Here are some of the highlights from this explanation:

- Debit means left.

- Credit means right.

- Every transaction affects two accounts or more.

- At least one account will be debited and at least one account will be credited.

- The total of the amount (s) entered as debits must equal the total of the amount (s) entered as credits.

- When cash is received, debit Cash.

- When cash is paid out, credit Cash.

What are the rules for debit and credit in accounting?

Rules of debit and credit

- Definition and explanation. The rules of debit and credit (also referred to as golden rules of accounting) are the fundamental principles of modern double entry accounting that guide accountants and ...

- Normal balance of accounts. ...

- Application of the rules of debit and credit. ...

- Example of debit and credit rules: Started business with cash $95,000. ...

What are the rules of debit and credit?

- No hidden charges on credit cards issued free of charge.

- Card issuers can now consider an insurance cover for liabilities arising out of lost credit cards, or credit card frauds. ...

- Will require a one-time password to activate a credit card that has not been activated within 30 days from the date of issuance. ...

What is difference between credit and debit?

- You won't pay interest on your purchases.

- Your credit history will be unaffected by debit card spending.

- Paying with debit will take the money from your account pretty much immediately. 1

What are the rules of debits and credits?

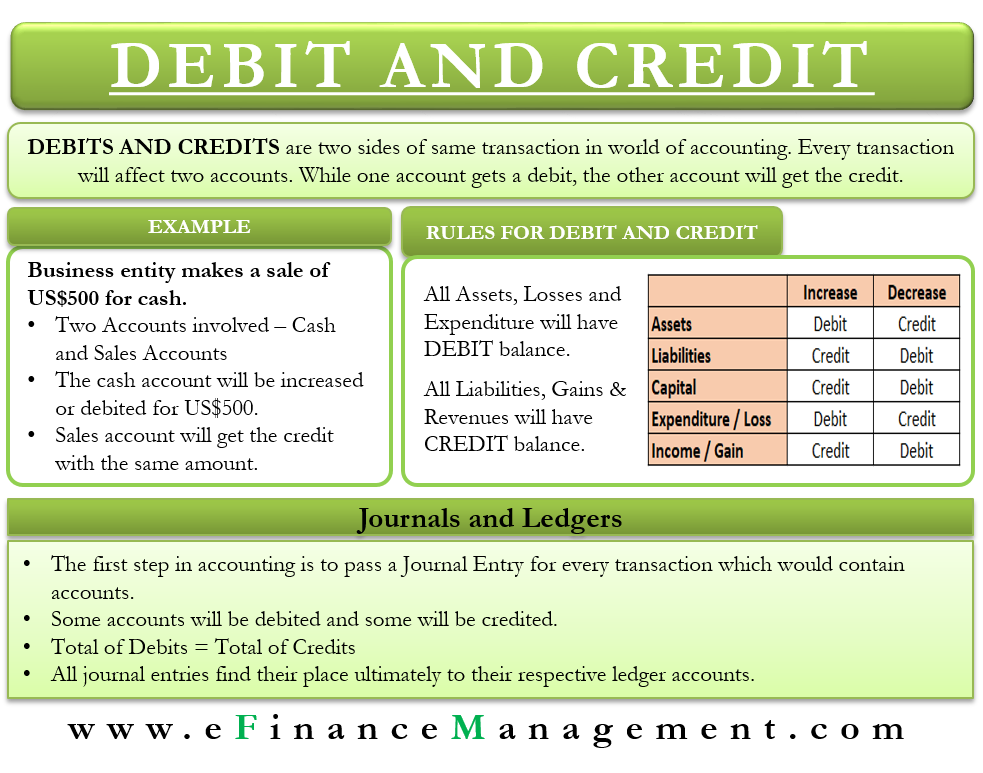

The debit and credit rule in double-entry bookkeeping can be stated several ways:

- For each and every transaction, the total amount entered on the left side of an account (or accounts) must be equal to the total amount entered on the right side ...

- For each and every transaction, the total of the debit amounts must be equal to the total of the credit amounts.

- Debits must equal credits.

What are debits and credits?

In a nutshell: debits (dr) record all of the money flowing into an account, while credits (cr) record all of the money flowing out of an account.

Why do we credit your cash account?

Just like in the above section, we credit your cash account, because money is flowing out of it.

Why does crediting an equity account make it go up rather than down?

Why is it that crediting an equity account makes it go up, rather than down? That’s because equity accounts don’t measure how much your business has. Rather, they measure all of the claims that investors have against your business.

Why do you debit your furniture account?

You debit your furniture account, because value is flowing into it (a desk).

Why do people use lists of accounts?

Most people will use a list of accounts so they know how to record debits and credits properly.

