How to buy SGS Bonds:

- For cash application: via DBS/POSB, UOB, OCBC ATMs, or through internet banking

- For SRS application: internet banking or your SRS operator (DBS/POSB, UOB, OCBC)

- For CPRIS application: submit the application in person at any CPFIS or bank branches (DBS/POSB, UOB, OCBC)

How do I buy SGS bonds and T-bills?

You can buy SGS bonds and T-bills using cash, Supplementary Retirement Scheme (SRS) funds or CPF Investment Scheme (CPFIS) funds. What you will need and how you apply depends on your type of application. For cash application: You will need a bank account with one of the three local banks (DBS/POSB, OCBC, and UOB).

Can foreigners buy SGS bonds?

Individuals, including foreigners, aged 18 years and above can buy SGS bonds Semi-annual coupon starting from the month of issue. Paid on the first business day of the month. Yes. SGS bonds can be traded on the secondary market – at DBS, OCBC, or UOB branches; or on SGX through securities brokers.

What is the minimum bid amount for SGS bonds?

The minimum bid amount for SGS bonds and T-bills is S$1,000. Decide how much you want to invest, in multiples of S$1,000. Note: There are allotment limits for competitive and non-competitive bids at each auction. For new SGS issues, the full bid amount will be debited from your account at the point of application.

How does SGS bond work?

SGS bond holders receive a fixed sum of interest every six months before the bond matures and the face value of the bond upon maturity. The interest rate for SSBs increases the longer they are held. When the bond matures, investors will receive the outstanding amount of SSBs that they hold. What is the purpose of SGS bonds?

How long do Singapore government bonds last?

Singapore Government Securities (SGS) bonds pay a fixed rate of interest and have maturities ranging from 2 to 30 years. You can buy SGS bonds at a primary auction or in the secondary market.

Who is SGS backed by?

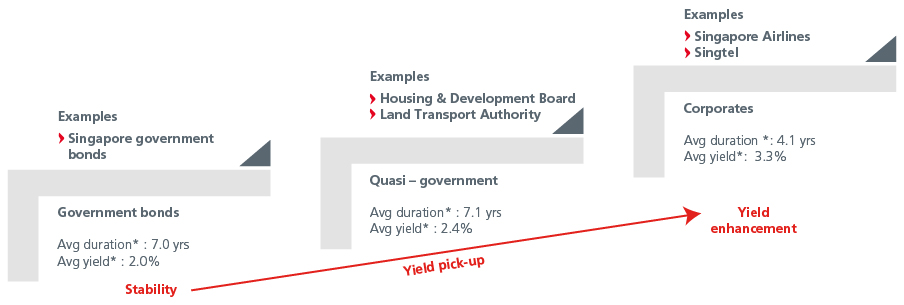

SGS bonds are fully backed by the Singapore Government. There are three different categories of SGS bonds, summarised here:

Can SGS bonds rise or fall?

Note: The price of SGS bonds may rise or fall before maturity. If you want the flexibility of getting your full investment back in any given month, consider Singapore Savings Bonds instead.

Is there capital gains tax in Singapore?

There is no capital gains tax in Singapore. For individuals, interest income earned on SGS is tax exempt. Non-residents without a permanent establishment in Singapore do not have to pay taxes on interest income.

What are Singapore Government Securities (SGS)?

"Securities" are basically government bonds issued by Monetary Authority of Singapore ( MAS) on behalf of well....the Singapore Government!

How to Read Singapore Government Bond Names?

This is not some product serial code or a WWII encrypted message. This is the SGS bond name which appeared on SGX website.

How long does a SGS last?

There are 2 types of SGS offered: Treasury Bills (< 1 year to maturity) – They can have a maturity of 3, 6 or 12 months. Treasury Bonds ( > 1 year to maturity) – They can have a maturity of 2, 5, 10, 15, 20 or 30 years.

Why are bonds the largest investment class?

It's far bigger the stock market due to the sheer size of credit issued and traded by large institutions. Bonds provide investors with interest income plus guaranteed principal at its maturity — provided the issuer doesn't go bankrupt.

Why is Singapore's CPF important?

The CPF system where everybody is responsible for themselves also helps to mitigate the problems associated with an aging population. 2. Low Debt.

Where are SGS bonds listed?

From 8 July 2011, SGS bonds are listed on the Singapore Exchange (SGX), allowing retail investors to buy and sell SGS bonds, the way you do with stocks. Moreover, the SGS bonds you purchased will be stored with CDP.

How much investment is required for a $100 bond?

So far, the right set has always been 10. I have not seen other numbers for SGS bonds. This means that 1 standard ‘lot’ size is 10 bonds. So a $100 bond will require a minimum investment of 10 x $100 = $1,000.

What determines who owns an I bond and who can cash it?

How you register the bond at purchase determines who owns the bond and who can cash it. The registration is the name of the owner (either a person or entity), the Taxpayer Identification Number, and, if applicable, the second-named owner or beneficiary.

How much in I bonds can I buy for myself?

The limits apply separately, meaning you could acquire up to $15,000 in I bonds in a calendar year

How much can you buy in a gift bond?

So, in a calendar year, you can buy up to $10,000 in electronic bonds and up to $5,000 in paper bonds for each person you buy for.

How long does a series 1 bond last?

The bond earns interest until it reaches 30 years or you cash it, whichever comes first.

What is the interest rate on a Series I bond?

What's the interest rate on an I bond you sell today? For the first six months you own it, the Series I bond we sell from May 2021 through October 2021 earns interest at an annual rate of 3.54 percent. A new rate will be set every six months based on this bond's fixed rate (0.00 percent) and on inflation.

How much do you pay for a bond?

You pay the face value of the bond. For example, you pay $50 for a $50 bond. (The bond increases in value as it earns interest.)

Can a child buy a savings bond in TreasuryDirect?

Electronic bonds in TreasuryDirect. A child may not open a TreasuryDirect account, buy securities in TreasuryDirect, or conduct other transactions in TreasuryDirect. A parent or other adult custodian may open for the child a TreasuryDirect account that is linked to the adult's TreasuryDirect account. The parent or other adult custodian can buy securities and conduct other transactions for the child, and other adults can buy savings bonds for the child as gifts.