For investors, the expense ratio is deducted from the fund's gross return and paid to the fund manager. An expense ratio is determined by dividing a fund's operating expenses by the average dollar value of its assets under management (AUM). Operating expenses reduce the fund's assets, thereby reducing the return to investors.

What is considered a good expense ratio?

“Expense ratios directly impact the return of the fund to the shareholder, so funds with extremely high expense ratios should be considered carefully,” Cozad says, adding that a good expense ratio depends if it’s actively or passively managed. “A good expense ratio is anything below 0.20%, which is the current average,” Hanson says.

What is an expense ratio and what does it mean for You?

The expense ratio, also known as the management expense ratio (MER), measures how much of a fund's assets are used for administrative and other operating expenses. An expense ratio is determined by dividing a fund's operating expenses by the average dollar value of its assets under management (AUM).

What is the expense ratio of a fund tells you?

An expense ratio tells you the annual management fees (as a percentage of assets) that you must pay for investing money in a mutual fund or ETF. Some mutual funds charge one-time fees, such as loads, which you pay when you buy or sell shares. Often, these cover sales commissions for the people selling you the shares.

What is a good ETF expense ratio?

An ETF's expense ratio indicates how much of your investment in a fund will be deducted annually as fees. A fund's expense ratio equals the fund's operating expenses divided by the average assets of the fund. A good guiding principle is to not invest in any fund with an expense ratio higher than 1%. Typical ETF expense ratios are less than 1%.

Are expense ratios paid daily?

They are, but keep in mind that the expense ratios you commonly see are expressed in annual terms.

Are expense ratios paid automatically?

When you buy a fund, the expense ratio is automatically deducted from your returns. When you view the daily net asset value (NAV) or price for an index fund or ETF, the fund's expense ratio is baked into the number you see.

Is expense ratio charged every month?

Now an expense ratio of 1.5% means that the fund house will charge 1.5% of your investment value for managing your money. However, you won't see this charge deducted annually because the daily NAV of the fund that you see is calculated after deducting the expense ratio.

Are expense ratio paid annually?

The expense ratio an investor pays for a fund is separate from any commission or other transaction fees they pay to invest. While transaction fees represent one-time costs when you buy or sell an investment, the expense ratio applies each year.

What expense ratio is too high?

High and Low Ratios A number of factors determine whether an expense ratio is considered high or low. A good expense ratio, from the investor's viewpoint, is around 0.5% to 0.75% for an actively managed portfolio. An expense ratio greater than 1.5% is considered high.

What is a good expense ratio for 401k?

Ideally, your 401(k) fees should be well under 1%, especially if you're part of a large-scale plan (anything over 1% should be scrutinized). Fees can have a significant impact on your bottom line, so it pays to find out what you're paying—and take steps to lower them if appropriate.

What is a good expense ratio for an index fund?

The best expense ratio is 0%. Surprisingly, some passive fund managers are starting to offer index funds with expense ratios of 0%. A good expense ratio for a mutual fund is less than 1%.

How are expense ratios charged on mutual funds?

The expense ratio for a fund is calculated by dividing the total amount of fund fees—both management fees and operating expenses—by the total value of the fund's assets.

How are expenses paid on ETFs?

Investment management fees for exchange-traded funds (ETFs) and mutual funds are deducted by the ETF or fund company, and adjustments are made to the net asset value (NAV) of the fund on a daily basis. Investors don't see these fees on their statements because the fund company handles them in-house.

Should I care about expense ratio?

Expense ratios can eat away at your investment earnings, so it's important to know what they are and how they work.

How does Vanguard expense ratio work?

Vanguard funds charge expense ratios as their compensation for the management and issuance of the fund. The expense ratio is calculated by taking the fund's operating costs and dividing them by the assets under management (AUM). Vanguard's expense ratios are some of the lowest in the industry.

What is a good net expense ratio for an ETF?

A good guiding principle is to not invest in any fund with an expense ratio higher than 1%. Typical ETF expense ratios are less than 1%. That means that, for every $1,000 you invest, you pay less than $10 a year in expenses.

What is a good income to expense ratio for a business?

between 60% to 80%Expressed as a percentage, the operating expense ratio is your total operating expense (excluding interest), minus depreciation, divided by gross income. The normal operating expense ratio range is typically between 60% to 80%, and the lower it is, the better.

What is the average expense ratio for an insurance company?

Expense ratio The percentage of premium used to pay all the costs of acquiring, writing, and servicing insurance and reinsurance. According to Vertafore, the industry average expense ratio is 36.5%.

What should my income to expense ratio?

In general, experts recommend using the 50/20/30 rule to create your budget, especially if you're a young adult. The 50/20/30 guideline offers a basic financial strategy for your spending and saving. The rule says that you should spend 50% of your income on your living expenses, like your rent and car payment.

What is a good expense ratio for real estate?

The rule of thumb to qualify for a mortgage with the housing expense ratio is that anything below 28% is good. Above 28%, you may be stretched too thin and may struggle to cover your monthly mortgage payment or other debt obligations. Final loan approval decisions are made using this threshold.