What accounting jargon trips people up the most?

If there’s one piece of accounting jargon that trips people up the most, it’s “debits and credits.”

When money flows out of a bucket, do we record that as a credit?

When money flows out of a bucket, we record that as a credit (sometimes accountants will abbreviate this to just “cr.”)

Why do we need debits and credits?

You must have a grasp of how debits and credits work to keep your books error-free. Accurate bookkeeping can give you a better understanding of your business’s financial health. Debits and credits are used to prepare critical financial statements and other documents that you may need to share with your bank, accountant, the IRS, or an auditor.

What are some examples of debits and credits?

Here are some additional examples of accounting basics for debits and credits: Repay a business loan: Debit loans payable account and credit cash account. Sell to a customer on credit: Debit accounts receivable and credit the revenue account. Purchase inventory from your vendor and pay cash: Debit inventory account and credit the cash account.

What accounts do you need to record business transactions?

You must record business transactions in your small business accounting books. You will record these transactions in two accounts: a debit and credit account.

What are the accounts in accounting?

You will separate your transactions into accounts while doing your bookkeeping. Five common accounts include: 1 Assets: Resources owned by a business which have economic value you can convert into cash (e.g., land, equipment, cash, vehicles) 2 Expenses: Costs that occur during business operations (e.g., wages, supplies) 3 Liabilities: Amounts owed to another person or business (e.g., accounts payable) 4 Equity: Your assets minus your liabilities 5 Revenue: Cash earned from sales

What happens if a debit increases an account?

Debits and credits are equal but opposite entries in your books. If a debit increases an account, you will decrease the opposite account with a credit.

What is double entry in accounting?

Record credits and debits for each transaction that occurs. You record two or more entries for every transaction. This is considered double-entry bookkeeping.

What are assets that can be converted into cash?

Assets: Resources owned by a business which have economic value you can convert into cash (e.g., land, equipment, cash, vehicles)

What is debit and credit in accounting?

Debits and credits are used in double-entry bookkeeping, an accounting method where every entry in an account needs a corresponding and opposite entry in a different account.

What is debit and credit?

Debit and credit entries are bookkeeping records that balance each other out. Every transaction you make must be exchanged for something else for accounting purposes.

What is debit transaction?

A debit transaction increases asset or expense accounts and decreases revenue, liability or equity accounts. On the flip side, a credit transaction increases liability, revenue or equity accounts and decreases asset or expense accounts. We’ll explain each of these terms in more detail as well as how this works in practice in a later section.

What is counting up accounting?

Countingup is the business current account and accounting software in one app, automating the time-consuming aspects of bookkeeping and taxes. You can view real-time insights into your business finances, profit and loss statements, tax estimates, and create invoices in seconds.

Why is bookkeeping so time consuming?

Every transaction is recorded this way, which is why bookkeeping can be so time-consuming.

What is a liability in accounting?

Liabilities are financial obligations that your company has to pay, like supplier invoices or loan repayments. Accounts that fall under liabilities include:

What is revenue account?

Revenue accounts relate to income you earn from selling your products and services or interest you gain from investments. Examples include:

Why do debits and credits affect accounts differently?

The reason why debits and credits affect accounts differently is due to their accounting equations that are underlying and every accounting transaction begins with the basic accounting equation: Assets = Liabilities + Equity.

Why is debit and credit accounting important?

Learning about debit and credit accounting helps you to keep your business records accurate and gives you a better idea of where your finances stand. To do so, you must understand which account records debits and which account records credits and how each of these accounts balances the other.

What is a debit in accounting?

A debit is a record in personal accounting that represents the money that flows into an account. In business, accounting debits can lead to a decrease in liabilities or an increase in assets. Debits are added to the left side of T-accounts in double-entry bookkeeping methods and are considered the opposite of accounting credits.

How many accounts are affected by a debit and credit?

Every time an accounting transaction is made, at least two accounts are affected. There is no limit to the number of accounts that can be affected by a transaction, but at least two accounts will always be affected. A debit is recorded on one account and a credit is recorded on another account. In order for financial statements to be accurate, each debit and credit must be balanced and have an equal number of recordings on the accounts that they affect. Before you can understand the way debits and credits work in accounting, you must first understand the accounts that are affected by debit and credit transactions. Here are the common accounts that can be affected by debits and credits:

When an account has a credit balance, the amount increases?

When accounts have a credit balance, the amount increases when a credit is applied to them and is lowered when a debit is applied to them. This rule is consistent with accounts such as revenues, liabilities and equity.

What are assets in business?

Assets: Items that a company owns that have economic value and can be sold for a cash value, such as property, vehicles or land