Is a 560 credit score good or bad?

A 560 credit score is a very low credit score and means bad credit. 560 is NOT a good credit score. Someone with a credit score of 560 will have smaller chances of getting a loan or even a good job compared to people with a higher credit score.

Can you get a home loan with a 550 credit score?

If you’re a Veteran or currently in the US Armed Forces, you can now get a VA Home Loan with a 550+ Credit Score. You’ve probably been told by lenders, friends, etc that you need to have a 620 or better score to qualify.

Is 530 a good credit score?

Is 530 a Good Credit Score? A 530 FICO® Score is considered “Poor”. It means you’ve had past payment problems, including collection accounts, judgments, bankruptcy or worse. With a “Poor” score, it’s harder to obtain credit cards, loans, and favorable interest rates. The good news?

Can you get an apartment with a 550 credit score?

Yes, You Need A Credit Report AND A Credit Score To Rent ... Rent can go anywhere from 550 a month to over 7000. that 550 apartment will look at all income and references first then run the credit check, just to see.

Can you get anything with a 550 credit score?

You'll typically need good to excellent credit to qualify for a personal loan — which means you might have a harder time qualifying if you have a credit score of 550. However, there are several lenders that offer personal loans for poor credit.

Is 550 a terrible credit score?

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 550 FICO® Score is significantly below the average credit score.

How big of a loan can I get with a 550 credit score?

The amount you can qualify for with a credit score of 550 usually depends on the lender. One lender that considers borrowers with a credit score of 550 is Avant. They can lend up to $35,000, and their rates range from 9.95%-35.99%.

How do I get my credit score from 550 to 700?

How to Bring Your Credit Score Above 700Pay on Time, Every Time. ... Reduce Your Credit Card Balances. ... Avoid Taking Out New Debt Frequently. ... Be Mindful of the Types of Credit You Use. ... Dispute Inaccurate Credit Report Information. ... Don't Close Old Credit Cards.

Is 600 a Good credit score?

Your score falls within the range of scores, from 580 to 669, considered Fair. A 600 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

What is considered a poor credit score?

FICO considers a credit score to be poor if it falls below 580. According to FICO, a person with a FICO score in that range is viewed as a credit risk.

How can I raise my credit score overnight?

5 Ways to Boost Your Credit Score OvernightReview Your Credit Reports and Dispute Errors.Pay Bills On Time.Report Positive Payment History Like Utilities to Credit Bureaus.Keep Old Accounts Open.Keep Your Credit Balances Under 30%

How can I fix my credit score?

7 ways to improve your credit scoreCheck your credit reports for errors. ... Pay down any credit card debt you have. ... Get a credit card if you don't have one. ... Consider signing up for Experian Boost. ... Wait for negative items to fall off your credit reports. ... Apply for new credit sparingly. ... Pay your bills on time, every time.

Can I improve my credit score?

It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low balances and paying your bills on time.

How can I raise my credit score by 100 points in 30 days?

Learn more:Lower your credit utilization rate.Ask for late payment forgiveness.Dispute inaccurate information on your credit reports.Add utility and phone payments to your credit report.Check and understand your credit score.The bottom line about building credit fast.

How can I raise my credit score from 550 to 650?

How To Increase Your Credit ScoreCheck Your Credit Report. The first step you should take is to pull your credit report and check for errors. ... Make On-Time Payments. ... Pay Off Your Debts. ... Lower Your Credit Utilization Rate. ... Consolidate Your Debt. ... Become An Authorized User. ... Leave Old Accounts Open. ... Open New Account Types.More items...

How can I raise my credit score 100 points?

Here are 10 ways to increase your credit score by 100 points - most often this can be done within 45 days.Check your credit report. ... Pay your bills on time. ... Pay off any collections. ... Get caught up on past-due bills. ... Keep balances low on your credit cards. ... Pay off debt rather than continually transferring it.More items...

How to Improve Your 550 Credit Score

You can get personal information about what is hurting your credit score the most. When you check your credit score from Experian, you’ll get a lis...

