There are a few things you can do to avoid being double-taxed, including:

- Not structuring your business as a corporation

- Having employees be shareholders (smaller corporations)

- Adding shareholders to payroll as members of the board of directors (larger corporations)

What are the tax consequences of dissolving a C Corp?

What are the tax consequences of dissolving a business?

- C-Corp. Liquidating distributions to corporate shareholders from dissolving the business are taxed under IRC Section 331.

- S-Corp. S-Corporations are normally “pass-through” entities for tax purposes, meaning that the company’s profits and losses are reported on individual shareholders’ tax returns.

- LLC. ...

- Nonprofit. ...

How do corporations avoid paying taxes?

Play Shell Games with It

- Shell company: A type of company that only exists on paper, allowing you to funnel money through it and avoid paying taxes.

- Has a legal existence but typically provides few or no actual products or services.

- Often used for buying and selling to avoid reporting international operations conducted, and avoid taxes on the profits.

What is the tax rate for C Corp?

While other types of C corps are subject to income-based tax rates and S corps enjoy pass-through taxation, qualified personal service corporations are required to pay a fixed 35 percent rate on all taxable income.

How business owners can avoid double taxation?

Method 1 of 3: Avoiding Double Taxation as a C Corporation Download Article

- Pay yourself a salary. You can avoid double taxation, at least in part, by paying yourself a salary rather than taking dividends from the stock you hold in your ...

- Keep profits in the corporation. Your corporation must pay taxes on profits, and individuals must pay taxes on any dividends they receive – double taxation.

- Hire family members. ...

In which way can corporations avoid double taxation?

Elect S corporation tax status: Once a corporation has been created, the owners can ask the IRS to treat it as an S corporation for tax purposes. S corporations have the same liability-limiting attractions as C corporations, but their profits flow directly to shareholders, avoiding double taxation.

Does a corporation get double taxed?

In the United States, corporate income is taxed twice, once at the entity level and once at the shareholder level. Before shareholders pay taxes, the business first faces the corporate income tax.

How do corporations avoid taxes?

How do profitable corporations get away with paying no U.S. income tax? Their most lucrative (and perfectly legal) tax avoidance strategies include accelerated depreciation, the offshoring of profits, generous deductions for appreciated employee stock options, and tax credits.

How do CEOs avoid taxes?

A tax loophole allows corporations to deduct from their taxable income any amount paid to CEOs and their executives, as long as the pay is “performance-based.” This means that the more they pay their executives, the less they pay in federal taxes.

How can a business avoid taxable profits?

If you need ways to reduce your taxable income this year, consider some of the following methods below.Employ a Family Member.Start a Retirement Plan.Save Money for Healthcare Needs.Change Your Business Structure.Deduct Travel Expenses.The Bottom Line.

What is the S corp loophole?

One of the tax loopholes with S corporation status is that the business owner can avoid self-employment taxes apart from Social Security and Medicare.

What types of businesses don't pay taxes?

In terms of tax implications, sole proprietorships are considered a “pass-through entity.” Also known as a “flow-through entity” or “fiscally transparent entity,” this means that the business itself pays no taxes.

Do corporations always have to pay taxes?

Corporations are taxed differently than other business structures: A corporation is the only type of business that must pay its own income taxes on profits.

How to avoid double taxation?

There are several ways business owners can avoid double taxation or reduce taxation. Pass-Through Business Entities. One way to ensure that business profits are only taxed once is to organize the business as a flow-through or pass-through entity. When a business is organized as a flow-through entity, profits flow directly to the owner or owners.

Why are C corporations subject to double taxation?

Owners of C corporations who wish to reduce or avoid double taxation have several strategies they can follow: Retain earnings. If the corporation doesn’t distribute earnings as dividends to shareholders, earnings are only taxed once, at the corporate rate.

Why do corporations pay double taxes?

First, the tax on corporate profitsis seen as justified because businesses organized as corporations are separate legal entities. Second, levying individual taxes on dividends is seen as necessary to keep wealthy shareholders from paying no income taxes.

What is a flow through entity?

When a business is organized as a flow-through entity, profits flow directly to the owner or owners. Profits are not first taxed at the corporate level and again at the personal level. Owners still pay taxes at their personal rate, but double taxation is avoided. Flow-through business entities include:

Which type of corporation has double taxation?

C corporationsare the ones that experience double taxation. Again, the corporation pays taxes once. Double taxation occurs when dividends paid to shareholders get taxed at the shareholders’ individual rates.

Is a salary deductible for a corporation?

Shareholders who work for the corporation may be paid higher salaries instead of dividends. Salaries are taxed at the personal rate but are deductible expenses for the corporation. Salaries have to be justifiable to the IRS, however.

Is tax planning a strategy?

Tax planningshould be integral to your business strategy. That goes for pass-through entities and C corporations. Taking a strategic approach to your business structure – who you employ, the extent to which you lease equipment or space and compensation, including dividends – can result in a substantial boost to the profit of your business.

