

The safest option to avoid an underpayment penalty is to aim for "100 percent of your previous year's taxes." If your previous year's adjusted gross income was more than $150,000 (or $75,000 for those who are married and filing separate returns last year), you will have to pay in 110 percent of your previous year's taxes to satisfy the "safe-harbor" requirement. If you satisfy either test, you won't have to pay an estimated tax penalty, no matter how much tax you owe with your tax return.

How to get a jump on paying taxes?

One easy way to get a jump on paying your next year's taxes is to apply your previous year's tax refund to your next year's taxes. If you won't have federal income tax withheld from wages, or if you have other income and your withholding will not be enough to cover your tax bill, you probably need to make quarterly estimated tax payments.

How much of your income is considered a qualified farmer?

You're considered a qualified farmer or fisherman if you earn more than two thirds of your taxable gross income from farming or commercial fishing.

Do you have to make estimated taxes?

Do you expect to owe less than $1,000 in taxes for the tax year after subtracting your federal income tax withholding from the total amount of tax you expect to owe this year? If so, you're safe—you don't need to make estimated tax payments.

Do you have to pay estimated taxes if you are self employed?

But if you are self-employed, or if you have income other than your salary, you may need to pay estimated taxes each quarter to square your tax bill with Uncle Sam. You may owe estimated taxes if you receive income that isn't subject to withholding, such as: Interest income. Dividends.

What are the taxes that employers must withhold?

Employers are required by law to withhold employment taxes from their employees. Employment taxes include federal income tax withholding and Social Security and Medicare Taxes.

What percentage of income is taxed by a foreigner?

Foreign Persons. Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30 percent. The tax is generally withheld (Non-Resident Alien withholding) from the payment made to the foreign person. NRA Withholding.

Why do we need to do a checkup?

The IRS encourages everyone to perform a “paycheck checkup” to see if you have the right amount of tax withheld for your personal situation.