Did Reaganomics improve the economy?

Reaganomics overall did improve the economy on several indexes relative to the Carter administration. hen Reagan took office, unemployment was high and so was inflation. Both were lowered as a result of Reaganomics. However, the long-term implications of Reaganomics did not revitalize the economy as much as the adminstration predicted or claimed.

How did Reagan help the economy?

Reagan's economic policies were nicknamed Reaganomics. They were based on supply-side economics which prioritized tax cuts. Reaganomics reduced tax rates, unemployment, and regulations. Inflation was lowered through monetary policy. Reaganomics worked in the 1980s because it lowered record-high taxes.

How was Reaganomics helped the economy?

Key Takeaways

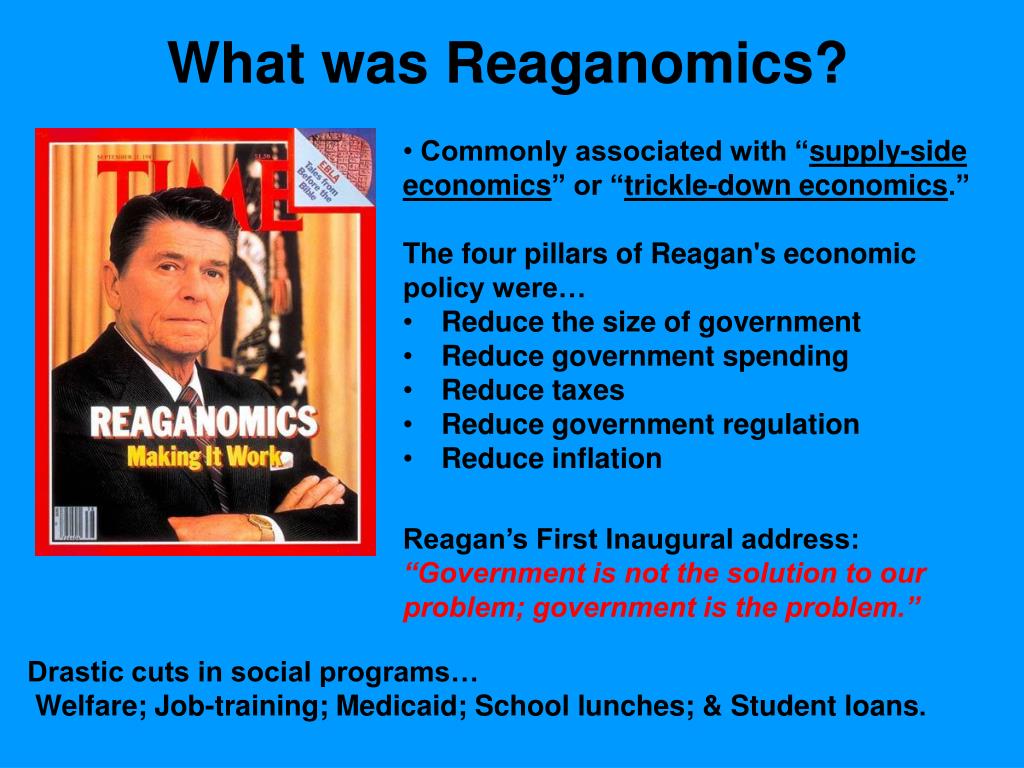

- Reaganomics refers to the economic policies instituted by former President Ronald Reagan.

- As president, Reagan instituted tax cuts, decreased social spending, increased military spending, and market deregulation.

- Reaganomics was influenced by the trickle-down theory and supply-side economics.

What were the failures and successes of Reaganomics?

The success of Reaganomics carries much debate when analyzed through the annals of time. Successes include lower marginal tax rates and inflation. Other issues, however, such as the savings and loan problem, size of federal government, and tax revenue did not see much change. Ronald Reagan was president of the U.S. from 1981 to 1989.

See more

How much did Reagan save in taxes?

Given actual rates of inflation, through 1987, the Reagan tax cuts saved the median-income two-earner American family of four close to $9,000 in taxes from what it would have owed in 1980. Tax cuts were only one “leg of the stool.”. The second, jobs, was equally strong.

What was Reagan's top priority?

Taxes were high, unemployment was high, interest rates were high and the national spirit was low. Bringing America back was the new President’s top priority.

What did Reagan know about the Inaugural?

He knew that only if people had money in their pockets and incentives to invest and build businesses would jobs be created, inflation tamed and interest rates reduced. Almost as soon as the Inaugural ceremony was over, President Reagan set his sights on Capitol Hill.

What was Reaganomics success?