How to reduce double taxation?

Taking a salary may be one of the most efficient ways to cut down on double taxation. Following the same process as employing family members or shareholders, income splitting allows business owners to draw a salary directly from any profit earned, leaving the balance of the profit in the corporation. Though business owners will need to pay taxes on their individual tax returns, it will effectively reduce the amount of business taxable income as well as the amount you’ll have to pay double taxes on.

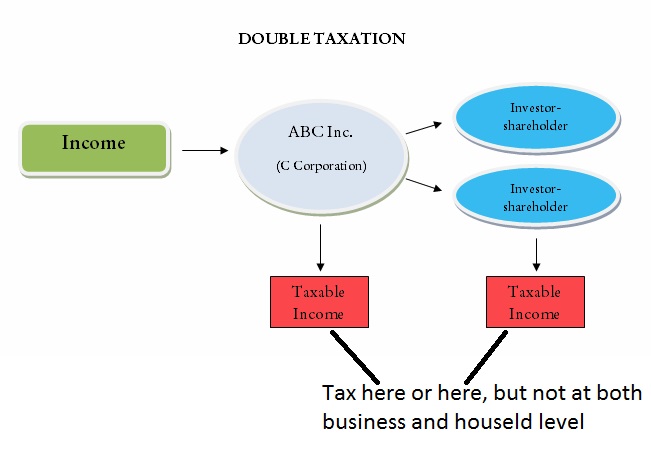

What is Double Taxation?

If you’re wondering what double taxation is, it’s exactly what it appears to be: being taxed twice on the same income.

Why do businesses put more of their earnings into retained earnings?

However, as your business grows, it becomes more likely that you will need to begin paying dividends to your shareholders.

Do shareholders have to be family to be employees?

Of course, your shareholders do not have to be family to become employees. This way, any profit earned can be easily distributed to shareholders in the form of a salary or bonus, and while your employees will still have to pay the appropriate amount of income taxes on their personal tax return, you’ll no longer be double taxed on dividend payments that you distribute.

Can you avoid double taxation if you are a C corporation?

If you do choose to incorporate as a C corporation, you may be able to reduce the amount of double taxation you pay, but it can be next to impossible to avoid double taxation entirely. This is particularly true if you regularly pay dividends to shareholders.

Is a sole proprietorship a good option?

A sole proprietorship can be a good option for a sole owner that has no intention of growing his or her business. Many small businesses start as sole proprietors but later opt for a different business structure. However, if you have plans to expand from the beginning, skip this business entity altogether for one of the other business structures.

Is a C corporation a separate entity?

C corporations usually bear the brunt of double taxation, since their business structure dictates that a corporation is a separate tax-paying entity. Other common business structures such as an LLC, Sole Proprietorship, or S corporation are not taxed on business income separately, but instead pass any tax liability on to the owners or members, where it’s reported on their personal tax return.

How to avoid double taxation?

How to Avoid Paying Double Taxation. If you’re concerned about being subject to double taxation, there are some ways to avoid it. 1. Don’t Pay Dividends. If you’re the CEO or on the board of directors of a C-corporation, refrain from paying out dividends. Instead, let the corporation pay the tax on the income. But….

Why do corporations double tax?

This is because the owner of a corporation is receiving a salary as an employee. That salary is then required to be taxed at the regular personal income rate.

What happens when you double tax a corporation?

Double taxation can also happen in international trade or investment when the same income is taxed in two different countries. It also occurs with 401k loans .

What is a qualified dividend?

Also, thanks to varying tax rates and tax credits, if dividends meet specific criteria, it can be classified as “qualified.” Being “qualified” happens when a shareholder or corporate executive buys and holds onto stocks long enough to meet the qualified dividend level.

How to become an S corp?

You may not even be able to form an S-corporation or another type of business structure. To create an S-corporation, you must meet the following criteria: 1 Business must have 100 or fewer shareholders 2 Shareholders must be U.S. residents 3 Shareholders must be individuals, not corporations or partnerships 4 Can only issue one class of stock

Is LLC a pass through entity?

LLC’s, partnerships, and sole proprietorships are pass-through entities. Meaning the IRS considers the income of the business as personal income to the owner. The owner (s) then are taxed directly and pay taxes on their individual income tax returns.

Is a C corporation separate from its shareholders?

C-corporations are Separate from its Shareholders. If you consider the corporation and its shareholders as two separate entities. The corporation is only paying tax on its profits, just like the shareholders are only paying tax on the dividend he or she personally received.

What are the two things that should be done to eliminate double taxation?

1. Legislation. Legislation must be enacted to remove elements of double taxation, which is inefficient and discourages investment . If investors are able to receive their dividends tax-free, they will be inclined to invest more rather than retain profit, especially for mature companies that do not need much capital. 2.

How to mitigate double taxation?