How Does an Expense Ratio Work?

In most cases, an expense ratio is the total costs of operating a fund divided by the fund assets. The higher those operational costs, the higher the expense ratio will be, which is why actively managed funds often have higher expense ratios. Actively managed funds are managed by a human, rather than a computer.

What Is an Expense Ratio?

An expense ratio is a fee that investors are charged by a mutual fund or exchange-traded fund (ETF). This fee covers the costs associated with administration, portfolio management, marketing, and more. These fees are usually percentage-based and represent an investor’s annual cost.

When buying a pooled investment, do you pay for a service?

When buy a pooled investment, you’re paying for a service. And just as you would expect to know the price of any other service you receive, it’s important to understand how much you’re paying in mutual fund or ETF fees each year.

What happens when you have a higher expense ratio?

The higher the expense ratio, the more it’ll eat into your returns. Before investing, check the fees.

Do you pay expense ratios out of your portfolio?

And given the popularity of mutual funds and ETFs, many of us pay expense ratios out of our portfolios each year . In this article, you’ll learn what an expense ratio is, why it’s important, and how to identify a good expense ratio when you see one.

Can a high expense ratio hurt your investment?

A High Expense Ratio Can Eat Up Your Investing Profits. Here’s a Good Rule of Thumb to Follow

What is expense ratio?

An expense ratio is an annual fee charged to investors who own mutual funds and exchange-traded funds (ETFs). High expense ratios can drastically reduce your potential returns over the long term, making it imperative for long-term investors to select mutual funds and ETFs with reasonable expense ratios.

Why do you pay higher expense ratio?

There are several reasons you might opt to pay a higher expense ratio, including the fund’s historical returns, the desire to have a one-stop mutual fund in your portfolio like a target-date fund or a lower-risk fund with more capital preservation or income.

What is the expense ratio for mutual funds?

For an actively managed mutual fund, Miko advises her clients that a reasonable expense ratio ranges between 0.40% for a domestic bond fund to around 1.0% for an international stock fund. For passive funds that simply mirror an index, Miko says costs for fund management are minimal and advises clients that expense ratios between 0.05% to 0.20% are reasonable.

Is expense ratio a factor?

An expense ratio shouldn’t be the only factor that guides an investor’s decision when comparing mutual funds and ETFs, though, says Sachs . “Yes, a lower overall total expense ratio will help your investment grow at a higher rate, but other factors may have a larger impact, such as tax efficiency,” he says.

Do ETFs have expense ratios?

Expense ratios vary widely, depending on the investment strategy used by the fund. “The majority of ETFs are passive, index-based funds, which inherently have a lower expense ratio due to lower operating costs,” says Miko.

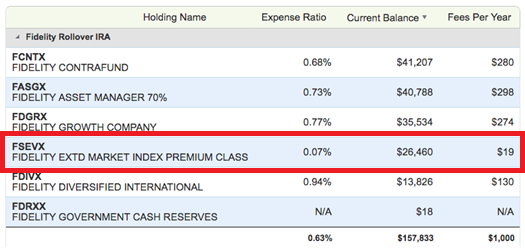

Does Fidelity have expense ratios?

Not all funds have expense ratios, though. For investors who are cost-conscious, Fidelity launched a line of no-expense ratio ETFs in 2018. There are currently four ETFs in this category.

Can you calculate expense ratios yourself?

You normally won’t be tasked with calculating expense ratios yourself, though, as they’re typically noted in fund documentation.

What is an expense ratio?

All mutual funds and exchange-traded funds (ETFs) charge their shareholders an expense ratio to cover the fund’s total annual operating expenses. Expressed as a percentage of a fund’s average net assets, the expense ratio can include various operational costs such as administrative, compliance, distribution, management, marketing, shareholder services, record-keeping fees, and other costs. The expense ratio, which is calculated annually and disclosed in the fund’s prospectus and shareholder reports, directly reduces the fund’s returns to its shareholders, and, therefore, the value of your investment.

Why are expense ratios lower?

The trend in lower expense ratios can be attributed to a variety of factors, such as money market funds waiving expenses to ensure that net returns remain positive during periods of low interest rates , and target date mutual funds being able to lower expenses due to economies of scale (target date mutual fund assets have increased since 2008). 3 In addition, expense ratios often vary inversely with fund assets, meaning that as a fund’s assets increase, its fixed costs likely represent a smaller percentage of its net assets; therefore, its expense ratio can correspondingly decrease.

How much does an ETF expense ratio top out?

While ETF expense ratios top out at no more than 2.5%, mutual fund costs can be significantly higher. The costs of operating funds vary greatly depending on the investment category, investment strategy and the size of the fund, and those with higher internal costs generally pass on these costs to shareholders through the expense ratio.

Why are international funds so expensive?

For example, international funds are typically very expensive to operate because they invest in many countries and may have staff all over the world (which equates to higher research expenses and payroll). Large-cap funds, on the other hand, tend to be less expensive to operate.

Is a large cap fund more expensive to operate?

