Here’s how:

- On the left pane, select Taxes.

- Select Payroll Tax.

- Under Taxes, click Pay Taxes.

- In the Pay Taxes page, find the tax name under TAX TYPE.

- An overpayment appears on that page as a negative amount.

- Click Resolve Overpayment.

- Select Apply to a future tax payment (recommended).

- Click Mark as Resolved.”

...

QuickBooks Online Payroll

- Select Taxes, then Payroll Tax.

- Select Payments.

- Select Resolve overpayment. ...

- Select one of the following if available: ...

- Select Mark as Resolved.

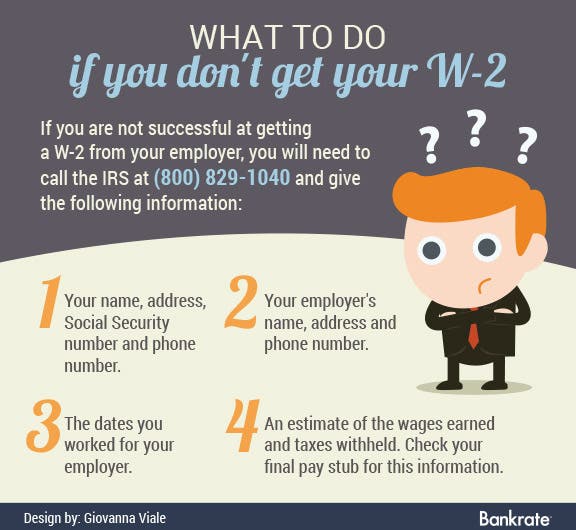

- Select Contact tax agency for next steps to get contact info for the IRS or state agency.

Can I get reimbursed for overpaid payroll taxes?

Sometimes, your business can be reimbursed for overpaid taxes. Don't worry, I'll explain how you'll go about recording the overpayment. In fact, you don't have to record any special transactions to account for the overpayment of your payroll tax liabilities. You'll simply wait until your next filing, and make the adjustments at that time.

How do I apply an overpayment to a bill?

You should then be able to apply the overpayment as a credit to the bill. This is done by choosing Vendors > Pay Bills, at which point you can select the bill that you want to offset the credit. Next, click Set Credits > Credits > Credit > Done.

What is a payroll overpayment?

A payroll overpayment is when an employer pays an employee more than the worker should have received in a pay period. This can lead to cash flow and payroll tax issues. Calculation errors: You’re old school when it comes to running payroll. Software? Calculators? Who needs it?!

What happens if an employer overpays an employee?

This means that you’ll withhold the overpayment collection after withholding taxes from the employee’s pay. Remember to update your records, including your accounting books, to reflect the overpayment and recovery. Here’s a brief overview of your payroll tax responsibilities as an employer.

How do I record a 941 overpayment in QuickBooks?

Apply the credit on Form 941 Right-click the number and select Override. Enter the new amount. The form adjusts the total due or amount of overpayment. If there is an overpayment, on the form, under line 15, select Apply to the next return if you want to apply the overpayment to the next return.

How do I apply for 941 overpayment to next return?

I'll guide you how.Prepare your 941 form.Add the credit amount and the amount shown on the 941 form.Locate line 11 on the form, right-click the number, and select Override.Enter the new amount. ... If you want to apply the overpayment to the next return, select Apply to next return.More items...•

What happens if you overpay payroll taxes?

If you end up with underpaid or overpaid payroll liabilities, you submit your added payment or refund request via IRS Form 941-X. If you have a mix – some employee taxes underpaid, one or two over – you can report them all on the same form as long as you're paying in, the IRS says.

How do I set up an overpayment in QuickBooks desktop?

We use QuickBooks Desktop Pro 2020....Let me show you how:Go to Vendors.Select Enter Bills.Click Credit.Choose the Vendor name.Enter the amount of the said overpayments.Press Save & Close.

What does it mean to apply overpayment to 2022 taxes?

An overpayment is your refund. You can have them keep all or part of your refund as an estimated payment towards next year's tax return. But most people want to get their refund now. So to get your refund now do not say to apply it to next year.

How do I apply overpayment to next year's taxes?

If the payments made exceed the amount of tax, then the amount of the overpayment is entered on the overpaid line in the Refund section of Form 1040. Taxpayers can choose to apply any portion of their overpayment to the following tax year or receive their refund as a check or direct deposit.

How do you fix a payroll overpayment?

If you accidentally overpaid an employee and it's too late to initiate a reversal, you may be able to correct the error by simply reducing (deducting) the employee's gross wages on future payrolls. Check to see if you can still cancel or reverse the payment.

How do you handle payroll overpayments?

What's required to collect wages from overpaid employees?Determine how much you overpaid the employee during the pay period.Contact the overpaid employee. ... Inform them you plan to deduct the overpayment out of their next paycheck or process a direct deposit reversal, which you have 5 business days to complete.More items...•

How do you record overpayment in accounting?