Tips For Improving Your Credit Score

A low credit score can make it difficult to get new credit at the best rates and terms. Fortunately, you can take steps to build your credit and im...

What to Do If You Can’T Get Approved

If your credit score is too low, lenders may reject your application for a loan or credit card. Building your credit may improve your chances of ge...

Find Out More About Your Credit Score

If you’d like to move up from 550 to a higher credit score, take the first step of understanding your credit by getting your free credit report fro...

Is 550 a good credit score?

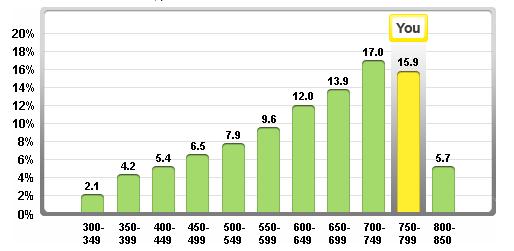

FICO scores range from 300 to 850. As you can see below, a 550 credit score is considered Poor.

550 Credit Score Credit Card & Loan Options

Many lenders choose not to lend to borrowers with scores in the Poor range. As a result, your financing options are going to be very limited. With a score of 550, your focus should be on building your credit and raising your credit scores before applying for any loans.

How to Improve a 550 Credit Score

Credit scores in the Poor range often reflect a history of credit mistakes or errors. Late payments, charges offs, foreclosures, and even bankruptcies. It’s also possible that you simply haven’t built credit at all. No credit is pretty much the same as bad credit.

Where to Go from Here

It’s important to know which factors make up your credit score. As you can see in the image below, there are 5 factors that make up your credit score.

How long does a negative credit report affect your 550?

Usually, accurate derogatory comments can remain on your credit report for a long period of time ranging from 5-7 years.

What percentage of credit score is owed on credit cards?

Amount Owed on Credit Cards and Loans: Your score will also depend on how much debt in credit cards and loans you owe. It constitutes 30% of your credit score. It is an indicator of the amount of debt you owe compared to the amount of credit available.

What is a good credit score?

There are a variety of scoring models with FICO Scores being the most popular. Basically, creditors or lenders use your score determine whether you are credit worthy. The higher your score, the more creditworthy you are considered. The scores are grouped in ranges with scores above 750 being excellent while those between 700-749 are considered to have a good score. Scores of between 650-699 are considered fair while any score below 649 is considered to be poor.

How much of your credit score is credited to a late payment?

It constitutes 15% of your score. The Types of Accounts You Have: This usually accounts for 10% of your credit score.

Why is it important to maintain a good credit score?

Achieving and maintaining a good score is a perfect way of keeping your finances in check.

Does accepting a hard inquiry affect your credit score?

Accepting a hard inquiry will result in a drop in your scores. Basically, there are multiple factors that could make your credit score drop. A drop-in credit score will lower your chances of getting mortgages, getting your auto-loans approved or even get personal loans.

Is 550 credit score bad?

A credit score of 550 is considered poor, however, it will still get you an auto-loan, some types of credit cards, a home loan and even a personal loan, especially from online lenders. The score, however, will impact your finances negatively as your credit report will indicate to the lenders that you have a high risk of defaulting your debt.

What should I do with a 550 credit score?

The one thing anyone with a 550 credit score should do is open a secured credit card. Even if you don’t use it to make purchases, a secured card can help improve your score by adding positive info to credit report on a monthly basis. It won’t give you an emergency loan, though.

How much does a credit score rise after 90 days of delinquency?

Delinquency & Default – The impact of a serious delinquency is obvious from the manner in which credit scores rebound when it’s gone. Roughly 11% of people who fall 90 days behind on a loan or line of credit see their credit scores rise by at least 50 points when that record comes off their credit reports, according to FICO research. And nearly half see an increase of up to 29 points.

What happens if you default on your credit card?