There are various ways to mitigate corporate double taxation, such as legislation, structuring an organization into a sole proprietorship, parentship, or LLC, avoiding the payment of dividends, and shareholders becoming employees of the businesses they own. International double taxation can be mitigated by formulating trade treaties, ...

What are the arguments against double taxation?

Arguments against corporate double taxation indicate that as shareholders are the owners of a corporation in which corporate tax is levied on profits attributable to the owners, income distributed to them as dividends and taxed with dividend tax at a personal level represents the same income stream being taxed twice.

How does double taxation affect the economy?

Hence, double taxation induces a hardship on taxpayers through an increased tax burden on the investor and can result in the increase of the price of goods and services, discourages cross border investment through curtailing capital movement, and violates the tax fairness principle.

How can international taxation be mitigated?

International double taxation can be mitigated by formulating trade treaties, such as double taxation agreements (DTAs), with countries they trade with and by using relief methods such as the exemption method and foreign tax credit method.

Why do countries sign DTAs?

DTAs encourage cross border trade and investment between countries. When trade between two countries is growing, and both countries anticipate further growth, they usually facilitate the signing of a DTA to eliminate double taxation and improve trade between them.

What is double taxation?

Double taxation is a situation associated with how corporate and individual income is taxed and is, therefore, susceptible to being taxed twice.

What is a reoccurring tax problem in selling a C corporation owned business?

A reoccurring tax problem in selling a C corporation owned business is the double level of taxation if the transaction is structured as an asset sale. First, there is a tax at the corporate level (35% maximum federal plus 8.84% California), and second, there is an additional tax when the corporation liquidates and distributes ...

What is tax free reorganization?

The tax-free reorganization rules of Section 368 2 can be utilized so that the target corporation’s shareholders receive the acquiring corporation’s shares tax-free in the asset acquisition. The target corporation shareholders then receive long-term capital gain at a future date if they sell the acquiring corporation’s shares.

Why does the acquirer want an asset sale?

However, the acquiring corporation often wants an asset sale (and does not want a stock sale) because the acquirer wants to avoid hidden liabilities and wants a step-up in the income tax basis of the target corporation’s assets. Accordingly, an asset sale structure may be required to close the transaction. Thus, the target corporation needs ...

What if the target corporation owns real estate?

If the Target Corporation Owns Real Estate Consider Utilizing a Section 1031 Tax-Free Exchange.

How long does a corporation amortize goodwill?

The acquiring corporation will not be concerned with whether there is personal goodwill or if that goodwill is owned directly by the target corporation since the acquiring corporation under Section 197 will amortize that goodwill over fifteen (15) years under either scenario.

How long do you have to wait to sell an S corp?

This will require the new converted S corporation to wait ten (10) years under current tax laws before the corporation does an asset sale under the Section 1374 built-in gain tax rules. Additionally, California still imposes a 1.5% tax on S corporation earnings.

How much is Medicare tax on a C corporation?

1 The 3.8% Medicare Tax is imposed on the amount of the shareholder’s income, based upon the shareholder’s adjusted gross income in excess of the threshold amount ($250,000 for a joint return and $200,000 for an unmarried individual). Unlike an S corporation stock sale, individuals owning C corporation stock have the Medicare Tax applied to them, whether or not that individual is an active or passive participant in the C corporation’s business.

Why do corporations pay double taxes?

Double taxation often occurs because corporations are considered separate legal entities from their shareholders. As such, corporations pay taxes on their annual earnings, just like individuals.

How do countries avoid double taxation?

To avoid these issues, countries around the world have signed hundreds of treaties for the avoidance of double taxation, often based on models provided by the Organization for Economic Cooperation and Development (OECD). In these treaties, signatory nations agree to limit their taxation of international business in an effort to augment trade between the two countries and avoid double taxation.

What Is Double Taxation?

Double taxation is a tax principle referring to income taxes paid twice on the same source of income. It can occur when income is taxed at both the corporate level and personal level. Double taxation also occurs in international trade or investment when the same income is taxed in two different countries. It can happen with 401k loans.

What is the tax rate for dividends?

For example, in the U.S. dividends meeting certain criteria can be classified as "qualified" and as such, subject to advantaged tax treatment: a tax rate of 0%, 15% or 20%, depending on the individual's tax bracket. The corporate tax rate is 21%, as of 2019.

Why are master limited partnerships so popular?

Certain investments with a flow-through or pass-through structure, such as master limited partnerships, are popular because they avoid the double taxation syndrome.

Is dividend income taxed at the same rate?

Most tax systems attempt, through the use of varying tax rates and tax credits, to have an integrated system where income earned by a corporation and paid out as dividends and income earned directly by an individual is, in the end, taxed at the same rate. For example, in the U.S. dividends meeting certain criteria can be classified as "qualified" ...

Do you have to pay taxes on dividends?

Supporters of dividend taxation also point out that dividend payments are voluntary actions by companies and, as such, companies are not required to have their income "double taxed" unless they choose to pay dividends to shareholders.