How to record when you receive an overpayment from a customer. This includes using the overpayment to pay another invoice and paying a refund. You save the overpayment as a Payment on Account. Once saved, use it to pay another invoice or match to a refund.

How do I record an overpayment refund in Quickbooks?

Here's how:Click Banking.Choose Make Deposits.Select the specific Deposit To bank account where the funds were initially posted.Type in the name of the vendor in the Received From column.Choose Accounts Payable as the account affected.Enter the payment method and the amount of the refund.Click Save and Close.

How do I match overpayments in Quickbooks?

How do I match an overpayment?Go to the +New button and choose Receive payment.Choose the customer from the drop-down arrow and tick the box beside the invoice transaction.Enter the total amount paid in the Amount received field. ... From the Deposit to field, click the drop-down button, and choose Undeposited Funds.

How do I turn an overpayment into a credit memo in Quickbooks online?

Go to the Customers menu and select Create Credit Memos/Refunds. Select your customer from the Customer:Job drop-down. Enter the items you're giving credit for, then select Save & Close. On the Available Credit pop-up, select Retain as an available credit.

How do I correct a payroll overpayment?

Here are two options:Ask the employee to return the net amount paid and have the payroll service reverse the erroneous paycheck. This approach may work if payroll tax returns have not been filed for the quarter affected. ... Reduce the employee's future wages for the amount of the overpayment.

How do I correct a 941 payment to the wrong quarter?

For example, use Form 941-X, Adjusted Employers QUARTERLY Federal Tax Return or Claim for Refund, to correct errors on a previously filed Form 941. Taxpayers will continue to use Form 843 when requesting abatement of assessed penalties and interest.

How do I reverse an Eftps payment?

1 Log in and select “Payments.” 2 Select “Cancel a Payment” and follow the process. 3 Record the Cancellation EFT Acknowledgment Number you receive, and keep for your records. days before the scheduled date.

How long does it take to get a 941x refund?

Currently, the IRS has been processing these within about 6-8 months. If your amended 941 was filed in late 2021, it could be 10 months before seeing a refund. The IRS does review the credits over $100,000 quarterly a little closer before issuing those refunds.

What is a payroll overpayment?

A payroll overpayment is when an employer pays an employee more than the worker should have received in a pay period. This can lead to cash flow and payroll tax issues.

When do you realize you overpaid an employee?

After the employee receives their pay: You realize you overpaid the employee after they already received their direct deposit or cashed their paycheck.

Why do you need to update your accounting books?

Remember to update your records, including your accounting books, to reflect the overpayment and recovery.

What to do if you deposited taxes and don't realize your mistake?

If you already deposited the taxes and don’t realize your mistake until after you file Form 941 or 944, file an adjusted return (e.g., Form 941-X).

Can you deduct overtime pay if you overpaid?

In fact, the Department of Labor puts wage overpayments in the same category as salary advances. If you have an overpaid employee, you can deduct money to recoup the difference, even if the deductions cut into federal minimum wage or overtime pay laws. However, state laws may be different.

What is the net effect of overpayments in 2020?

In 2020, you would deposit the cash (dr) and credit the exact same account you put the overpayment to in 2019. Then the net effect is zero.

Can you resolve an overpayment in QuickBooks Online?

With Quickbooks Online Payroll, you can resolve the overpayment to make your reports and tax forms correct. Here's how you can resolve the overpayment:

How to get a refund on a tax overpayment?

Contact your state's tax agency to get a refund or apply the overpayment to the next tax period.

What does "overpayment" mean on the pay taxes page?

Review the list of federal tax payments on the Pay Taxes page. An overpayment appears on the Pay Taxes page as a negative amount.

How to get a refund on unemployment 940?

For federal unemployment (940, also known as FUTA), you can get a refund. Click Save. Contact the IRSto get a refund or apply the overpayment to the next tax period. For state tax overpayments. Resolve state unemployment insurance (SUI) overpayments.

How to record an overpayment in QuickBooks?

To record an overpayment to a vendor, log in to your Quickbooks account and choose Vendors > Enter Bills, at which point you can select the vendor to whom you made the overpayment. Next, choose “Minor Charge-Off” in the “Item” field, followed by clicking “Save & Close.”. You should then be able to apply the overpayment as a credit to the bill.

Can you overpay a vendor?

Did you accidentally pay a vendor of your business too much money? It’s not uncommon for businesses to buy products or services from other businesses. In fact, most businesses do this. When making payments to vendors, however, you should double check to ensure that you pay the right amount. When you overpay, it can throw off your business’s financial records. The good news is that you can easily record overpayments to vendors using the Quickbooks accounting software. For step-by-step instructions on how to record an overpayment to a vendor, keep reading.