To him, the success of Reaganomics was what it brought to the American people. Millions had good jobs and were able to keep more of the money for which they worked so hard. Families could reliably plan a budget and pay their bills. The seemingly insatiable Federal government was on a much-needed diet.

What year did Reagan's recovery happen?

So impressive was the Reagan Recovery that at the G7 Economic Summit in 1983, when it was obvious the President’s plan was working, the West German Chancellor asked him to “tell us about the American miracle.".

What does it mean to put America back to work?

Putting America back to work means putting all Americans back to work. Ending inflation means freeing all Americans from the terror of runaway living costs. All must share in the productive work of this ’new beginning,’ and all must share in the bounty of a revived economy.”.

Did Ronald Reagan wear pajamas?

While still recovering, he summoned Congressional leaders to the White House to twist their arms. Ronald Reagan may have been the first President to wear pajamas to a meeting with the bipartisan Congressional leadership.

What was Reagan's economic plan?

President Reagan's economic approach was designed to invigorate a sluggish economy and create jobs and opportunity, goals that quickly came to fruition. Reaganomics’ tax cuts lessened the financial burden on hard-working Americans and encouraged corporations to invest in job growth.

What was Reaganomics?

Reaganomics ushered in one of the most prosperous times in American history and laid the foundation for continued economic progress. Carry on Ronald Reagan's tradition of support for personal freedom and conservative values by signing up for your own Reagan.com email address.

What was Reaganomics' last effect?

The Lasting Effects of Reaganomics. February 27, 2018. Reagan: IN HIS WORDS. One of the cornerstones of President Reagan's tenure was his economic policy, dubbed Reaganomics. Under this plan, Reagan aimed to reduce federal spending, put more money back into the pockets of working-class Americans and slow the rate of inflation—all promises on which ...

What was Reagan's position on the economy?

Reagan's position was dramatically different from the status quo. Prior presidents Lyndon Johnson and Richard Nixon had expanded the government's role. Reagan pledged to make cuts in four areas: The growth of government spending. Both income taxes and capital gains taxes. Regulations on businesses.

What was Reagan's top income tax rate?

Tax Cuts. Reagan cut tax rates enough to stimulate consumer demand. By Reagan's last year in office, the top income tax rate was 28% for single people making $18,550 or more. Anyone making less paid no taxes at all. That was much less than the 1980 top tax rate of 70% for individuals earning $108,300 or more.

How did Reaganomics work?

Inflation was lowered through monetary policy. Reaganomics worked in the 1980s because it lowered record-high taxes.

What was Reagan's inflation rate in 1980?

Reagan had campaigned on ending galloping inflation. That's when inflation rates reach 10% or more. In 1980 the inflation rate was 12.5%. These rates hurt the economy because money loses value too fast. Business and employee income can't keep up with rising costs and prices.

What was Reaganomics?

Reaganomics is President Ronald Reagan's conservative economic policy that attacked the 1981-1982 recession and stagflation. Stagflation is an economic contraction combined with double-digit inflation. 1 . Reagan's position was dramatically different from the status quo.

Who was the founder of Reaganomics?

That's according to William A. Niskanen, a founder of Reaganomics. Niskanen belonged to Reagan's Council of Economic Advisers from 1981 to 1985. 4 Inflation was tamed, but it was thanks to monetary policy, not fiscal policy. Reagan's tax cuts did end the recession.

Why are corporate tax cuts important?

It also says that income tax cuts give workers more incentive to work, increasing the supply of labor.

What was Ronald Reagan's most successful economic policy?

No matter how advocates of big government try to rewrite history, Ronald Reagan's record of fiscal responsibility continues to stand as the most successful economic policy of the 20th century. His tax reforms triggered an economic expansion that continues to this day. His investments in national security ended the Cold War and made possible the subsequent defense spending reductions that are largely responsible for the current federal surpluses. His efforts to restrain the expansion of federal government helped to limit the growth of domestic spending.

What was Reagan's fiscal policy?

In 1981, newly elected President Ronald Reagan refocused fiscal policy on the long run. He proposed, and Congress passed, sharp cuts in marginal tax rates. The cuts increased incentives to work and stimulated growth.

What was the 20 percent tax rate in 1980?

For the top 20 percent of taxpayers, from 56.1 percent in 1980 to 58.6 percent in 1989. On the other hand, the share of total federal taxes, if one includes the Social Security payroll tax, declined for four groups: For the second-highest 20 percent of taxpayers, from 22.2 percent in 1980 to 20.8 percent in 1989;

What was the greatest myth about the 1980s?