Having your account default will cause your credit score to fall further, possibly leading to collections and even a lawsuit, both of which could add to the credit damage. Each missed payment you make up will reduce your delinquency level, so you don’t have to pay the total amount due all at once.

How long does it take for a credit score to recover from bankruptcy?

And it generally takes scores 7-10 years to fully recover. Unfortunately, there’s no way to lessen the impact.

Is 550 a good credit score?

A 550 credit score is classified as "bad" on the standard 300-to-850 scale. It is 150 points away from being a “good” credit score, which many people use as a benchmark, and 90 points from being “fair.”. A 550 credit score won’t knock any lenders’ socks off, but it shouldn’t completely prevent you from being approved for a credit card or loan, ...

Can I repair my credit score to 550?

Of course, there’s a lot more to repairing a 550 credit score than simply picking the right credit card. You have to use that card responsibly, keep up with your other financial obligations and keep your credit report clear of negative information.

Do credit cards report on a monthly basis?

And they report account information to the major credit bureaus on a monthly basis, just like any other credit card. So each month your card’s issuer reports your account as being in good standing, a bit of positive information will be added to your credit reports to help cover up previous mistakes.

Credit Score Ranges in Canada

Credit scores in Canada range from 300 to 900, with 900 being the highest score you can achieve. A credit score of 650 is considered middle ground.

What a 550 Credit Score Means

According to Equifax Canada, a credit score range of 660 to 900 is generally considered good to excellent credit. So, is having a credit score of 550 good or bad?

How to Improve Credit Scores

Raising your credit score can make it easier to get approved for loans and land favorable interest rates. If you’re trying to improve your credit and move out of the 550 score range, these tips can help:

Why Birchwood Credit Is Different

While some lenders may not work with borrowers who have a credit score of 550, Birchwood Credit seeks to serve consumers with a variety of credit situations. We can work with you to review your credit, income and work history to find a loan solution that’s appropriate for your needs.

Is 550 a Bad Credit Score?

If we are taking a look at the normal range of 300-850, a credit score of 550 is considered bad. Do not let this discourage you. This particular score is only a couple of points away from being considered fair (usually around the 600 marking).

Credit Cards for a 550 Credit Score

Consumers with a 550 credit score are not exactly the target market for credit cards. You most likely would not be able to get a high-end credit card, but there are still many options out there for those looking to build their credit.

Car Loan with a 550 Credit Score

Are you asking yourself, “can I get a car loan with a credit score of 550?” Well, it is not going to be easy. However, it is still doable. To many’s surprise, there are specific types of lenders that work with consumers who have bad credit and give out 550 credit score auto loans.

Personal Loans for a 550 Credit Score

It is not impossible to get a 550 credit score personal loan. You may have to jump through extra hurdles in order to make this happen for yourself. Do not let your low score stand in your way! To get a personal loan for a 550 credit score, it might be easier to get a cosigner.

The Mortgage with a 550 Credit Score

550 credit score mortgages are especially tricky because the loan values are typically much higher than other types of loans. There are ways to get around a lower credit score so that you can get approved for a mortgage with a 550 credit score.

How to Improve a 550 Credit Score?

It can be a frustrating time building up your credit, but there is a light at the end of the tunnel. A score of 550 could always be worse, and the good news is that there is a multitude of ways to amend your 550 FICO score. If you are wondering how to fix 550 credit scores, here are some steps that you can use to improve your score.

Conclusion

Getting loans for a 550 credit score is not easy. Knowing what you can get with a 550 credit score can make your life less difficult. You must understand where this credit score stands and what you can do with it. Although this score is considered bad on the traditional scale, it is not awfully poor.

550 Credit Scores Are Common

It has been over a month since we’ve looked at a particular credit score to determine whether it’s good news, bad news, or not even newsworthy.

550 Fico Score Is Bad Credit

There’s no way around this one. A 550 Fico score is a bad credit score. I’m sorry if you’ve got a score this low, but it is what it is. I’m not going to sugarcoat it.