Large-cap funds, on the other hand, tend to be less expensive to operate. While it is reasonable to compare expense ratios across multiple international funds, it would not make sense to compare the costs of an international fund against a large-cap fund.

Do active funds carry higher expenses?

The selling and buying of securities in one’s portfolio is not included when calculating the expense ratio, and so active funds tend to carry higher expenses than passive ones.

Is expense ratio important when buying mutual funds?

While it's important, a fund’s expense ratio is not the only consideration when analyzing and comparing fund investments. There are numerous avenues to purchase mutual funds, including online, and investors must also consider a variety of factors before buying, like each fund's individual: Sales charges. Taxes.

How does expense ratio work?

Think of the expense ratio as the management fee paid to the fund company for the benefit of owning the fund. The expense ratio is measured as a percent of your investment in the fund.

Why are expense ratios falling?

Expense ratios have been falling for years, as cheaper passive ETFs have claimed more assets, forcing traditionally more expensive mutual funds to lower their expense ratios. You can see the figures for both mutual funds and ETFs in the chart below.

How much has the average expense ratio declined over the past 20 years?

The fees on stock mutual funds have declined from 0.99 percent in 2000 to 0.50 percent in 2020 on an asset-weighted basis. An asset-weighted basis factors how much is in each fund and weights larger funds more heavily in the calculation.

Why do larger funds charge lower expense ratios?

Larger funds can often charge a lower expense ratio because they can spread out some costs, such as the management of the fund, across a wider base of assets. In contrast, a smaller fund may have to charge more to break even but may reduce its expense ratio to a competitive level as it grows.

Do mutual funds charge sales load?

In contrast, a smaller fund may have to charge more to break even but may reduce its expense ratio to a competitive level as it grows. Mutual funds may charge a sales load, sometimes a very pricey one of several percent, but that’s not included as part of the expense ratio.

What is expense ratio?

What is an expense ratio? An expense ratio is an annual fee expressed as a percentage of your investment — or, like the term implies, the ratio of your investment that goes toward the fund’s expenses. If you invest in a mutual fund with a 1% expense ratio, you’ll pay the fund $10 per year for every $1,000 invested.

What does asset weighted average expense ratio mean?

This number represents the average expense ratio that investors are paying.

Do mutual funds have expense ratios?

If you’re an investor, you need to know about expense ratios. These fees — inherent in all mutual funds, index funds and exchange-traded funds — can significantly drag down your portfolio returns. And although they can’t be avoided completely if you invest in these funds, you can take steps to keep these costs as low as possible.

Can expense ratios eat into your returns?

Over time, expense ratios can really eat into your returns. This calculator will show you how the difference between two expense ratios adds up over time.

Do mutual funds charge more?

Actively managed mutual funds employ a professional manager who makes investment decisions on a day-to-day basis; these funds will charge more as a result.

Is expense ratio trending downward?

In general expense ratios have been trending downward, which is great for long-term investors since they will pay less for their investments. In recent years expense funds have dropped significantly, with a few funds not charging a cent (and many more charging fees under 0.20%). To get a sense of which funds have low expense ratios at the moment, check out our list of low-cost index funds.

What Is An Expense Ratio?

What The Expense Ratio Can Tell You

- Operating expenses vary according to the fund or stock; however, the expenses within the fund remain relatively stable. For example, a fund with low expenses will generally continue to have low expenses. The largest component of operating expenses is the fee paid to a fund'sinvestment manageror advisor. Other costs include recordkeeping, custodial services, taxes, legal expenses…

Components of An Expense Ratio

- Most expenses within a fund are variable; however, the variable expenses are fixed within the fund. For example, a fee consuming 0.5% of the fund's assets will always consume 0.5% of the assets regardless of how it varies. In addition to the management fees associated with a fund, some funds have an advertising and promotion expense referred to as a 12b-1 fee, which is incl…

Passive Index Funds vs. Actively Managed Funds

- The expense ratio of an index fund and an actively managedfund often differ significantly. Index funds, which are passively managed funds, typically carry very low expense ratios. The managers of these funds are generally replicating a given index. The associated management fees are thus lower due to the lack of active management, as with the funds they mirror. Actively managed fun…

Example of Expense Ratios

- In general, passively managedfunds, such as index funds, will have much lower expense ratios than actively managed funds. Consider two hypothetical mutual funds, the Active Fund (AFX) and the Index Fund (IFX). AFX seeks to beat the market by identifying underpriced stocks based on extensive research and experience. IFX instead seeks to exactly replicate the Dow Jones Industr…

Expense Ratio vs. Management Fees

- Mutual funds charge management feesto cover their operating costs, such as the cost of hiring and retaining investment advisors who manage funds' investment portfolios and any other management fees payable not included in the other expenses category. Management fees are commonly referred to as maintenance fees. A mutual fund incurs many operating fees associat…

The Bottom Line

- Expense ratios are taken out of mutual fund and ETF returns to help pay for operations and fund management. The expense ratio charged to investors will vary depending on the fund's investment strategy and level of trading activity. In general, expense ratios have been declining steadily over time as competition for investor dollars has heightened. Actively-managed funds a…