Perhaps the greatest myth concerning the 1980s is that Ronald Reagan slashed taxes so dramatically for the rich that they no longer have paid their fair share. The flaw in this myth is that it mixes tax rates with taxes actually paid and ignores the real trend of taxation:

What percentage of taxes increased between 1980 and 1989?

Nevertheless, even if one counts the Social Security payroll tax, the share of total federal taxes increased between 1980 and 1989 for the following groups: For the top 1 percent of taxpayers, from 12.9 percent in 1980 to 15.4 percent in 1989;

What should Congress stand on the evidence and defend the Reagan record?

Today, Members of Congress from across the political spectrum should stand on the evidence and defend the Reagan record. To the extent that President Bush's proposals mirror those of Ronald Reagan, his plan should be a welcome strategy to lower the tax burden on Americans and to make the system more responsible.

Why did the Reagan boom appear to be a bust?

Proponents of additional government spending try to make the Reagan boom appear to be a bust because they fear that Reagan's success will help President Bush build popular support for lower taxes, further deregulation, and reduced government spending.

Social Studies

Which type of economic system has the highest level of government control? A. traditional economy B. market economy C. command economy D. mixed economy

Texas State History

Why would John Reagan be considered a crucial figure to the fortunes of the people of Texas in the Civil War? A. Reagan organized the Secession Convention. B. Reagan urged the governor to secede from the Union. C. Reagan was

Social Studies

PLEASE HELP I NEED A RIGHT ANSWER I HAVE A D IN THIS CLASS Which of the following factors has helped improve Bangladesh’s economy in recent years? A. new tariffs B. microlending C. shifting to a command economy D. increasing

English

My uncle, along with my cousins, ________ to see my acrobatics recital; I hope they ________ the show. a) plan/enjoy b) plans/enjoy c) plans/enjoys d) plan/enjoys Answer A

Social Studies

Read the quote. “Most people in rural areas are farmers, and when you have a disease like Guinea worm [a parasite], you are incapacitated, unable to continue with your work. By preventing the hundreds of thousands of cases that

government

What contradiction exists in American public opinion about Ronald Reagan’s claim that government is not the solution but the problem? A. Americans want regulation and public services but not tax cuts. B. Americans want

Personal Finance

Which of the following statements is true concerning home equity loans? A. Home equity loans are generally installment loans with a 5-15 year term. B. Home equity loans are secured by all of the borrower’s assets. C. Home equity

What was the inflation rate during the Reagan tax cut?

Inflation was nearly 10 percent. The Federal Reserve had pushed interest rates into double digits. The federal debt was about half what it is today, measured as a share of the economy. The Reagan tax cut was huge. The top rate fell from 70 percent to 50 percent. The tax cut didn’t pay for itself.

Which president signed the tax increase in 1981?

So with Reagan’s signature, Congress undid a good chunk of the 1981 tax cut by raising taxes a lot in 1982, 1983, 1984 and 1987. George H.W. Bush signed another tax increase in 1990 and Bill Clinton did the same in 1993.

What did the 1980s teach us?

A. What the 1980s teach is that you can’t look at taxes in isolation. The Fed’s war on inflation push ed interest rates to nearly 20 percent and provoked a severe double-dip recession, one of the worst of the post-World War II era. Uemployment rose above 10 percent in 1982 and 1983. When the Fed cut rates, the economy took off. The tax cuts undoubtedly contribute. So did big increases in federal spending on defense and highways. Many of the business tax breaks in the 1981 bill didn’t survive so it’s hard to see how they helped much.

What was the 1986 tax bill?

The 1986 bill was very different than this year’s tax bill. One, it was preceded by a couple of years of ground work by tax experts at the Treasury. Two, it was bipartisan. And, three, it was intended to improve the tax code but to raise just as much money as the then-existing tax code did – no more and no less.

What happened to the economy when the Fed cut rates?

When the Fed cut rates, the economy took off. The tax cuts undoubtedly contribute. So did big increases in federal spending on defense and highways. Many of the business tax breaks in the 1981 bill didn’t survive so it’s hard to see how they helped much.

Did the Reagan tax cut pay for itself?

The tax cut didn’t pay for itself. According to later Treasury estimates, it reduced federal revenues by about 9 percent in the first couple of years . In fact, most of the top Reagan administration officials didn’t think the tax cut would pay for itself.

Is the tax bill speeding through Congress good for the economy?

Twitter. davidmwessel. The tax bill speeding through Congress is being sold – by its advocates – as so good for the economy, that it will boost growth and offset any losses from the cuts. Those of you who were around in the 1980s might be feeling a sense of deja vu, especially when you recall what Ronald Reagan had to say back in 1981.